Carbon Capture Gaining Traction

Carbon Capture and Sequestration (CCS) faces daunting Math. Mike Cembalest, JPMorgan Asset Management’s Chairman of Market and Investment Strategy, publishes a well-researched and insightful annual energy paper. In the 13th edition last March, he provided the sobering CCS math that sequestering just 15% of the US’s annual CO2 output would involve the same volume as all the oil moving through our distribution and refining system. That’s a lot of infrastructure. He has good reason to be a skeptic on the ability of CCS to have much impact – research shows that many projects fail to complete or fail to deliver their promised volumes.

Nonetheless, commercial involvement in CCS is growing, helped in the US by last year’s mis-named Inflation Reduction Act and its tax credits for carbon capture. Because there’s no cap on the 45Q credits, private estimates of their cost are substantially higher than the $3.5BN provided by the Congressional Budget Office. Goldman Sachs projects them to be 10X more costly. The Brookings Institute thinks the overall legislation will cost $1TN in direct spending and tax credits, more than 3X government estimates.

America prefers tax credits to reward emissions reduction, whereas many other countries impose taxes on those who generate them.

Occidental (OXY) is leading the charge to scoop up Federal handouts. They’re spending $1.3BN to build the world’s biggest Direct Air Capture (DAC) facility in west Texas, called Stratos. Blackrock recently agreed to invest $550 million in the project. Stratos is expected to be in operation by 2025. They’ve already sold carbon credits to Amazon and All Nippon Airways and have sold 65% of the plant’s capacity through 2030. Many companies are concluding that it’s more impactful to pay for offsetting carbon credits rather than trying to curb their own emissions.

Stratos will remove 500K Metric Tonnes (MTs) of CO2 annually, insignificant versus US annual emissions of 6.3 billion MTs of CO2 equivalent. But OXY CEO Vicki Hollub has big plans for DAC. She thinks OXY could build up to 100 plants similar to Stratos and by licensing the technology out enable perhaps thousands more.

Exxon Mobil is partnering with Indonesia’s state oil company Pertamina to invest $2BN evaluating a potential storage site in the Java Sea.

The infrastructure challenge Mike Cembalest cited above assumes that CO2 has to be transported to permanent storage, which usually means finding a place underground with the right geology. But CO2 in the ambient air has a fairly uniform concentration throughout the world’s atmosphere of around 417 parts per million (0.04%). This means that DAC plants can be located above the storage location, eliminating the need for pipeline infrastructure to transport the CO2 and improving feasibility. Often the best rock formations are the same ones that held hydrocarbons previously, which creates the beautiful symmetry of returning carbon atoms to their point of origin, just as a different molecule.

Enlink (ENLC) and BKV Corporation just announced the successful sequestration of CO2 in a well in the Barnett Shale in north Texas. The CO2 was captured from a natural gas processing facility where concentrations can be 1,000X or more the 0.04% in the atmosphere.

ENLC plans to build a CCS business in Louisiana, capturing emissions from petrochemical customers supplied with natural gas via ENLC’s pipelines. Given their $6BN market cap, they offer more concentrated CCS exposure than many larger companies in the sector.

Climate extremists, rarely accused of serious thought on the subject, generally oppose carbon capture as prolonging the world’s reliance on fossil fuels. They should welcome anything that cost-effectively removes CO2 from the atmosphere. Instead, they throw paint at priceless art, proving both that they’re Philistines and that the UK criminal code has been hijacked by liberals. You don’t see that behavior in the US, nor the traffic disruption they cause by marching in the road. American drivers so delayed would naturally hit the gas, reducing the odds of repeat offenders. Throw in the disgusting marches in support of Hamas and Britain, where I grew up, is sliding towards left-wing sponsored anarchy.

Following up on last week’s blog (see Will We Use More Hydrogen?), Germany is planning a 6,000 mile hydrogen pipeline network costing around €20BN ($21BN) by 2032. Encouragingly for US natural gas pipeline owners, 60% of this network will repurpose existing natgas pipelines, showing their versatility during the energy transition.

Germany has had a bad energy transition so far, marked by great expense and huge strategic errors (reliance on Russian natural gas; eliminating nuclear power; industry fleeing to cheaper energy such as in the US). They offer little to emulate – the technical adaptability of gas pipelines is the main positive in their hydrogen story. Germany will be producing more hydrogen than they can use domestically so plan to export 70% to neighboring countries. Let’s hope there’s demand.

Finally, I spent last week seeing clients in Arizona and had the opportunity to play golf with two long-time investors. It was warm, sunny and welcoming. Scottsdale is mercifully free of the homeless drug addicts that disgrace so many downtowns, even though China’s premier is not scheduled to visit. At least one city government has its act together.

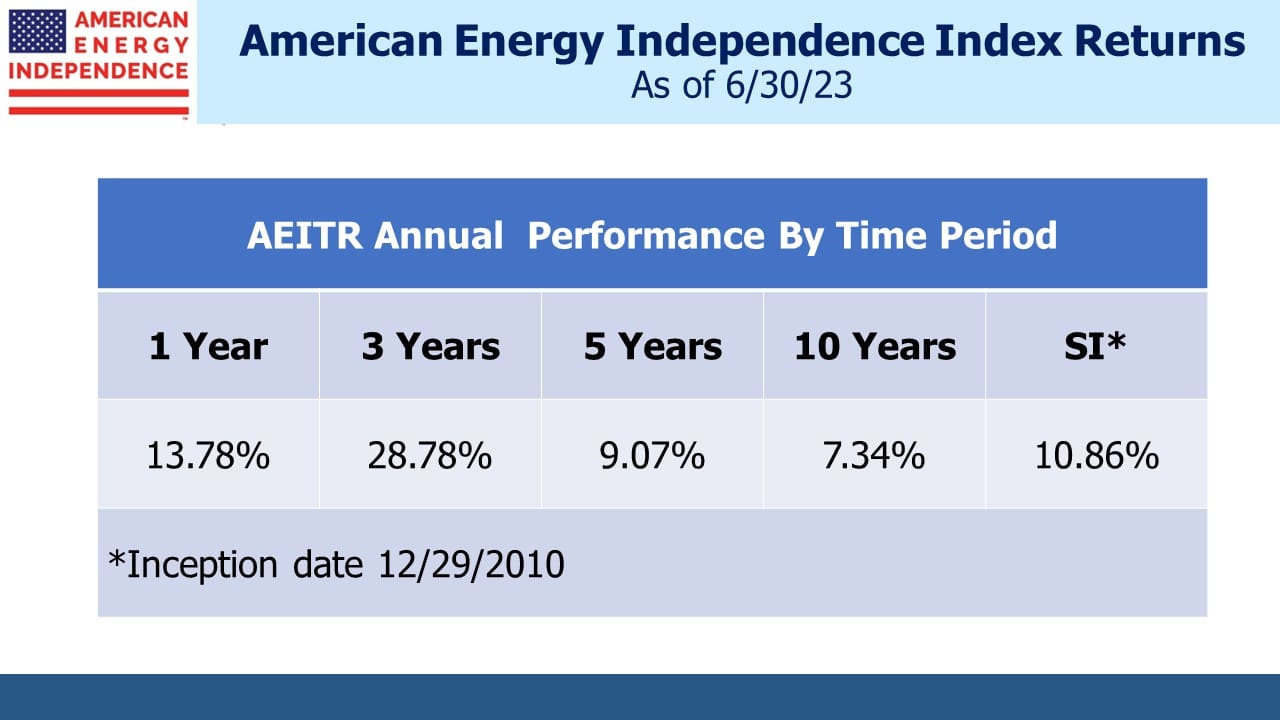

We have three have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF Real Assets Fund