The Pipeline Outlook Keeps Improving

/

The trend of positive assessments is continuing for the pipeline industry. Sell-side analysts are pressing the case for their favorite names. JPMorgan sees further upside for Targa Resources (TRGP) even though it’s returned 40% YTD. They have a $140 price target for the end of next year, up from ~$120 today. They cite a “fully integrated well-to-dock Permian NGL value chain” and attractive Enterprise Value /EBITDA multiple of 9.0X (2025E) versus a peer group median of 9.7X.

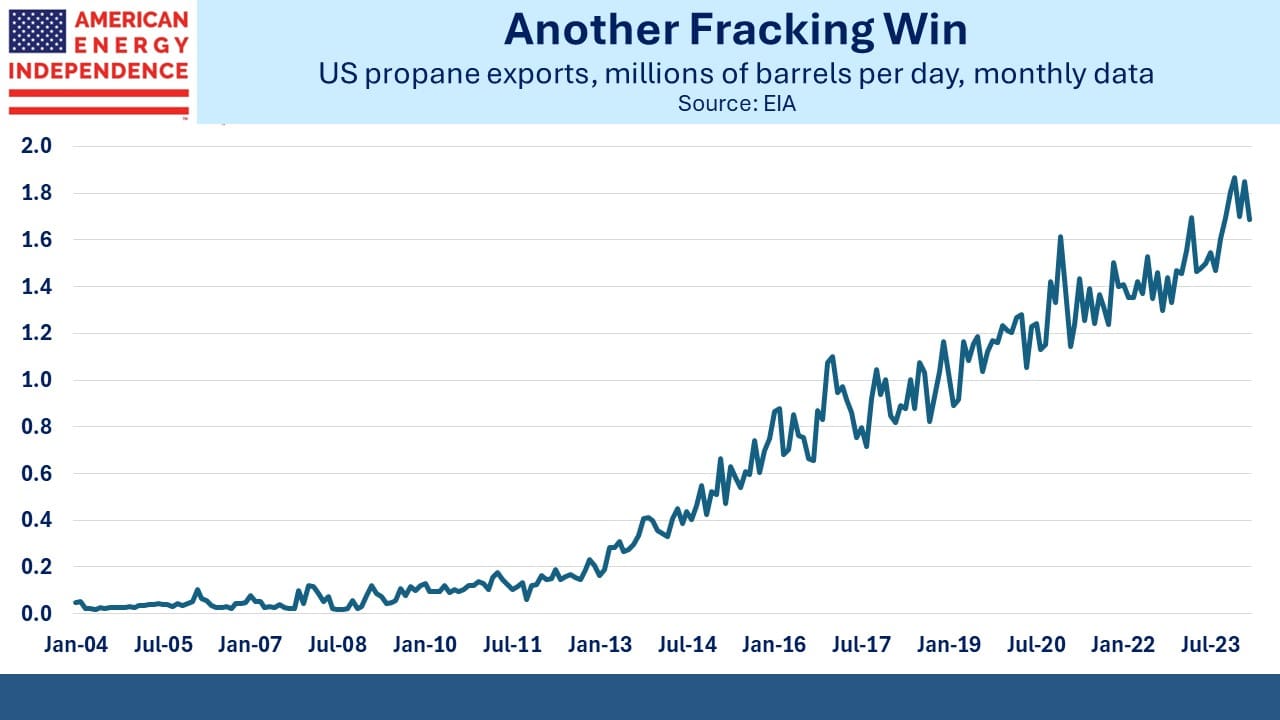

NGLs are natural gas liquids, mostly ethane and propane. The latter is used in agriculture (for crop drying) cooking and heating where natural gas isn’t available, and also as a petrochemical feedstock. NGLs get less attention than oil and gas, but their production has also grown through fracking. US propane exports are now well above 1.5 Million Barrels per Day. They’ve more than tripled in the past decade. TRGP is one of the beneficiaries.

Years ago when MLPs were overinvesting and investors wanted to see reduced capex, then-CEO Joe Bob Perkins would flippantly talk about “capital blessings” on earnings calls where he defended unwelcome big outlays.

Today TRGP has a greater focus on capital discipline, but it’s also fair to note that many of those prior investments have worked out fine.

Wells Fargo recently upgraded several natural gas-oriented names based on attractive valuations and power demand from AI data centers. Some investors are skeptical that enough new power plants will be built to drive the 7 Billion Cubic Feet per Day of increased natural gas demand they expect. New rules from the Environmental Protection Agency require all coal-fired and any new gas-fired power plants operating past 2039 to control 90% of their CO2 emissions, meaning capture and sequestration.

Regulations can always be changed, but the counter is that enough existing power generating plants have available capacity to drive gas demand higher anyway.

Morgan Stanley expects the median pipeline stock to return 21% over the next year, including a 6.1% median dividend yield. Buybacks are supportive of this, with $1.5BN of stock retired during 1Q24. Cheniere was $1.2BN of this and TRGP $124MM.

Some of the best energy analysts in the market remain constructive on the sector.

I’ve been searching for a good energy podcast. Progressive “renewables will solve everything and the world’s on fire” podcasts are abundant and useless. I did stumble on the educational Energy Policy Now and found Power Struggle: The Electric Grid’s Natural Gas Challenge informative. AI will drive the increased demand for natural gas. This drills down into some of the consequences.

When Storm Uri hit Texas in 2021 it didn’t only highlight the need for winterized natural gas production facilities. Many power plants had natural gas contracts that didn’t guarantee supply, because there’s a big price difference. The Texas grid, run by ERCOT, has tended to place less importance on reliability than the rest of the country in exchange for low prices. Uri led to a reassessment.

At the Federal level, NERC, which oversees electricity, prioritizes reliability while FERC, which regulates interstate natural gas, values safety most highly. Electricity “days” that govern contracts start and end at midnight, whereas gas “days” begin at 10am ET. So a gas-fired power plant faces a mismatch between its pricing for inputs versus outputs.

These problems can be solved more easily than coping with the 20-35% utilization that burdens intermittent solar and wind.

If you enjoy learning about the intricacies of the energy business, you’ll enjoy the podcast. Or you can rely on me to chronicle the highlights.

Once or twice a year I play golf with my old boss from JPMorgan, Don Layton. In 1986 he decided to hire a 23 year old derivatives broker as a trader. It was to my great benefit and hopefully not something he had later reason to regret. Don (often referred to by his initials, DHL) went on to become vice-chair of JPMorgan, running the investment bank. I soon took over interest rate derivates trading in NY.

Later in his career Don was CEO of E*Trade and then Freddie Mac, from 2012-2019.

Don was a terrific leader, with the rare ability to combine strategic vision with command of detail. I’ve remained in touch with many who used to work for Don in the 1980s and 90s. We all retain fond memories and great respect for him. On Monday we reminisced with two other former colleagues, Don Taggart and Don Allison.

DHL remains strongly competitive and draws unseemly pleasure from beating me at golf on one of his home courses. The nostalgia easily compensates.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!