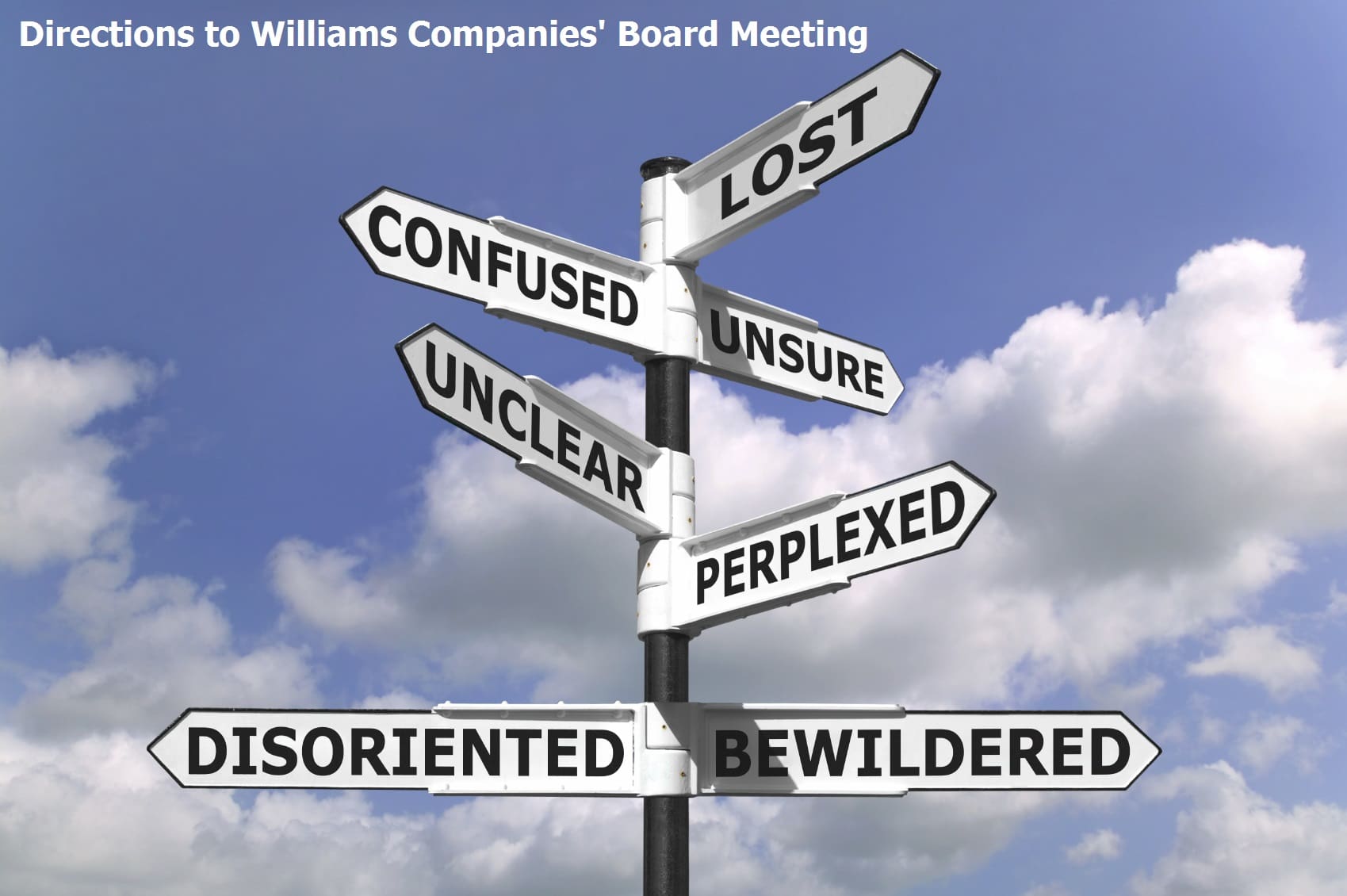

Williams Loses Its Way

With only the slightest risk of hyperbole, I can assert that anything written by Michael Lewis is worth reading. His latest work, The Undoing Project, recounts the friendship between two Israeli psychologists which led to Daniel Kahneman’s Thinking Fast and Slow. Kahneman, with his late friend Amos Tversky, developed an area of Behavioral Economics which shows why so much economic theory fails in practice – because humans inconveniently act like humans and not the economic agents (“econs” in Kahneman’s book) economists assume. Both books are highly readable.

I was reminded of this by Williams Companies’ (WMB) ill-considered secondary offering announced late on Monday. Last August, WMB and its MLP, Williams Partners (WPZ) were pondering how they would finance their capex budget. The Shale Revolution has led to many opportunities for WMB to add on to its Transco natural gas pipeline network, an irreplaceable artery running down the eastern United States. The price of WPZ reflected this uncertainty through a 9.7% yield. So WMB did something rather clever; they cut their distribution with the intention of using the cash saved to invest in WPZ. Removing the financing uncertainty drove both stocks higher. WPZ’s distribution was now secure, its financing assured and WMB shareholders (who are total return oriented rather than fixated on dividends) cheered the redirection of some WMB cash into cheap WPZ units. We wrote about this in Williams Satisfies Two Masters.

To return to Michael Lewis, he recounts how Amos Tversky came to believe that humans underestimate how random life is. He showed how events that appeared inevitable after the fact were very often assigned extremely low probabilities prior. Thus is it that last Summer’s moves by WMB appeared to be the reliably sensible choice you’d expect from an insightful management team. Whereas in fact the partial reversal of the August moves by WMB last week confirm that intelligent moves don’t necessarily confirm intelligence by the protagonists, but can in fact be dumb luck.

The two press releases reflect an Orwellian quality. Last August the goal was to ensure WPZ’s distribution was stable and WMB’s dividend was sacrificed to this end. Confusingly, today WPZ’s distribution is no longer regarded as important, while WMB’s is now raised. The solemn language about positioning for long term growth appears in both press releases even while in concert they reflect not a coherent strategy but a staggering from one transaction to another based on the last piece of advice received. WMB doesn’t seem to know if it needs cash or not — on the one hand it’s raising $2BN in equity, but on the other it’s increasing its payout.

More disappointing than their flip-flopping on dividends was the elimination of the Incentive Distribution Rights (IDRs) received by WMB from WPZ. IDRs are the payments the GP receives for running their MLP. WMB gave up its future claim to IDRs, which based on their 3Q16 receipt amounts to $900MM in annual cashflow. In exchange, they received 289MM WPZ units which, based on the new reduced dividend will generate only $694MM in cashflow. Moreover, IDR cashflows are worth a much bigger multiple than LP cashflows because they grow faster. Pure GPs trade at 2X the multiple of MLPs, and this was one of the attractive features of owning WMB. A fair consideration for the foregone IDRs would have been substantially more than the number of WPZ units actually received, which is why WMB shares fell 10% when the moves were announced. If WMB management was surprised at the market’s reaction, they’re either dim or incompetent.

WMB’s management has shown that they never really understood how intelligent they’d been in August when they redirected some of WMB’s cashflows away from dividends and towards WPZ. There wasn’t anything obviously wrong with this plan; it didn’t require tinkering. Their moves are random. There is no strategy, just a series of unrelated moves. Tversky showed Israeli Air Force instructors that the harsh feedback they gave trainees following errors wasn’t, in fact, causing subsequent improvement. Rather, pilots’ performance varies, and regression to the mean caused bad decisions to be followed by good ones regardless of the feedback from instructors. The management at WMB is similarly showing that they’re no better than average at corporate finance.

As usual, their advisers are the smartest guys in the room, finding new ways to shuffle the deck while generating fees. If you’re an equity underwriter, every client looks as if they’d benefit from more equity capital. This is no doubt the type of muddle-headed thinking that has caused Keith Meister, one-time WMB board member, vocal critic and head of Corvex Capital, so much frustration. WMB controls great assets – unfortunately the management isn’t of the same quality.

We are invested in WMB.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

I note the last sentence: “We are invested in WMB”, to which I ask Why??

We are less invested than before, but think eliminating this holding entirely would be a step too far.

Although they could have extracted higher value for idrs I think that both entities will be strengthened long term by this transaction. Transco is simply the best asset out there. I like these simplifications like what plains did and now Williams did. The fact that coming out of it you offer investors two choices – either a 1099 way so they have the option of holding in an Ira or pension fund, or the traditional k-1 partnership method.

Yes, Transco’s a great asset. But the incoherent series of steps, as well as the undervaluation of the IDRs, reflect poorly on management’s strategy.

WMB has a long and checkered financial history, marked by consistent use of high debt leverage and periodic brushes with financial disaster. As a general proposition, I think financial management of capital intensive businesses ought to call for investment grade debt ratings to ensure both access to and reasonable cost of capital. With WMB as a junk credit and WPZ as a very weak BBB-/Baa3 credit having a negative outlook (so say both S&P and Moody’s) and facing billions of external financing in 2017, it looks to me like management bit the bullet, bolstering the balance sheet’s equity cushion as well as providing for greater retention of future cash flow at WPZ. In any event, Moody’s liked the move. I suspect we are not privy to enough data points to fully determine whether or not WMB shareholders got fair value for giving up the IDR’s; time will tell. I’ve never owned either WMB or WPZ. I’ve followed the company off and on since the 1970’s. Never cared for the management; always thought they were rubes.

Those are good points, but surely the IDRs were given up for too little? Otherwise management must regard WPZ’s prospects as far more tenuous than they have otherwise communicated.

If management truly believes they have excellent growth prospects, they undervalued the IDRs. And, how often do you see management disadvantaging their primary ownership vehicle vs the LP…. maybe they are just that incompetent?

Yes, maybe. There’s no good reason why they valued them as they did, which was why WMB dropped so much on the announcement. Sometimes people aren’t as smart as you originally believed was the case. Or it could be their advisor had more clients in WPZ than WMB and therefore biased their advice so as to favor them.