Will The January MLP Effect Beat Negative Sentiment?

/

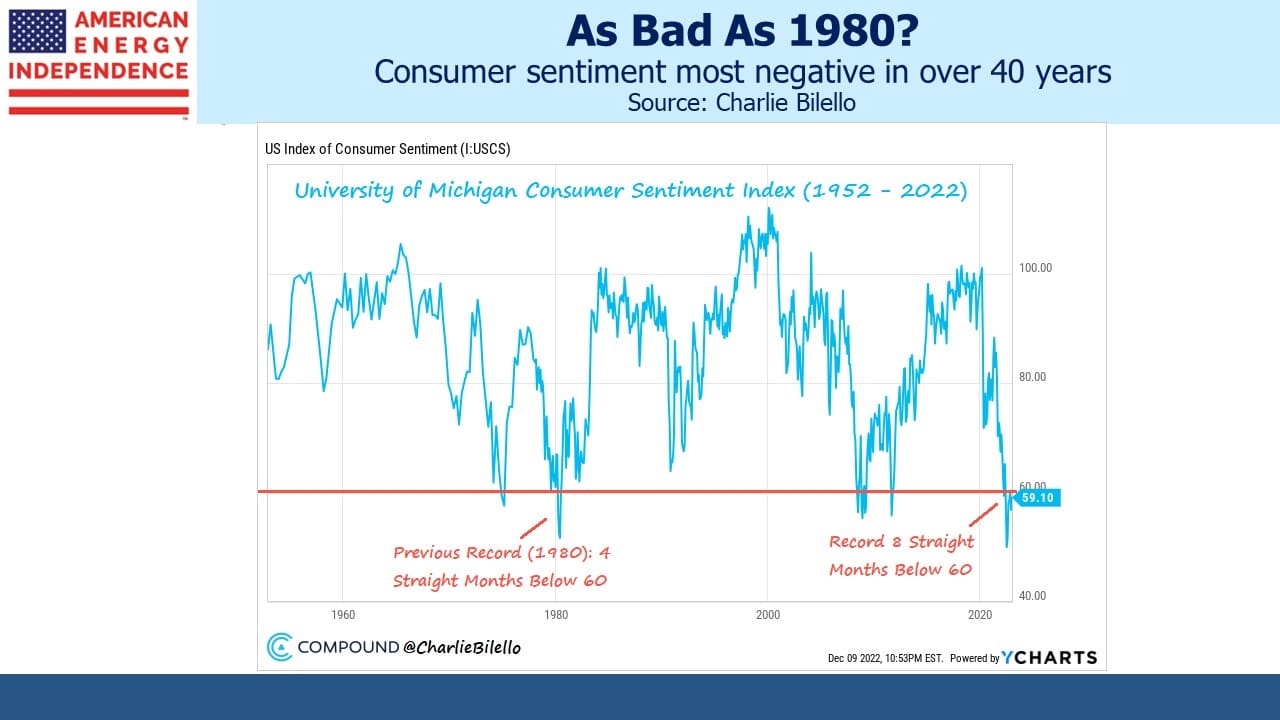

Consumer sentiment is as bad as 1980 when inflation was 13%. The Fed funds rate swung from 17% to 9% before peaking at 19% in early 1981. Eight US marines died in Iran in a failed attempt to rescue our hostages. John Lennon was shot. No wonder Ronald Reagan won election later that year. Consumers today are more negative than they were back then.

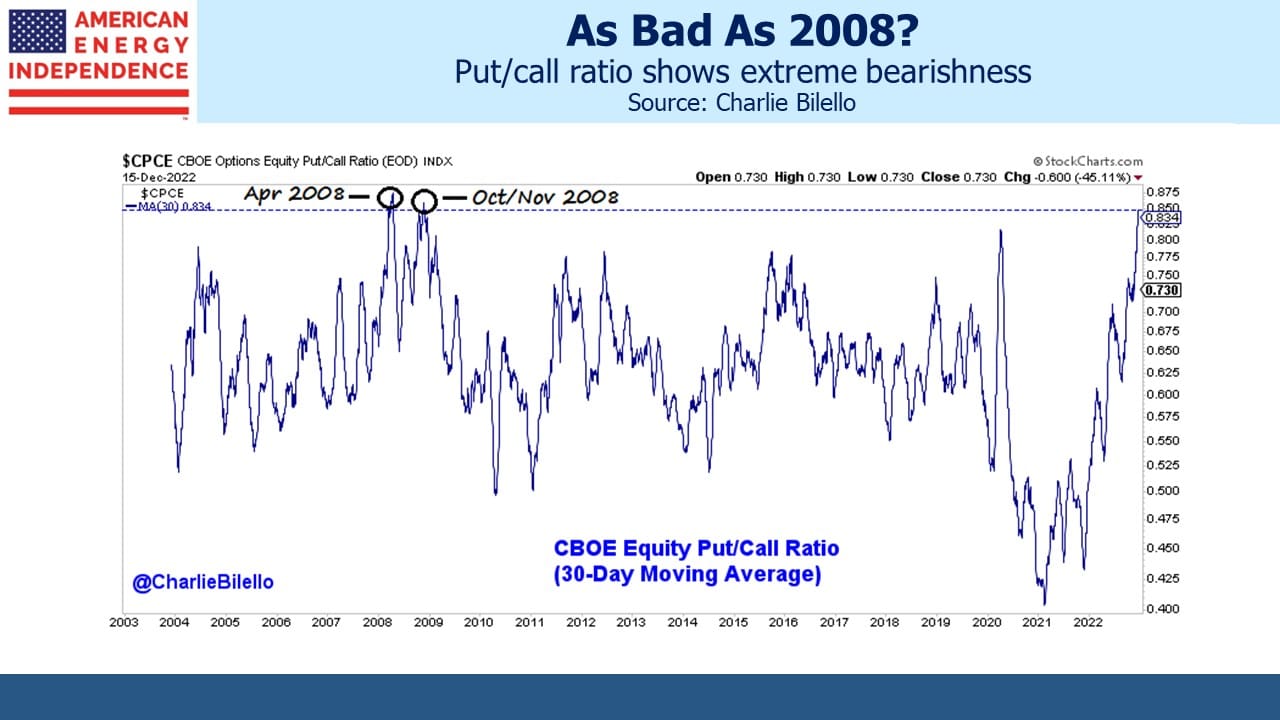

The put/call ratio is close to the extremes of the Great Financial Crisis in 2008 when Bear Stearns was bailed out by JPMorgan and Lehman failed. There’s plenty of negatives, but are prospects really that terrible?

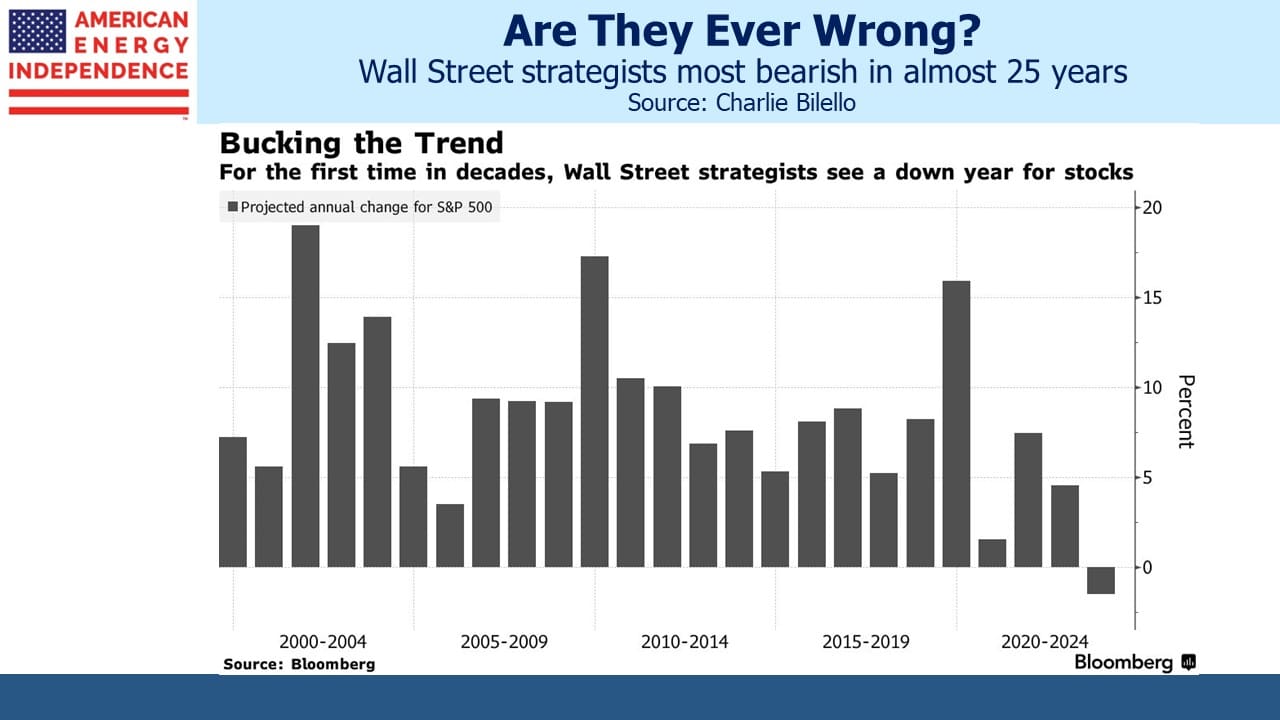

If you’re not yet convinced of pervasive bearishness, how about that for the first time in 25 years US equity strategists are forecasting a down year.

Conventional portfolios did poorly. Diversification and a dollop of fixed income have caused misery. Energy and cash was the improbable winning combination. Meme stocks, tech and bitcoin (useless except when it’s going up) have slumped along with animal spirits.

But everyone who wants a job has one, albeit pay is lagging inflation. We’re not at war, although between Ukraine and Taiwan there’s plenty to worry about. And it looks like we handled covid rather better than China even though they had a head start on us since it originated there.

If today’s outlook compares unfavorably with 2008 or 1980, you have to conclude that people expect more out of life. Warren Buffet famously said that the secret to a happy marriage is to marry someone with low expectations. At moments of marital discord, I’ve pushed my luck by sharing this wisdom with my wife, who retorts that her expectations couldn’t be any lower.

Perhaps happiness in life requires lower expectations than evidenced by survey respondents to the University of Michigan.

The Alerian MLP ETF (AMLP) may be a flawed investment product, but it still has its uses. It serves as a reminder of what an ETF should not be, which is a payer of corporate taxes. As regular readers know, AMLP doesn’t qualify to be exempt from taxes like virtually all ETFs and mutual funds, because it invests almost all its assets in MLPs. Our Byzantine tax code recently led to a 3.9% NAV hit for AMLP investors as its advisor Alps reassessed what they owed (see AMLP Trips Up On Tax Complexity).

AMLP is inadequate as a long-term investment because its taxable structure ensures it will substantially lag its index. But it can still be worthwhile as a short. One example is when market appreciation turns unrealized losses into gains. Upon crossing that threshold the tax drag kicks in, such that it goes up at 79% of its index (ie 1 – the 21% corporate tax rate) but still falls with the market. Such asymmetry can make it a useful hedge on a long portfolio of MLPs or even a good short position (see Uncle Sam Helps You Short AMLP).

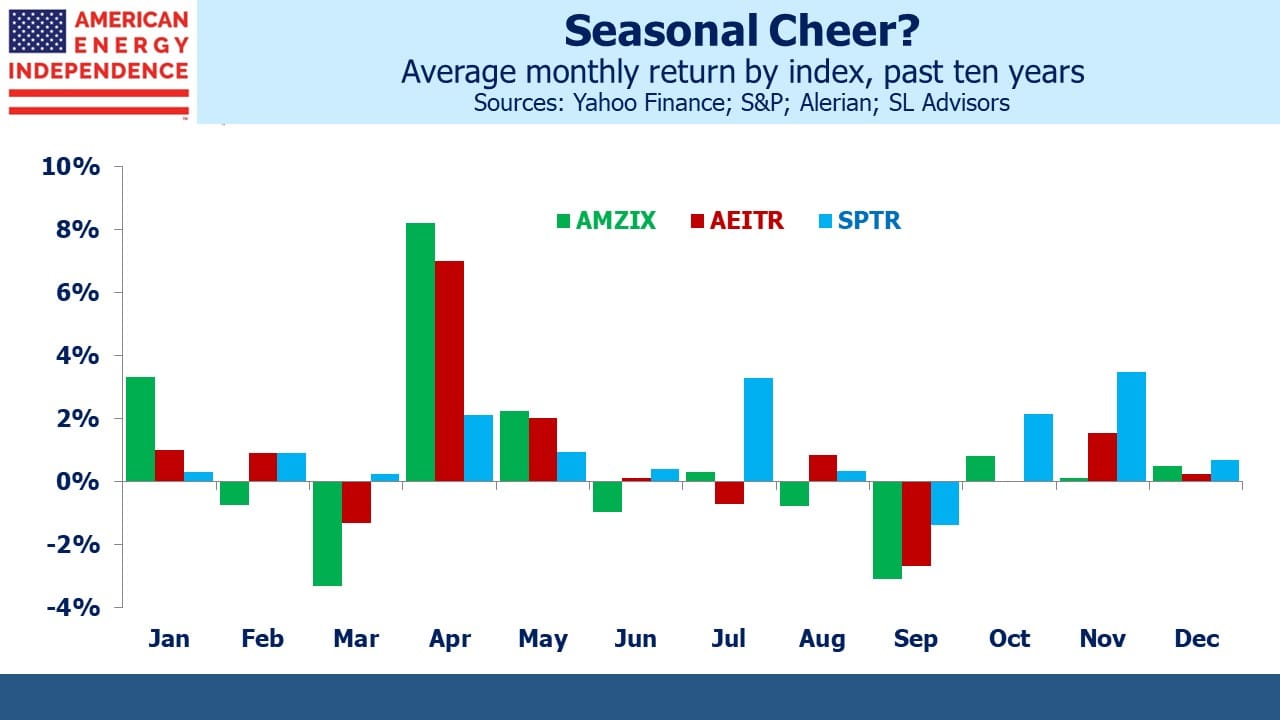

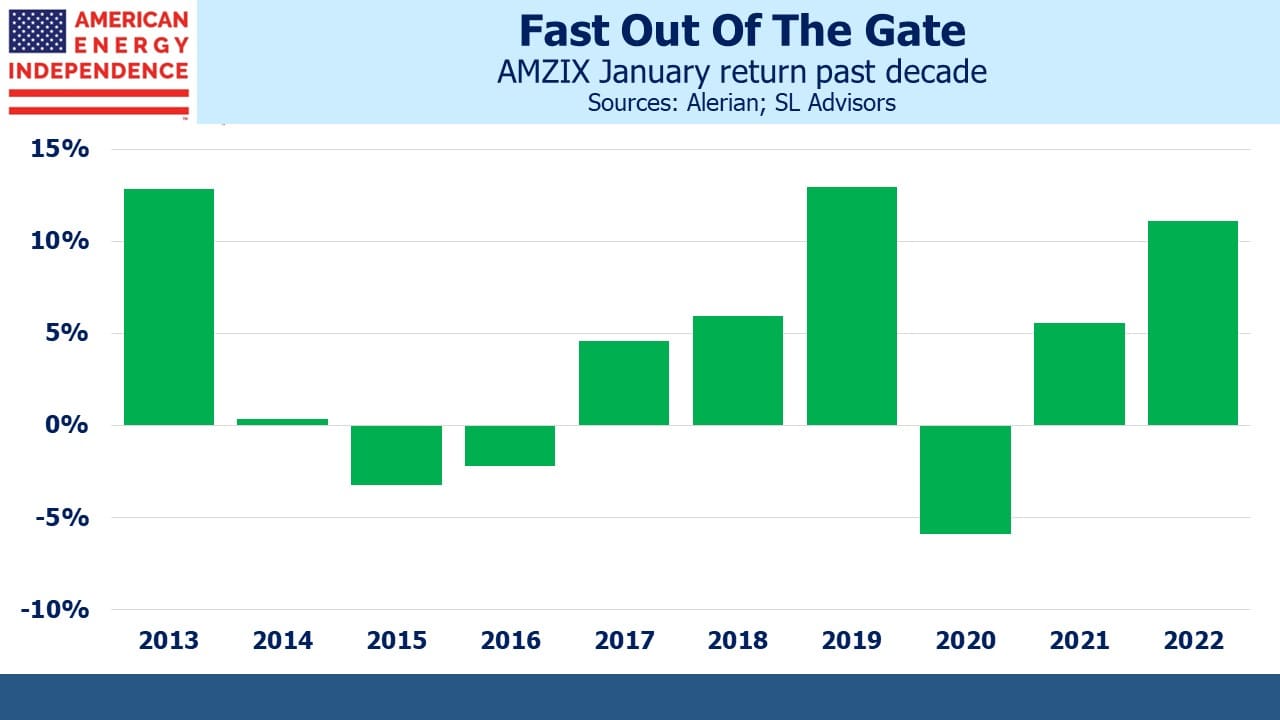

Another trade opportunity exploits the January effect. This used to be a feature of the S&P500 but has disappeared in recent years. It’s not that pronounced for the American Energy Independence Index (AEITR), but still shows up in the Alerian MLP Infrastructure Index (AMZIX), which AMLP seeks to track minus the tax drag and expenses.

The likely reason for a positive start to the year is that MLP holders tend to be K-1 tolerant, US taxable Americans. Because K-1s are a pain in the neck, if you’re contemplating selling an MLP December is better than January because you’ll avoid one last K-1 for the stub year. Similarly, purchases delayed until January avoid a K1 for the last month of the prior year.

Over the past decade, the AMZIX has averaged +3.3% in January, versus 0.5% for all months. Seven out of ten Januarys were positive, and only one was down more than 5% (2020). On average it’s up around half the time. If you’re inclined towards trading, buying AMLP now and planning to exit next month has an attractive risk/reward. And if you’re thinking of investing in the sector, delay is likely to mean paying higher prices. Just don’t make AMLP a long-term holding, because with its tax structure and absence of the biggest pipeline corporations it’s likely to continue underperforming the sector.

The seasonal January AMLP trade might benefit from a macro backdrop that suggests more investors than usual are hedged, defensive, in cash and hunkered down. In addition, the fundamentals for midstream energy infrastructure remain positive as tirelessly reported on this blog (see Energy – The Only Bright Spot In 2022). And if you already own AMLP, late January could be your best chance to swap it for a fund with a more investor-friendly structure.

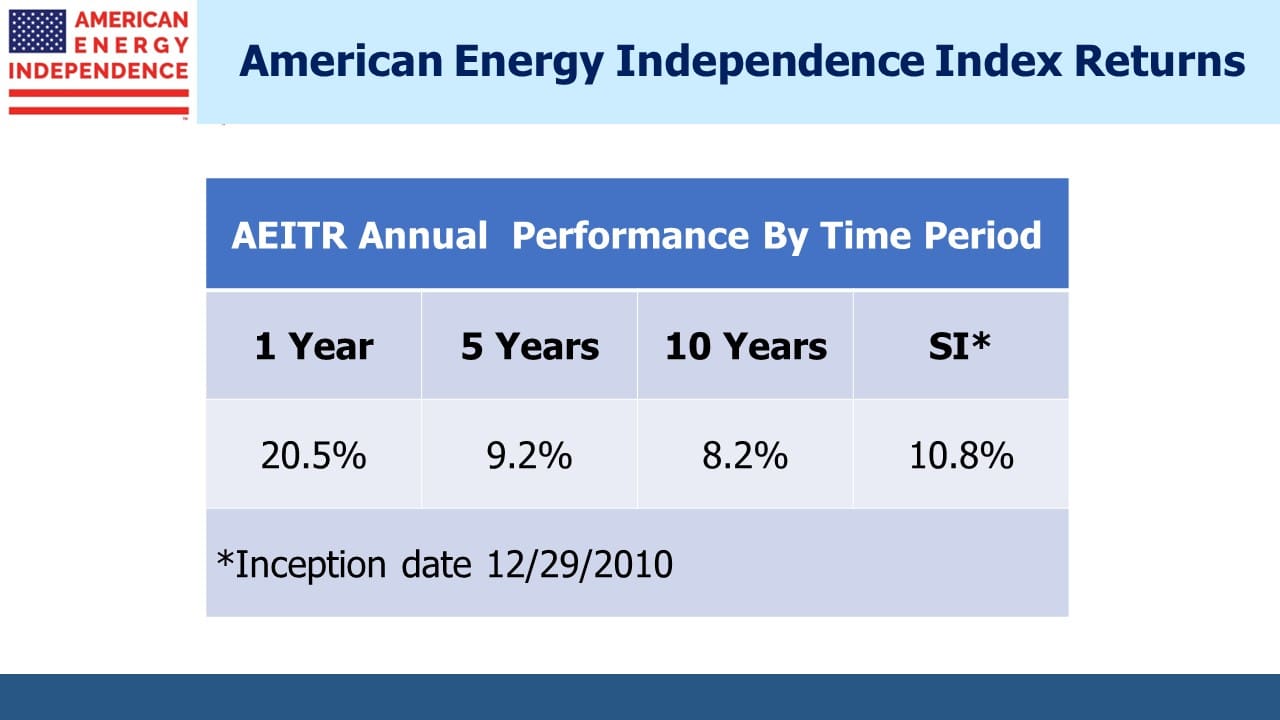

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!