Book Review – We Need To Talk About Inflation

Steven D King is not as famous as his namesake, but for an economist can still write a spine-tingling book. Prompted by the inflation that followed the pandemic, King walks us through past episodes of inflation and their causes, and offers some clues as to whether it’s persistent or transitory.

Moderate inflation of 2% or lower had become so entrenched that by 2020 the Federal Reserve adopted an asymmetric policy of tolerating inflation above target in order to allow the long run average to reach 2%. Policymakers worried about a Japan-style deflation as much as they fretted over inflation, and when Covid uber-stimulus caused it, the Fed maintained that it would not persist. Hence “transitory” became a flip criticism of Fed chair Jay Powell.

Until the last hundred years or so inflation and deflation were equally likely. Although citizens in the Roman Empire suffered disastrous inflation during the third century CE, over the next fifteen hundred years or so centuries passed with little inflation and sometimes deflation. During the 15th century the British pound is estimated to have gained 11% in purchasing power. The 20th century up until today is more notable for the absence of any serious deflation. Avoiding deflation at all costs “is likely to end up delivering an inflationary bias.”

The US 1930s depression was the most economically destructive period in the country’s history. By contrast, Germany’s experience with hyperinflation under the Weimar Republic led to the catastrophe of Hitler. Economic policy in both countries is biased to avoid a repeat – hence the Fed targets maximum employment consistent with stable prices while for decades the Bundesbank’s mandate was simply price stability.

Quiescent inflation from the late 1980s perhaps led to central bank complacency that their credibility largely assured price stability. But some economists think globalization allowed a one-time enormous increase in the supply of cheap labor and improved supply chains. Central bankers were less important than they thought.

The aftermath of the US Civil War saw the Federal government fear a repeat of the inflation that followed both the US and French revolutions. But northern financiers had provided extensive credit to southern farmers. The debtor benefits from inflation through a devalued obligation as much as the creditor loses out. Therefore, the deflation that followed the end of hostilities had the effect of making the South poorer while the North got richer, “…a mechanism to ensure the economic costs of the war were imposed on the former Confederate states.”

King draws an interesting analogy with the periodic debt crises in the Eurozone, during which heavily indebted southern countries like Greece and Italy would benefit from inflation while trapped in the same currency as northern creditors such as Germany. A fracturing of the Euro was only avoided when ECB central bank head Mario Draghi pledged to do “whatever it takes” to preserve the Euro, which eventually included buying Italian and Greek sovereign debt.

Modern Monetary Theory (MMT) receives a brief and disparaging mention, one with which we heartily agree (see The Death Of Modern Monetary Theory). MMT holds that because a government can never default in its own currency, expansionary fiscal policy should be run to maximize employment. This relies on governments constraining themselves only when forecast inflation shows the limits of productive capacity have been breached. The flaw is in expecting any government to honestly forecast inflation. Even the Fed is bad at it.

Perhaps the biggest change in central banking in our lifetimes has been the granting of independence from political interference, at least over the short to medium term. During the late 1970s and early 1980s high inflation was a political issue and elected leaders accepted that it was their responsibility to tame it. Paul Volcker could never have driven interest rates to 21%, helping cause two recessions, without support from President Reagan and Congress.

Central bank independence frees monetary policy from political interference, but it also frees governments from responsibility. The massive fiscal stimulus following the pandemic soon turned out to be excessive. The Fed and other central banks were rightly criticized for reacting late, but few called for the fiscal drag of spending cuts or tax hikes to offset the earlier mistake. Quantitative Easing has blurred that independence. Even wildly imprudent fiscal policy can always rely on the QE bailout. Now that excessive government debt is increasingly financed by central banks, the conduct of monetary policy is more complicated. The unfortunate milestone of $1TN in annual interest expense on Federal debt was brought two years closer, from 2030 to 2028, because the Fed raised rates.

King offers a four-point test to see whether an uptick in inflation will be persistent or not. The Fed’s asymmetric tolerance for higher inflation, attributing it to external shocks such as covid and Russia’s invasion, and trade tensions that are constraining supply chains are three indicators of persistence. The absence of monetary excess (M2 has been shrinking for over a year) is the only one to provide comfort. King concludes that recent inflation “has been the most worrying since the 1970s.”

His lessons from past bouts of inflation and warnings about the future make this a book worth reading for every investor.

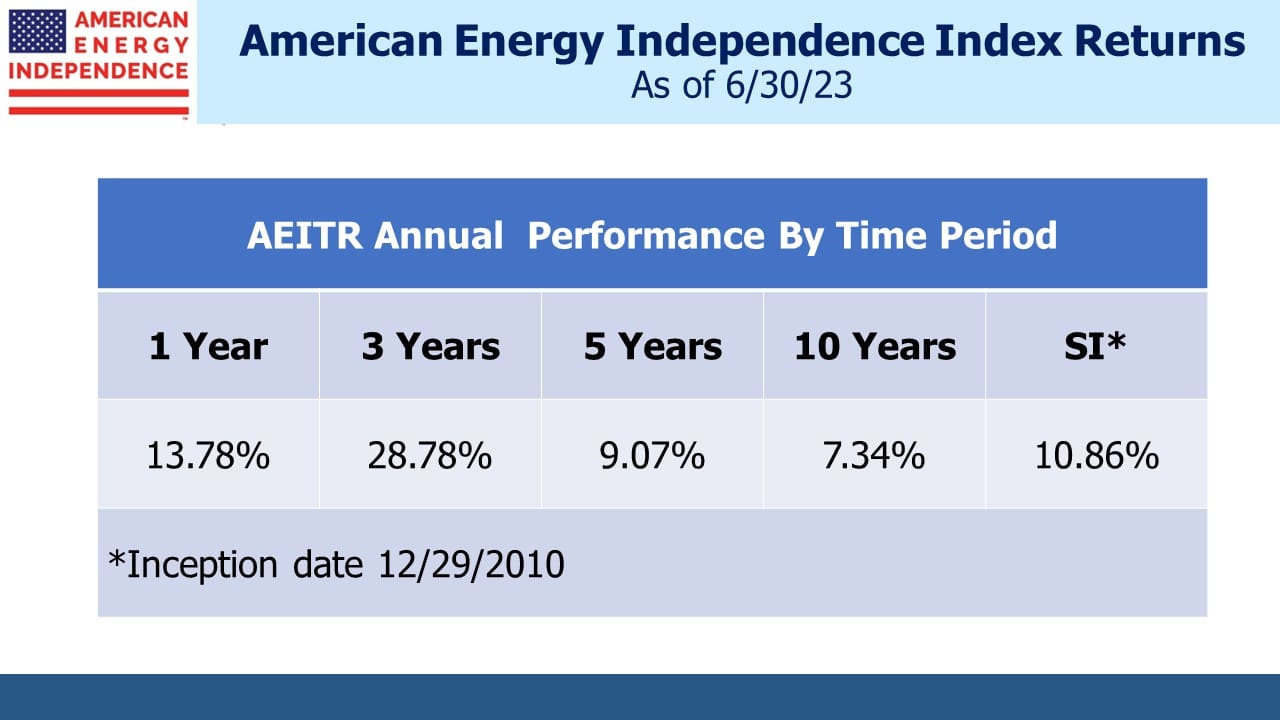

We have three have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF Real Assets Fund