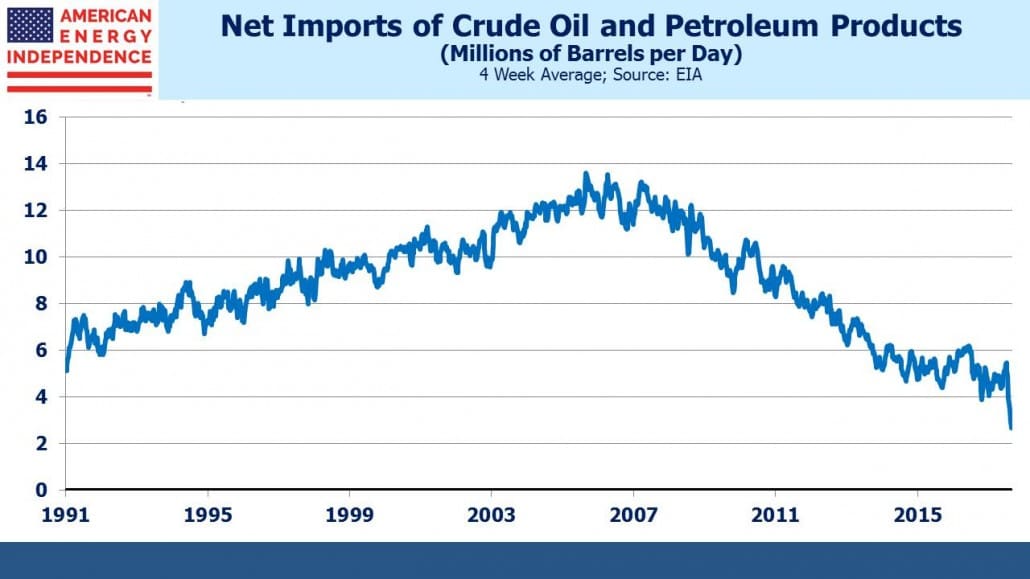

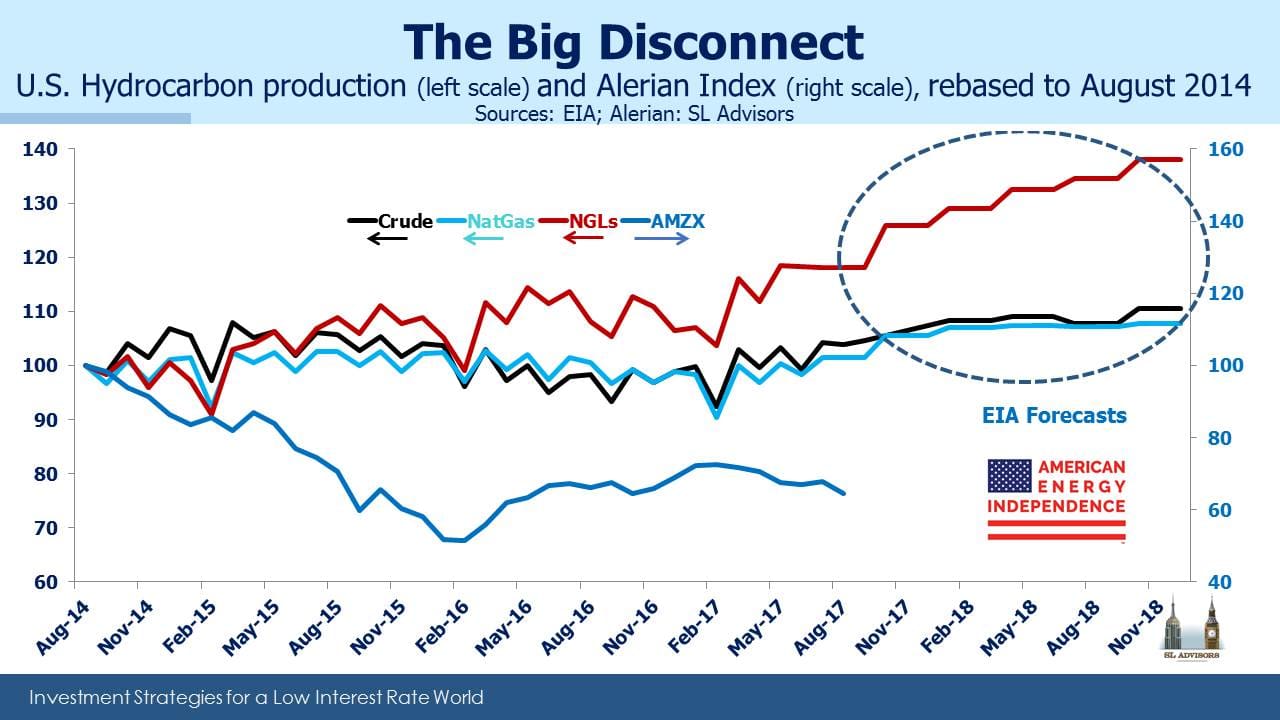

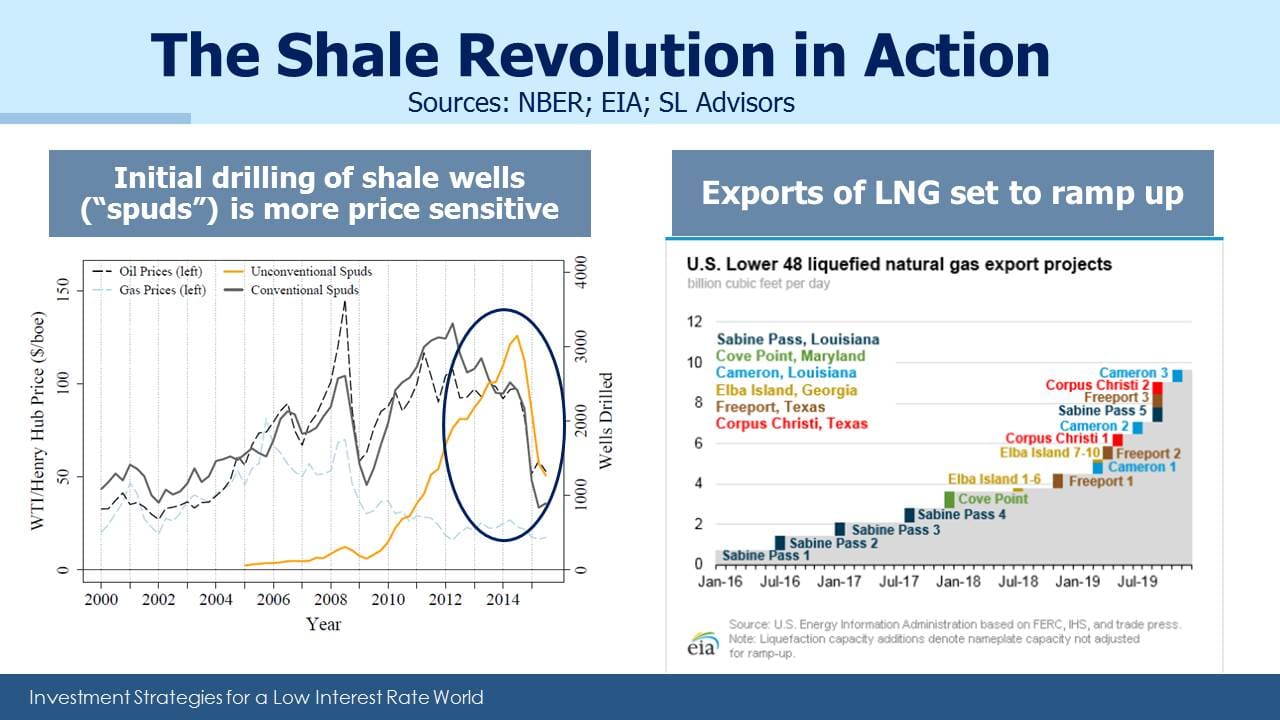

U.S. energy production continues to grow, boosting exports and continuing our path towards Energy Independence. The most recent weekly production figures from the Energy Information Administration (EIA) show U.S. crude output reaching 9.62MMB/D (Millions of Barrels per Day) exceeding the previous recent peak in June 2015. Production has fully recovered from the dip following Hurricane Harvey. The EIA projects that we’re on track to reach a daily average of 9.9MMB/D next year. This will eclipse the prior record of 9.6MMB/D set in 1970. Until the Shale Revolution few thought we’d ever see that figure again as crude output began a 40-year decline.

Natural gas production is expected to average 73.4 BCF/D (Billion Cubic Feet per Day) this year, up 0.6 BCF/D from 2016. Next year should see a big leap to almost 79 BCF/D. As we noted last week (see The U.S. Lowers Oil Volatility), exports of Liquified Natural Gas are set to more than quadruple over the next three years.

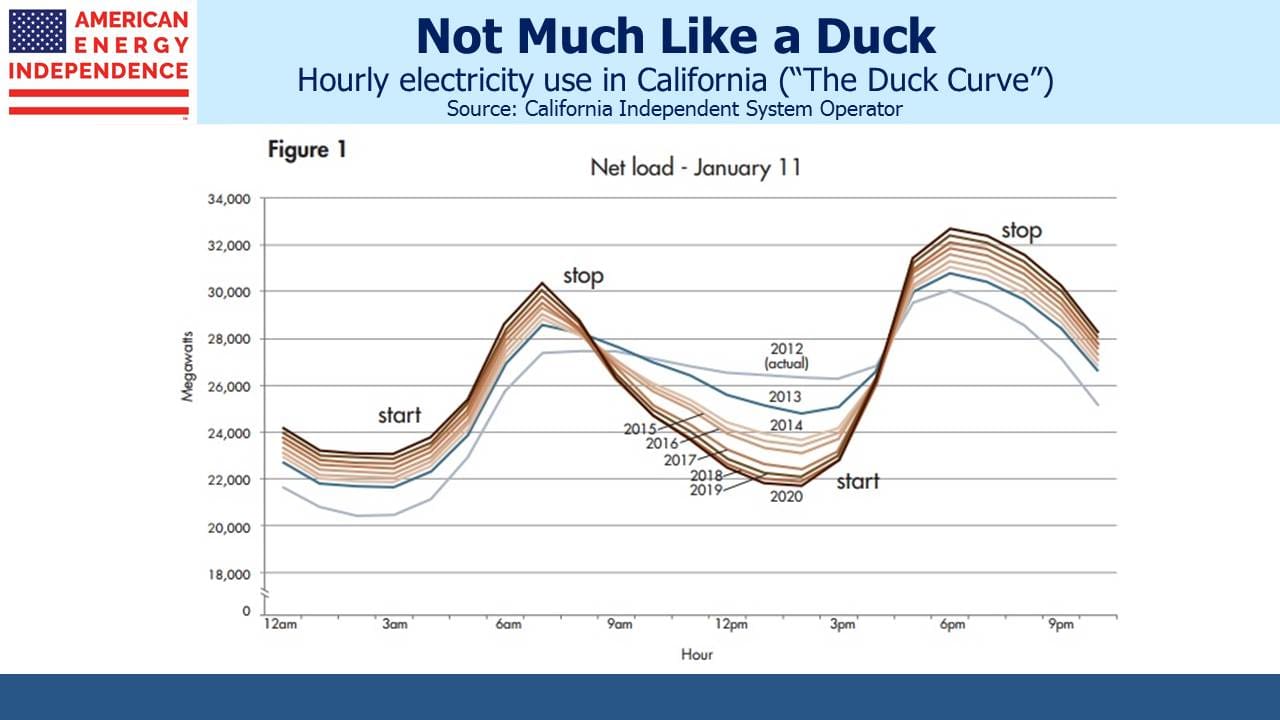

Electricity generation from renewables is also growing. Ex-hydro power, renewables will increase their share of generation from 8% this year to 10% by 2019. Since it’s not always sunny and windy, this growth in renewables is often supported by baseload power from natural gas plants that can vary output as needed. Natural gas and renewables have a symbiotic relationship.

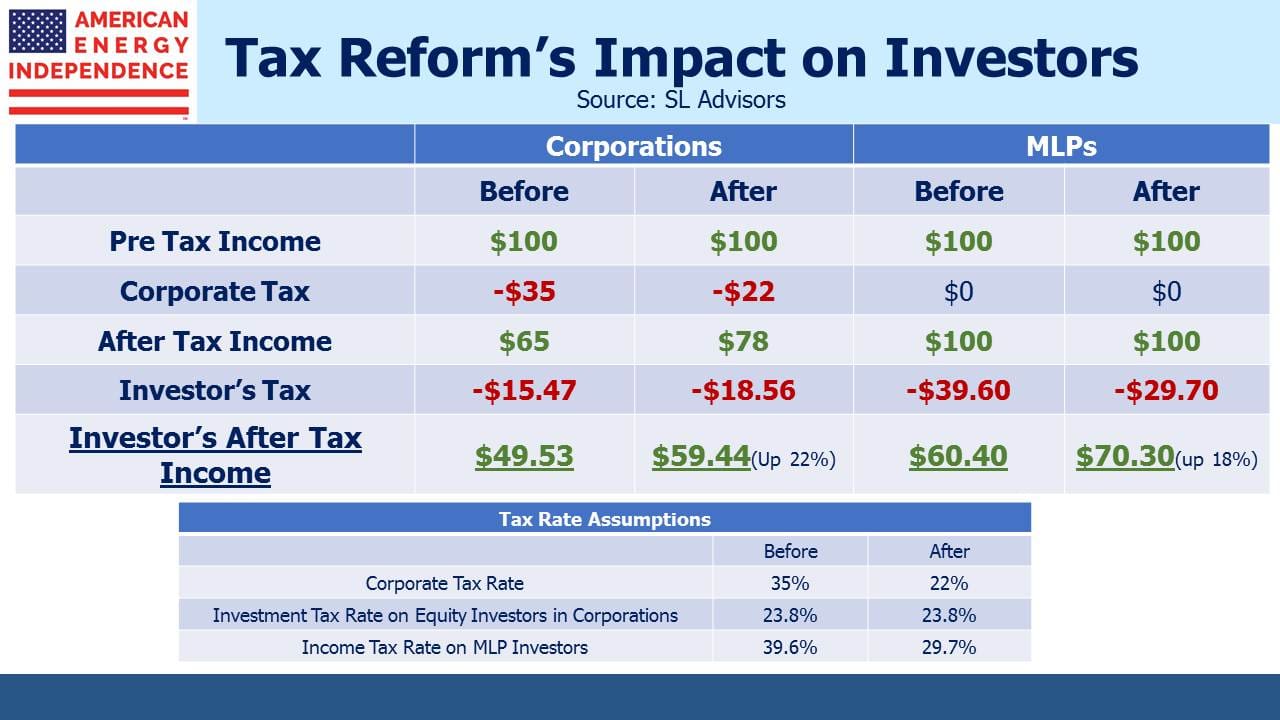

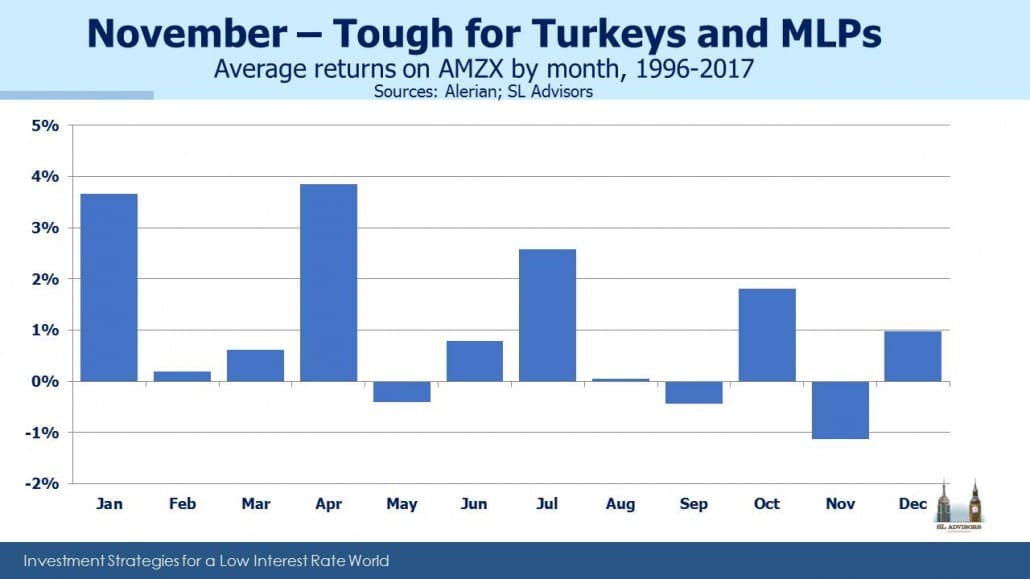

A financial advisor asked me the other day what variables he should watch most closely as near-term drivers of MLP performance. As current investors know too well, crude oil sometimes moves the sector (as was the case in the first half of the year) but sometimes doesn’t (the case since June). The fundamental link between the two is tenuous — volume growth must surely be a more important driver of returns, since the financial link with cash flows is there.

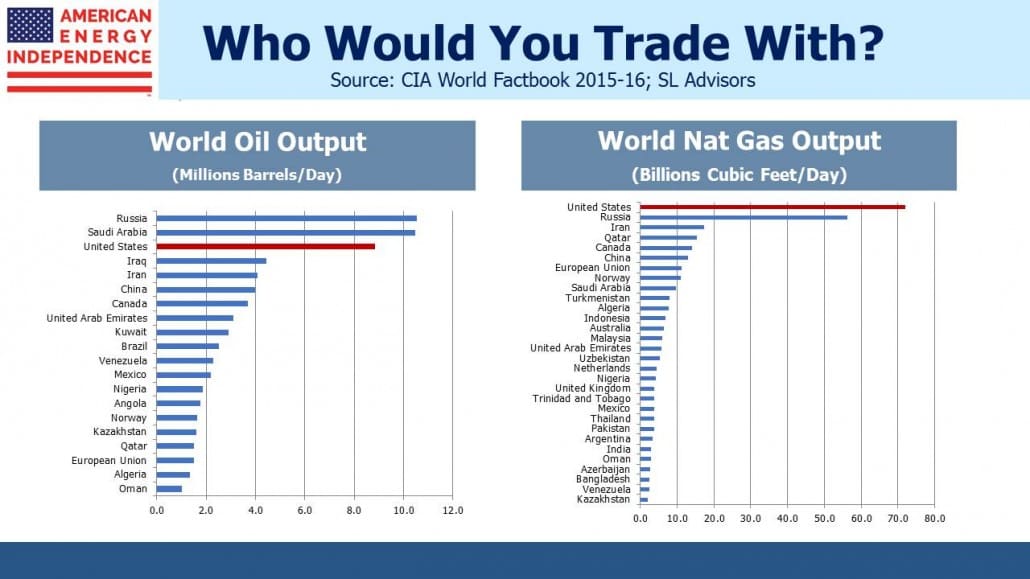

The security of our domestic energy supplies is in marked contrast to other parts of the world. Saudi Arabia (10 MMB/D) is tackling widespread corruption with dozens of arrests of princes. Iraq (4.35) is grappling with Kurdistan’s increasing independence. Iran (3.78) is engaged in a proxy war with Saudi Arabia via Yemen. Venezuela (1.95) is close to economic collapse. The list goes on. The President wants “Energy Dominance”, which sounds even better than energy independence if you’re invested in domestic energy assets.

Last week Bloomberg broadcast a really terrific 45-minute documentary on The Next Shale Revolution. It’s absolutely worth watching.

The American Energy Independence Total Return Index is now updated daily by S&P Dow Jones Indices.

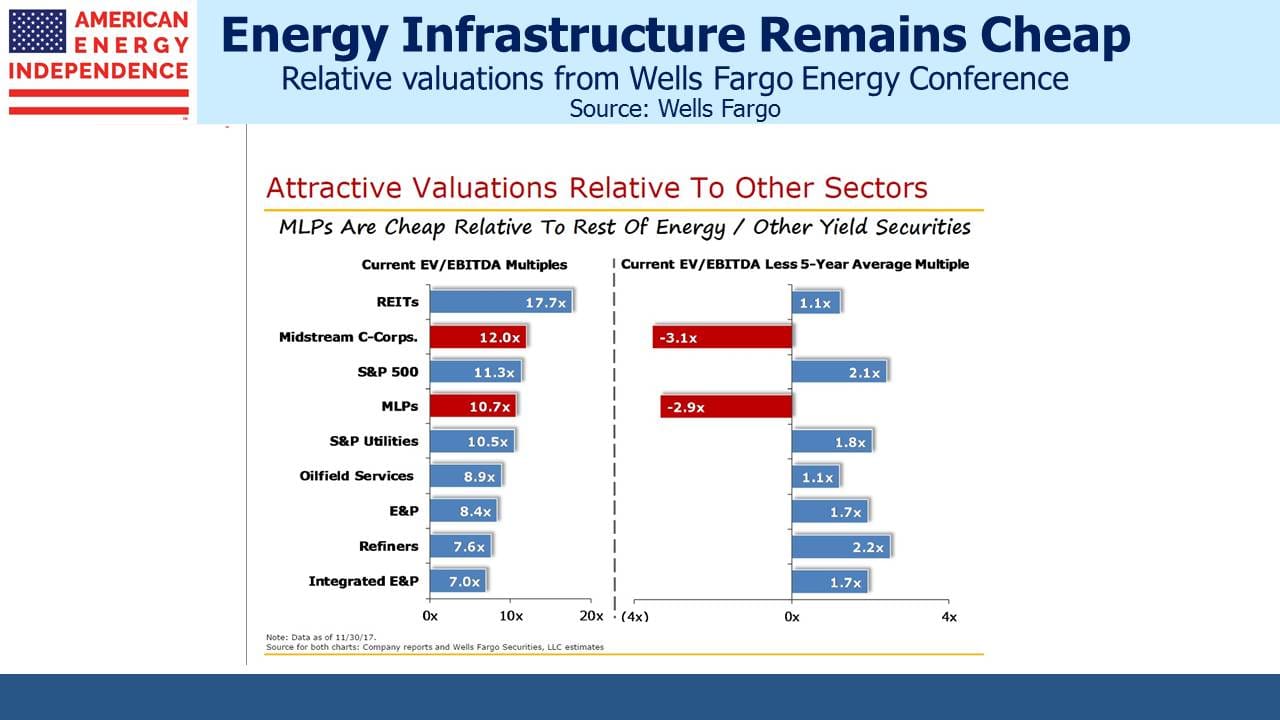

MLPs have been reporting earnings which have generally been in-line. Sentiment and valuations remain depressed, but the shorts have found little ammunition in recent conference calls. Yields are attractive and in some cases defiantly high. Energy Transfer Partners (ETP) yields 13%, while its General Partner (GP) Energy Transfer Equity (ETE) yields half that. ETP results were in line with expectations but guided to higher growth capex next year than some were expecting– clearly, few investors expect ETP’s 13% yield to persist, in spite of the recent hike in payout and a promise to evaluate further hikes in the future. An acquisition of ETP assets in exchange for new ETE units would be a stealth distribution cut for ETP, but lacks repricing up of ETP assets to create a bigger depreciation charge since ETE is not a c-corp (they could create a c-corp first — if they do, a subsequent combination is likely). ETE CEO Kelcy Warren remains a deterrent for many potential ETE buyers given his history of self-dealing (see Is Energy Transfer Quietly Fleecing Its Investors?). In any event, ETP is unlikely to yield 13% a year from now. And it’s worth noting that when asked if there was any likelihood of ETE/ETP consolidation within the next two years, Kelcy Warren simply answered, “No”.

NuStar (NS) also yields over 13% and its GP NuStar GP Holdings (NSH) offers over 12%. Market skepticism oozes over both names, caused most notably by NS’s decision earlier this year to acquire crude oil gathering and processing assets (Navigator) in the Permian for almost $1.5BN. NS’s distribution is not covered by Distributable Cash Flow (DCF) and 1.0X coverage remains over a year away. Merging the two would improve things because the NSH distribution is fully covered by DCF. It would bring Debt/EBITDA down from 6.1X to 5.3X, still above the 4-5X generally targeted by MLPs. However, it would also cede the optionality inherent in the GP/MLP structure. NSH seems to appreciate this better than most, since the Navigator acquisition was funded by NS with a temporary waiver of IDRs to NSH. To apply our hedge fund analogy, the hedge fund (i.e. NS) issued debt and equity at the direction of its hedge fund manager (NSH) which ultimately creates increased cashflows to NSH. Another alternative is for NS to issue equity to NSH who would issue debt to finance it (NSH has almost no debt). They have a lot of levers to pull.

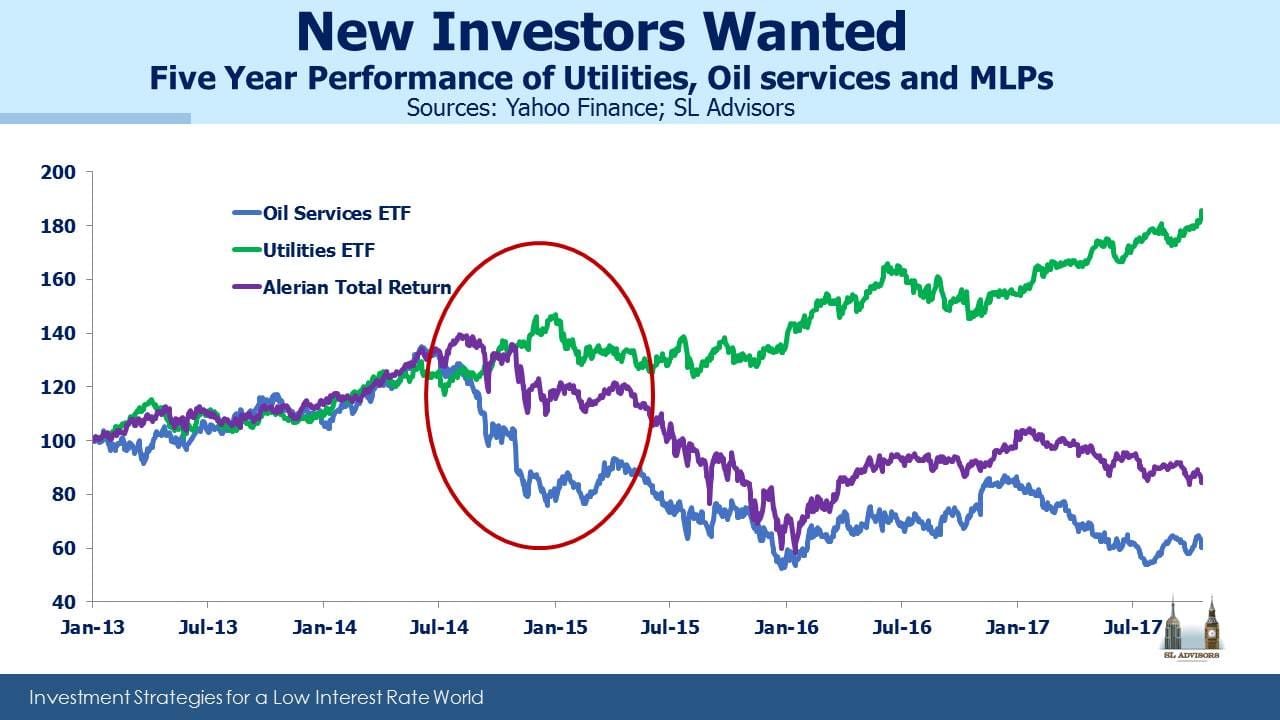

Nonetheless, NuStar’s consolidated debt is $3.7BN, and the Navigator assets cost $1.5BN. It’s another example of an MLP seeking growth funded by debt when its traditional, yield-seeking investors just want stability with no excitement. Wealthy, older K-1 tolerant American investors don’t find the Shale Revolution’s need for new infrastructure nearly as exciting as the management teams.

Hence you have this monologue from President and CEO Brad Barron, in response to a question about distribution coverage: “…I would have never dreamed past year and a half close to 20 MLPs that have either restructured or reset or cut their distribution in some way. …how do you value MLP, is it a dividend discount model, with (sic) the enterprise to EBITDA model. So what I think would be most helpful is for the space to in terms of the normalcies with the equity markets begin acting rational again. … the value of NuStar has not being recognized appropriately …we’re managing this business for the long term.” In fact, one analyst counts 56 MLP distribution cuts since 2014.

Since distribution cuts are no longer rare, UBS’s Shneur Gershuni asked NS why they don’t cut theirs by $200MM annually (in 3Q17 the distribution was $34MM in excess of DCF). This is why the yield is high. NS investors are clearly not scrambling to reinvest their distributions back into NS, even though management rates the opportunity highly and Chairman William Greehey regularly adds to his holdings of NS and NSH. We appreciate Greehey’s perspective even if the market is skeptical. The admission by NS Treasurer Chris Russell that Navigator’s 3Q EBITDA was only $12MM didn’t help. But by 2020 NS expects Navigator to be generating $250MM of EBITDA. Until then, management forecasts a net cash outlay of around $100MM (EBITDA that is ramping up less debt expense and approximately $350MM in capex). That will leave NS having invested around $600MM in equity ($500MM at acquisition plus the $100MM since then), supported with $1BN in debt. By 2020 they’ll own an asset valued at roughly 6-7X EBITDA (i.e. $1.6BN cost divided by $250MM), with Debt:EBITDA leverage of 4X. It’s the outlook of a private company whereas NS is public, and three years is a very long time for equity traders. But we see the logic in the transaction.

Investors are increasingly rejecting using dividends to value MLPs, because (as Barron notes) so many have cut dividends. The industry could have opted for more modest growth, but levered up instead, and can’t figure out why their dividends draw so little respect. We think NuStar’s leverage metrics will improve and it’ll all work out, but it’s been a challenging run for traditional MLP investors.

We are invested in ETE and NSH