The Oil and Water Business

It’s seldom appreciated outside the energy industry, but drilling for oil, natural gas and natural gas liquids (NGLs) involves handling far more water than hydrocarbons. This isn’t just because production often involves pumping water into a well. Water is usually present naturally, and comes up with the oil and gas that is produced. Ideally in holding tanks the oil separates from the water and floats above it, although often some further treatment is required to isolate them. Following separation, the water needs to be disposed of safely. This is creating some growing challenges.

Much of the available data is fragmented because in the U.S. the states generally oversee Exploration and Production (E&P) activities except where on Federal land. As a result, the aggregated data that does exist relies in part on estimates because of differing standards of collection. In addition, the most recent data is still a few years old, and given the growth in domestic oil and gas production since then, today’s figures would be higher.

“Produced water” refers to any water that comes up along with hydrocarbons. Water occurs naturally in most plays and comes up with the extracted oil and gas. But it also includes water pumped into a mature well to force oil up (Enhanced Oil Recovery, EOR) and the flowback of water used in fracking. Any water that comes out of a well is deemed produced water and is subject to Federal rules on safe disposal. Sifting through the available studies, while the ratio of produced water to oil varies widely, it’s clear that we produce substantially more of the former. The water/oil ratio differs by region, by play and by age of well. With conventional drilling, early output typically favors oil and becomes less favorable over time. Produced water generally has no value, although not always; for example, iodide recovered from produced water in Oklahoma represents the largest source of iodine in the U.S. But generally, produced water is high in salt content and contains many unpleasant minerals including NORMs (Naturally Occurring Radioactive Material). Its disposal can represent a significant cost, and because increased water disposal reflects deteriorating well economics (since produced water volumes usually increase over time), installing water disposal infrastructure is often delayed.

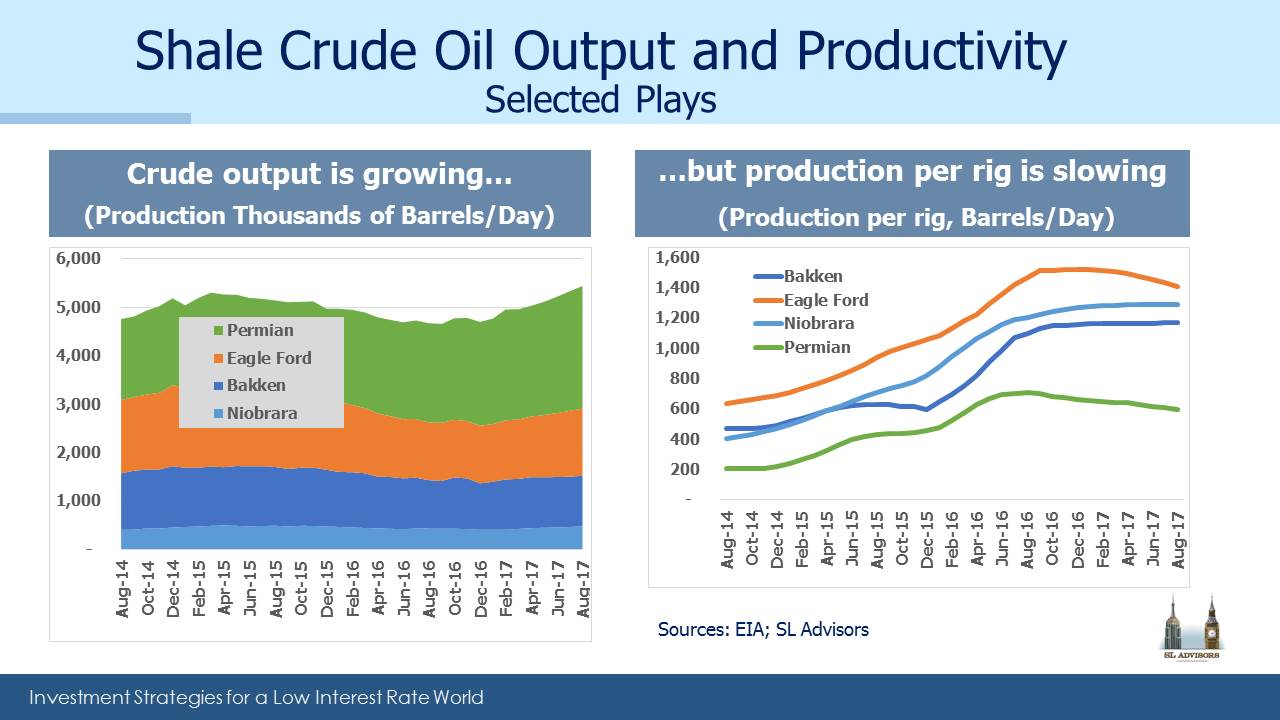

Some numbers are helpful to illustrate the scope of the issue. A 2012 GAO report cited 56 million barrels of produced water daily, relying on a 2009 study. Back then the Shale Revolution was virtually unknown. U.S. crude oil production was 5.3 Million Barrels per Day (MMB/D), slightly over half of today’s level, while natural gas output is up by a third. Since injection of water into wells via fracking has further contributed to produced water, one would think produced water volumes have increased proportionally. However, a more recent study of 2012 data suggests that produced water hadn’t increased despite rises in oil and gas production.

One possible reason is that the water:oil ratio is higher in older conventional wells (estimates are 10:1) that are being replaced by new horizontal shale wells which have lower produced water ratios (3:1) after the initial flowback. Nonetheless, a lot of produced water must be disposed of and unlike conventional wells that can inject the water back into a reservoir, tight shale rock won’t accept it.

The result is that substantial quantities of water have to be moved by truck or (if infrastructure exists) by pipe to treatment centers for ultimate disposal. Other applications can include recycling water into new completions, irrigation and industrial cooling, depending on the presence of harmful elements in the water. But most of it gets injected back into the ground using deep wells specially designed for produced water disposal. A single oil well producing 1,000 barrels per day, even if it came with only three times as much water would still require 12 water trucks per day (one barrel = 42 gallons; 3,000 barrels of water = 126,000 gallons; assumed truck capacity of 10,000 gallons), to haul the water away. The 56 million barrels a day of produced water, which is cited by several researchers, is twice the daily flow over Niagara Falls. It’s why the industry often regards itself as being in the water hauling business more than the oil business.

That all this water disposal takes place without much media focus is testament to the already tight rules in place and the industry’s general adherence to them. The minor tremors in Oklahoma are often incorrectly blamed on fracking. In fact, the disposal of produced water into unstable rock formations is the primary cause. Although some of that water is likely the result of hydrofracturing, all oil wells generate produced water. Infrastructure for water disposal is a topic that increasingly draws questions from analysts on conference calls. Of course one man’s expense is another’s business opportunity, and MLPs are adding water disposal infrastructure to the services they provide. Crestwood (CEQP) provided water volume statistics on their most recent earnings call and is planning further investments in this area. COO Heath Deneke commented that, “…the water handling business is likely to grow to be an $8 billion to $10 billion per year business over the next five to seven years in the Delaware-Permian.”

Some worry that the growth of crude oil production in the Permian will be constrained by the challenges of safe water disposal, although the industry is working on solutions and the challenges are likely to be manageable.

We are invested in CEQP