4% Inflation Is Our Least Bad Option

/

Last week the WSJ warned that We May Be Getting Used To High Inflation. Only 9% of respondents in a recent survey think inflation is our most important problem. Government leadership (presumably the absence thereof) and “the economy in general” were both bigger concerns.

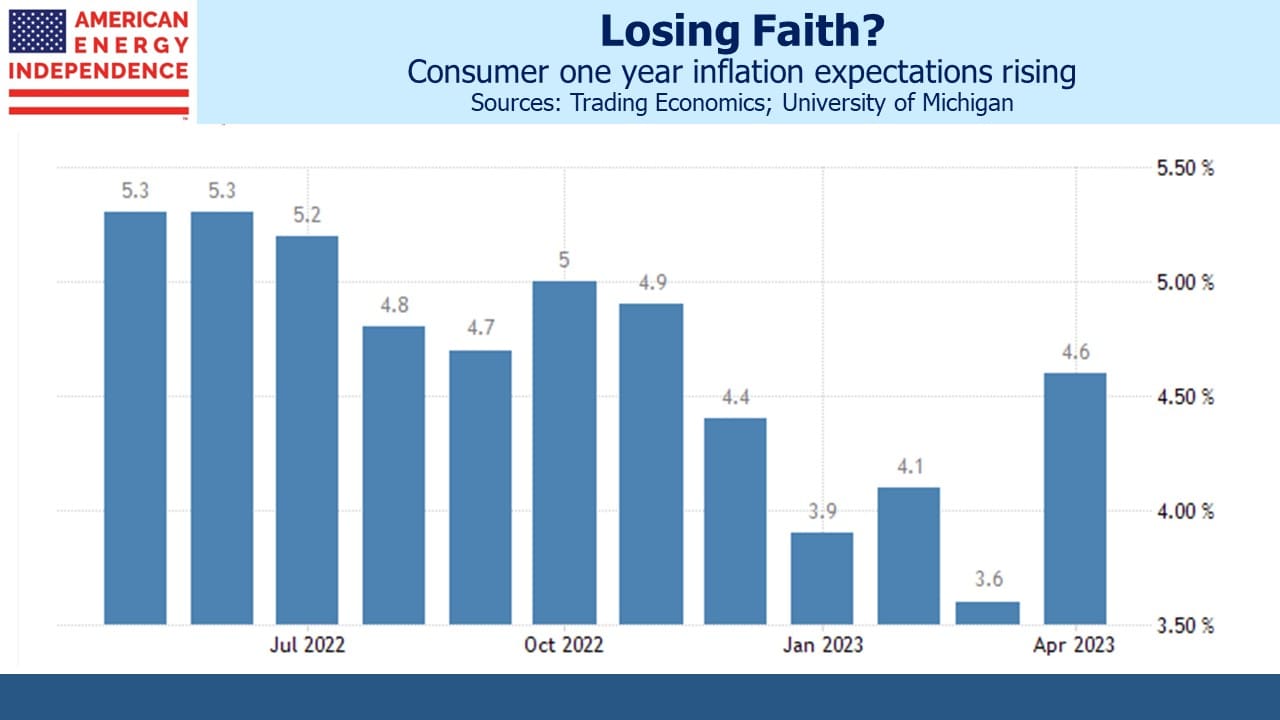

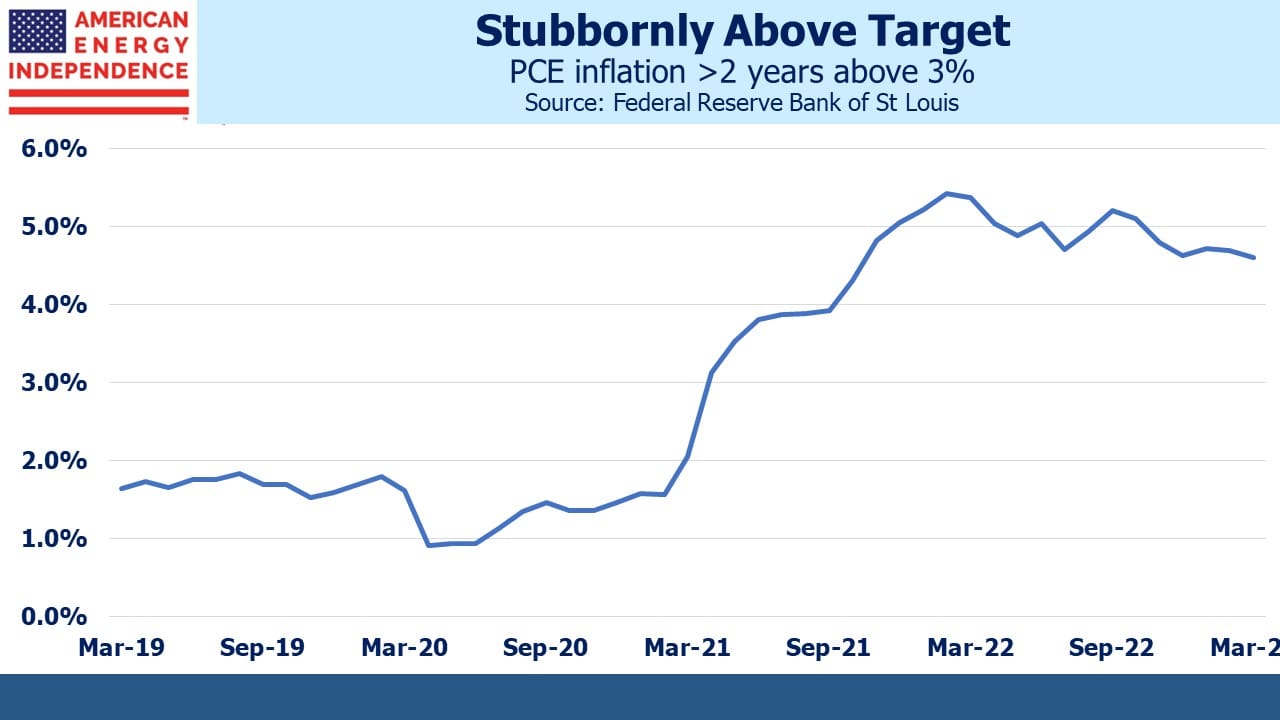

Americans are learning to live with higher inflation. The University of Michigan shows that one year inflation expectations among consumers have been rising all year. The Employment Cost Index is increasing at 5%, a figure generally felt to be inconsistent with 2% inflation. The Fed’s preferred Personal Consumption Expenditures (PCE) deflator has been above 3% for two years. These are all signs that households and businesses are adapting to a world of 3-4% inflation, not 2%.

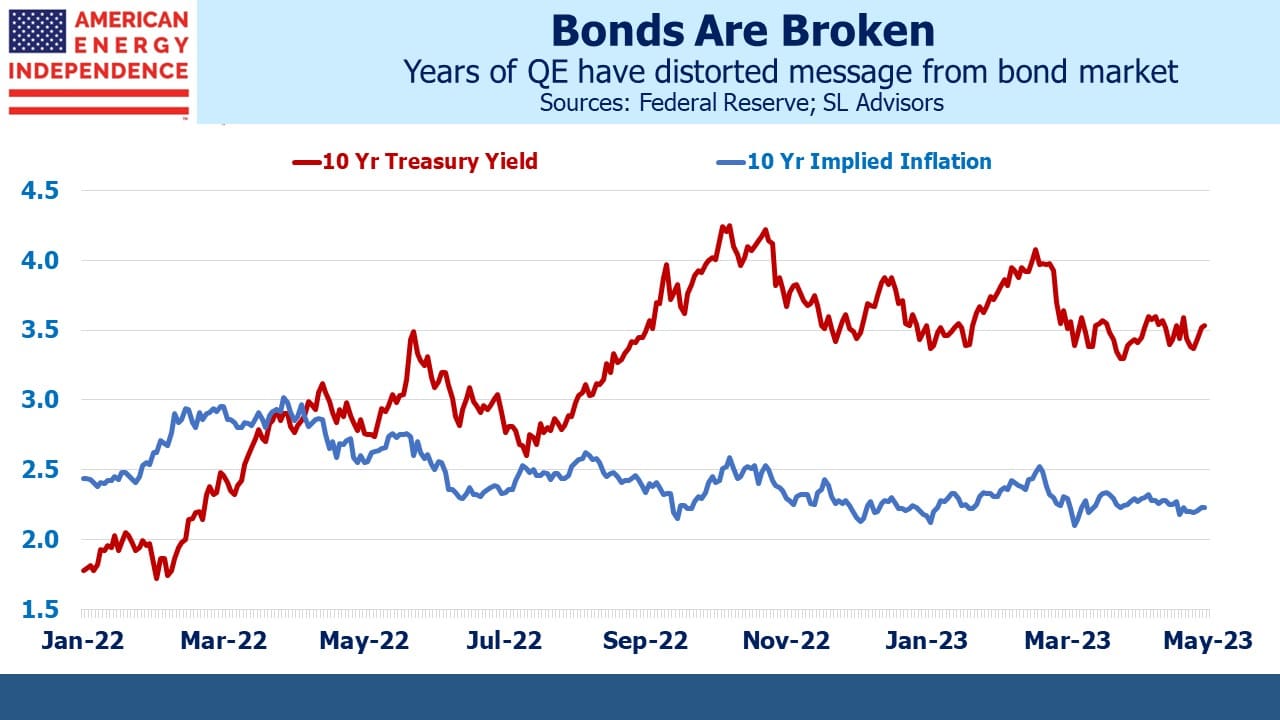

The bond market tells a different story. The spread between ten year treasury notes and TIPs implies investors expect CPI to average around 2.3% over the next decade. By this measure, markets have never been that worried about persistent inflation. It’s remained below 2.5% for most of the past year.

TIPs ought to be a reliable indicator, because return-seeking bond buyers are presumably putting considerable thought into their purchases. But to this observer it looks likely that years of Quantitative Easing (QE) along with $TNs held by foreign central banks (China; Japan) and others who want returnless liquidity have distorted the message bonds would otherwise communicate. Bonds are a broken indicator.

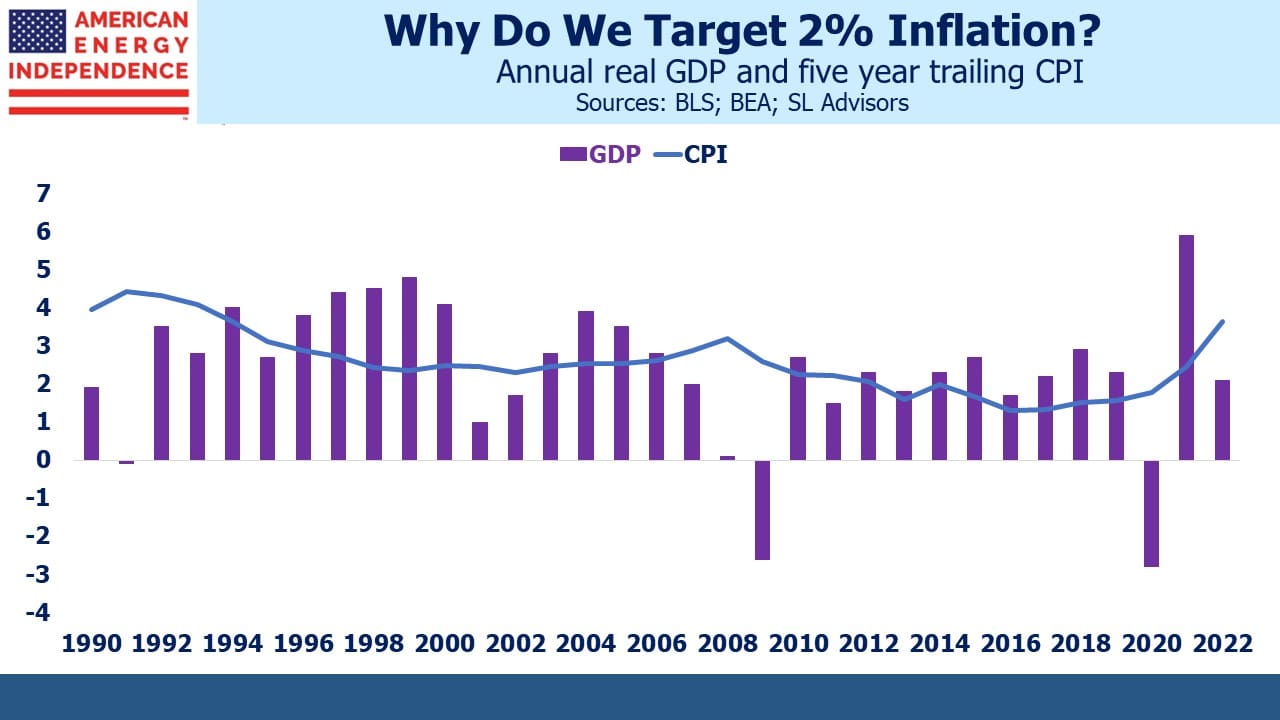

WSJ writer Greg Ip thinks Americans getting used to higher inflation “very bad news”. He’s right if the Federal Reserve regards embedded inflation expectations as in need of further monetary attention. But it’s not clear that 3% or 4% inflation is worse for real GDP growth than 2%.

Since 1990, five year trailing CPI inflation has ranged from 2-4% and had been slowly declining until the pandemic-induced jump. There is no statistical relationship with real GDP growth. That doesn’t mean that inflation doesn’t matter, but the data shows that if it’s relatively stable 2% isn’t any better than 4%. Central bankers have made 2% a religious tenet. It’s really a shibboleth.

Raising the debt ceiling will soon become the biggest concern of market participants, since negotiations look likely to reach or even pass the deadline. A rare flaw in the US constitution separates spending decisions from financing ones – Congress ought to raise the debt ceiling whenever they approve a budget. The debt ceiling standoff is what passes for serious consideration of America’s fiscal outlook in Washington, so every couple of years we wonder whether this game of chicken will go wrong. US credit default swap spreads are wider than Greece.

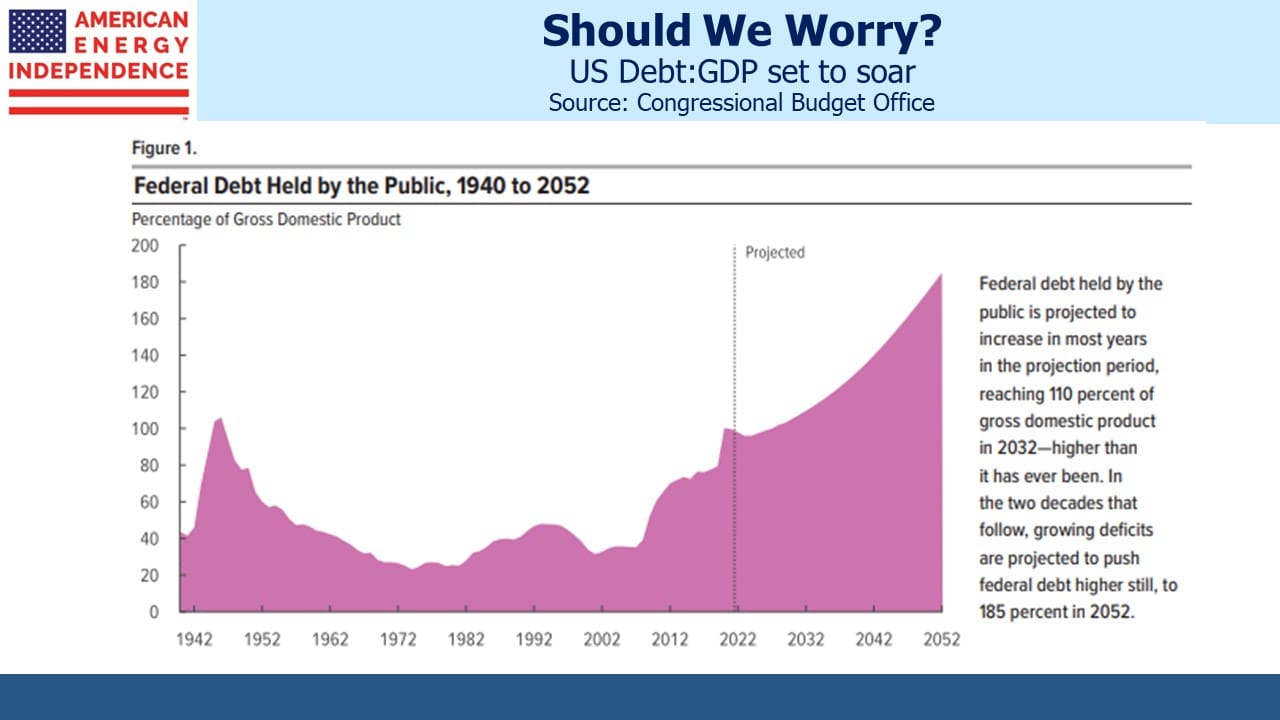

Our projected indebtedness is familiar with no solution in sight. The deficit barely registers as an issue. Politicians who suggest raising taxes or cutting spending soon get dumped by voters and move on to the more lucrative business of lobbying.

The Fed deserves their share of blame. Fifteen years of QE has held bond yields down, muting whatever warning of fiscal profligacy higher yields might otherwise transmit.

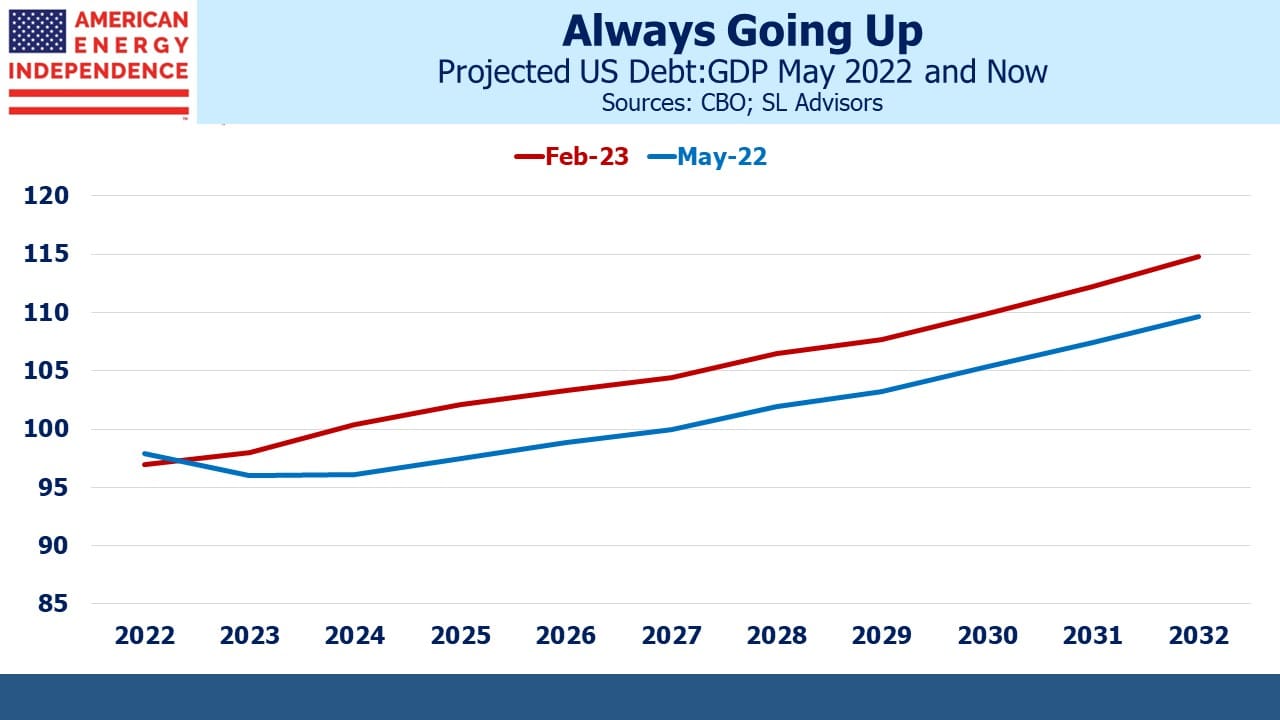

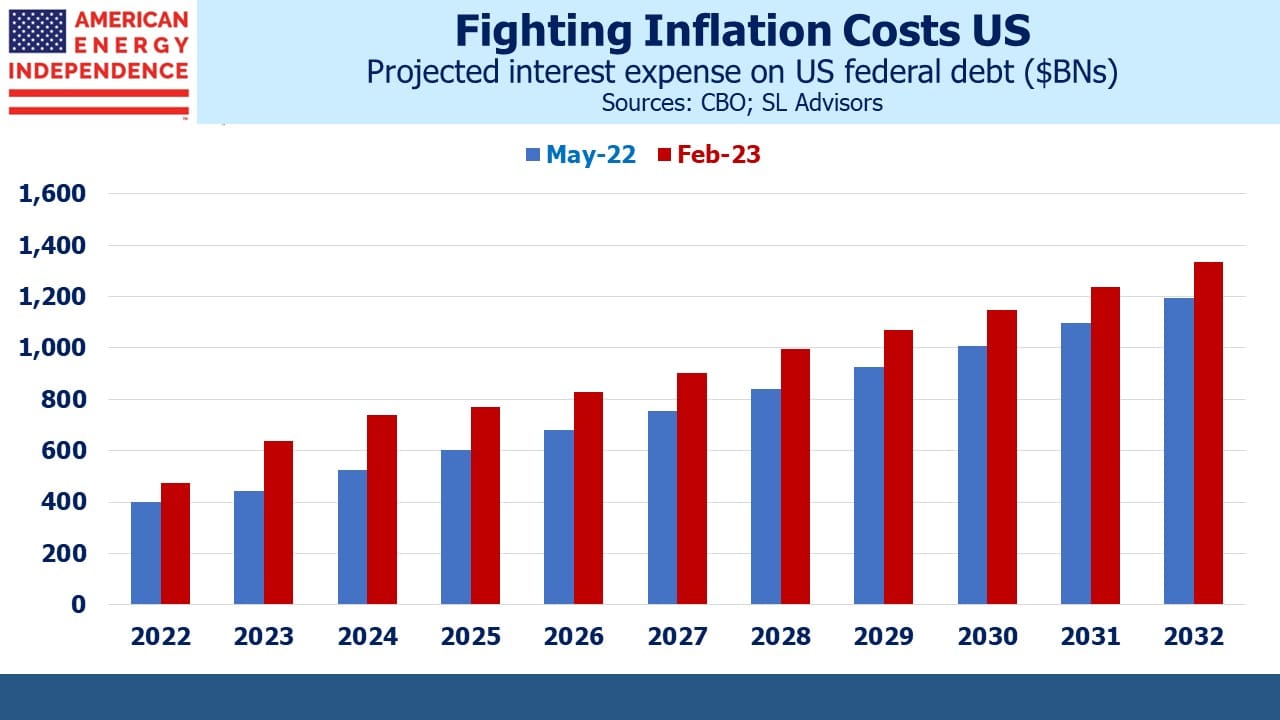

More recently, higher interest rates have brought various terrible milestones closer by two to three years (see How Tightening Impacts Our Fiscal Outlook). The February 2023 edition of The Budget and Economic Outlook, published by the Congressional Budget Office, was updated for the Fed’s tighter monetary policy compared with the previous publication in May 2022. Debt:GDP will now cross 100% in 2024 rather than 2027. Annual interest expense will reach $1TN in 2028 not 2030.

Inflation is the friend of the inveterate borrower. It reduces the real value of obligations. Our fiscal outlook will benefit if debt growth lags nominal GDP. Low interest rates, especially negative real rates, help. 4% inflation leaves more room for real yields to be negative. 2% doesn’t, and as we’re seeing the effort to get inflation back to 2% is making our fiscal outlook worse.

Throughout history governments have eased their debt burden through currency debasement. I explained why this will be America’s solution a decade ago in Bonds Are Not Forever. Developments since then confirm this outlook. There’s little reason to expect spending cuts or tax hikes because there are no votes in it and no apparent cost to current policies. Today’s biggest economic disruption is coming from the Fed’s efforts to restore inflation to 2%. Regional banks and the Federal government need lower rates. There’s a fiscal cost to tight monetary policy.

We can lower inflation or our debt burden. We can’t do both. They are mutually incompatible objectives. We are already learning to live with 4% inflation. It’s not that bad. It’s the path of least resistance.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!