Clean Energy Isn’t Just About Renewables

Technological advances in solar, wind and batteries receive widespread media coverage. Costs are falling and battery back-up is improving, vital to cope with renewables’ intermittency. As Enbridge CEO Al Monaco noted last week (listen to our podcast, Oh Canada’s Pipelines!), the world is going to use more energy, and consumption of every form of energy will increase. While the media focus is on renewables, fossil fuels represent 80% of global energy consumption. Improving what already works, by dealing with emissions, is also a recipient of considerable R&D.

Hydrogen is receiving increasing attention. It has a reputation for being perennially five years away from cost effectiveness – but investors are certainly taking note of anything that’s hydrogen-related. A couple of months ago we noted how New Fortress Energy (NFE) had seen their stock triple this year on little more than vague plans to ship hydrogen (see Hydrogen Lifts an LNG Company).

The emission benefits of using hydrogen depend on how it’s produced. The most common method is methane pyrolysis, which uses heat to separate hydrogen from carbon (methane is CH4). Another process applies electrolysis to water, which separates the hydrogen atoms from oxygen, Both require energy as an input.

Most hydrogen in use today is “gray”, meaning fossil fuels are used in its production. “Blue” hydrogen is derived from methane, with the CO2 that’s produced as a by-product being captured. That’s already a pretty good result. “Green” hydrogen relies on energy from renewables to power the extraction process.

Hydrogen is an appealing solution if costs can be brought down, because burning it produces water, not CO2. Compared with methane it is less dense, and causes the steel used in pipelines to become brittle, which means it can’t currently be moved in a pure form through existing infrastructure.

But hydrogen is already being added in small quantities to existing supplies of natural gas (methane). For example, Los Angeles is currently adding 4% hydrogen to their natural gas supply and is hoping to get to 10%.

Pipeline companies are watching this area closely, awaiting solid evidence that it can be made commercially viable. If hydrogen use does gain traction, today’s midstream infrastructure businesses are well positioned to benefit, since hydrogen transportation will be via pipelines. The industry will surely find a technical solution to the problems caused by direct interaction of hydrogen with steel – perhaps by applying a protective coating to the inside.

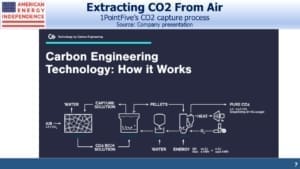

Recently, United Airlines announced an investment in 1PointFive, a joint venture between Occidental (OXY) and Rusheen Capital Management that aims to extract CO2 from the atmosphere. Airlines know that renewable energy won’t help them curb emissions – batteries are far too heavy to be built into an airplane. And jet fuel has the added benefit of being burnt as it’s used, decreasing weight.

Aviation is estimated to produce over 2% of global CO2 emissions. Post-Covid, flying is likely to resume its upward path in developing Asia at a minimum, even if a full return to normalcy is five years away as some airline executives fear. Nonetheless, it highlights that solar and wind offer a limited set of solutions, which means ongoing need for liquid fuels.

Extreme weather events have caused a jump in solar panel insurance. Last year a hailstorm in Texas caused $70MM in damage to a solar farm. California wild fires damaged three sites earlier this year. Solar panels are easily damaged, and insurance rates are 20-30% higher than a year ago.

“We have seen projects that were achieving their expected returns no longer able to do that, as a result of the change in the cost of insurance,” said Michael Kolodner, US power and renewables practice leader at Marsh, an insurance broker.

Those who blame these and other extreme weather events on climate change will not appreciate the irony.

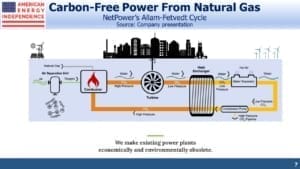

Another non-renewable, clean energy solution is NetPower’s emission-free natural gas turbine (see Clean Fossil Fuels May Be Coming). The company explains that their patented “Allam-Fetvedt Cycle burns natural gas with pure oxygen. The resulting CO2 is recycled through the combustor, turbine, heat exchanger, and compressor.”

NetPower says they have, “Multiple projects are in development worldwide for rapid global deployment of commercial units.”

Cleaner ways of burning natural gas; extracting harmful CO2 out of the atmosphere; commercially viable hydrogen. These are all potential solutions to the problem of lowering emissions that don’t rely on solar panels, windmills and batteries. These are the types of breakthrough that could quickly put today’s pipeline companies at the forefront of combating climate change. What’s clear is that innovation is happening in many more areas than simply the use of sun and wind.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Very interesting.

Thanks for sharing this wonderful, positive news. I am interested in the project.