Bearishness Is Holding Back Energy

/

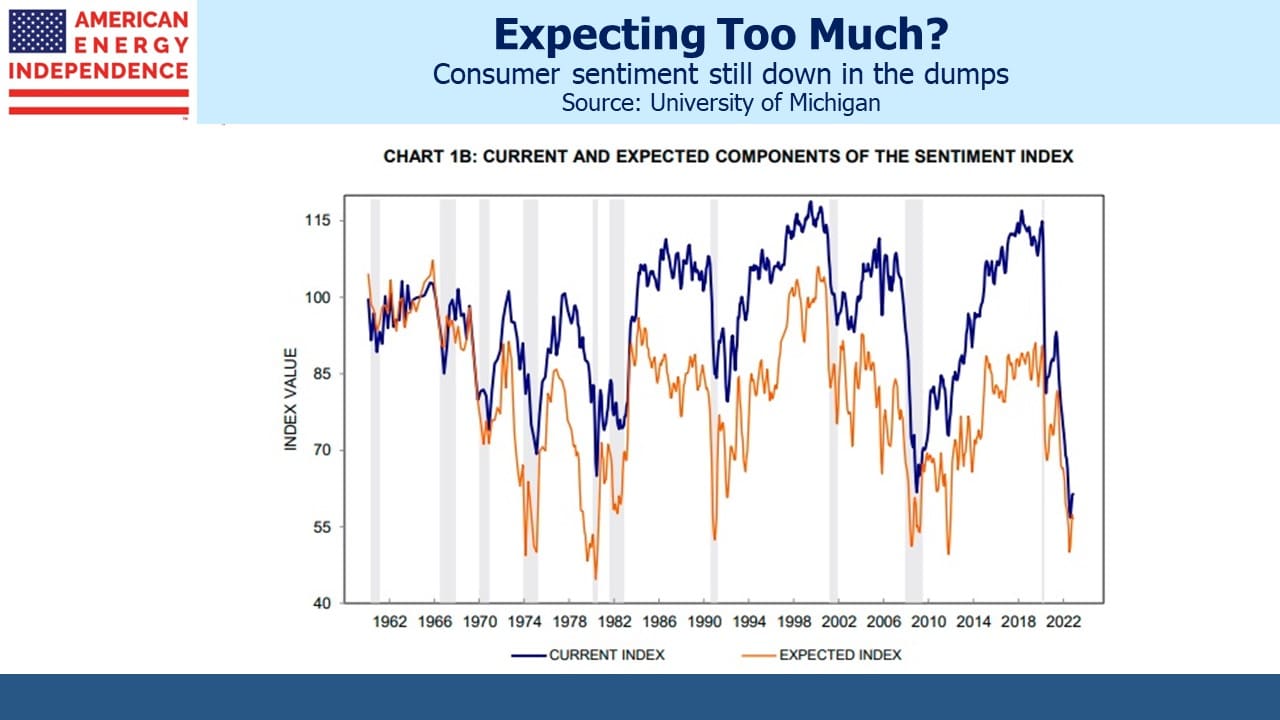

Michael Wilson, Morgan Stanley’s chief equity strategist, thinks stocks could fall 22% this year. Wall Street is bearish, and the mood has spread to consumers. Earnings forecasts are falling and households report expectations close to the depths of the 2008 great financial crisis. A lot of smart people are negative. We don’t spend any effort positioning for the economic cycle – when recessions have struck they’ve usually been unexpected. If the US slips into one later this year it’ll be the most anticipated in living memory.

Fortunately, Morgan Stanley like most firms encourages disparate opinions and does not enforce a “house” view in its public pronouncements. Hence Robert Kad, who heads up MLP and Energy Infrastructure research is publicly, even giddily bullish on the sector. Of the companies they cover, which is most of them, he expects a median one year price return of 21.9%. With dividends he expects 29.1%. Kad is so bullish that he even expects those companies that are ranked Underweight to deliver a total return of 17.1%.

Some readers may think your blogger is the most relentlessly optimistic on pipelines. When investors ask me to offer an estimate for one year returns, I meekly offer 6% dividends plus 3% growth plus 1% in buybacks, or 10%. I have to confess that Kad’s bold optimism casts a pall of inadequacy over my forecast compared with his fearless proclamation of the opportunity that is presented.

JPMorgan’s Jeremy Tonet expects a median one year total return on his coverage group of 23.5%. Wells Fargo’s Michael Blum is more constrained, expecting a 13% price return on their Overweight group

We agree with Kad’s reasoning – the sector’s free cash flow yield is 2X the S&P500 and well above those of all major sectors. The boost to carbon capture from increased tax credits in the Inflation Reduction Act should cause a rethinking of terminal asset values as pipelines remain key to the energy transition. Sluggish growth in US crude production looks likely as areas mature and capital discipline persists among E&P companies. China is emerging from its three year lockdown, Russian exports are falling with the price cap imposed in December, and the Administration has completed its sale from the Strategic Petroleum Reserve (SPR). Oil looks like a risky short. The US rejected offers of crude to replenish the SPR as too high or the wrong grade. The White House attempt to trade oil is likely to leave it unable to cover earlier sales profitably.

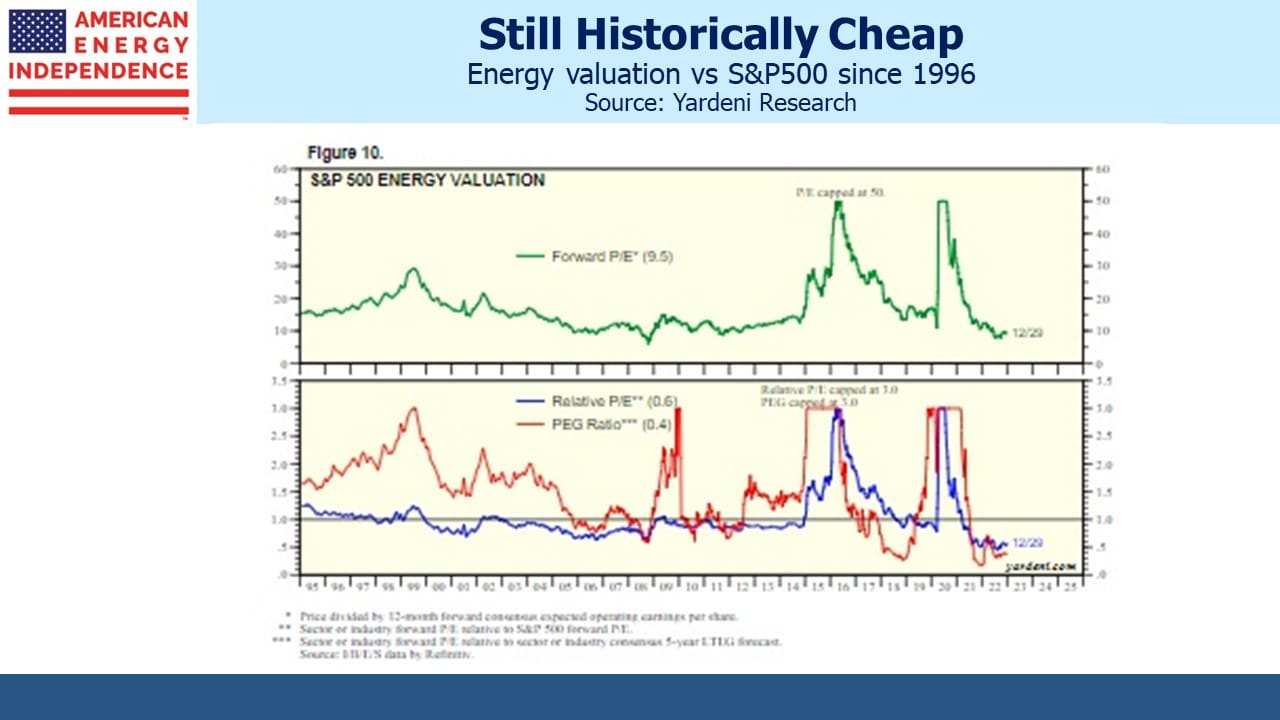

The energy sector’s P/E ratio is 0.6 of the S&P500, the lowest in over twenty five years according to Yardeni Research. Energy analysts are bullish, but the market is not. The three headwinds of shale overbuild, fears of stranded assets and covid demand destruction inflicted such financial trauma on investors culminating in 2020 that the cathartic rebound continues amid skepticism. Retail investors are not yet contributing net inflows into sector funds, although the year-end bounce we postulated (see Will The January MLP Effect Beat Negative Sentiment?) is working. Sector analysts are more bullish than investors.

Last month Tallgrass bought the Ruby natural gas pipeline which runs from the Rocky mountains west to California, out of bankruptcy. Combined with the Rocky Mountains Express (REX) pipeline Tallgrass owns, this creates the potential for natural gas in the Marcellus to move across the country to California markets where prices are high even as Californian politicians seek to reduce its use. Tallgrass likely assesses the Golden state will be using gas for a long time yet.

In other news, AQR’s Cliff Asness wrote an eloquent criticism of private equity valuations. Increasingly, the absence of a regular mark to market is being regarded as a welcome absence of volatility instead of simply an absence of information. Blackstone (see Is BREIT Marked To Market?) recently raised $4BN from University of California (UC). Far from endorsing Blackstone’s valuations, the terms which include close to a guaranteed 11.25% return to UC, suggest that’s what it took to raise new money.

Lastly, a photo from Vail where my younger daughter and I are on our annual ski trip with good friend, client and instructor Bill Edwards. Bill’s a retired orthopedic surgeon from San Antonio that I’ve known for twenty years. We’ve spent many enjoyable ski vacations in his unfailingly good company. Every year he generously sees improvement and I really think he’s right. Any skiing competence I exhibit is down to him; the falls are my own work (or as he says, a failure to listen).

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!