Natural Gas Demand Keeps Growing

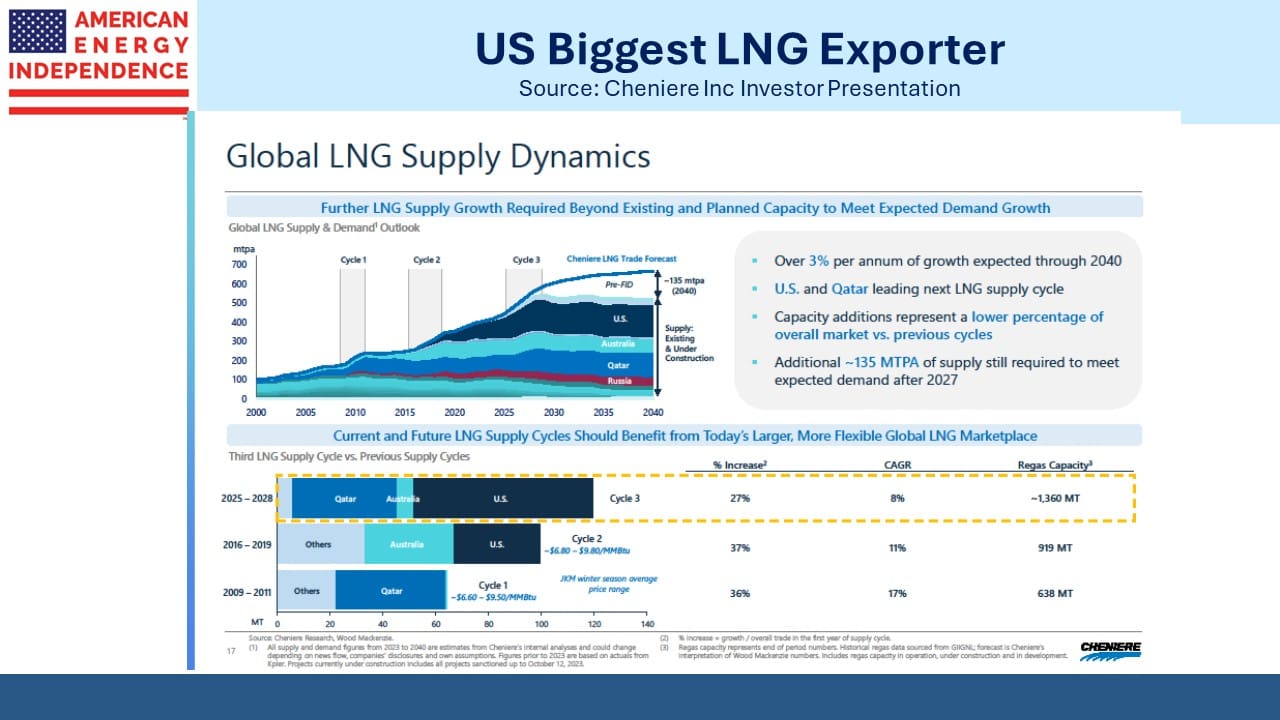

The White House pause on LNG permits has impacted negotiations. Poten and Partners, a research firm, estimates that Sale Purchase Agreement (SPA) volumes are –15% in 1H24 versus a year ago. It’s hard to get buyers to commit to buying LNG from a new export terminal without certainty about when it’ll be constructed.

Fortunately, last week a Federal judge lifted the pause. Appropriately, it was U.S. District Judge James Cain in Lake Charles, Louisiana, the site of Energy Transfer’s proposed LNG terminal whose planning has been impacted by the pause. Cain said the pause was, “completely without reason or logic” and described it as, “arbitrary, capricious, and unconstitutional.”

The LNG export opportunity persists because US prices are cheap while production remains robust. Output is running at 107 Billion Cubic Feet per Day (BCF/D), but demand has grown from 95 BCF/D a year ago to 102 BCF/D now. Power consumption is the biggest driver, up from 40 BCF/D to 45 BCF/D.

AI data centers are going to consume increasing amounts of power, which will support natural gas demand. We may already be seeing this. Texas recently announced plans to double their low-interest loan program that supports the construction of natural gas power plants, from $5BN to $10BN.

Governor Abbot thinks they may need as much as 130 Gigawatts (GW) of power capacity by 2030 from all sources, versus the 85 GW they have now. Even after doubling the loan program it’s likely to be several times over-subscribed.

Texas is a good example of how growing power demand will flow through to natural gas. Texas has had good success with windpower which provided 28% of its electricity last year. Natural gas was 40%. Regardless of goals to increase the share of power provided by renewables, natural gas remains a convenient, reliable and clean resource.

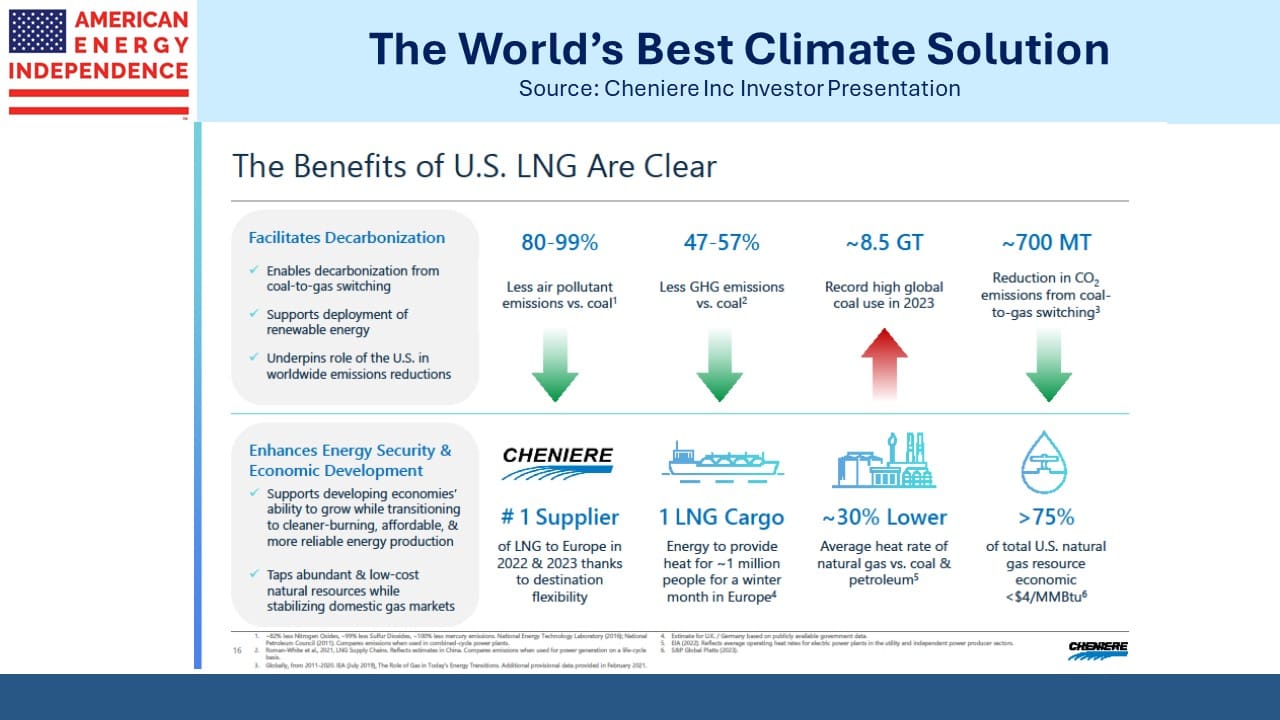

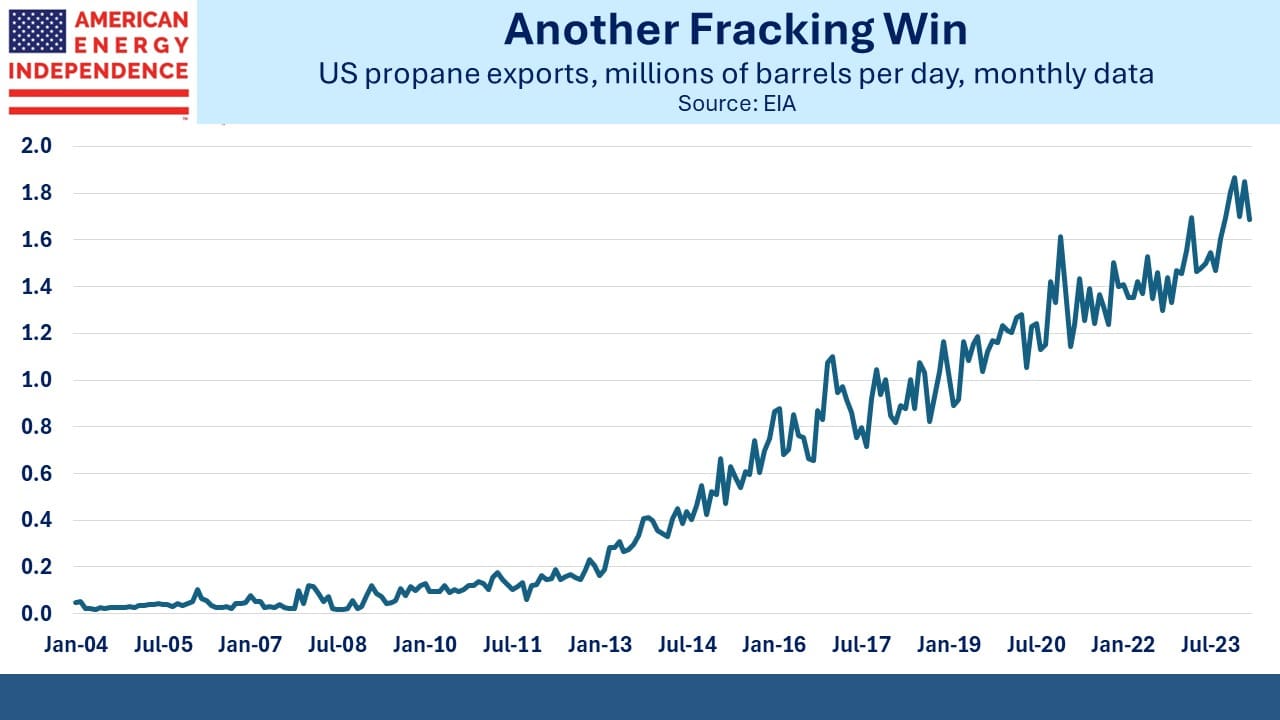

Fracking has unleashed cheap, secure energy for the US. Germany is de-industrializing because of high power prices. Britain’s new Labor government is committed to becoming a “clean energy superpower” and is centralizing the approval of new wind farms to speed up construction. The US is reducing emissions with natural gas and attracting FDI because it’s cheap. No other country has adopted such a pragmatic yet self-interested energy policy, albeit one that’s the result of policies from both parties.

US natural gas prices have surprised many analysts by staying low, with the Henry Hub benchmark at around $2.50 per Million BTUs (MMBTUs). It’s cheaper elsewhere, with the basis reflecting transportation costs to the Henry Hub distribution point in Louisiana. Gas from western Canada is priced $1.80 per MMBTUs below the benchmark. Associated gas is often produced with crude oil and is unwanted but must be dealt with. Flaring has come down sharply, from 1.3% of production five years ago to 0.5% now. It’s become harder for E&P companies to obtain a flaring permit by arguing that needed infrastructure is unavailable.

The Energy Information Agency is forecasting $2.90 per MMBTUs for 2H24, up from $2.10 in 1H24.

As we head into earnings season the phrase “upside risk” is showing up in JPMorgan’s outlook. It sounds like a high class problem unless you’re a short seller. For several quarters pipeline companies have delivered results that were largely in-line with some modest surprises, except for Cheniere who consistently beats forecasts. We’ll be interested to hear from Energy Transfer (ET) whether the court-ordered lifting of the LNG pause has helped them progress with their Lake Charles project.

Williams Companies (WMB) won their legal dispute with ET over WMB’s ability to build a gas pipeline that crossed over an existing one owned by ET. It was either unsafe or anti-competitive, depending on which side was talking. With a judge having concluded the latter, WMB is suing ET for damages. Sometimes it seems that ET is involved in half the energy sector’s disputes.

I visited Minneapolis and had the opportunity to visit long-time blog readers and pipeline investors GHJ Financial Group in Oakdale, MN with Andrew Freiberg, our regional wholesaler from Pacer Financial. It’s always a great pleasure to meet people who have been following us for a long time online. We had a most enjoyable chat, and I shall look forward to stopping by again in the future. The background for the photo was selected to show Big Ben.

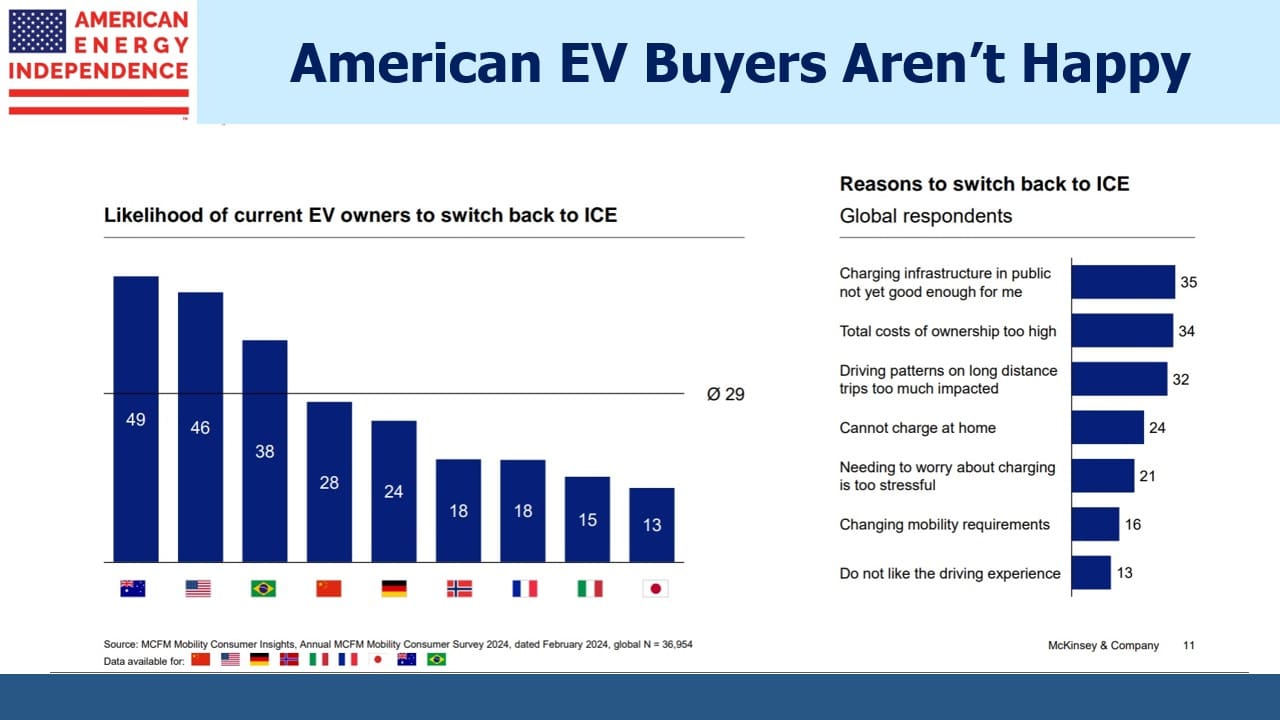

In discussing EVs, I learned that charging stations are increasingly being targeted by criminal gangs. There are lots of stories of vandalism and theft of the copper that’s used. But EV owners are wealthier than average and can represent a target themselves while they’re waiting…and waiting for their cars to recharge.

The outlook for reliable energy has never looked brighter.

We have three have funds that seek to profit from this environment:

Energy Mutual Fund Energy ETF Real Assets Fund