Struggling To Justify The Pause

/

We’ve received a lot of questions recently about the White House pause on approving new Liquefied Natural Gas (LNG) export terminals. Several projects are already under way, and the pause does not rescind approvals that have already been issued. So for example construction of NextDecade’s Rio Grande terminal is continuing, with permits already in hand.

It immediately looked to use like a politically motivated decision (see White House Adopts An Energy Policy Where Everyone Loses). It’s easy to be dismissive of choices intended to gain votes. Democracies allow that even if the result is poor policy.

The pause is intended to allow the Department of Energy (DOE) to examine the climate impact of US LNG exports – obviously this study could be carried out without pausing new approvals. The immigration policy catastrophe is causing the White House to pivot away from progressives on that issue – hence the need to provide left wing voters an alternate reason to vote in November.

A handful of Democrat congressmen have been critical, worried that it will cost them votes of energy workers in their districts. Senator Joe Manchin (D-WVa) is holding hearings on the issue.

An official at the DOE said that they were concerned about the harm LNG exports might cause to nascent plans to develop green hydrogen among potential LNG buyers. Those countries will decide for themselves what energy mix suits them. No country, including the US, has much ability to influence the energy choices other countries make. China is the world’s biggest importer of LNG and consumes over half the world’s coal. India burns coal for three quarters of its power and plans to sharply increase its imports of LNG. Making energy prices higher for these buyers isn’t the solution.

The DOE official’s response is so implausible it shows they’re struggling to come up with coherent justifications. The pause is about November’s election not thoughtful climate policy.

Wealthy opponents of US LNG exports include members of the Rockefeller family and Michael Bloomberg. It’s always the people who fly in private jets and and have never bothered to register for TSA Pre-check that cynically push restrictive energy policies they can afford to avoid.

Taylor Swift will be jetting in from Tokyo to Las Vegas just in time to see Travis Kelce play in the Superbowl. Anticipating criticism of the CO2 emissions from her global concert tour, she bought 2X the carbon credits her private jet will generate as an offset. The effectiveness of such credits varies. She has many talents but wouldn’t make a credible proponent on climate issues.

Nonetheless the impact on stock prices has been muted. Energy Transfer (ET), whose proposed Lake Charles LNG export terminal is affected by the pause, closed up on the day of the announcement (January 26th) and on the following trading day as well.

Cheniere’s Midscale trains 8-9 aren’t yet permitted. Wells Fargo estimated that if the project is never completed that would reduce their “sum-of-the-parts” valuation of Cheniere by around 4%.

Woodside Energy, itself Australia’s leading natural gas producer, is in talks with ET about buying LNG from their Lake Charles terminal assuming it gets built.

LNG infrastructure takes years to build, and the consensus is that following the election Trump or Biden will restore the approval process. The pause has gained the attention of energy investors but hasn’t done much else.

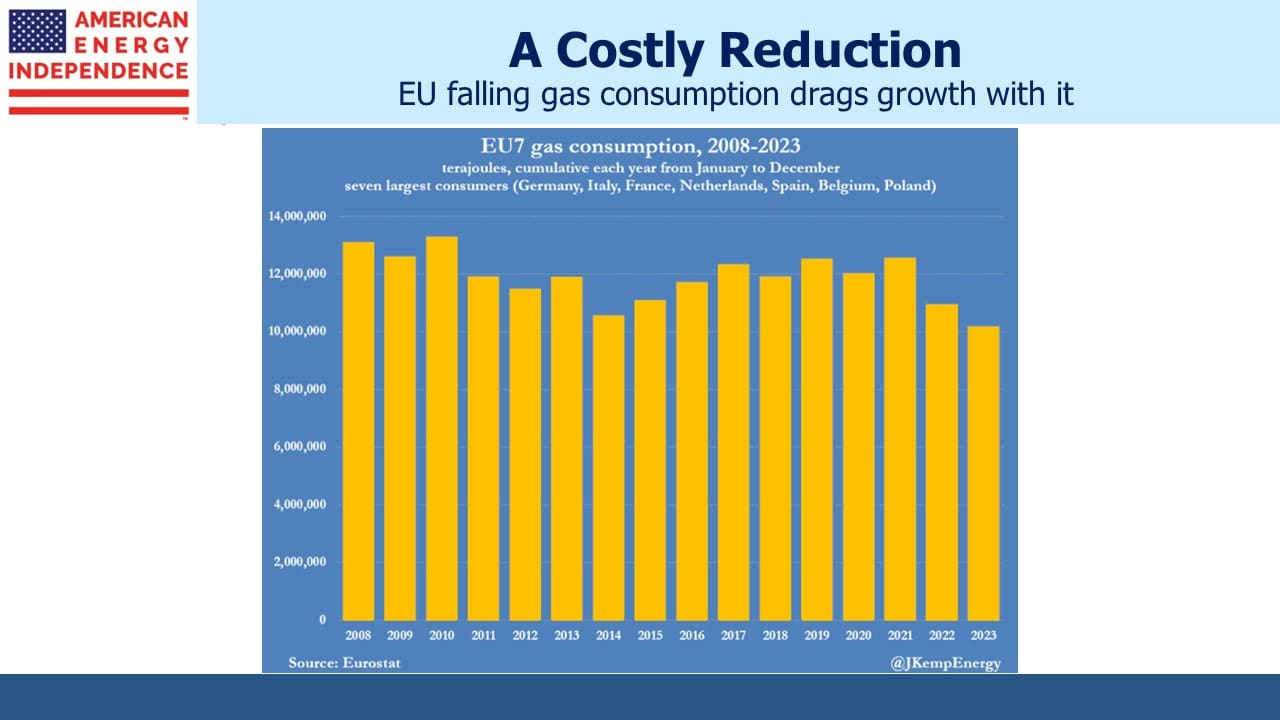

The EU’s seven biggest gas consuming countries have seen consumption drop 21% over the past two years. The loss of Russian supply has exposed them to high global LNG prices, depressing growth. Many German industrialists regard domestic energy policy with its rush towards renewables as ruinous to their manufacturing base. One business chief recently complained that it was impossible for companies to make investment decisions when they can’t be certain what their energy supply will be or what it will cost. He called current policies “toxic”.

Germany’s economy didn’t grow last year, and probably won’t this year. They could use more cheap US LNG, which Biden promised would be coming in the wake of Russia’s invasion of Ukraine in March 2022.

Alex Epstein, author of Fossil Future and The Moral Case for Fossil Fuels, calls it “a deadly fraud”. His talking points are here. Epstein argues that civilization is much safer today from extreme weather because of fossil fuels. He believes emerging economies should focus on raising living standards over the next several decades by which time new technologies and their increased wealth will make tackling the problem much easier than it is now.

Given how relentlessly coal consumption is growing among developing countries led by China, it looks as if they have embraced Epstein’s philosophy.

Smart climate policy will see the pause lifted within a year. We think that’s what will happen.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!