Infrastructure As An Inflation Hedge

/

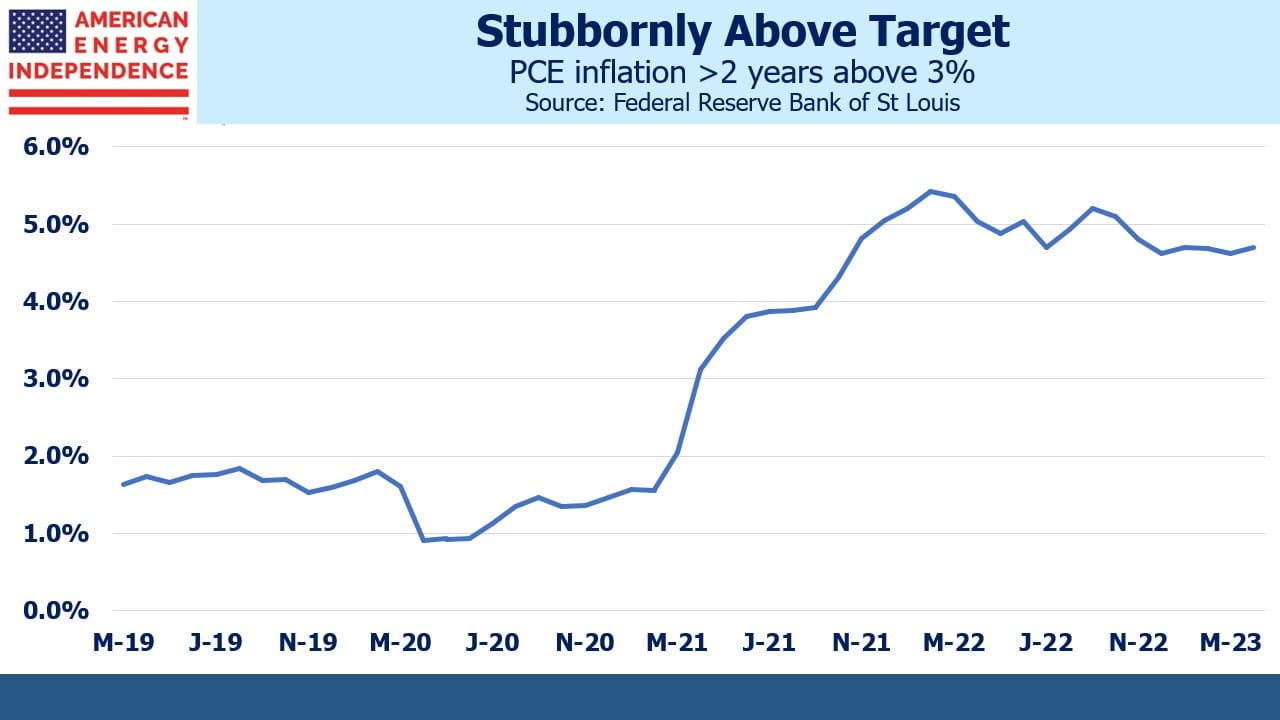

We’re getting used to 4-5% inflation. Using the Fed’s preferred measure, core Personal Consumption Expenditures (PCE), it’s been above 3% since April 2021. People are quietly mentioning the unmentionable – what if the Fed raises its inflation target?

The Economist recently published a briefing warning that “failure to quell it quickly will transform financial markets”. Whether the Fed suppresses the economy enough to get inflation back to 2% or not, it’s already too late for it to be quick.

Richard Clarida was vice chair at the Fed until he resigned in January 2022 amid controversy over well-timed personal stock trades just prior to a barrage of pandemic-related rescue programs. He returned to PIMCO. Clarida told the Economist the Fed, “… will eventually get the inflation rate it wants” adding, “It could be 2.8% or 2.9% when they start to consider rate cuts.”

Clarida joins a growing chorus of Wall Street strategists who are asking the same question. There’s nothing magic about 2%. It’s predictability that’s important, although the Economist goes on to argue that higher inflation is damaging precisely because it makes future inflation harder to forecast.

Don’t expect Fed chair Jay Powell to announce a revised interpretation of their twin mandate (full employment with stable prices). The last time they did that was following their 2020 Jackson Hole symposium. Powell expressed a tolerance for “…inflation moderately above 2 percent for some time.” Thereafter, “transitory” became overused and then dropped from his lexicon.

We know this Fed focuses on whichever element of its twin mandate is farthest from target. They do not anticipate events, even though the tools of monetary policy take many months to have an impact. A jump in unemployment could see them pivot away from inflation.

As we’ve noted before, some investors are already considering how to respond (see 4% Inflation Is Our Least Bad Option). Aging populations in the rich world mean a shrinking labor force. Globalization, the big driver of disinflation for decades, is reversing as supply chains are modified to match national security needs. Apple is just one company planning to reduce its reliance on China by shifting iphone production to India.

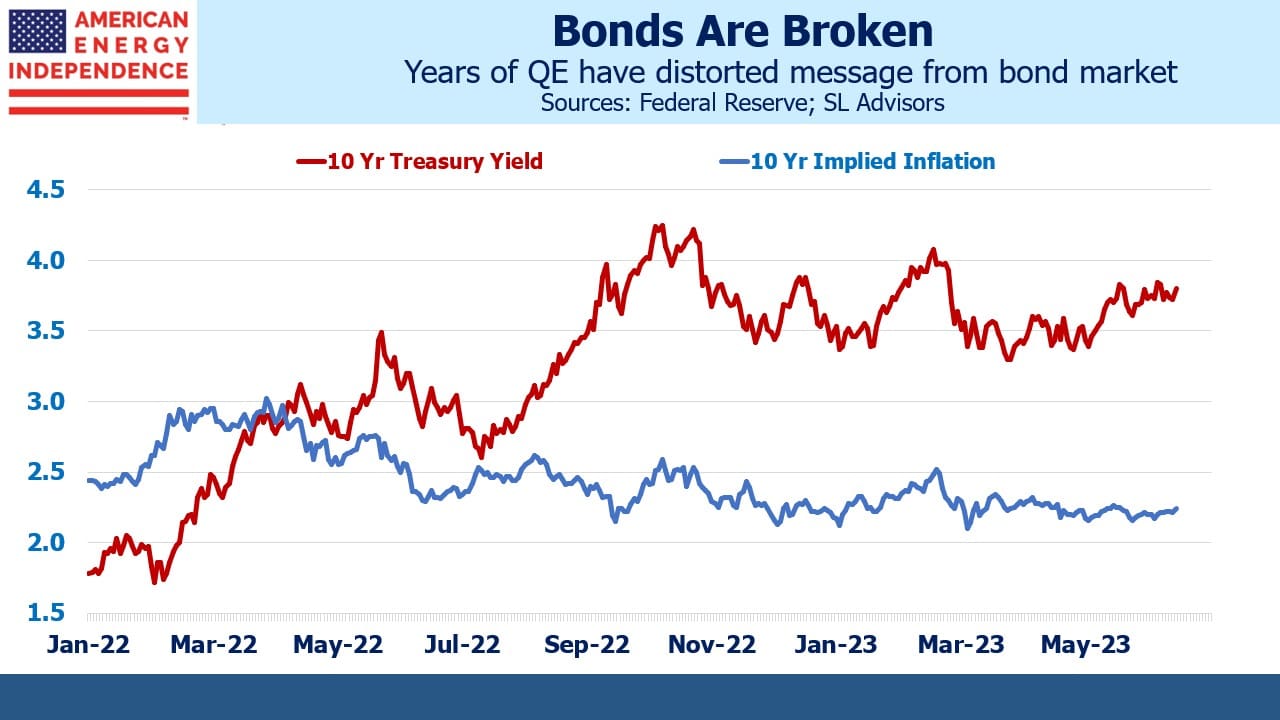

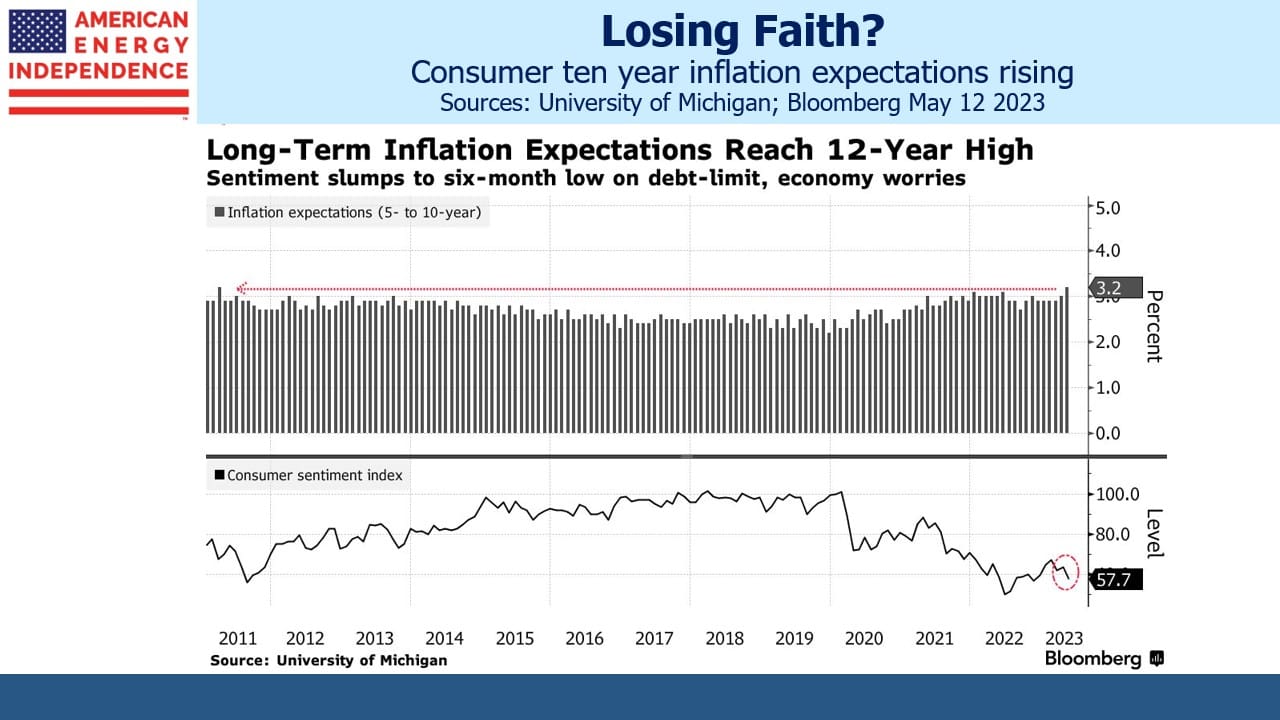

Treasury Inflation Protected Securities (TIPS) are expensive, their prices as much distorted by the Fed’s QE purchases as conventional securities. Ten year TIPs at 1.5% are priced for ten-year inflation expectations of 2.2% when subtracted from regular ten year notes yielding 3.7%. This calculation has been below 2.3% all year. It’s a mistake to infer credibility in the Fed’s efforts. The University of Michigan survey shows ten-year inflation expectations have been rising all year, and now sit at a twelve year high of 3.2%, almost 1% above TIPs. This shows the bond market can’t be relied on as a measure of what investors think will happen.

Stocks are better than bonds in such an environment. Within the equity market, stocks with pricing power should offer protection. The Economist recommends physical assets including infrastructure, because they, “generate income streams, in the form of rents and usage charges, that can often be raised in line with inflation or may even be contractually linked to it.”

The Economist adds that such assets are hard to access, often “…dominated by private investment managers, who tend to focus on selling to big institutional investors.”

An important exception is midstream energy infrastructure, the regular topic of this blog. This sector might be the solution to any investor wanting a portfolio designed for a world where 4% is the new 2%.

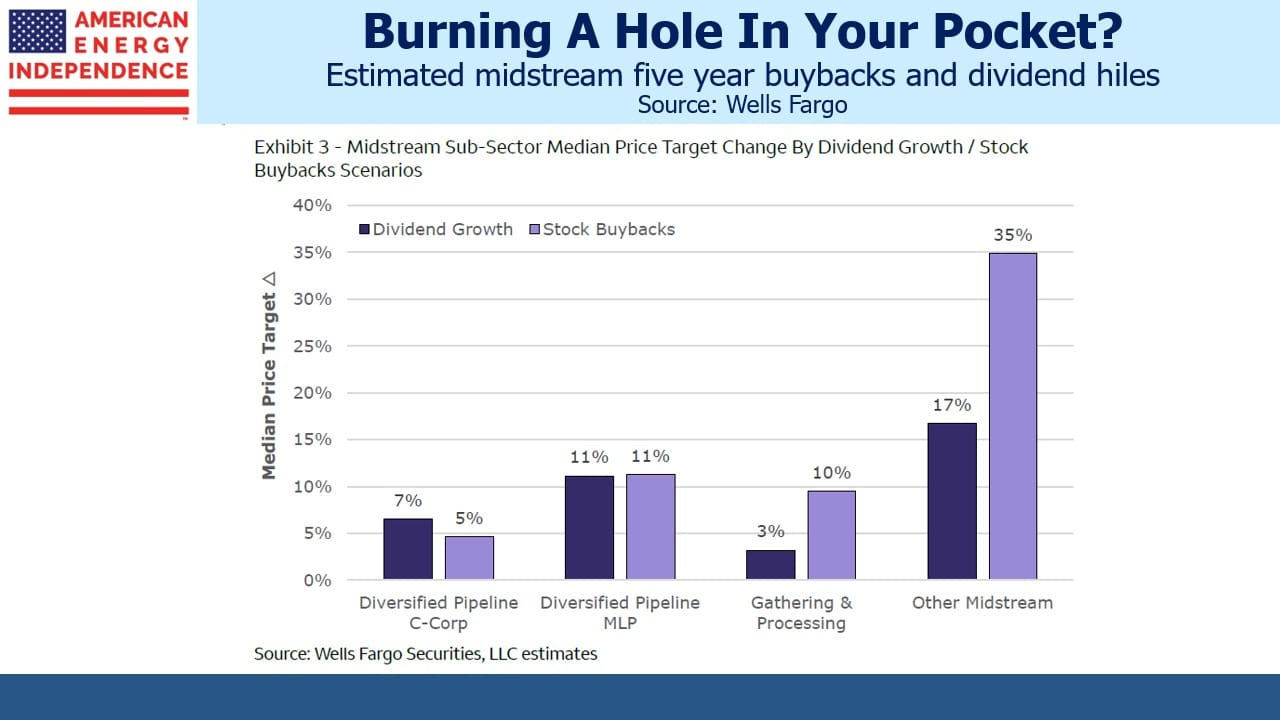

Right on cue, Wells Fargo just published Midstream: Capital Allocation Conundrum—What to Do with All That FCF? They see 10%+ price upside over the next five years from excess free cash flow deployed to either buybacks or dividends. Pipelines have pricing power, in that many tariffs increase automatically with inflation. These are scarce assets, thanks in part to climate extremists who have made new construction unappealing through persistent ruinous court challenges. Mountain Valley Pipeline will soon be finished, but the protracted timeline will serve as a warning that returns on growth capex can be uncertain. Hug a climate protester and drive them to their next protest.

Dividend yields are around 6%. The Wells Fargo analysis includes baseline 4.3% annual dividend growth and steady capex. The excess cash flow they project is worth around 2% pa. Adding the three together results in a 12.3% pa five year return. That’s not assuming any repricing as investors are drawn towards publicly traded infrastructure, even though returns like this would probably create their own momentum.

After reading The Economist’s Investors must prepare for sustained higher inflation, you’ll be relieved to turn to midstream energy infrastructure which just might be part of the solution.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

C While you quote dividend yields of around 6% from C corporations, of course distributions from many MLPs are materially higher, with EPD– perhaps the safest MLP–having a tax deferred distribution of 7.5%. Moreover, I would emphasize a point on which you don’t deal in your preference for C corporations over MLPs in the midstream infrastructure sector. That is that the net investment income tax (NIIT) surcharge of 3.8% applies to corporate dividends but not to MLP distributions. That is meaningful to me as an investment determinant.