Rallying Crude

/

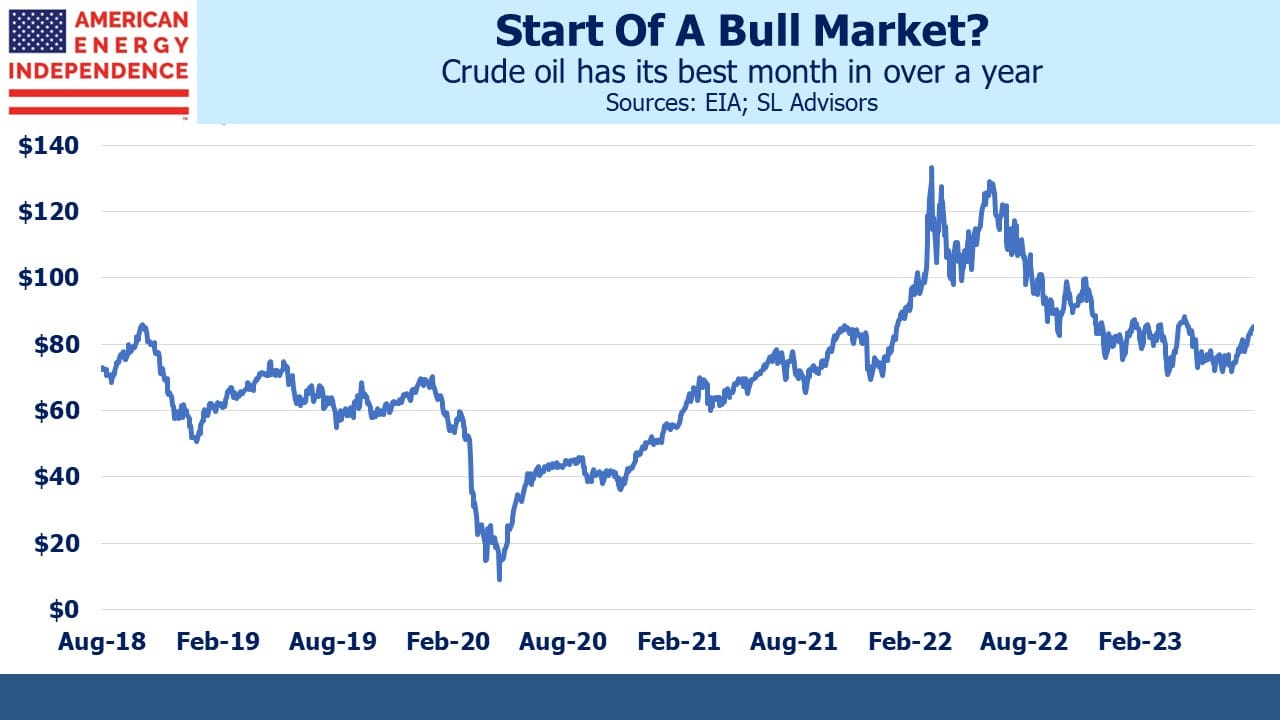

It doesn’t look like a bull market, but July was crude’s best month in more than a year with the Brent benchmark closing up almost $11 per barrel at over $84. After peaking in spring of last year following Russia’s invasion of Ukraine, crude oil has been sliding irregularly lower. Russia has found ways to get its product to market, to the quiet relief of western Europe’s governments whose application of sanctions has been constrained by a desire to avoid causing a price spike. China’s long Covid lockdown further depressed demand.

OPEC wants stable, high prices and regularly tweaks output to that end. Traders now expect Saudi Arabia to extend their voluntary production cuts of one Million Barrels per day (MMB/D) into September. The US is also replenishing the Strategic Petroleum Reserve following the Administration’s blatantly political release of reserves in the run up to last year’s mid-term elections.

Recession fears are also receding, helped by last week’s US 2Q GDP report. Goldman Sachs recently increased their forecast for global oil demand but stuck to their one year forecast of $93 for Brent. For now, the Fed has confounded the skeptics who believed monetary tightening would cause a recession (see Jay Powell’s Victory Lap)

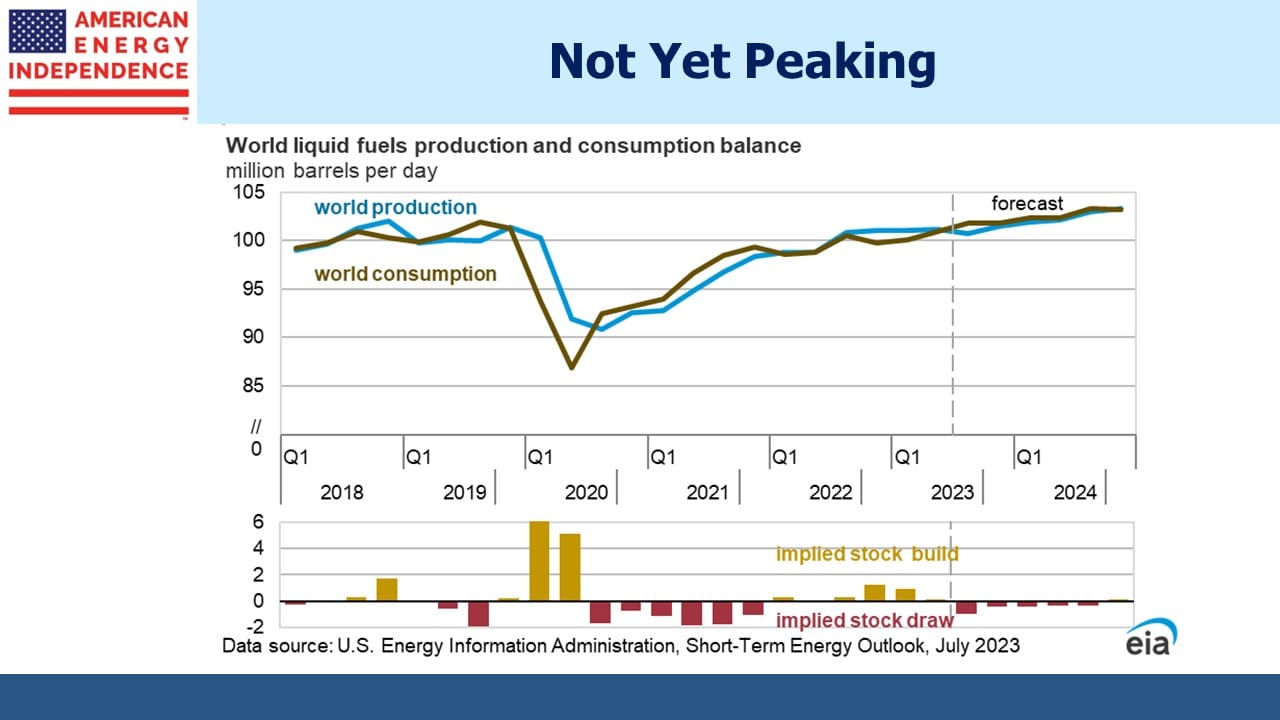

Peak oil is still out there somewhere, but for now demand keeps growing. The US Energy Information Administration (EIA) calculates that the second quarter saw record global liquids consumption of 100.96 MMB/D, marginally above the prior record of 3Q18 (100.91 MMB/D). For 2024 the EIA is forecasting 102.80 MMB/D, up from 101.15 MMB/D this year.

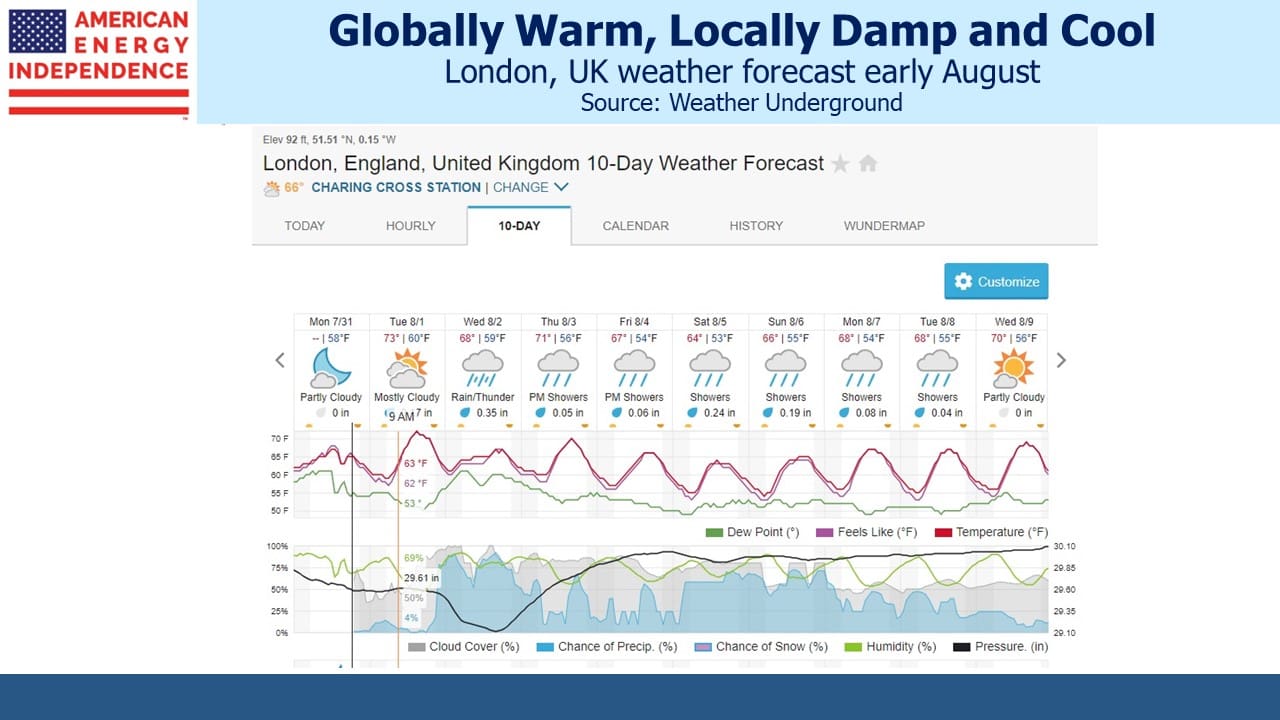

The hot weather we’ve recently experienced in the US has boosted energy demand. But above average temperatures haven’t been the norm throughout the northern hemisphere. In any case, your blogger finds 90+ degrees less distressing than most following a childhood in the UK where the climate is euphemistically referred to as “temperate”, thanks to the moderating effect of the gulf stream. Damp and cool might be more accurate, as the current forecast shows. Britain’s efforts at lowering CO2 emissions are especially selfless, because they could surely benefit from an extra couple of degrees.

Record natural gas consumption for power generation has helped keep Americans cool over the past few days, with an estimated 52.9 Billion Cubic Feet (BCF) burned last Friday. That compares with an average daily consumption forecast for this year by the EIA of 34.5 BCF, which is up 1.3 BCF/Day from 2022.

Union Pacific expects railroad shipments of coal to receive a warm weather boost, as coal-burning power plants ramp out consumption to meet increased demand for air conditioning. However, coal is rapidly losing its share of power generation at 15%, down from 28% five years ago. Natural gas remains America’s favorite source of power at 41% this year, up from 39% last year. Solar is at 4% and wind 11%, both flat year-on-year.

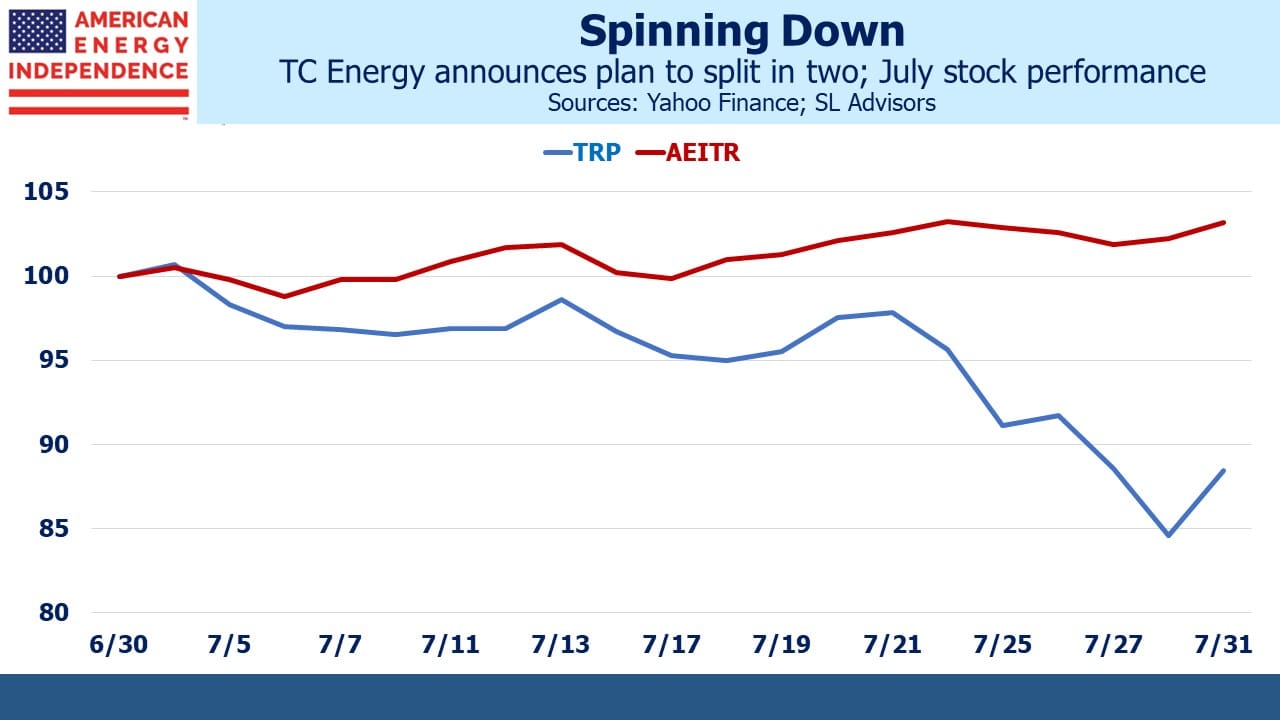

TC Energy (TRP) announced they’d be splitting the company into two last week on Thursday, 27th. Usually such announcements boost a company’s stock because it’s assumed each new entity will benefit from more focused management attention. Oddly, TRP sank on the news.

Three days earlier TRP had announced the sale of 40% of their Columbia pipeline system to Global Infrastructure Partners. The 10.5X EBITDA multiple was below what some analysts had valued the business at in their sum-of-the-parts analysis. This was followed by the spin-off announcement, and the relatively high projected 5.0X Debt:EBITDA leverage of the new stand-alone liquids business is high relative to peers.

After the price drop, TRP now yields over 8%. Canadian pipeline companies have a more robust history of maintaining dividends than their southern counterparts. A sustainable dividend at this level is likely to find value-oriented buyers.

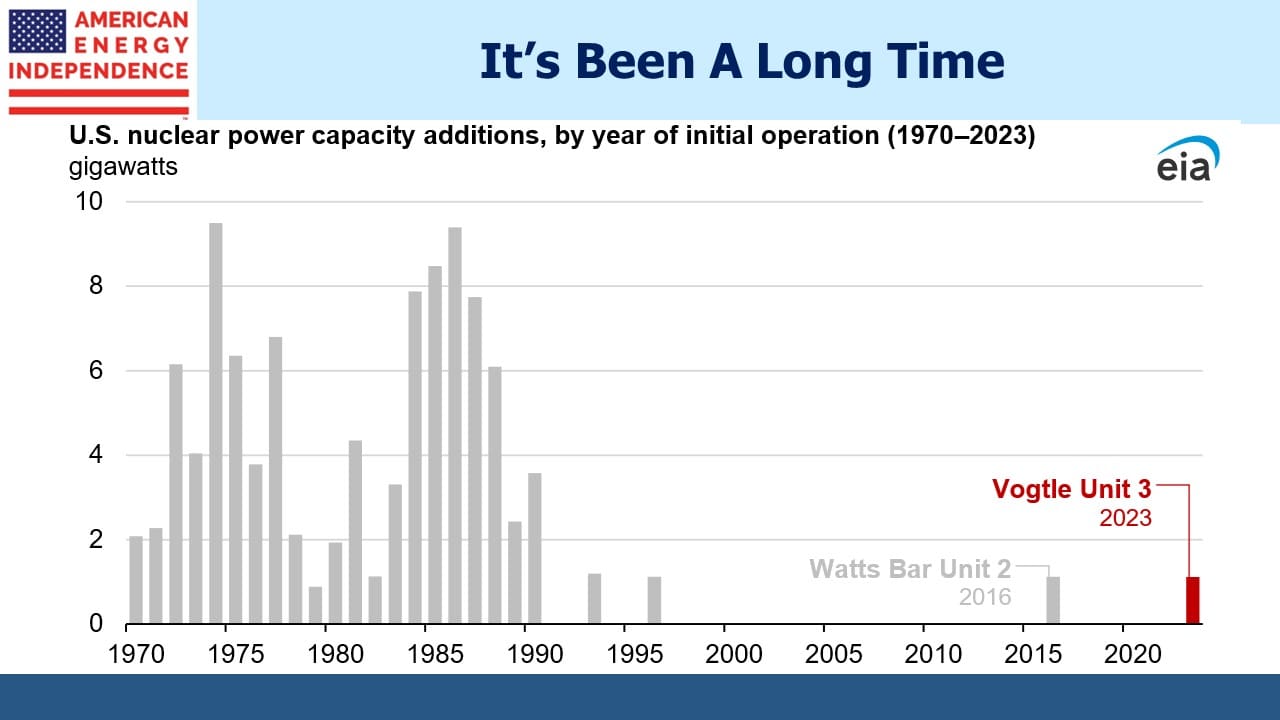

Finally, the Vogtle nuclear power plant in Georgia began commercial operations recently. It’s the first new nuclear power plant in the US since 2016 and only the second since 1996. The long hiatus since the early 1990s reflects public skepticism about nuclear safety along with the successful use of legal challenges by opponents to impede development. Nuclear power is expensive because our broken permitting process allows opponents to use the courts to insert unpredictable delays. This boosts the cost, thereby depressing the IRR. The same techniques have been used to delay needed pipeline infrastructure.

The Mountain Valley pipeline is an example – even though Congress recently fast-tracked its approval under the Fiscal Responsibility Act that headed off a debt ceiling crisis, a DC court still saw fit to impose a stay on resumed construction. It took an emergency ruling from the US Supreme Court (a “stay of the stay”) to allow construction to begin again. Long distance high power transmission lines and the related infrastructure in support of solar and wind will face similar headwinds. Reform of infrastructure permitting is an issue that both ends of the political divide should agree is well overdue.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

One issue with TRP is that, unless the shares are held in a tax qualified plan account, there is a 15% deduction from dividends for Canadian income taxes, which means that a US taxpayer will have to apply for a credit for that amount against his or her US income taxes.