Deficit Spending May Yet Cause Inflation

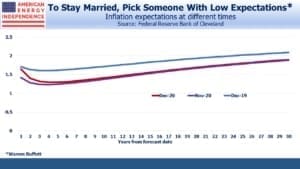

The biggest question for long term investors is why bond yields remain so low. The Equity Risk Premium (see Stocks Are Still A Better Bet Than Bonds) has favored equities for most of the time since the 2008 financial crisis. Inflation expectations remain well-anchored and are noticeably lower than a year ago. Investors don’t expect it will even rise to the Fed’s 2% target within the next three decades, despite the Fed’s professed objective to overshoot this.

Should inflation, and therefore interest rates, move surprisingly higher, a key support for the bull market would be knocked away.

Betting on higher inflation, or even worrying about it, has been a wasted effort for as long as any of us can remember. My own career began in 1980, around the time inflation peaked. Bond yields have been falling ever since. Jim Grant’s Interest Rate Observer has been warning of resurgent inflation for this entire period. That he retains so many subscribers shows how erudite prose beats accurate forecasts.

The most likely outcome remains low inflation. However, it’s safe to say that few investors are prepared for a surprise. Should it happen, the resulting market response is likely to be traumatic.

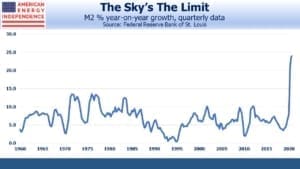

There are reasons to worry. M2 is rising faster than at any time in the past 50 years, exceeding even the inflationary late 70’s and early 80’s. The link between money supply and inflation appears to have broken, and any analysis of current conditions must consider that Covid has affected everything. Nonetheless, 24% year-on-year growth means something.

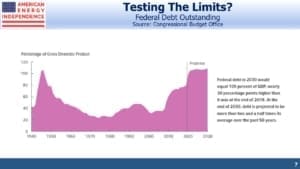

The Federal deficit, invariably nowadays the subject of hand–wringing but inaction, is forecast to be $3.3TN this year, at 16% of GDP the highest since 1945. The Congressional Budget Office expects total debt outstanding to reach 109% of GDP by 2030, exceeding the 1945 peak at the end of World War II. Unlike then, it is expected to remain at elevated levels.

Fiscal discipline has gone because there are few votes to be had in it. Past and present fiscal profligacy has caused little visible damage, as measured by the bond market. The burden of proof increasingly lies with the advocates of prudence.

Believers in Modern Monetary Theory (MMT) should be pleased. MMT holds that countries with a fiat currency, the prevailing global standard nowadays, can never go bankrupt. This is because the government can always issue itself money to pay any bill. Therefore, deficits don’t matter, as explained by Stephanie Kelton in The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy (you can read our review here). Or at least, deficits don’t matter until excessive government spending leads the economy to exceed its productive capacity, which is inflationary.

MMT remains at the fringes of political discourse, embraced by the same progressive Democrats who love the Green New Deal (see The Bovine Green Dream). It’s not conventional economic policy.

And yet, the deficit trend suggests that we are embarking on a great MMT experiment. $1TN is now a round lot for stimulus spending, rebuilding our creaking infrastructure, forgiving student debt or combating climate change. Proposing less betrays a lack of urgency. Derisively low bond yields deny fiscal conservatives their most potent weapon. MMT advocates must retain a disciplined silence, in case the rest of us comprehend that we are unwittingly doing their bidding.

Years of costless Federal profligacy have caused voters to become so disinterested in budget discipline that inflation is the only remaining constraint. We will continue testing the limits until we get a different result. MMT has become our fiscal policy. Higher inflation is assured, eventually. We don’t know when, but until then fiscal hawks will remain defenseless, disarmed of empirical arguments.

Therefore, every investor needs to consider how their portfolio will cope with higher inflation. Though the timing of such is unclear, it is inevitable. Gold and Bitcoin suggest that some see warning signs ahead.

The point of investing is to preserve purchasing power. For years, simply earning positive returns was almost sufficient. Companies with pricing power offer some protection. If inflation is 5%, Coca-Cola will pass that through to customers, like so many companies with a strong brand and barriers to entry.

Real assets are another good choice. The rising cost of pipeline inputs (steel, concrete, labor) will increase the value of what’s already built. The next few years will in any case see few new pipelines. President Biden and relentless legal challenges from environmental extremists will add value to existing assets that have become hard to replicate.

This is why planned spending on new pipelines is continuing its downtrend. Investors are welcoming the resulting boost to free cash flow, which has spurred a series of buyback announcements (see Pipeline Buybacks To Shift Fund Flows).

Oil is a global commodity whose recent price rise is partly to compensate for a weakening US dollar. Natural gas is similar, although relatively high transportation costs allow greater regional price disparities. And much of the North American pipeline network operates with tariffs that include inflation adjustments.

Inflation remains dormant, but America is probing for the conditions which will change that. MMT proponents are getting their wish. Pipelines offer protection for every portfolio.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Could not agree more. Because we haven’t experienced the crash personally, we think the risk of it doesn’t exist. Looking at our own history as well as that of others, there are two key characteristics of inflation. First, it doesn’t tell you just when it will strike. Like the COVID/Putin collapse in March, when you discover it is happening it is too late to come up with a strategy. Second, unlike the collapse in March, when it comes, the damage is permanent. That dollar that is now worth sixty cents will never again be worth more than sixty cents. Some for that bond. The damage is irreversible. (So ironic – and counter-intuitive to the general public – that one of the best hedges against inflation is to be a borrower of cash.)