Management Stumbles; Getting Less From Our Power Sources

/

Midstream earnings have been reported for the most part and generally came in at or close to expectations. Cheniere once again surprised to the upside, with 2Q EBITDA of $1.86BN versus market expectations of $1.62BN. They modestly increased full year guidance, carried out planned maintenance on their Sabine Pass facility on schedule and for the first time spent more cash repurchasing stock than on retiring debt.

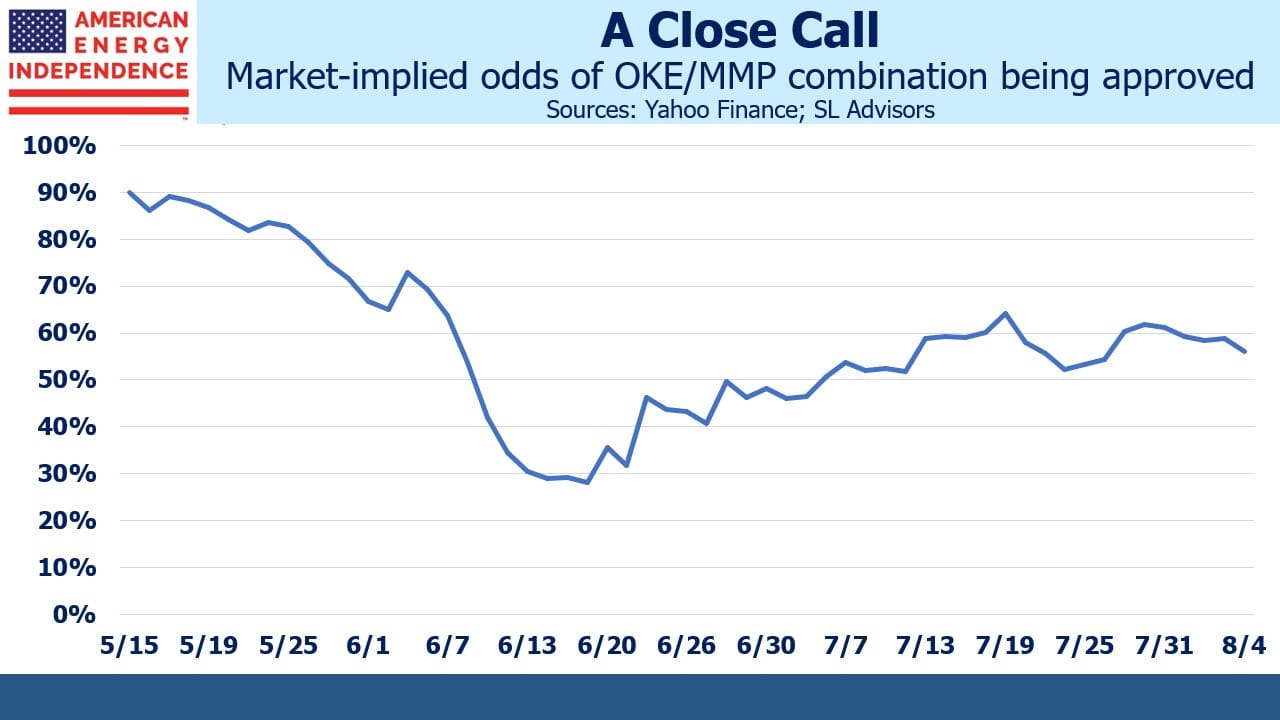

Magellan Midstream reported better than expected earnings and raised full year guidance at the same time as proxies were distributed to MMP and Oneok (OKE) investors to vote on the proposed merger. We estimate the market assigns “more likely than not” odds of shareholder approval. But it’s only a little over 50%, well short of the ringing endorsement both management teams would have liked.

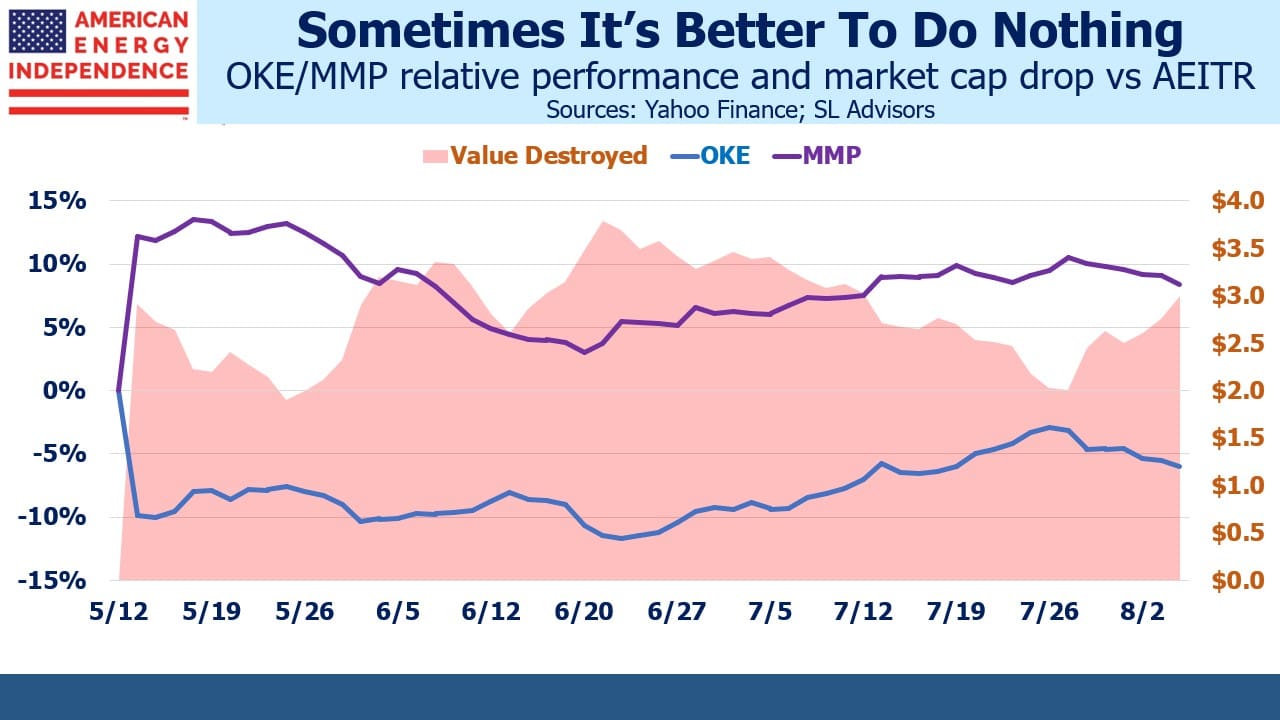

We’re unhappy about the tax liability which should have been deferred at the investor’s option but will now become due this year if the deal closes (see Oneok Does A Deal Nobody Needs). We voted no twice – once for each company since we own both. We estimate that $3BN in equity value has been destroyed since the merger announcement. That’s derived from the aggregate market cap underperformance of both stocks versus the American Energy Independence Index (AEITR).

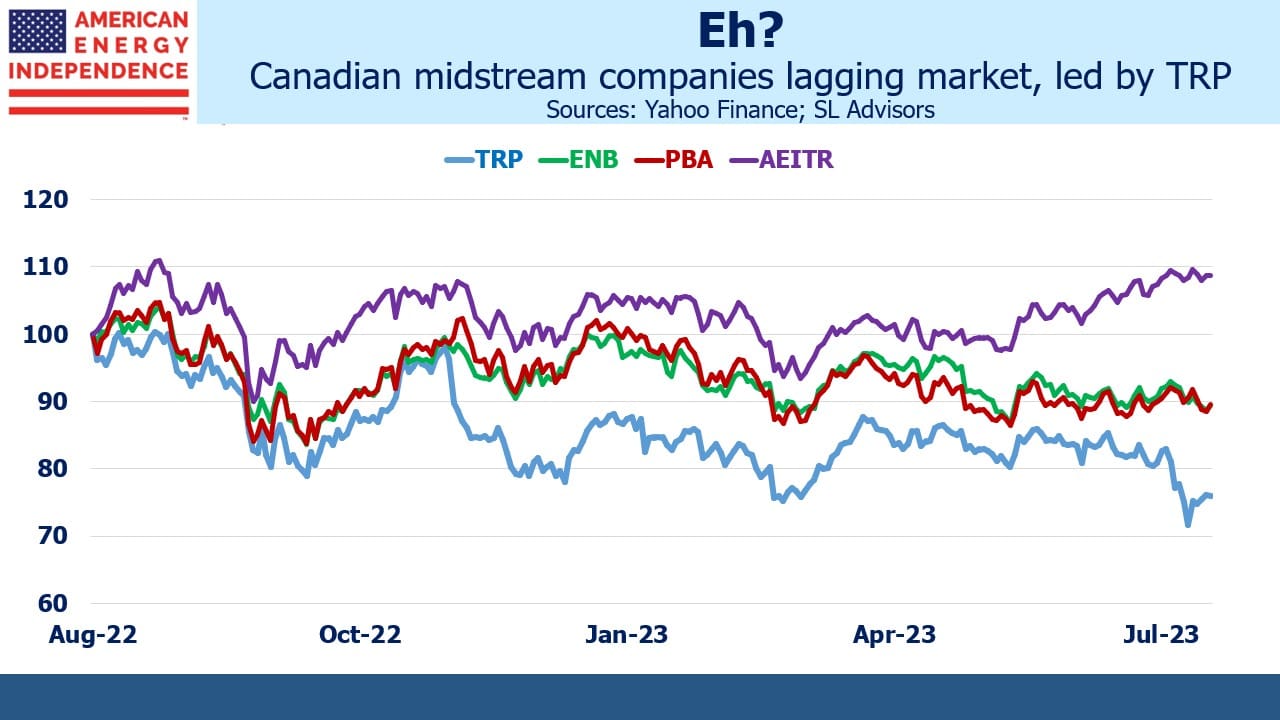

Canadian pipeline companies have long enjoyed a reputation for being conservatively run – at times reflecting poorly on their American peers. This was especially true five years ago when it seemed that the only management teams not pursuing growth at any price were north of the border (see Send in the Canadians! and Canadians Reward Their Energy Investors).

This year all three big Canadian firms (Enbridge, TC Energy and Pembina) have significantly lagged the sector. TC Energy (TRP) decided to unlock unrecognized value in their liquids business by announcing its spin-off. This announcement came a couple of days after they sold a minority interest in their Columbia Gas pipeline network to Global Infrastructure Partners at a lower multiple than many analysts had assumed it was worth. The expected 5X Debt:EBITDA leverage on the stand-alone liquids business raised eyebrows, and the market has even started to question the security of TRP’s dividend.

A yield approaching 8% reflects skepticism that TRP will manage its substantial growth capex program and execute needed asset sales flawlessly. We’ve maintained an underweight exposure for the last couple of years, and we’re not yet increasing.

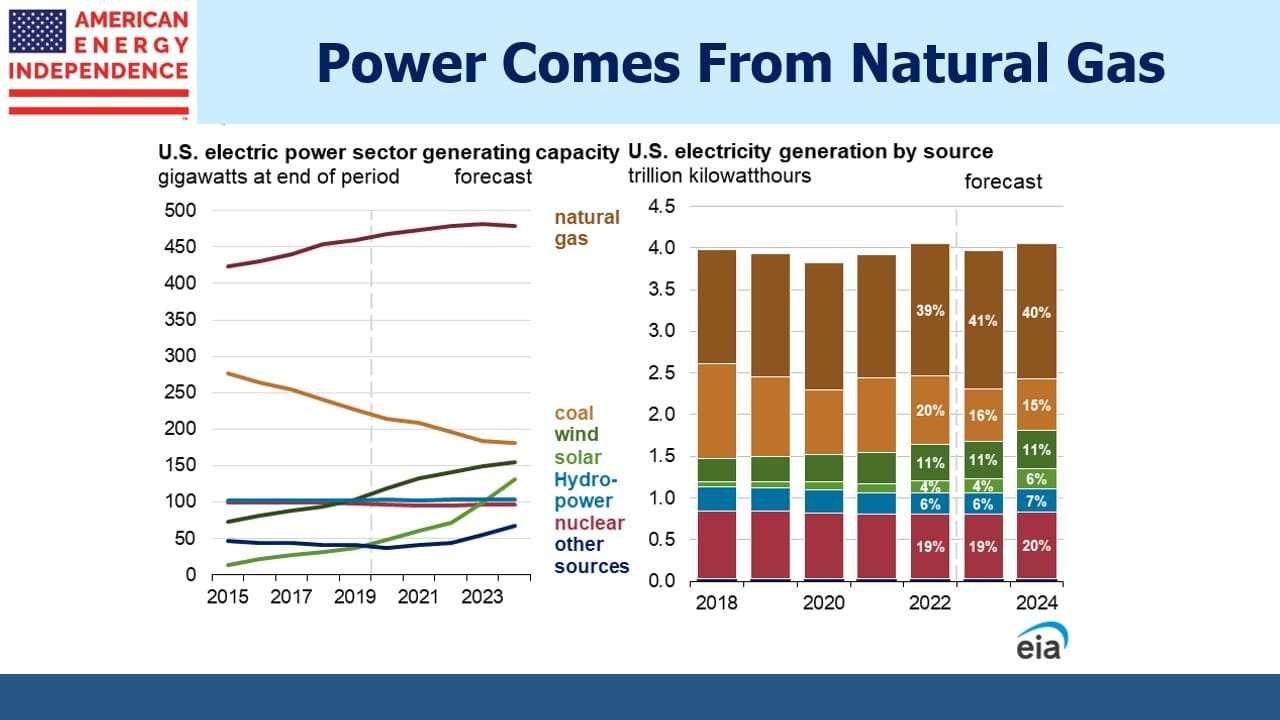

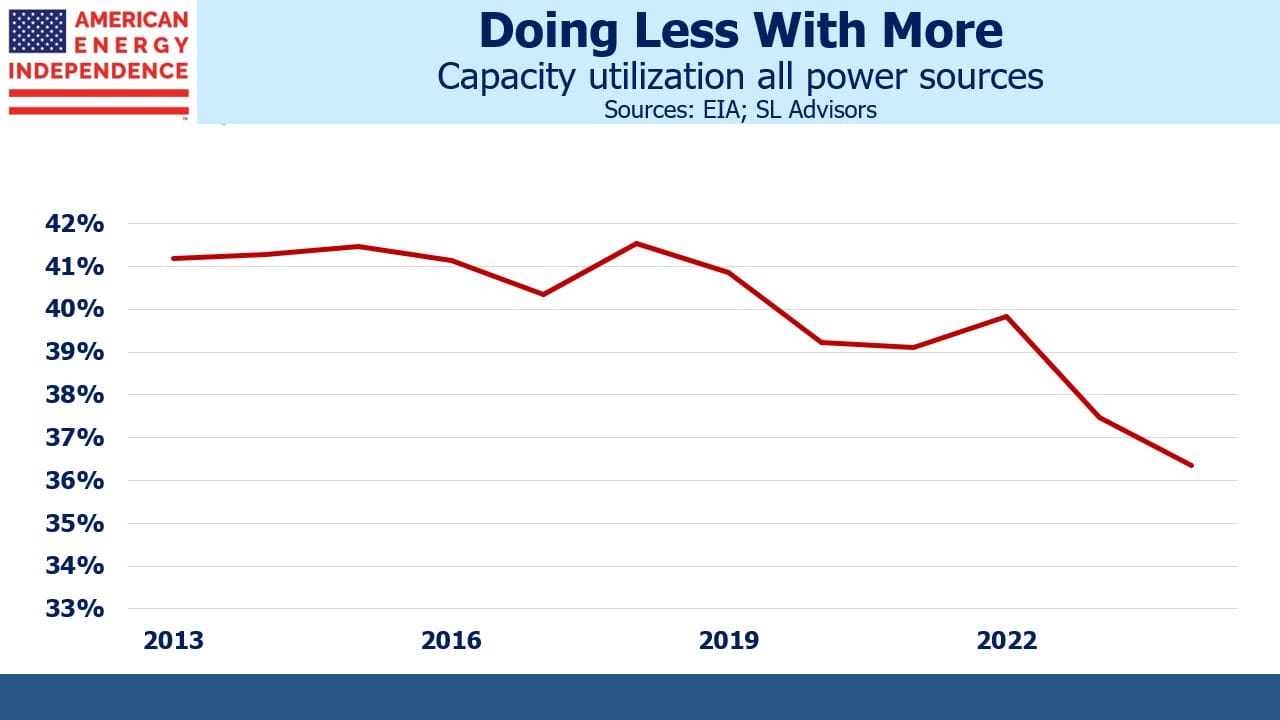

A chart from the US Energy Information Administration’s (EIA) recent Short Term Energy Outlook (STEO) prompted us to examine capacity utilization by power source more carefully. Over the past decade the increase in electricity generation from natural gas power plants is greater than the additional output from solar and wind, although you’ll see few headlines on the topic.

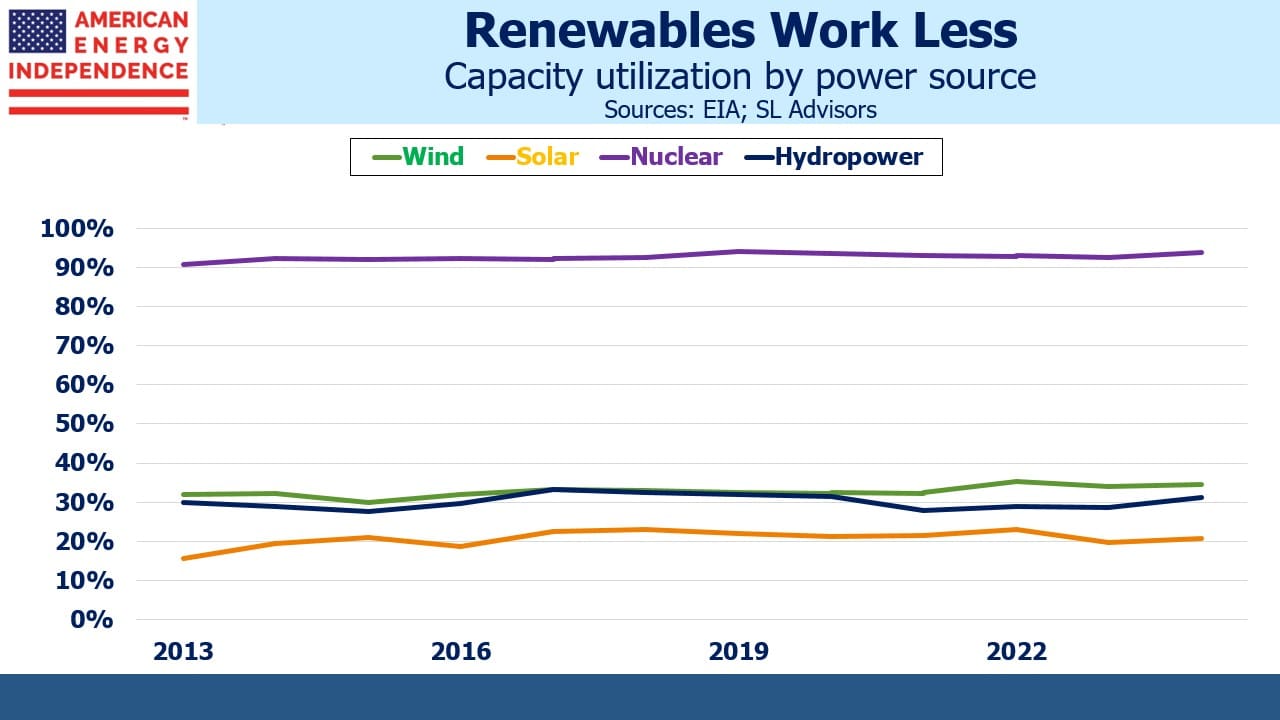

Increases in solar and wind capacity draw attention. But because they’re weather-dependent and it’s not always sunny or windy, they generate power less frequently and unpredictably.

Among carbon-free sources of power, nuclear operates at by far the highest capacity utilization. It’s always on and represents important baseload where it’s used. Hydropower is seasonal, generally best in the spring when snowmelt swells our rivers. Solar is barely over 20%. Offshore windpower tends to be more productive than onshore, but is more expensive too.

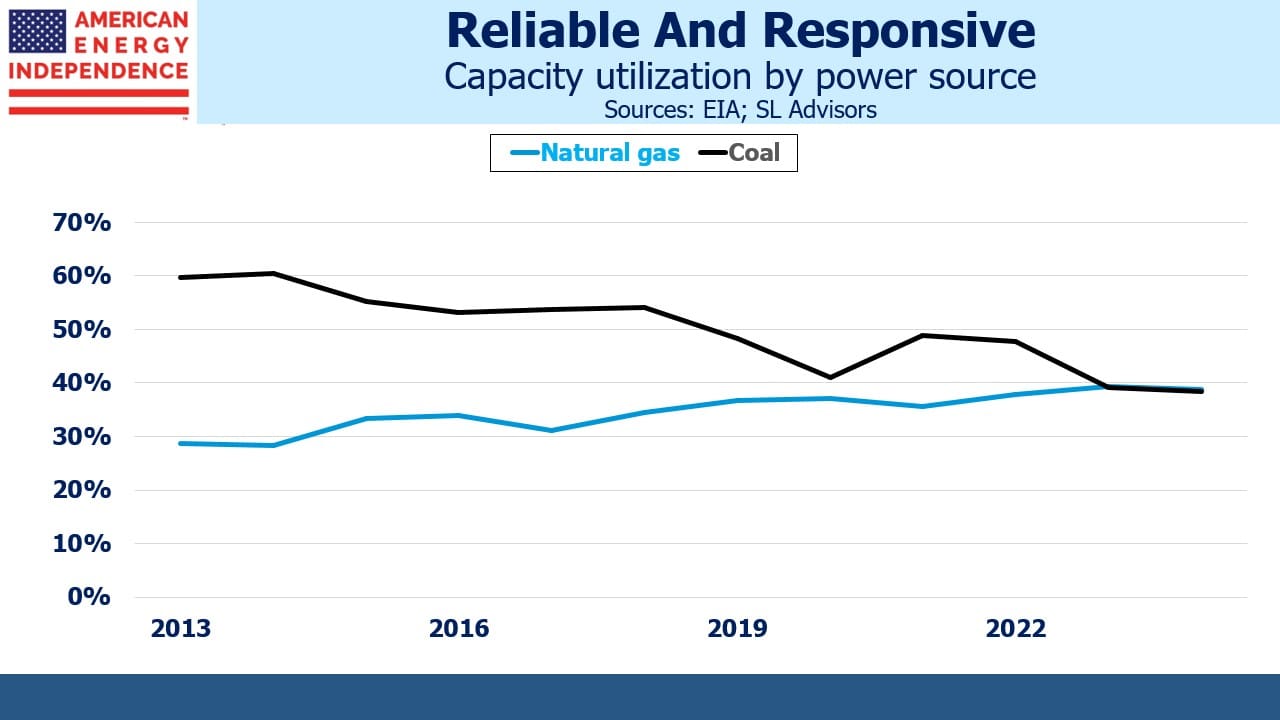

With dispatchable power, coal and natural gas are moving in opposite directions. Coal plants run less efficiently when their output is stopped and then restarted. Power generation from natural gas plants can be ramped up and down more easily. A decade ago coal provided 28% of our electricity compared with 15% today. Coal capacity hasn’t fallen as quickly, hence its reduced capacity utilization.

By contrast, the utilization of natural gas power plants has increased, in part because of their greater flexibility in altering their output up and down – either because extreme hot or cold weather raises demand, but also because increased renewables penetration has made flexible, on call power more valuable. Natural gas power plants are a natural complement to renewables, because they provide responsiveness and reliability, qualities not found in solar or wind.

When you look across the entire US power grid, capacity utilization has fallen from 41% to 36% over the past decade. This is because we’re using more solar and wind. Poorly informed advocates for renewables promote their apparently low cost per unit of power capacity. Sometimes they implausibly criticize utilities for willfully avoiding the cheapest source of power generation. But as our falling capacity utilization shows, this is a flawed measure of the true cost. The cost of dispatchable power or battery back-up needs to be included. Power prices in America are going up as unreliable energy sources gain market share. This shouldn’t surprise anyone, and yet we’re far better off than Germany and some other EU members with their dysfunctional energy policies (see Germany Pays Dearly For Failed Energy Policy).

China emits the most greenhouse gases and these emissions continue to grow every year. So our climate will be set in Beijing, not Washington DC.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!