A Simpler MLP Can Be Better

“Oceania was at war with Eurasia; therefore Oceania had always been at war with Eurasia.” 1984, George Orwell.

The hurriedly organized investor call with Plains All American (PAA) a week ago (rushed because of approaching Hurricane Harvey) must have been inspired by the revisionist history propagated by “the Party” in Orwell’s polemic against totalitarianism. PAA’s distribution “reset” (Newspeak for a cut) was larger than previously expected and was directed towards rapidly lowering leverage. Like Orwell’s Ministry of Truth, they explained “…we have assessed the appropriate distribution level to accelerate our deleveraging objectives.”

It’s as if balance sheet strength was always their main objective. There’s no mention of paying stable distributions to their unit holders, which in a different era was the reason for investing in MLPs. If you listened between the lines, you could hear, “We care most about our leverage; therefore, we’ve always cared most about our leverage.”

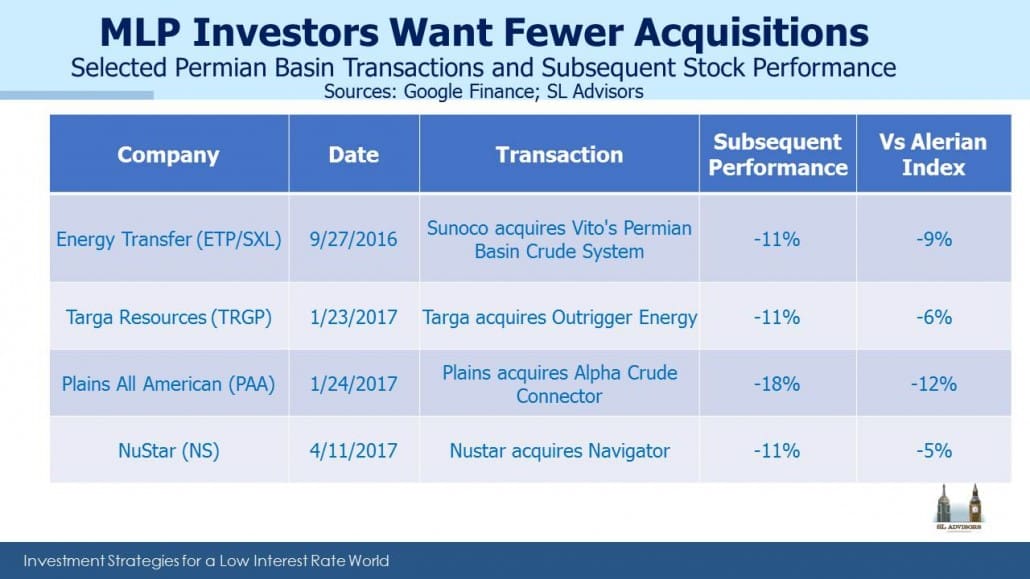

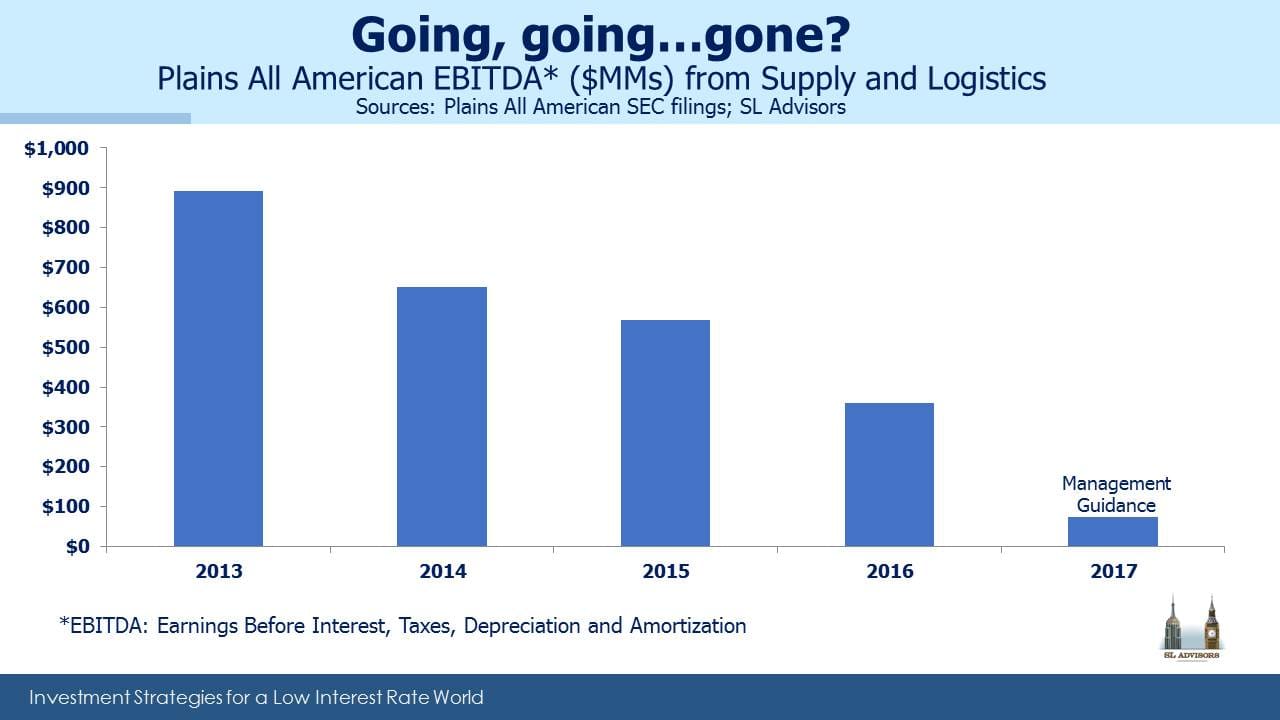

In January, when PAA acquired a Permian gathering system for $1.2BN they reaffirmed prior 2017 EBITDA guidance of $2.3BN and hinted it might be higher. During their 2Q17 earnings call they cut it to $2BN because of the collapse in their Supply and Logistics (S&L) segment (see MLP Investors Learn About Logistics). Nonetheless, they still forecast 15% growth in 2018, reaching their 2017 target a year late and with a better mix of earnings even more oriented towards traditional, fee-based cashflows since their S&L business has shrunk.

Nonetheless, rating agencies determined that this represented too much risk for an investment grade debt issuer. It’s part of a pattern whereby MLP managements are finding that their goals are not aligned with those of their traditional equity investors. An “It’s not you, it’s me” kind of moment. Although you didn’t ask for this, we went for growth with leverage and risked the distribution. Sorry. Get over it. Ironically, Moody’s still downgraded PAA’s debt to junk in spite of steps that favored debt holders over equity.

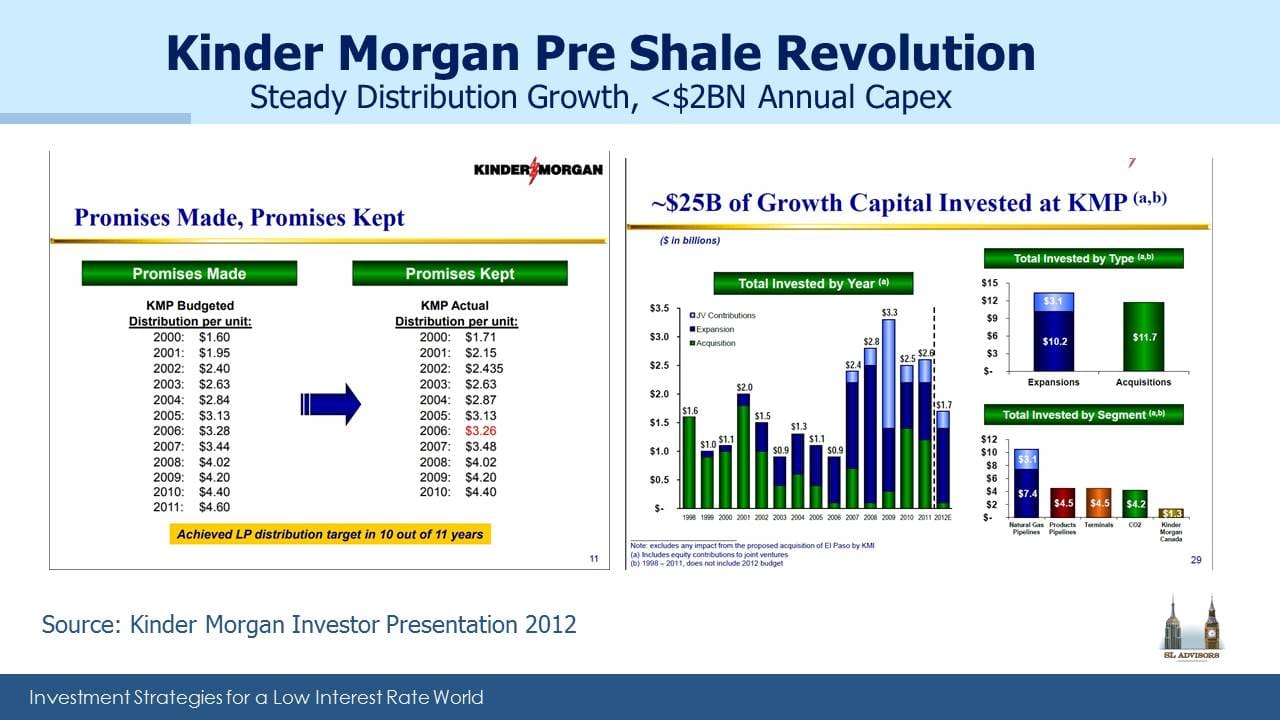

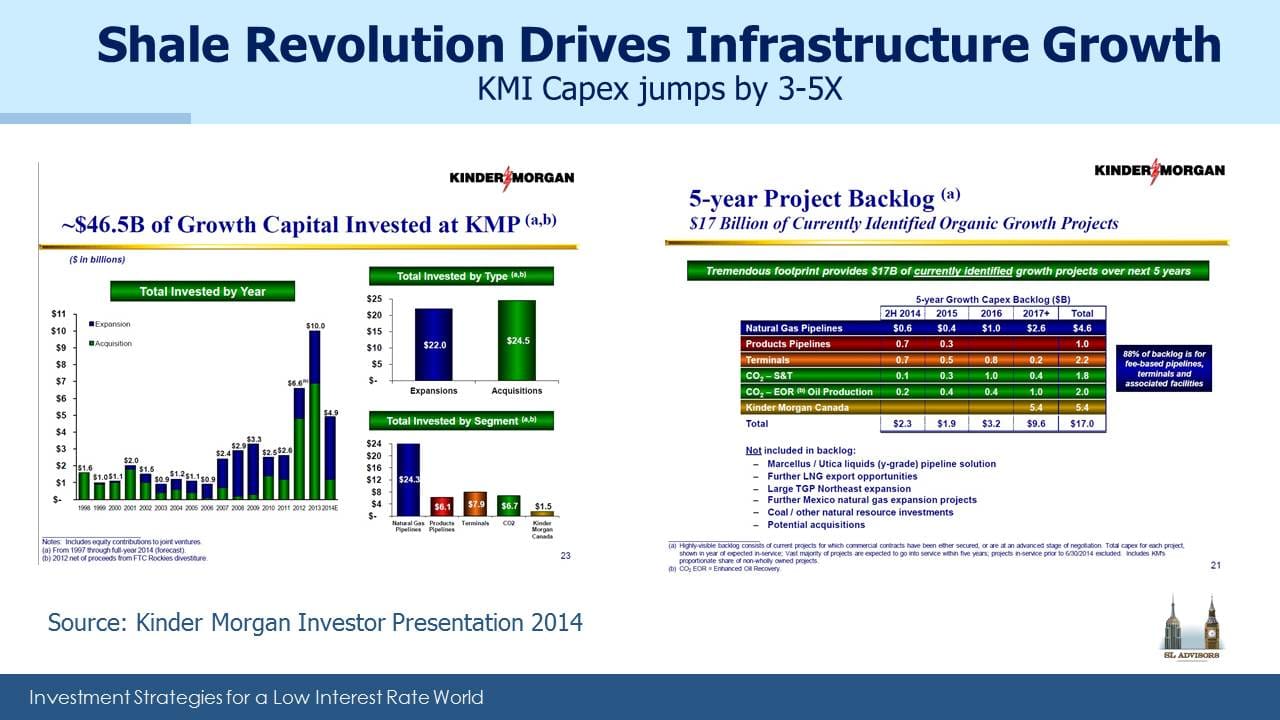

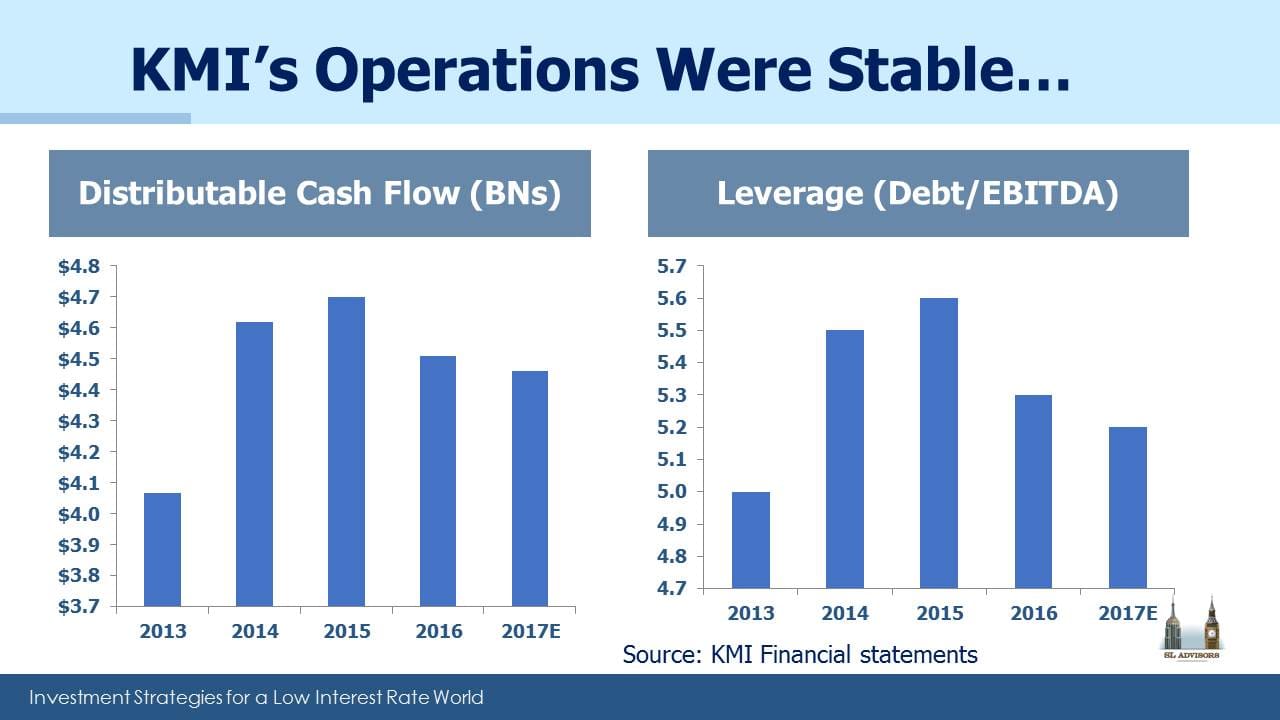

Simplification, the euphemism for distribution cuts to fund growth and reduce debt, has been used by several other large MLPs beginning with Kinder Morgan (KMI) in 2014-15 and including Targa Resources (TRGP), Semgroup (SEMG), Williams Companies (WMB) and Oneok (OKE). Current MLP investors are by now a battle-hardened bunch, and the veterans among them are unlikely to sell at this stage because of the recapture of their tax deferral. But it’s hard to see why a yield-driven investor would commit new money to the sector, since the clear message being communicated is that the yield that attracts you today may not be there tomorrow.

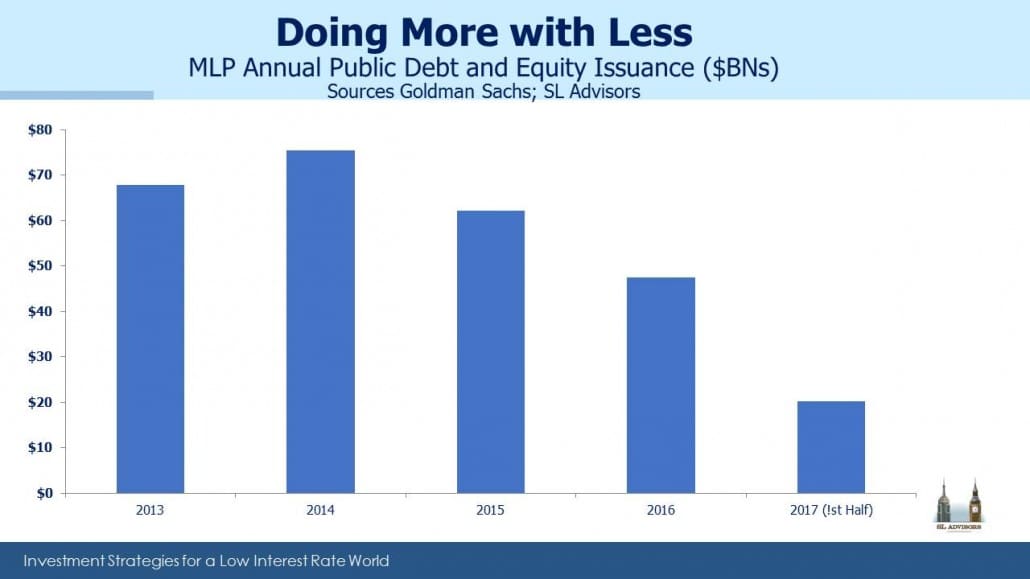

The trend is for the resulting entities to look more like conventional corporations, relying less on equity markets for growth capital. The General Partners (GPs) have tended to do better out of the changes, or at least fare less poorly. For example, in its November 2016 Simplification Transaction, Plains GP (PAGP) gave up its Incentive Distribution Rights (IDRs) in PAA in exchange for 246MM units of PAA. At the time this was worth around $7.4BN to PAGP plus assumed debt of $642M. Even today, with the stock 30% lower, it still represents over $5BN of value. And yet, under the newly “reset” distribution just announced by PAGP, the IDRs (if they still existed) would be throwing off less than $12.5MM per quarter. In 2016 PAA paid PAGP $565MM.

PAA investors transferred considerable value to PAGP last year in the forlorn hope of preserving their distribution. It’s probably the worst investment PAA has ever made, and the decision was made for them by PAGP. Having received almost $8BN to forego IDRs, PAGP then cut the distribution that PAA LPs were receiving. (1) Cancel IDRs for large consideration (2) Cut distribution. It wouldn’t make any sense to reverse the steps, because once the distribution was cut retiring the IDRs would have been worth far less. If not for the Simplification Transaction, PAGP’s stock price would have collapsed following the recent distribution cut at PAA.

Investors have conventionally regarded GPs as providing leveraged exposure to their affiliated MLP, with outsized upside and proportionate downside. But simplification protected PAGP investors from experiencing any worse downside than PAA. Moreover, PAGP even now retains the ability to acquire PAA, transferring its assets to PAGP and revaluing them at market which would create a new source of depreciation charges. In that scenario, PAA investors will get stuck with a tax bill in the same way that Kinder Morgan Partners LPs did when KMI acquired their assets. When PAGP’s current tax benefits expire (in 2016 their effective tax rate was under 11% of net income) they will be incented to do just that. PAGP shares are still worth more than PAA units, which is one more reason why it’s good to be invested with the GP.

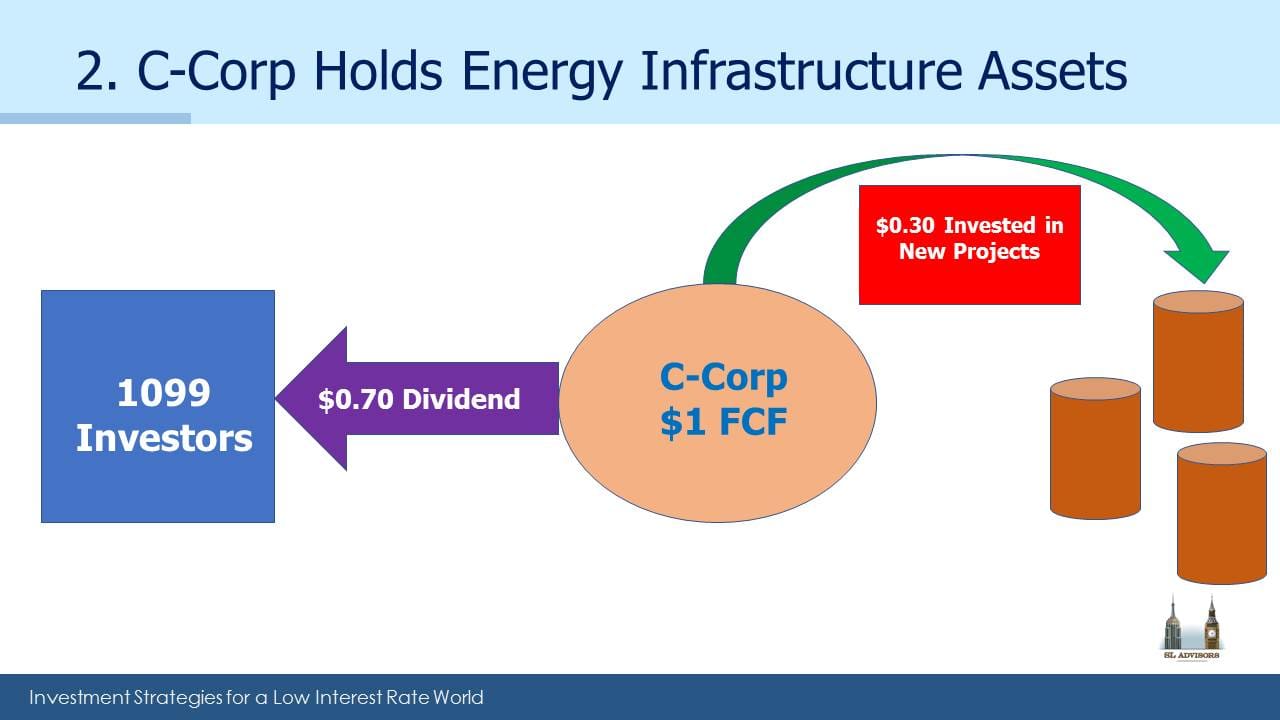

KMI, TRGP and OKE all imposed unpleasant tax outcomes as they acquired assets from their MLP affiliates (see The Tax Story Behind Kinder Morgan’s Big Transaction and Another MLP Simplification Benefits From Favorable Depreciation Rules). Simplification concedes that since MLP investors won’t provide needed growth capital on acceptable terms, it’s time for new investors. Limited Partner (LPs) investors in MLPs get a tax bill. GPs get a tax shield!

The only MLPs worth holding have already simplified their structure to eliminate IDRs (such as Enterprise Products, EPD and Magellan Midstream, MMP). They at least have a stable construct. Under the GP/MLP configuration the GP always has the option to waive IDRs so as to preserve LP distributions. However, such moves are rare. The power has always been with the GPs, many of which are C-corps today.

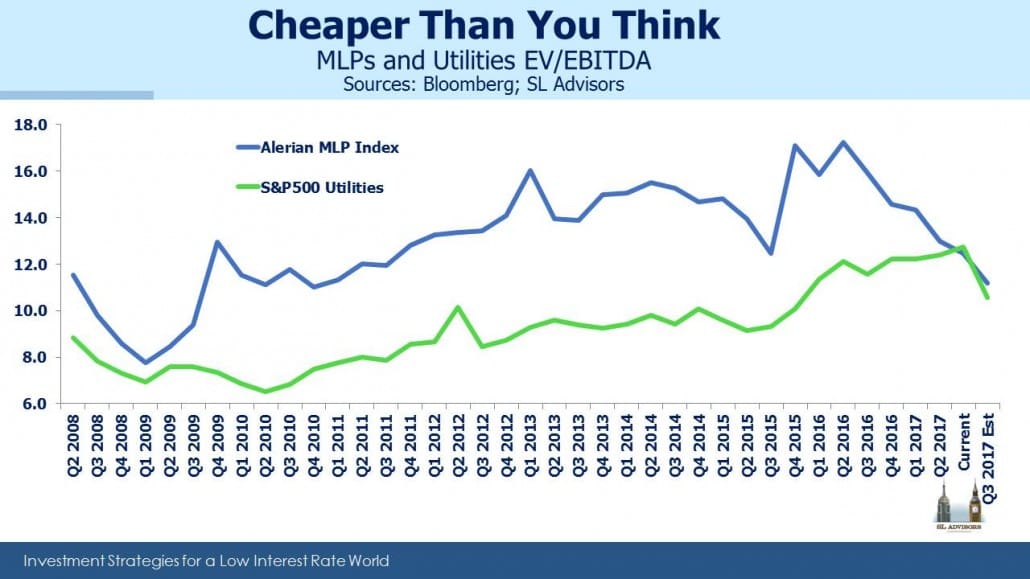

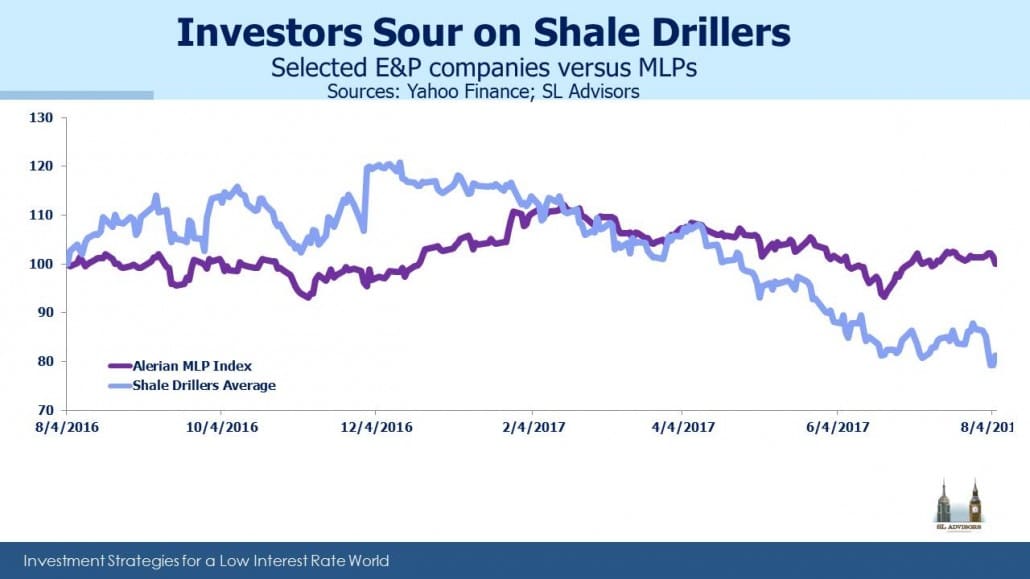

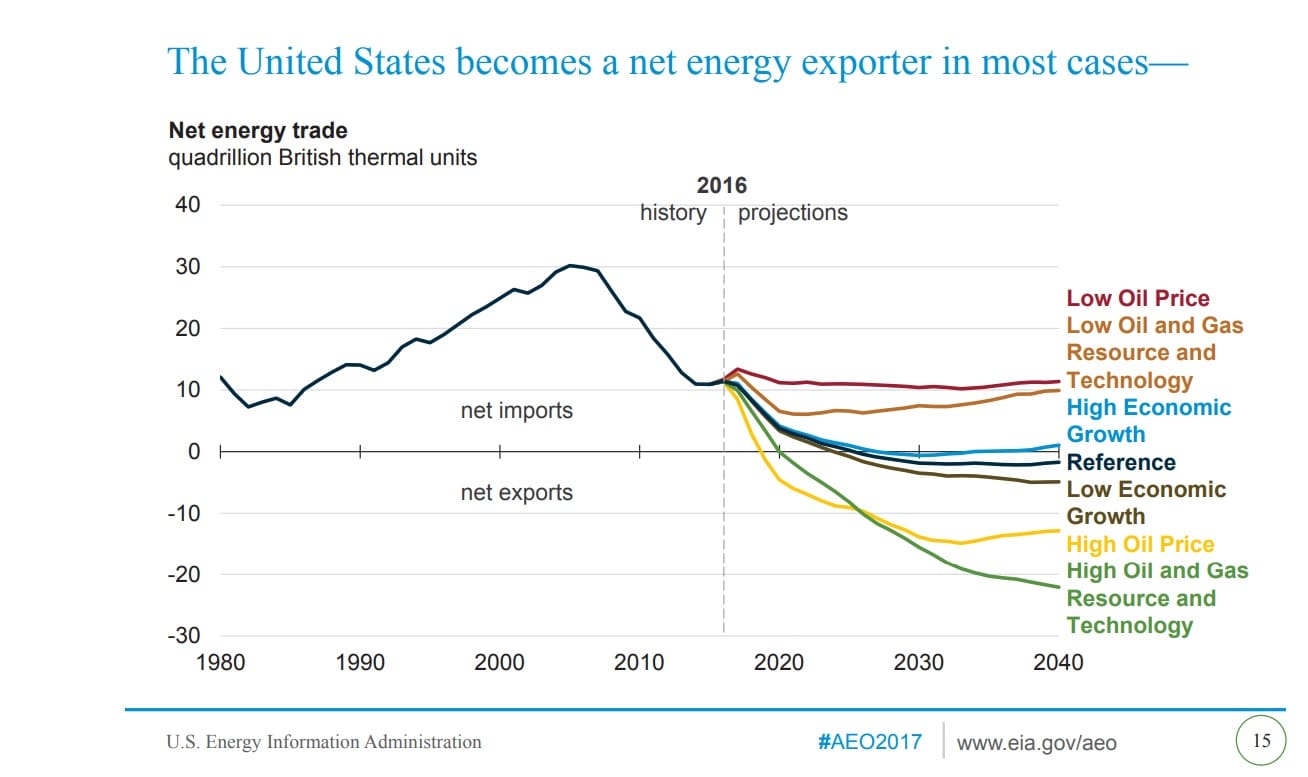

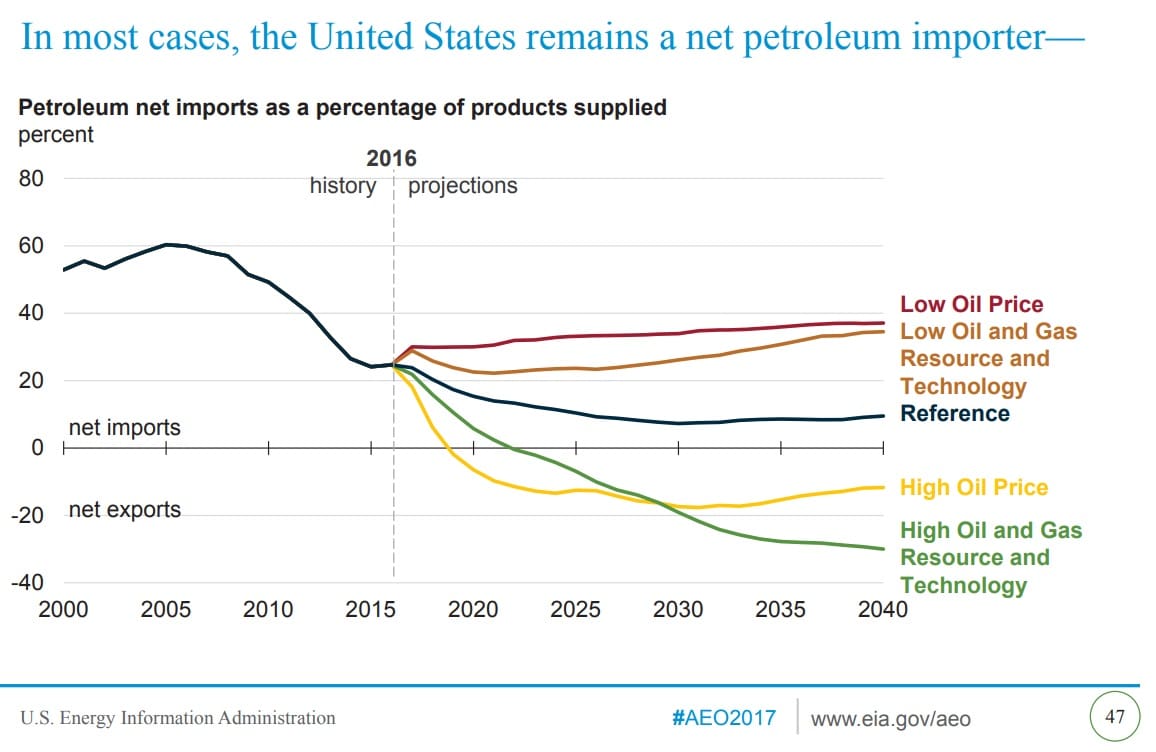

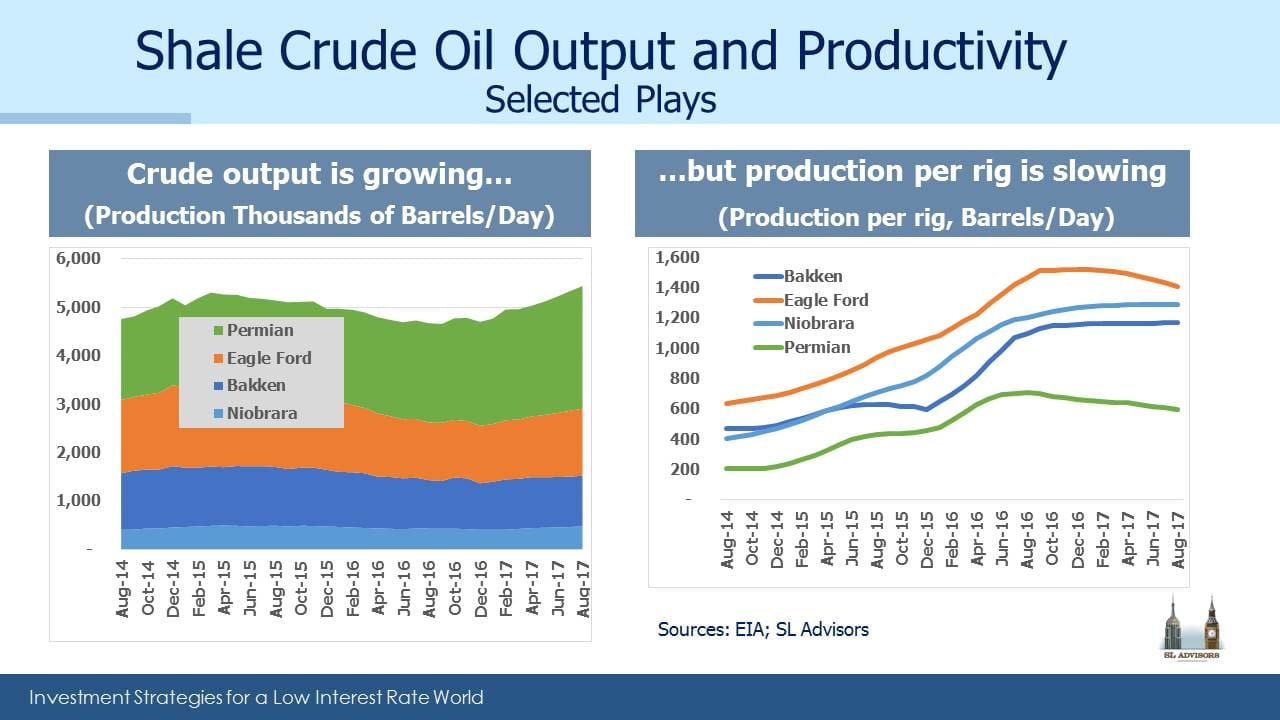

The road to American Energy Independence, driven by the Shale Revolution, is being navigated by regular corporations and GPs rather than MLPs. Valuation metrics that have worked in the past, such as Distribution Yield, are less relevant today given the changes to the financing model. A better measure is Enterprise Value/EBITDA, which allows comparison with other related sectors such as Utilities (see The Changing MLP Investor). At around 11.2X, this highlights the sector’s cheapness quite effectively.

We are invested in EPD, KMI, MMP, OKE, PAGP and WMB