Bearishness Is Holding Back Energy

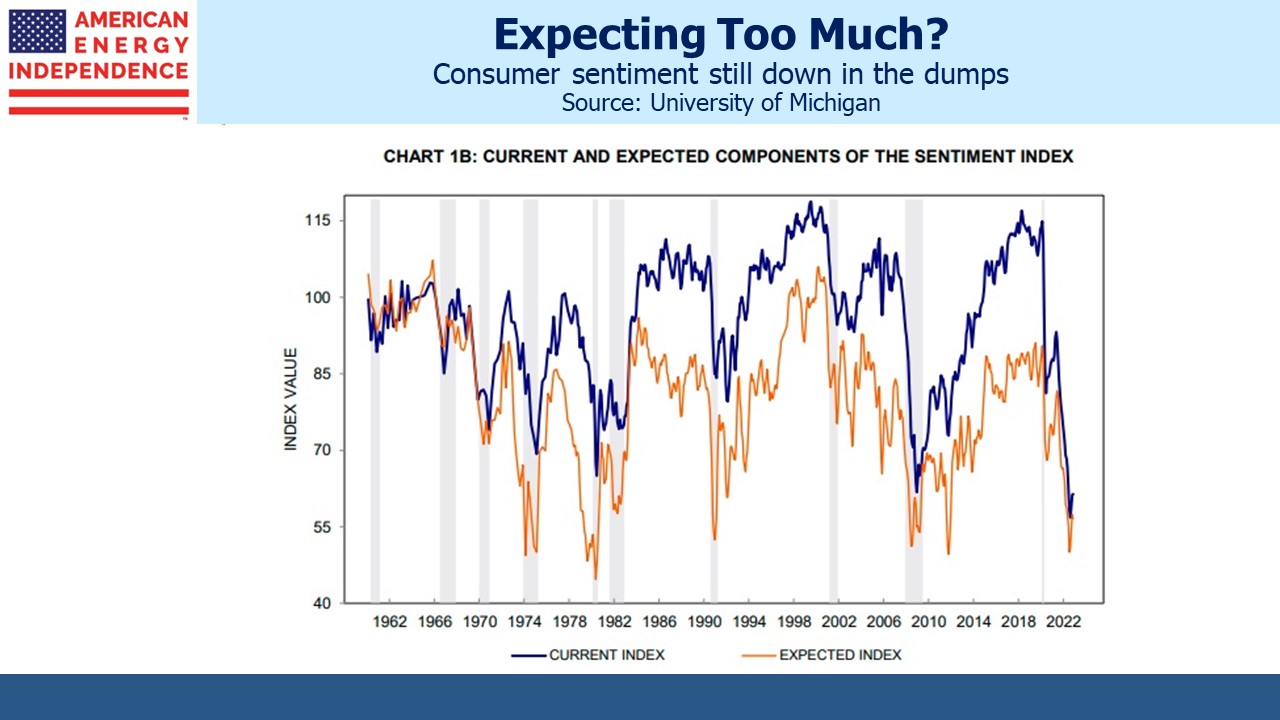

Michael Wilson, Morgan Stanley’s chief equity strategist, thinks stocks could fall 22% this year. Wall Street is bearish, and the mood has spread to consumers. Earnings forecasts are falling and households report expectations close to the depths of the 2008 great financial crisis. A lot of smart people are negative. We don’t spend any effort positioning for the economic cycle – when recessions have struck they’ve usually been unexpected. If the US slips into one later this year it’ll be the most anticipated in living memory.

Fortunately, Morgan Stanley like most firms encourages disparate opinions and does not enforce a “house” view in its public pronouncements. Hence Robert Kad, who heads up MLP and Energy Infrastructure research is publicly, even giddily bullish on the sector. Of the companies they cover, which is most of them, he expects a median one year price return of 21.9%. With dividends he expects 29.1%. Kad is so bullish that he even expects those companies that are ranked Underweight to deliver a total return of 17.1%.

Some readers may think your blogger is the most relentlessly optimistic on pipelines. When investors ask me to offer an estimate for one year returns, I meekly offer 6% dividends plus 3% growth plus 1% in buybacks, or 10%. I have to confess that Kad’s bold optimism casts a pall of inadequacy over my forecast compared with his fearless proclamation of the opportunity that is presented.

JPMorgan’s Jeremy Tonet expects a median one year total return on his coverage group of 23.5%. Wells Fargo’s Michael Blum is more constrained, expecting a 13% price return on their Overweight group

We agree with Kad’s reasoning – the sector’s free cash flow yield is 2X the S&P500 and well above those of all major sectors. The boost to carbon capture from increased tax credits in the Inflation Reduction Act should cause a rethinking of terminal asset values as pipelines remain key to the energy transition. Sluggish growth in US crude production looks likely as areas mature and capital discipline persists among E&P companies. China is emerging from its three year lockdown, Russian exports are falling with the price cap imposed in December, and the Administration has completed its sale from the Strategic Petroleum Reserve (SPR). Oil looks like a risky short. The US rejected offers of crude to replenish the SPR as too high or the wrong grade. The White House attempt to trade oil is likely to leave it unable to cover earlier sales profitably.

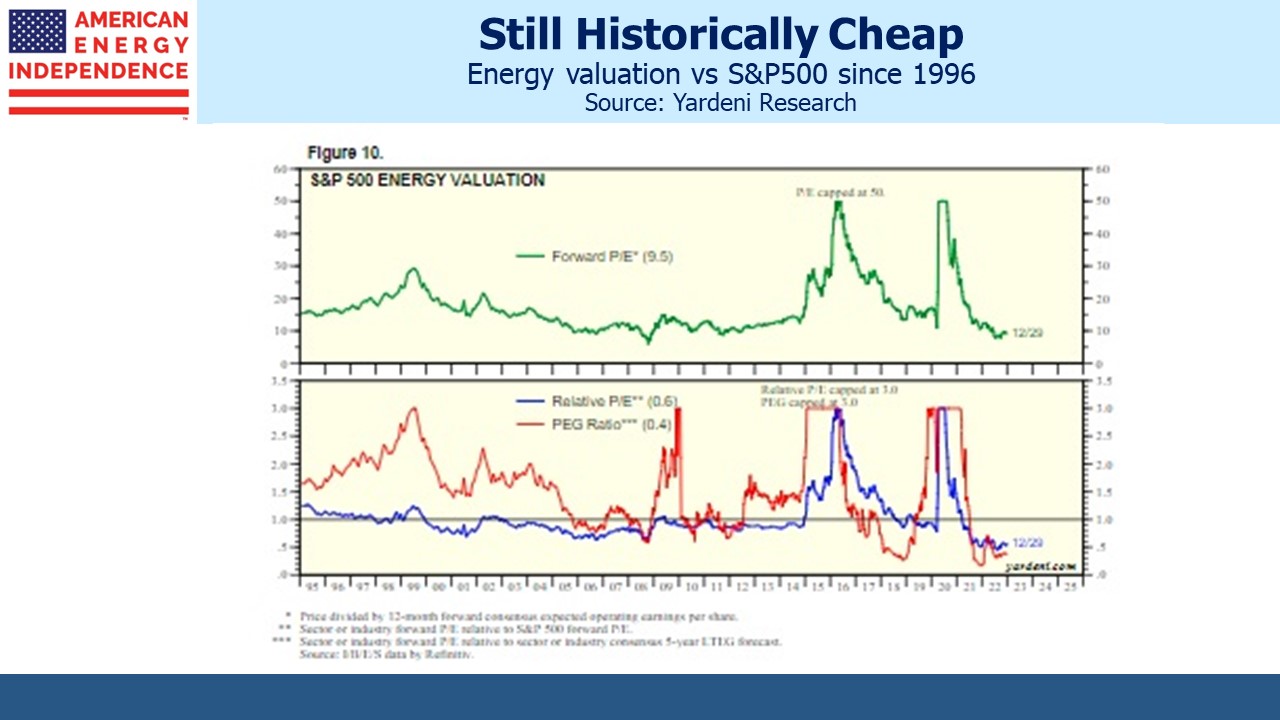

The energy sector’s P/E ratio is 0.6 of the S&P500, the lowest in over twenty five years according to Yardeni Research. Energy analysts are bullish, but the market is not. The three headwinds of shale overbuild, fears of stranded assets and covid demand destruction inflicted such financial trauma on investors culminating in 2020 that the cathartic rebound continues amid skepticism. Retail investors are not yet contributing net inflows into sector funds, although the year-end bounce we postulated (see Will The January MLP Effect Beat Negative Sentiment?) is working. Sector analysts are more bullish than investors.

Last month Tallgrass bought the Ruby natural gas pipeline which runs from the Rocky mountains west to California, out of bankruptcy. Combined with the Rocky Mountains Express (REX) pipeline Tallgrass owns, this creates the potential for natural gas in the Marcellus to move across the country to California markets where prices are high even as Californian politicians seek to reduce its use. Tallgrass likely assesses the Golden state will be using gas for a long time yet.

In other news, AQR’s Cliff Asness wrote an eloquent criticism of private equity valuations. Increasingly, the absence of a regular mark to market is being regarded as a welcome absence of volatility instead of simply an absence of information. Blackstone (see Is BREIT Marked To Market?) recently raised $4BN from University of California (UC). Far from endorsing Blackstone’s valuations, the terms which include close to a guaranteed 11.25% return to UC, suggest that’s what it took to raise new money.

Lastly, a photo from Vail where my younger daughter and I are on our annual ski trip with good friend, client and instructor Bill Edwards. Bill’s a retired orthopedic surgeon from San Antonio that I’ve known for twenty years. We’ve spent many enjoyable ski vacations in his unfailingly good company. Every year he generously sees improvement and I really think he’s right. Any skiing competence I exhibit is down to him; the falls are my own work (or as he says, a failure to listen).

We have three funds that seek to profit from this environment: