Still Uncovinced By Oneok Magellan Combo

/

It’s almost two months since Oneok (OKE) announced their proposed acquisition of Magellan Midstream Parners (MMP). Consummation of the transaction has never looked more promising than on the day of the press release.

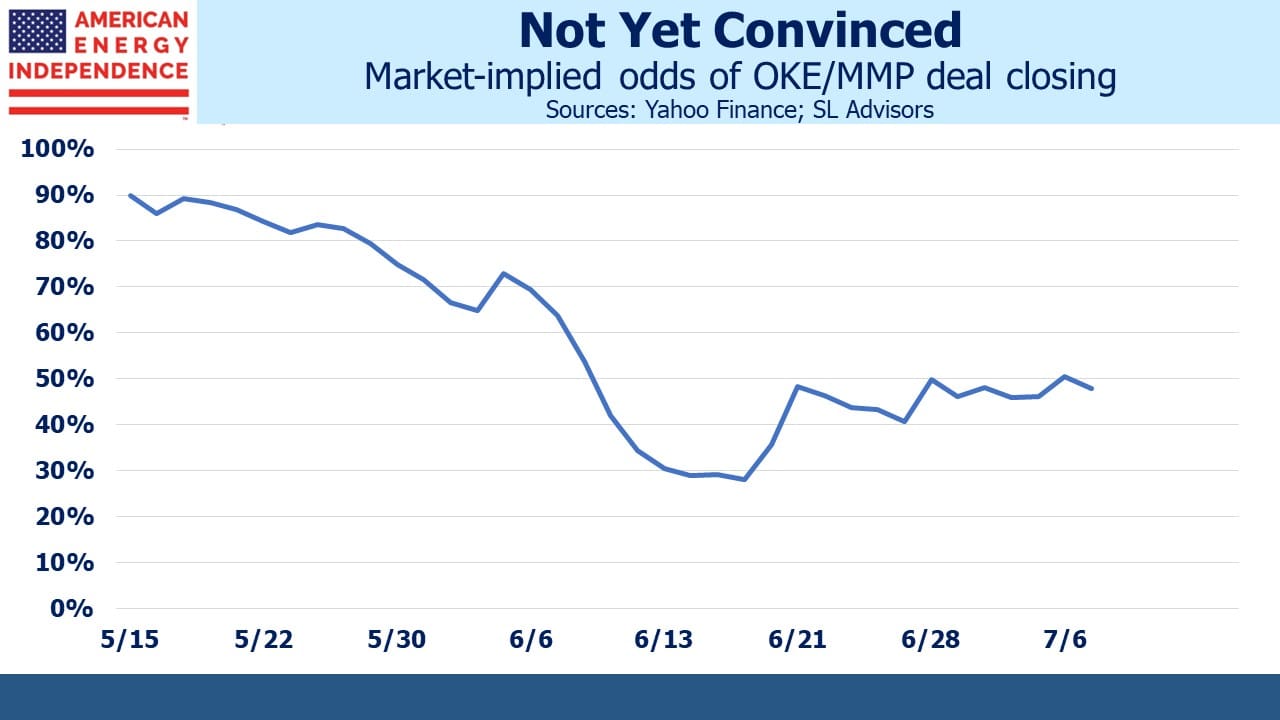

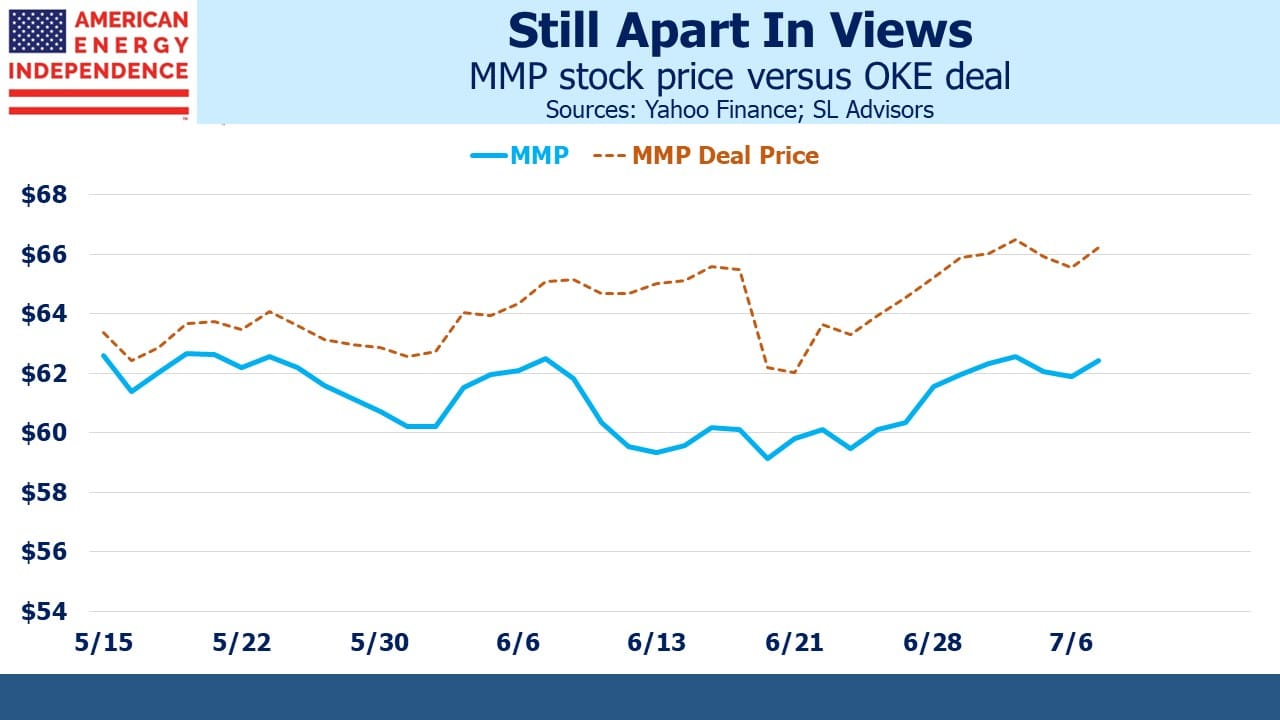

By mid-May, the market was ascribing less than 30% odds of shareholder approval, based on the gap between MMP and the combination of OKE stock and cash that is on offer. Energy Income Partners (EIP), a significant holder of MMP, issued a public letter outlining the reasons for their opposition. We had made similar arguments in prior blog posts (see Oneok Does A Deal Nobody Needs).

EIP’s letter so far marks the nadir of the market’s support for the deal. Neither company responded publicly to EIP’s criticisms although both have been active behind the scenes. At a couple of recent industry events they were making the case to interested investors, and the market-implied probability of the deal closing improved.

The tax bill facing MMP unitholders is the most offensive element of the transaction. The longer you’ve held MMP, the lower your cost basis and the greater your recapture of taxes deferred on distributions. MMP business model is designed to encourage investors who plan to stick around. In their May 4 press release disclosing 1Q earnings, MMP said they remain committed to, “…maximizing long-term investor value.”

Except this isn’t true.

The merger with OKE rewards the short-term investor whose recent purchase doesn’t create a tax obligation. This includes the MMP management team who are embarrassingly paltry investors in their own company. By MMP’s own calculations, the investors who have held their units the longest are facing the biggest tax bill. Like John Kerry (“I did vote for (it) before I voted against it”) MMP wants investors with a long-term outlook until they don’t. Their pursuit of a combination with OKE prioritizes value creation for short term investors because they’re the ones without the inconvenient tax deferral.

Sell-side analysts are not unbiased, objective observers. There’s not much in underwriting fees to be gained from upsetting potential capital markets clients. Therefore, the lukewarm comments from several firms can be interpreted as a negative view ameliorated by their business models. It’s a form of code. The deal odds slipped below 50% a month ago and still haven’t broken above in spite of the management charm offensive. The market’s unenthusiastic response means that if the deal does get approved there will be many former MMP investors ready to dump their newly received OKE stock, since they’ll have no taxable gains. OKE/MMP remains, just, more likely than not to be voted down. We’re happy to be raising awareness.

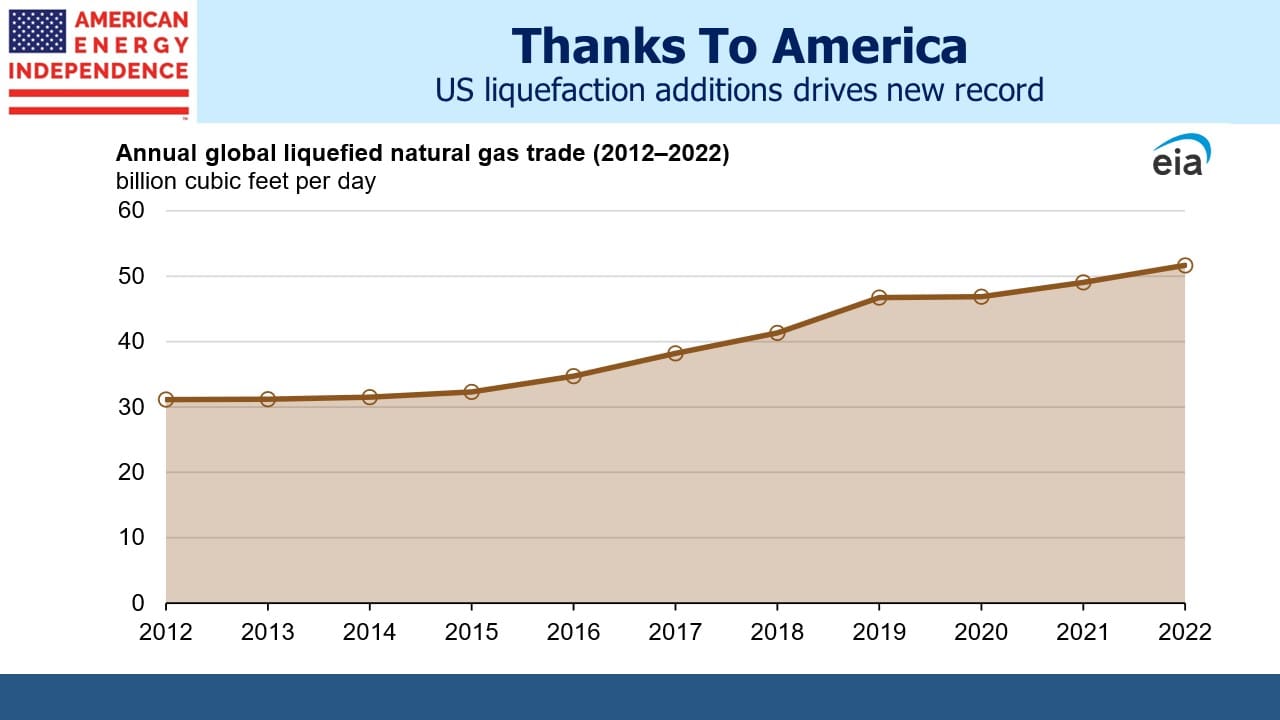

In other news, the US Energy Information Administration (EIA) reported that global trade in Liquefied Natural Gas (LNG) reached a new record last year of 51.7 Billion Cubic Feet per Day (BCF/D). Recent increases have been driven by liquefaction capacity additions in the US. Europe’s loss of Russian pipeline imports has also helped, since these have been partly replaced by imported LNG.

NextDecade (NEXT) is a company we’ve followed for some time. They recently confirmed they have bank financing in place to begin construction of their Rio Grande LNG export facility. Bechtel, who has the contract, just awarded an order to Baker Hughes to supply three main refrigerant compressors as part of the project. NextDecade hasn’t yet announced a Formal Investment Decision (FID) to proceed but have indicated this is imminent. We continue to think NEXT is attractively priced at current levels. Announcement of FID should be reflected in the current price although may still provide a modest boost. In any event we think the stock offers good upside potential.

Finally, within the details of Friday’s employment report was the news that black workers have accounted for 90% of the recent rise in unemployment. Monetary policy is hardly the tool with which to combat such a development. Past history shows that minority unemployment rises faster during a slowdown. However, Fed chair Jay Powell has in the past stated a desire for maximum employment that is “broad-based and inclusive” (see Criticism Of The Fed Goes Mainstream). Democrat lawmakers have another reason to criticize the conduct of monetary policy.

Market expectations have shifted in recent weeks towards the blue dots from the FOMC’s Projections. Just two months ago Fed funds futures were priced for a policy rate of 2.75% by the end of next year. Since then, hawkish comments from the FOMC and moderately firmer data have led traders to revise this to 4.25%. Usually the market is better than the Fed at forecasting monetary policy. This time around, they’ve caught some traders flat footed.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Don’t forget that if this deal does close, in addition to capital gains resulting from a reduced basis in MMP units because of tax deferred ditributions, there will also be ordinary income resulting from depreciation recapture after the release of suspended passive activity losses.