We Need Much Cheaper EVs

/

93% of car trips are less than 25 miles, according to data from the Bureau of Transportation Statistics. The problem with EVs in America is with the other 7%. That’s where the range anxiety and charging infrastructure become an issue.

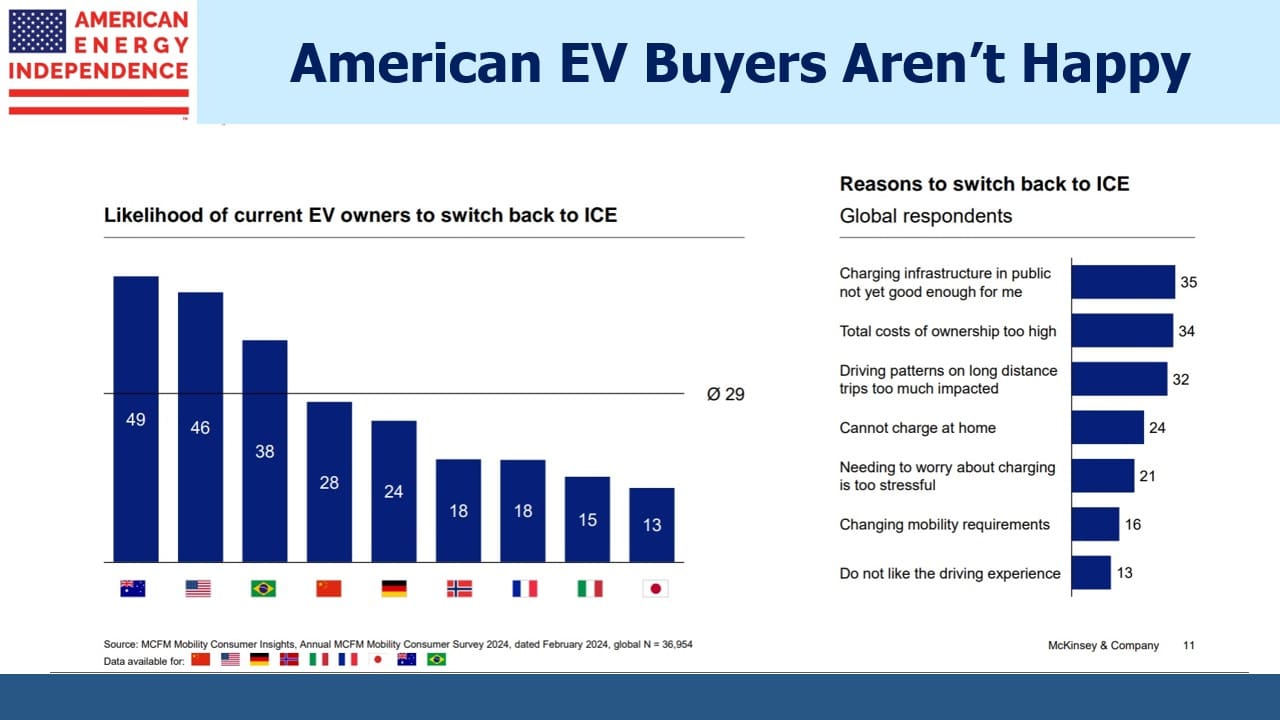

According to a recent survey from McKinsey, the US has among the least satisfied EV owners, with 46% intending to switch back to an Internal Combustion Engine (ICE) with their next purchase. Only Australia, another big country with high average mileage, reports more dissatisfied EV owners at 49%.

It’s a failure of the EV industry that almost half their customers are unhappy with their purchase. Along with poor charging options, cost is another factor. US sales rely heavily on altruistic choices by customers who are virtue-signaling. Research has shown that blue-leaning regions are far more likely to buy EVs than red. It’s why California dominates EV registrations. This is a problem for future sales, similar to subscription churn. If half of your subscribers don’t renew, it’s hard to grow your customer base.

Hybrid plug-in electric vehicles (HPEVs) are thought to be a good compromise. You can always rely on filling up with gas, but by keeping the battery charged you can minimize use of the conventional engine. The problem is that HPEV owners tend to not bother recharging, because (shockingly) it’s so convenient to stop by a gas station. So owners often fail to achieve the EPA mileage estimates that are advertised.

We’re running out of buyers who are willing to pay more for faster acceleration or to show they care about climate change. Like solar and wind power, reducing greenhouse gas emissions costs more than business as usual.

Except with EVs it could be different. Almost half of US households own two or more cars. The EV industry is selling expensive vehicles intended to replace one of the two ICEs a household owns.

There’s a market for very cheap EVs, perhaps souped-up golf carts, for the 93% of journeys that are local and don’t rely on charging infrastructure. As a policy matter, this could induce consumers to add a car that covers most of their driving needs while keeping the ICE for longer trips. The EV would be a compliment to the ICE, rather than trying to be a substitute.

These cheap EVs would need to be bigger than a golf cart – half of US auto sales are light trucks and minivans. But cheap EVs would compensate for the range anxiety. Even if we carpet the country with charging stations and speed them up, Americans are just not going to spend twenty minutes recharging.

BYB’s Seagull sells in China for around $12K. They’d sell millions at that price in the US. They could, except for the tariffs imposed on them, because the White House has a flexible concern about climate change. Red state energy workers aren’t much use to this White House. Blue state auto workers may be. So the latter are protected with tariffs, at the expense of higher US GHG emissions.

Joe Biden told everyone the energy transition will be painless. So far it’s not.

More coherent energy policies are looking more likely since the debate. Guy Caruso served as administrator of the U.S. Energy Information Administration (EIA) from July 2002 to September 2008. In a recent WSJ op-ed he argued that US LNG exports provide energy security to our allies and lower GHG emissions by displacing coal. We’re betting that the LNG permit pause will be lifted by next year, part of a more pragmatic policy approach to climate change.

If President Biden could struggle out of bed in time for an abbreviated day to consider the issue carefully (see Biden Tells Governors He Needs More Sleep and Less Work at Night) he would never have imposed the pause.

Midstream continues to perform well, with the American Energy Independence Index +18.6% for the first half of the year. Wells Fargo points out that the sector’s correlation with the S&P500 has been falling and is only 0.33 in 2024 versus 0.51 over the past five years.

Part of the reason is in the inflation protection that pipelines offer. Because tariffs are so often regulated with an inflation price escalator built in, cash flows responded positively when inflation surged in 2022. Investors have started to take note, which has underpinned performance.

Midstream has also closed most of its valuation gap with utilities, with EV/EBITDA of 9.3X compared to utilities of 9.6X. But leverage is lower (Debt:EBITDA 3.4X vs 5.2X) and dividend yields higher (5% vs 3.8%).

In our opinion, there remains plenty of upside.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!