Jay Powell’s Victory Lap

/

Criticizing the Fed is a self-indulgence afforded the rest of us unburdened with the need to actually set monetary policy. The FOMC usually provides a target-rich environment. The last couple of years have offered a sumptuous feast of mis-steps.

Start with synchronization of accommodative monetary policy with Biden’s uber-stimulus following his inauguration in early 2021. Quantitative Easing (QE) was promoted from a one-off solution to the 2008 great financial crisis to just another part of the Fed’s toolkit. Over the past fifteen years their balance sheet has taken a series of steps higher, from $1TN to $8TN, with only brief episodes of contraction. They don’t seem to know how to shrink it, so the partial monetization of our debt continues.

Monetary policy has adopted its own vocabulary, repurposing words such as hawk and dove. Transitory has become a pejorative word since it more accurately described the seeming permanence of high inflation. One imagines a freshman Economics class at Harvard where a self-appointed member of the monetary policy cognoscenti derides a fellow student’s poor grades as transitory.

Your blogger has taken regular shots at the Fed with irrational exuberance (see Time For Powell To Go). It’s just so easy.

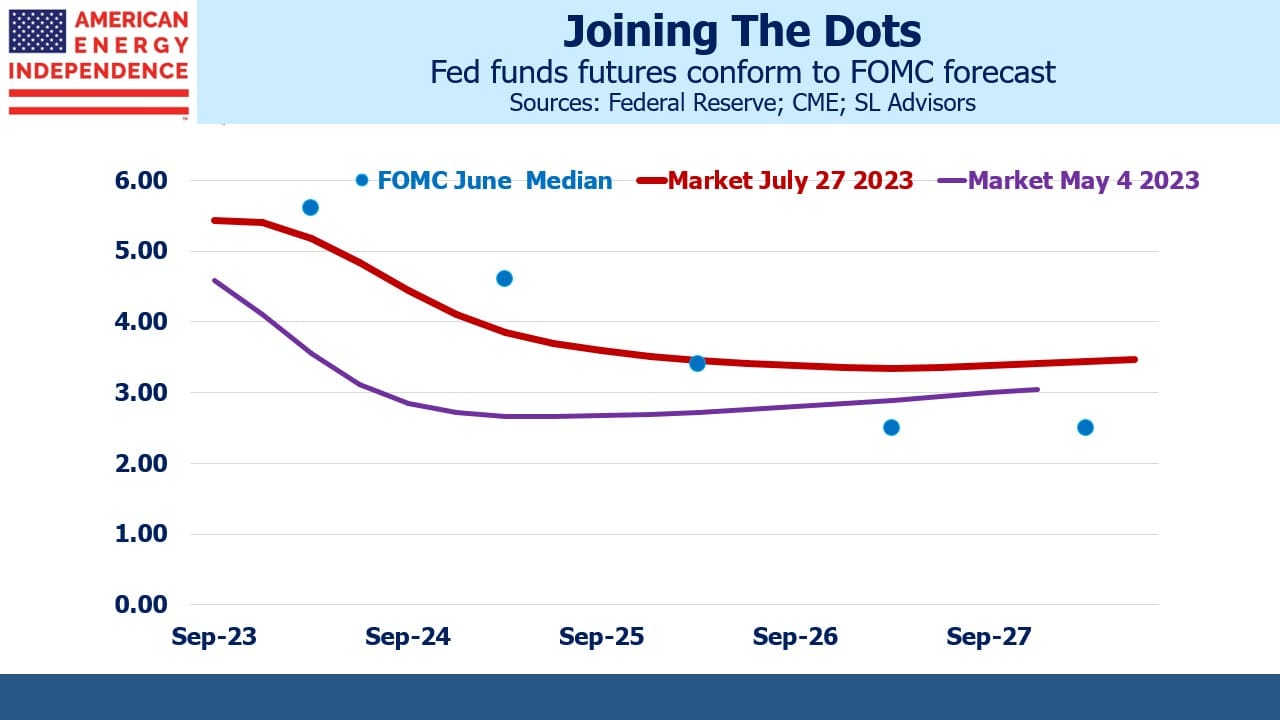

So Fed chair Jay Powell might have permitted himself a small victory lap in the green room last Wednesday out of sight of the cameras following his press conference. He’d just announced another hike in the Fed Funds target range, to 5.25-5.5%. As recently as May SOFR futures had been priced for a summer’s end rate of 4.7% with imminent easing. Since then, the June ‘24 futures yield has risen almost 2%, conceding to the Fed. Powell said it’s unlikely they’ll cut rates this year.

Inflation has been falling – not yet to the Fed’s 2% target but heading that way. JPMorgan is forecasting CPI inflation of 2.4% by next spring. The FOMC is projecting their preferred inflation measure using the Personal Consumption Expenditures (PCE) deflator to average 2.5% next year. PCE tends to be 0.2-0.4% below CPI because its weights adjust dynamically (CPI weights are updated biennially). So the FOMC inflation forecast is more conservative than JPMorgan’s. They expect PCE inflation to reach 2.1% by 2025.

For months economists have been warning of a recession. JPMorgan projects that 4Q23 and 1Q24 GDP will each be –0.5%, meeting the technical definition of a recession which is two consecutive quarters of GDP contraction. But the day after the Fed raised rates second quarter GDP came in at 2.4%, ahead of expectations as consumption remained strong. Powell has maintained for months that a recession could be avoided, and he reiterated that view at his Wednesday press conference.

One way to think about the Fed’s dual mandate of seeking maximum employment consistent with stable prices is that they focus on whichever of these two metrics is most off target. Hence in 2020 with inflation stubbornly low they said they’d tolerate higher inflation than in the past in order to achieve higher employment. That reinterpretation of their goals was as transitory as the higher inflation that followed.

Older readers will remember Ronald Reagan citing the “Misery Index” (Inflation + Unemployment Rate) under President Jimmy Carter as reason to vote him out. If FOMC policymakers ran for office rather than being political appointees, Powell would be running ads proclaiming the Utopian Index (think of it as the Misery Index when it’s low) was looking as good as ever on his watch.

Full employment is probably still somewhere above 4%, since the time it’s been below 4% has coincided with inflationary wage growth. Both JPMorgan and the FOMC are projecting unemployment next year of around 4.5% and inflation of around 2.5%. If things turn out that way, it will represent a deft monetary policy navigation that seemed implausible just a few months ago.

Even hyper-active Jim Cramer, ever sensitive to the market’s zeitgeist, asserted on Thursday morning that he had always been a supporter of Fed chair Powell. He proclaimed himself a “Jay fan” — and even a “Jay Hawk.”

Therefore, we must be at Peak Powell. The Fed’s critics have been relentlessly disarmed by empirical data that suited the Fed’s narrative more than theirs. Recession fears are receding. Inflation has not resisted downward pressure too stubbornly. Partial debt monetization via QE has not led to a collapse of the dollar or hyperinflation. The stock market has remained buoyant, unbowed by the improving returns offered by fixed income. Events have hewed more closely to what Powell told us to expect than the naysayers.

Jay Powell should gratefully accept whatever accolades come his way. Popularity for a Fed chair is ephemeral. The economy is a fickle mistress. He is, for now, on top.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!