Clean Fossil Fuels May Be Coming

Tokyo enjoys on average 1,800 sunny hours a year, less than half of sun-drenched Arizona. It’s also subject to extreme weather, such as typhoons. Arizona may be a candidate for solar power, but if Japan’s capital relied on the sun for its electricity, it would require battery back-up to provide the 25 Gigawatts (GW) its residents use for each day that bad weather, including typhoons, blocked its power source.

That’s 600 GWh per 24 hours. By 2021, Southern California Edison is planning a single system capable of running 100 MW for four hours. Tokyo would need 1,500 of them for 24 hours of back-up, sitting mostly idle until called into action by an extreme weather event.

This thought experiment is used in an interview with Bill Gates, where he illustrates the challenges facing renewables in meeting the world’s energy needs. Elon Musk is planning bigger batteries, but the economics of storing vast amounts of power to compensate for cloudy days remains daunting.

This is why combating climate change requires innovation on so many fronts. Given the enormous fixed investment and substantial R&D budgets of today’s biggest energy companies, developing technologies to use fossil fuels more cleanly remains a more likely solution.

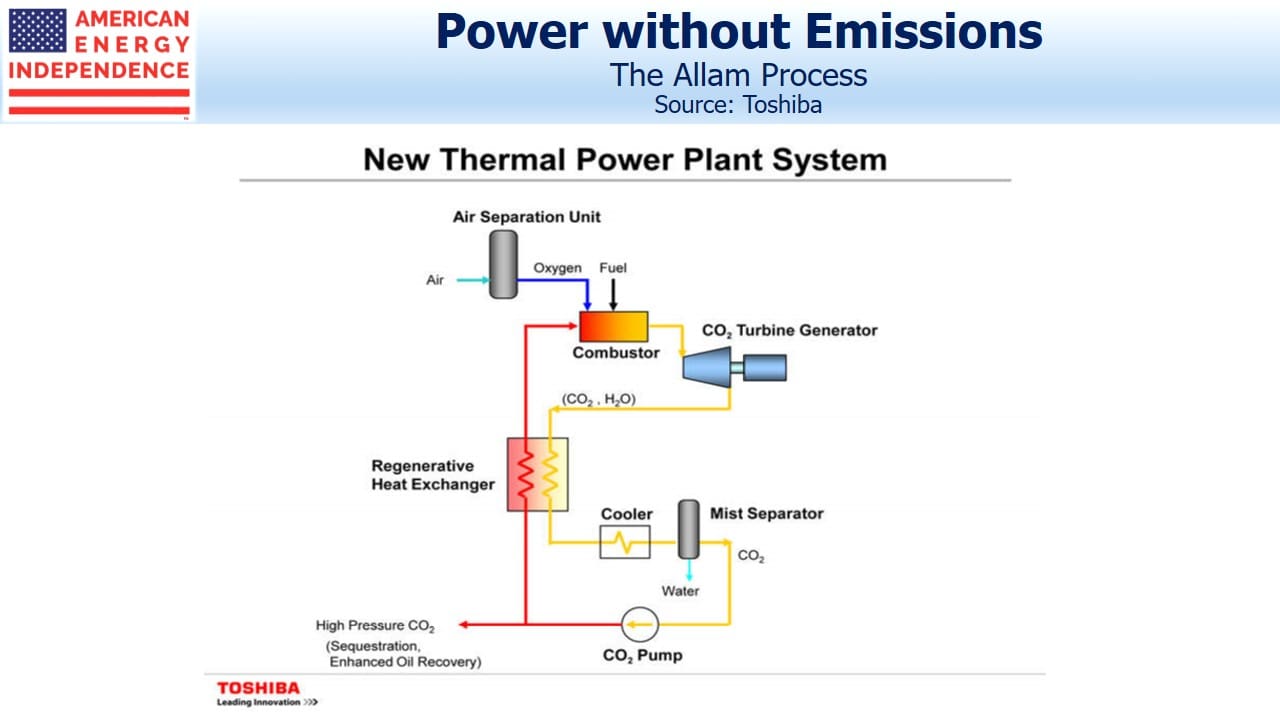

NET Power has developed a natural gas power plant that produces electricity with no CO2 emissions. Conventional single-cycle power plants burn natural gas (or coal) to heat water which acts on a turbine to generate electricity. This produces CO2, and in the case of coal plants other noxious gases and polluting particles. Combined cycle power plants use some of the produced CO2 to power a second turbine, improving efficiency but still ultimately emitting Greenhouse Gases (GHGs).

The Allam Cycle burns methane (natural gas) with pure oxygen extracted from the air (which is roughly 80% nitrogen and 20% oxygen). The result is water, and supercritical CO2 (sCO2) which is used to power the turbine. Most of the sCO2 is then recycled in a closed system to provide further power. There are no emissions, and the CO2 is eventually captured for resale or to be permanently sequestered underground.

Its backers, who include Exelon, Occidental Petroleum and venture capital firm 8 Rivers, aim to show that the technology is commercially viable. Publicly, developments have been slow. An experimental power plant is operating in La Porte, Texas. For now its power output is only being used internally while testing continues; it’s not yet reliable enough to connect to the Texas grid, run by ERCOT. NET Power expects the technology to be deployed commercially by 2022.

In testimony before the Senate Committee on Energy and Natural Resources last year, 8 Rivers principal Adam Goff noted the business potential in China and India, where local pollution is as big a concern as GHG emissions.

NET Power has been around for some time. Goff said 8 Rivers began developing the Allam Cycle in 2009. Progress has been methodical, or ponderous, depending on your perspective. Based on public comments from Goff and others, within the next year or two we should see tangible signs confirming that NET Power has a commercially viable product.

The electricity produced is expected to be cheap, partly because of the rebate from selling CO2. Occidental, one of NET Power’s investors, pumps 50 million tons of CO2 into the ground annually to boost oil production. Although the CO2 is permanently out of the atmosphere, climate extremists are unlikely to be impressed. And it’s unclear that there’s demand for the amount of CO2 that such plants would produce if the technology was widely adopted.

The Allam Cycle is not limited to natural gas. Petroleum-based products and even coal can be combined with pure oxygen to generate electricity, although the focus has been on developing the natural gas capability. Capturing the CO2 from conventional power plants is expensive because it has to be separated out from the air as it’s emitted. NET Power’s approach captures the CO2 while it’s still in a relatively pure form, which is much cheaper.

80% of the world’s primary energy comes from fossil fuels. Although only around 20% of global energy use is for electricity, that’s still substantial and initiatives to combat climate change generally contemplate increased electrification of transportation. Electric vehicles charged by hooking up to a predominantly solar and wind grid remain the dream of many. But when you consider how well fossil fuels work, and the enormous capital invested in their continued dominance, privately-owned NET Power looks like a venture that much of the energy sector is cheering on from the sidelines.

If its backers are right, they’ll earn an enormous return as well as ensuring continued demand growth for natural gas. If emission-free power from fossil fuels becomes a reality, depending on sunny and windy days supported by a huge battery back-up will seem rather quaint.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

This is a really nice piece, but it would be good to get the numbers and units right in the first couple of paragraphs. It is 25 GW (not GWh). that Tokyo uses continuously (Gates said 22). That adds up to 600 GWh per day. To handle a 3-day cyclone you need 1800 GWh of storage. This is 18,000 units with a capacity of 100 MWh. If you do the numbers using 22 GW, you get 15,840 units.