Pipeline Buybacks To Shift Fund Flows

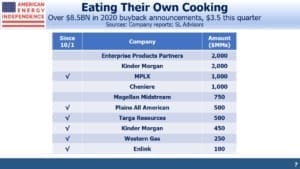

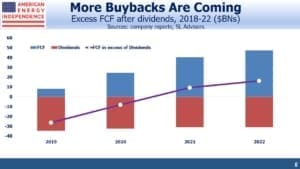

The pipeline sector’s increasing Free Cash Flow (FCF) has quietly allowed several companies to initiate buyback programs. We calculate that over $8.5BN in buyback programs have been announced this year, including $3.5BN following 3Q earnings.

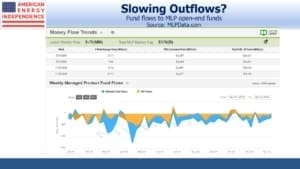

One of the biggest headwinds to improved equity returns this year has been selling by funds. There was the forced selling in March (see MLP Closed End Funds – Masters Of Value Destruction), which was likely in the $1-4BN range, and $6.4BN in steady redemptions from open-ended funds all year.

Recent buyback announcements have improved the buy/sell balance in the sector, such that companies could be absorbing investor sales with their own excess cash. Of course, buyback programs don’t have to be executed if, for example, prices rally to less attractive levels. This flexibility adds to their appeal. And while it’s impossible to predict what fund investors will do, their total AUM sank as low as $24BN in November before rising prices increased values.

It’s likely that positive investment returns will turn outflows to inflows before too long.

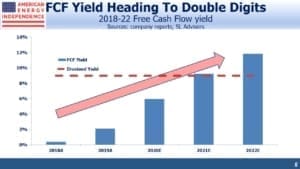

Increased buybacks, if combined with a shift in investor appetite for the sector, would represent a substantial change in flow of funds into pipeline stocks. Valuations have been attractive for months (see May’s post, Pipeline Cash Flows Will Still Double This Year). Fund flows are starting to reflect this.

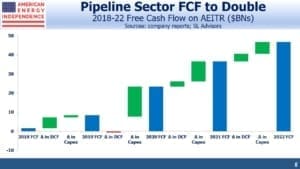

Next year the continued growth in FCF will leave excess cash after dividends. Over the next two years, we estimate that the sector will generate $25BN in excess FCF after dividends. This should leave room for further buyback announcements over the next few quarters.

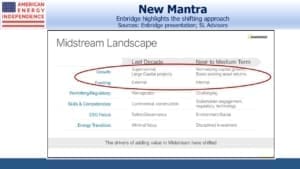

The market has been slow to recognize this, but pipelines are becoming cash-generative businesses. Enbridge (ENB) reflected this shift on a slide at their investor day last week. Large capital projects are being replaced with a focus on boosting returns from existing assets. Funding is now internally generated cash rather than the capital markets. And they are making investments in renewables as part of the energy transition, as long as returns justify it.

Related to the energy transition, on Thursday United Airlines announced an investment (amount unspecified) in 1PointFive, itself joint venture between Occidental (OXY) and Rusheen Capital Management. They are developing technology to extract CO2 from the air and convert it into pellets that can be stored.

It’s possible to by cynical about such efforts – United Airlines, like every public company, has an ambitious ESG agenda. The requirements to score well on ESG criteria are extremely flexible. For example, Lockheed Martin has been in the Dow Jones Sustainability Index for seven years (see Pipeline Buybacks and ESG Flexibility). Think green bombs. In many cases there’s more style than substance to ESG-initiatives. Nonetheless, this illustrates that the R&D to combat climate change isn’t limited to improving battery storage to compensate for renewables’ intermittency. Commercially viable carbon capture would recast the debate about climate change. It’s worth watching.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!