AI Boosts US Energy

/

In recent years the International Energy Agency (IEA) has moved from providing objective forecasts to championing the world’s shift away from fossil fuels. In embracing a liberal political stance they’ve lost relevance to companies and governments making investment decisions to meet future demand. For example, the IEA projects peak oil demand within the next few years, whereas OPEC sees no visible peak. The IEA’s base case for energy consumption sees annual demand growth of less than 1% even though the past decade was 1.4% pa.

One result is that the IEA often revises its near tern forecasts higher. They now see 2024 global crude oil demand at 103.2 Million Barrels per Day (MMB/D), up 1.3 MMB/D from last year. Although the IEA has raised its growth forecast by half since it was first released last year, they’re still behind others such as OPEC which expects 2.2 MMB/D of growth.

Analysts have long warned that underinvestment in new oil production would push prices higher. Russia’s invasion of Ukraine two years ago briefly took prices near $110 per barrel, but a porous sanctions regime has allowed Russian oil to find its way onto the market. However, over the past month oil futures have edged higher as traders digested the upward revisions to demand forecasts.

It’s part of a growing pattern whereby traditional energy consumption is proving more resilient than many forecasts project.

An example is Shell, which has moderated its carbon intensity targets to incorporate the sale of its retail renewable power business. Investors are rewarding companies that prioritize returns, which for companies like Shell come more reliably from oil and gas. In explaining their changed goals Shell cited, “uncertainty in the pace of change in the energy transition.”

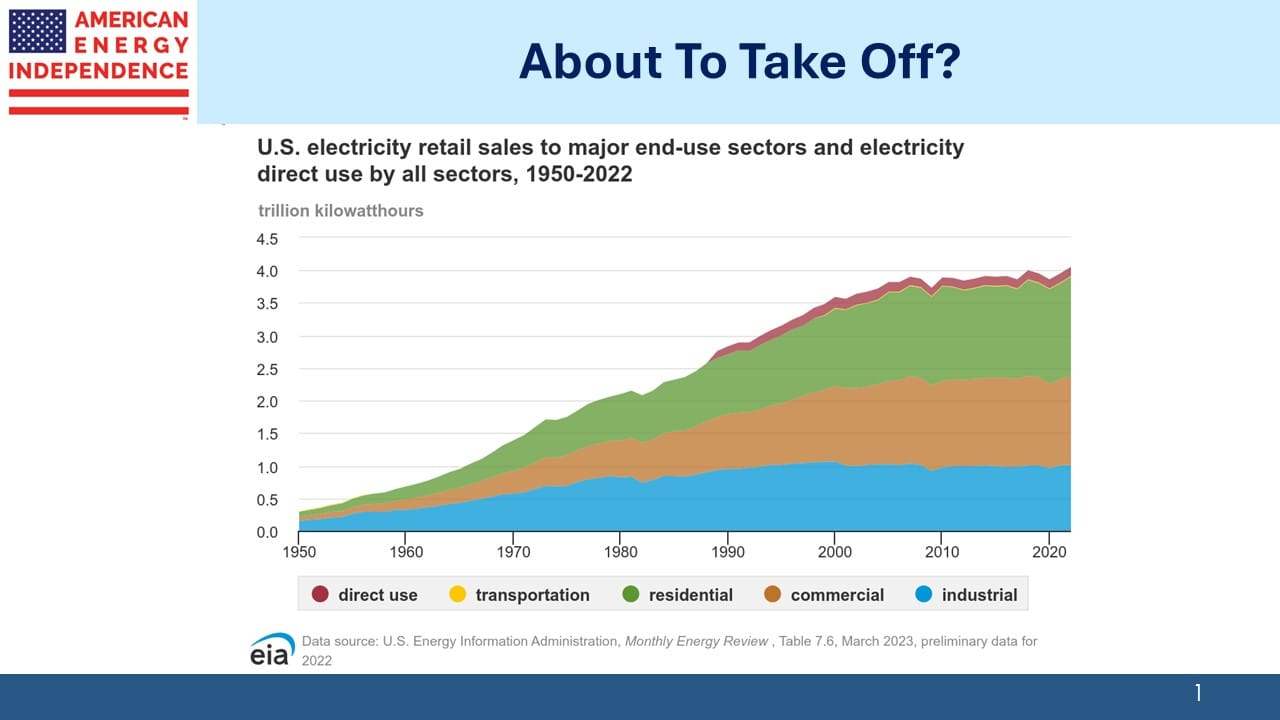

Another area of surprising demand growth is in US power. For over a decade, electricity consumption has hovered just below 4 Trillion Kilowatt Hours. But utilities across the country are preparing for a surge over the next five years. Electric Vehicles (EVs) are only a small part of this. Indeed, Tesla is losing its stature as a growth stock with sales volumes being revised down weekly.

The increased need for US electricity is driven by data centers. Since last year, five year growth in power demand has been revised up by 80%. Virginia has added at least 75 new data centers since 2019. Most regional grids expect increased demand from data centers. California is the exception – the home of computing is a hostile place to build anything.

The Boston Consulting Group expects power demand from data centers to triple by 2030.

In a recent interview, Elon Musk said that AI computing power was increasing at a staggering 10X every six months. Obviously, this isn’t sustainable, but he described it as the fastest growth in a new technology he’s ever seen. Musk has long been optimistic about autonomous driving. He believes Tesla is very close to delivering, although he has said that often over the past several years. He expects self-driving cars using AI to allow much greater utilization of automobiles in the future. While the average car is used for ten hours per week, he expects autonomous cars to move people 50-60 hours a week as they operate like taxis.

Manufacturing is also benefiting from cheap, reliable US energy. New plants to build automobiles and batteries are adding to demand. In the past three years $481BN in new commitments for industrial and manufacturing facilities have been announced. Some of this is the beneficiary of Germany’s slow de-industrialization, caused by years of their disastrous energy policies (see Germany Pays Dearly For Failed Energy Policy).

California, where EVs are popular, expects charging them to consume up to 10% of peak power demand by 2035.

The increased capex among utilities should give investors in that sector pause. But the consequent demand for additional natural gas will further boost utilization of pipelines.

Reducing emissions relies on electrification of activities where it results in a switch to low emission energy. However, renewables are in many cases inadequate to meet this new demand. Georgia, North Carolina, South Carolina, Tennessee and Virginia are planning to add dozens of new natural gas power plants over the next fifteen years.

A challenge to adding renewable power capacity lies in transmission lines. Because solar and wind power require large open spaces, their power must be transmitted often over long distances to population centers. Adding grid capacity is proving difficult. The legal system has been turned into a weapon by climate extremists opposed to traditional energy, but interminable lawsuits are also delaying new power infrastructure.

GridStrategies reports that the U.S. installed 1,700 miles of new high-voltage transmission per year on average in the first half of the 2010s but dropped to only 645 miles per year on average in the second half of the 2010s.

Oil and gas demand remain strong, with many companies finding them the most reliable source of investment returns in the energy sector.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!