Don’t Bet On A Return To 2% Inflation

/

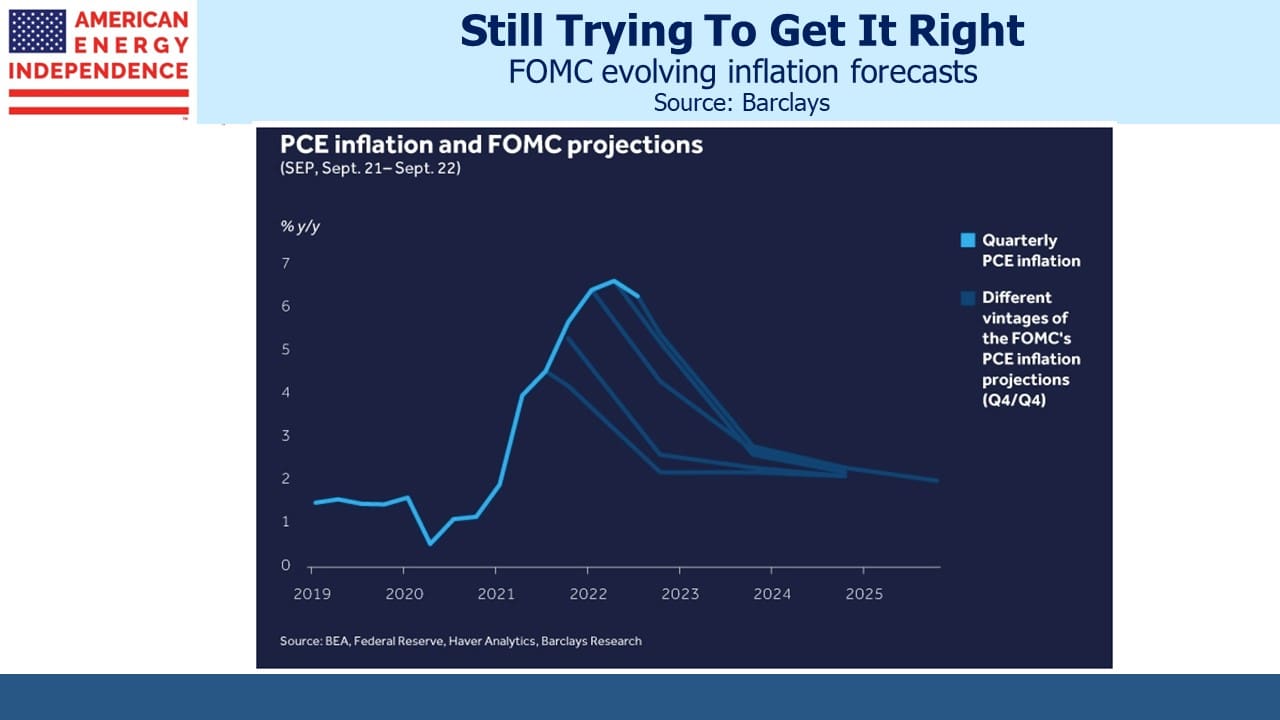

The Fed has a poor forecasting record, something Wall Street never tires of pointing out. The chart below from Barclays shows the FOMC’s constant self-correction on inflation through successive meetings.

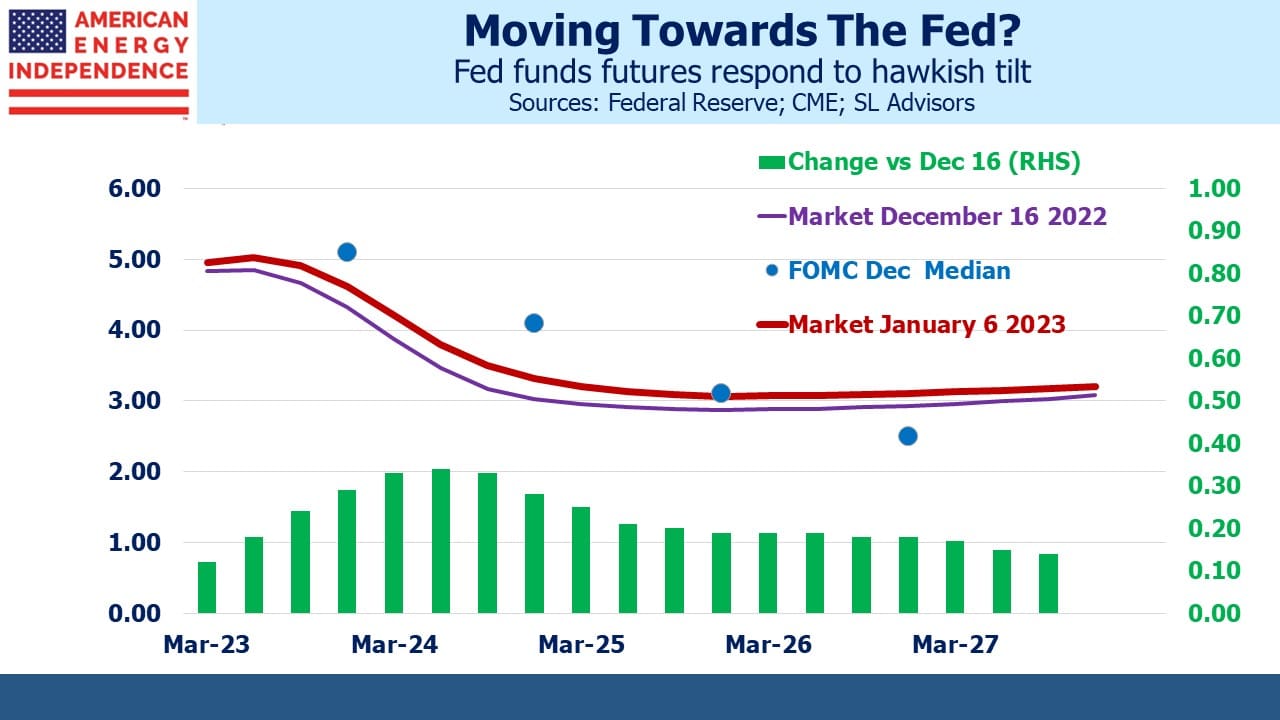

Fed chair Powell downplays the blue dots but often refers to them at his press conferences. Usually, the dots move towards the market as the Fed even has trouble forecasting their own policy rate. A recession later this year is the consensus forecast. It’s conventional wisdom that tighter policy will depress growth and induce a pivot. Fed funds futures imply easier policy by year’s end, although with less conviction than a month ago. The minutes released last week showed members expect, “a sustained period of below-trend real GDP growth would be needed.”

Futures modestly bowed towards the blue dots, with rate expectations a year out moving up 0.25% or so since the last FOMC meeting.

Inflation is finally falling and is widely expected to return to 2% within a couple of years. Long-term inflation expectations have remained surprisingly sanguine. Blackrock has a different view. In their 2023 Global Outlook they expect the “politics of recession” to force easier policy on central banks prematurely.

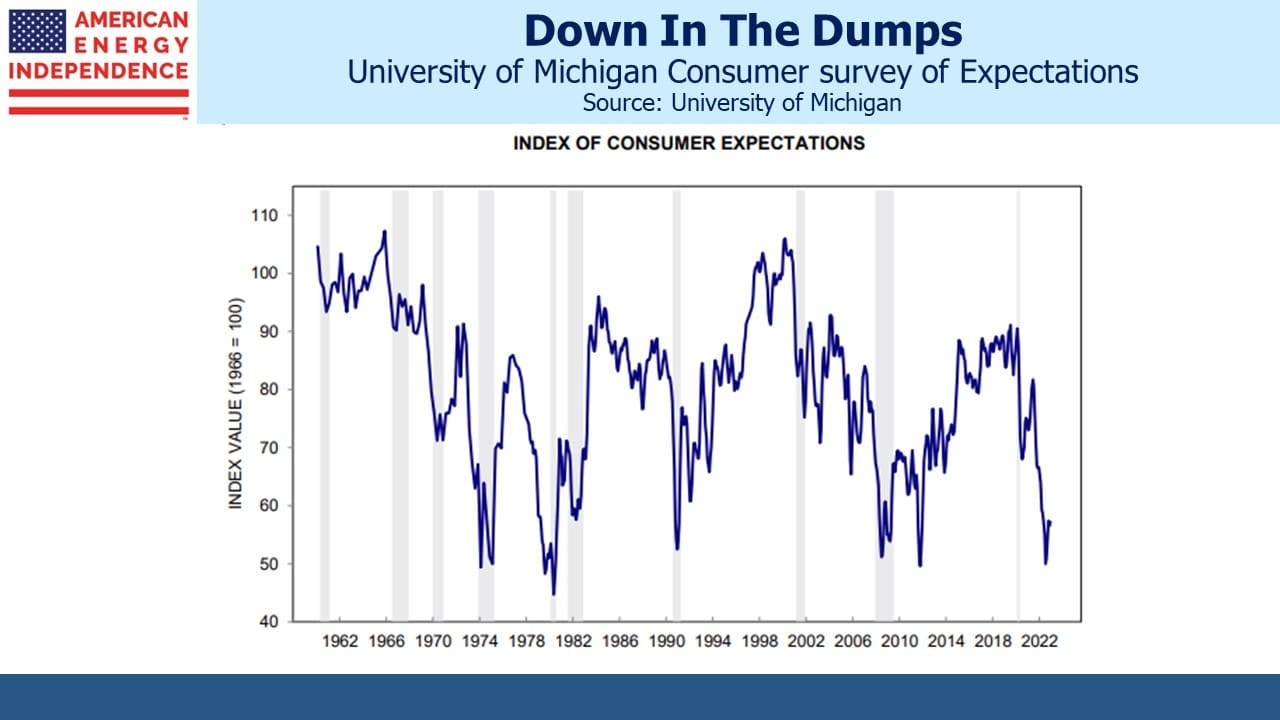

We noted recently that market sentiment measures are as negative as extremes such as the 2008 financial crisis and even turbulent 1980. Inflation was public enemy #1 and there was broad political agreement to vanquish it. Consumer expectations are recession-like and the economy is well beyond full employment.

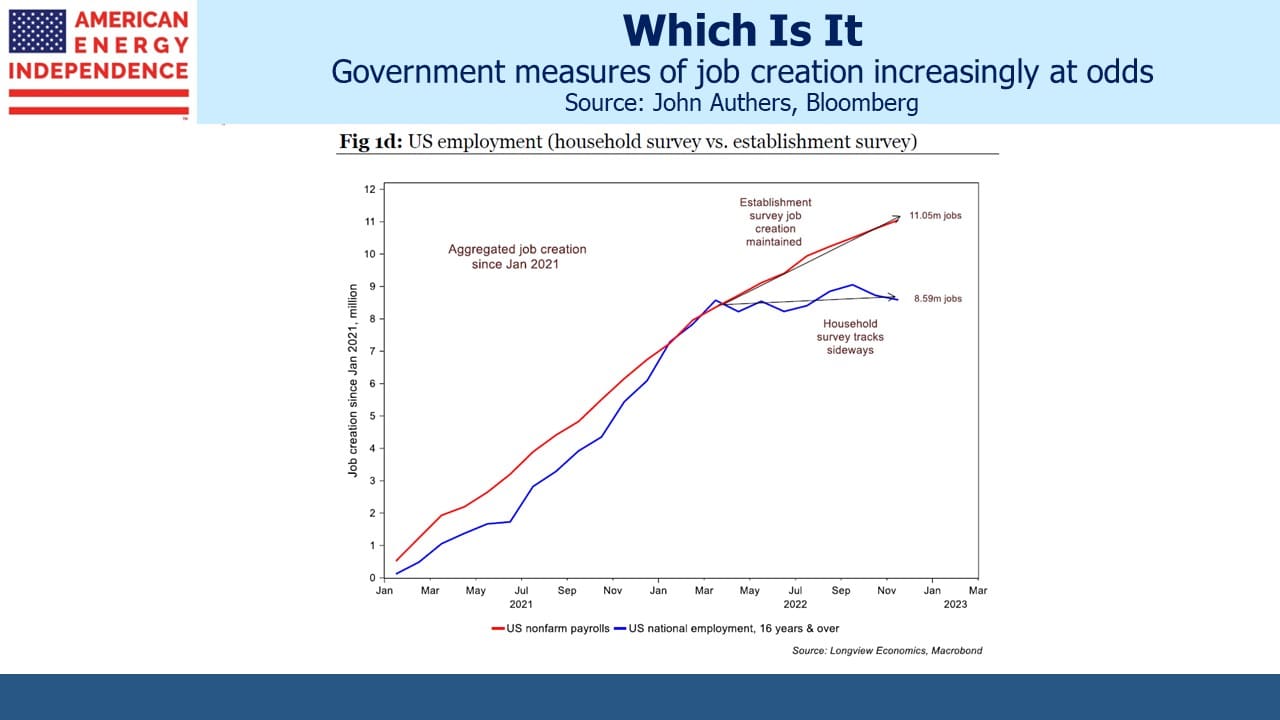

And yet, there are conflicting measures of the job market. The Establishment survey, which targets businesses, and the Household survey, which targets people, are diverging sharply in estimating job creation. Through December a gap of over 2.3 million jobs opened up between the two in the past year, approximately when the Fed began tightening monetary policy. Friday’s household survey registered an additional 717K workers, so the discrepancy has closed somewhat.

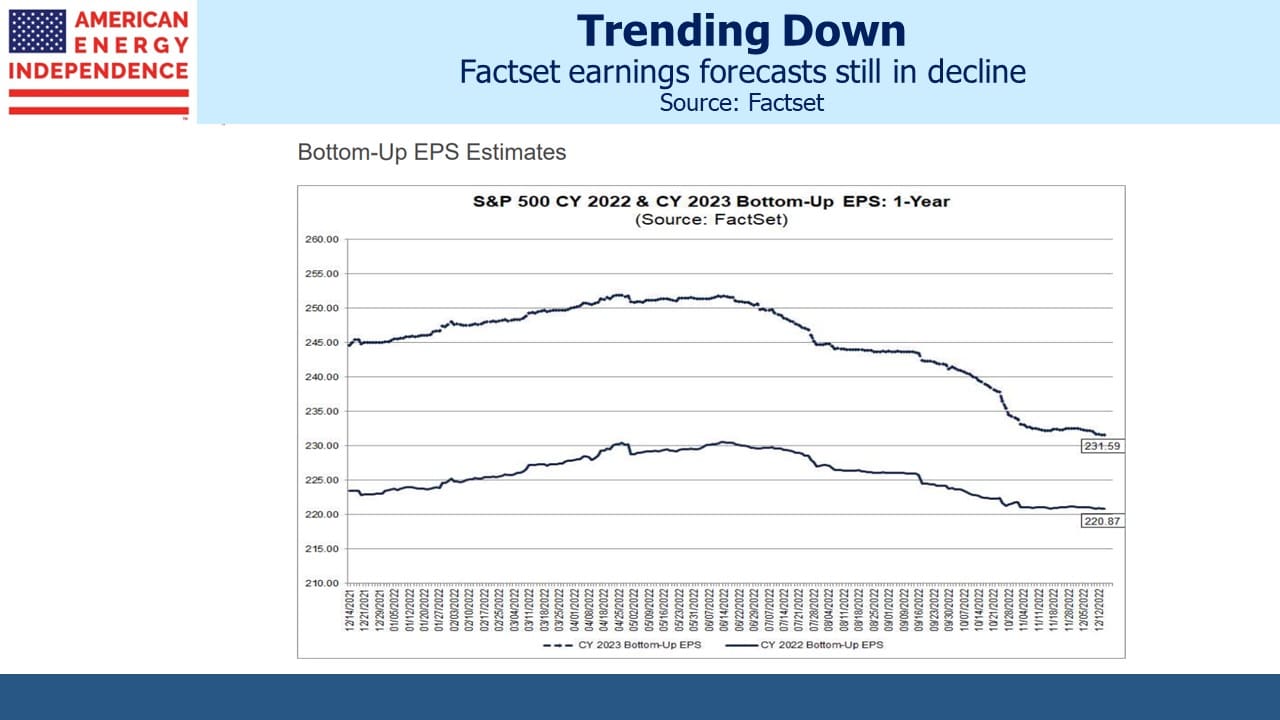

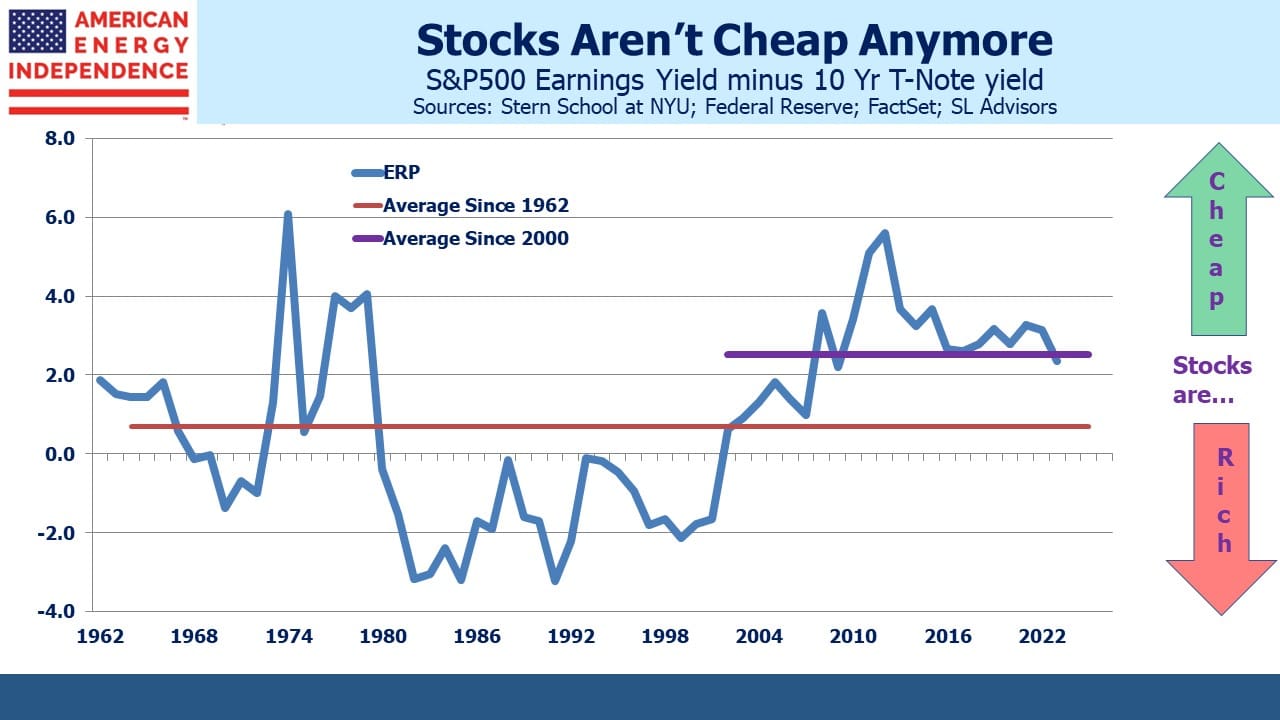

Analysts’ earnings forecasts are trending down and are expected to grow less than 5% this year. As a result, the Equity Risk Premium (S&P500 earnings yield minus the ten-year treasury yield) suggests stocks are at neutral valuation.

This suggests looming economic weakness sufficient to bring inflation back to 2%. But consumer sentiment is already so negative that evidence of a slowdown, such as a couple of weak employment reports, are likely to expose Fed policy to political criticism. Enthusiasm for reducing inflation is unlikely to withstand economic weakness.

This is the point of Blackrock’s view that we’re going to live with higher inflation. They cite three reasons: (1) an aging population (2) geopolitical fragmentation, and (3) the energy transition.

An older population means reduced eligible workers. The participation rate edged up to 62.3% and the unemployment rate fell to an historic low of 3.5%, both consistent with that long-term trend. China’s appeal for manufacturing has weakened with extended covid restrictions. Along with the risk of eventual conflict with Taiwan, companies are bringing production closer to home. The disinflationary effect of globalization is receding.

The energy transition is also inflationary, in two ways. The first is that it drives prices higher. If solar and wind were cheaper they’d be ubiquitous instead of around 14% of power generation which is itself around 19% of US primary energy.

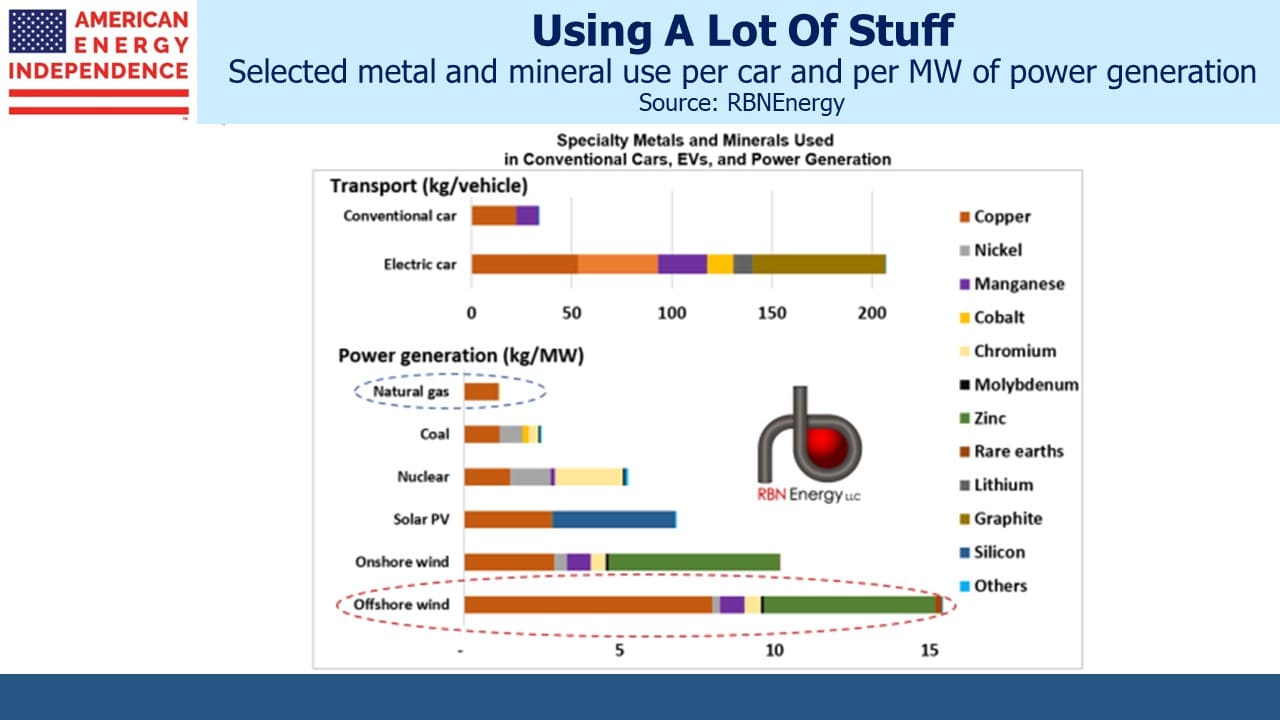

The second inflationary impulse from solar and wind is coming from their consumption of steel, cement, copper and other resources. RBN Energy compares the inputs needed to power a town of 75,000 homes with a single 100 MW combined cycle natural gas plant or 200 MW of windpower. More power output is needed than for the natural gas plant because intermittency requires generating an excess that can be stored for when it’s not windy. They estimate you’d need 200X as much iron ore, 50X as much concrete and 20X as much specialty metals and minerals such as copper, chromium and zinc.

Manufacture of wind turbines is already driving up the prices of inputs. Companies such as Vestas and Siemens Gamesa are renegotiating contracts to try and restore profitability. Avangrid has told Massachusetts that the Commonwealth Wind project, the largest offshore wind farm in the state’s pipeline, “cannot be financed and built” under existing contracts.

None of the three drivers of inflation described above is necessarily deserving of a monetary policy response. Many would regard higher energy prices in support of reduced CO2 emissions as appropriate. Natural gas prices have collapsed in recent days due to unseasonably warm weather and doubts about whether the Freeport LNG export facility will be in operation again by late January as promised by the company. But looking ahead, the energy sector is likely to remain both a source of, and a hedge against, inflation.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Simon, I just watched a very long info commercial on Facebook (which is very rare for me to do)) where this guy is advocating that Larry Fink and Michael Bloomberg are the two most powerful men and are setting policy in the US. He is a very strong advocate of investing in LNG and Natural Gas related companies, which I agree with after following you for the past several years. I’m considering moving a higher % of my investment $ into this space. It just seems to make sense.

Hope your well and have a great year.

Jim Hinnegan

UBS

Thanks for your comment Jim.