Is BREIT Marked To Market?

/

How do you conservatively value illiquid assets in a fund that offers liquidity to existing investors and accepts money from new ones? That’s the unsolvable question inadequately answered by the $125BN Blackstone Real Estate Investment Trust (BREIT), which is why they were forced to suspend withdrawals.

Private equity funds typically raise money and invest it over time. Generally, a fund’s investors commit at around the same time and share the portfolio results pro-rata. If a seasoned fund allowed latecomers who were enticed by early investment results, it would be unfair to those who committed at the outset without that information. In such a case, conservative low valuations on existing investments would harm the early investors whose stake in those positions would be diluted on unfavorable terms. High valuations might dissuade later investors if they felt they were paying too much for the existing positions.

It’s why successful private equity managers run one fund after another. It allows them to keep raising capital while ensuring each class of investors is pari passu. With realizations driving liquidity for investors and the manager’s incentive fee, interim valuations don’t matter that much.

When it comes to illiquid assets such as real estate, a valuation range is more realistic than a single point. By allowing inflows and outflows, BREIT has sought to provide liquidity at odds with their underlying assets. Smooth monthly returns, the promise of “consistent, tax-advantaged distributions” and the Blackstone brand made BREIT attractive to institutions. Their published monthly returns go to two decimal places, suggesting a precision at odds with what they own. They’ve reported three down months out of 69. Such unerring profitability should draw skepticism.

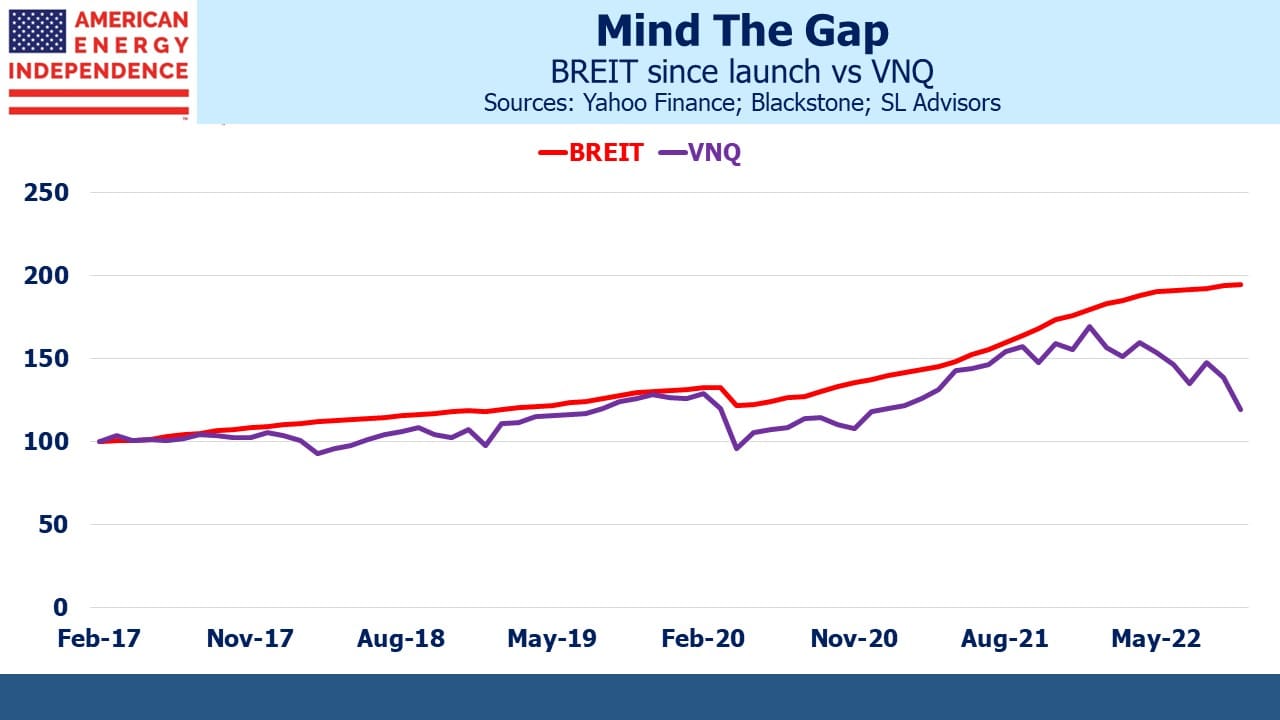

The fall in price of other publicly traded REITs has challenged the credibility of Blackstone’s valuation of the BREIT portfolio. The Vanguard Real Estate Index Fund (VNQ) was down 26% for the year through October. BREIT reports it is up 8.5% over the same period (they report with a lag). Some investors doubt that such a large fund could so nimbly avoid the markdowns that public market investors have endured. The biggest REITs in VNQ have seen their Price/Book ratio drop by over a quarter this year, suggesting book value for other funds will eventually be marked down.

BREIT addresses this, noting that they’ve sold $5BN of real estate this year “at a meaningful premium to carrying values.” They argue that because public real estate is only 8% of the market, private market values are more representative. Therefore, Blackstone regards today’s publicly traded real estate as being discounted to private market values rather than their own portfolio of private investments being overvalued.

Nonetheless, the BREIT investors who have exited recently and others blocked from doing so deem it attractive to redeem at an unchanged Price/Book.

Non-traded REITs, which are registered so as to have the widest possible set of buyers but unlisted to discourage analyst coverage, attract the ethically challenged as fund managers. Almost a decade ago we published Inland American Realty Runs Its Own Hotel California, concluding that disclosing how many ways you intend to fleece your investors can provide some defense when the SEC takes a close look. Non-traded REITs don’t perform regular appraisals, which has led their promoters to disingenuously extoll the consequent “absence of public market volatility.” For more, see Unlisted, Registered REITs; an Investment Designed for Brokers, and also chapter one of my 2015 book Wall Street Potholes.

BREIT shares some of the ignominious qualities of the maligned and shrunken non-traded REIT sector, although they prudently omit claims of low volatility or a high Sharpe Ratio that smooth monthly performance suggests.

Years ago as a hedge fund investor I ran into this problem with a convertible bond arbitrage fund (for the full story see The Hedge Fund Mirage Pp 107-111). If a fund’s bonds are priced by market makers at 101-102, they can be valued anywhere within that one-point range without the manager being open to accusations of misvaluation. If inflows are expected it can make sense to value at 102, pushing up the NAV at which new money comes in and helping performance.

Similarly, outflows might induce valuation at 101, benefiting remaining investors over those exiting. Since the manager must buy or sell bonds in response to flows, incurring transactions costs for the fund, this will always create winners and losers. Investors generally assume greater liquidity than really exists, and don’t consider transactions costs. Fund managers rarely educate them.

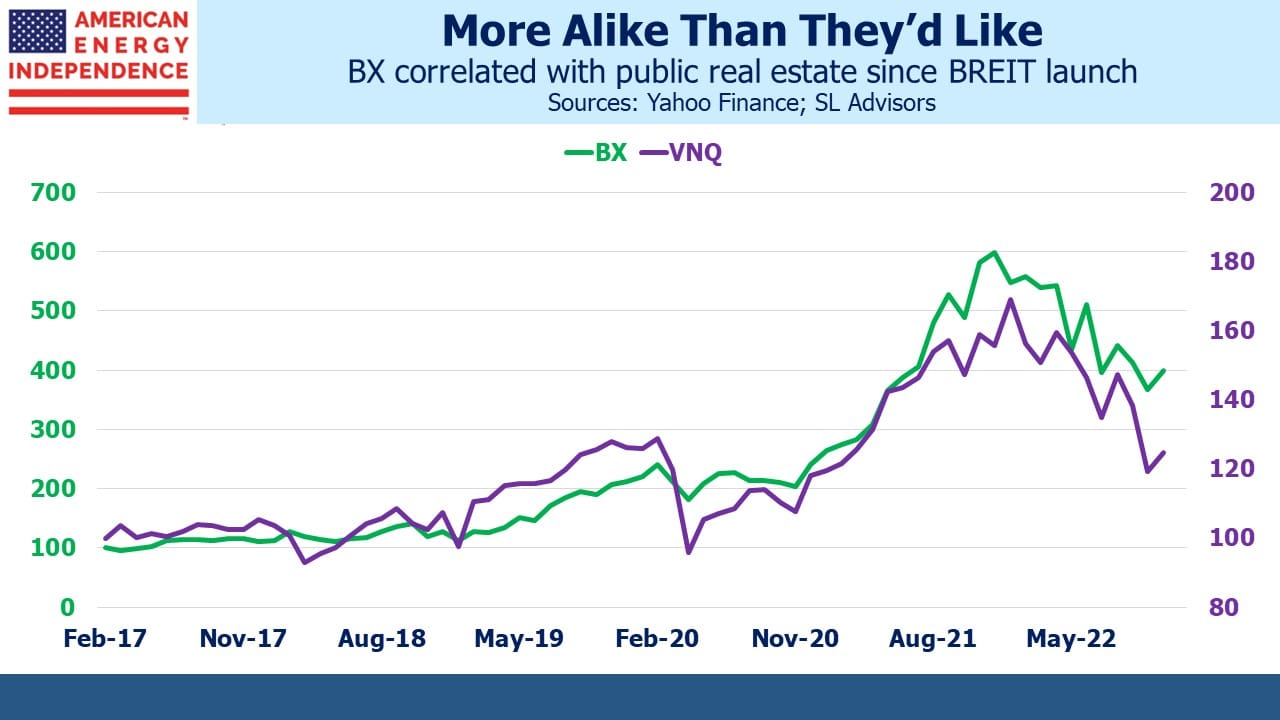

The less liquid the assets, the bigger the range of valuations. Real estate doesn’t belong in a fund that allows regular investor flows. BREIT’s NAV sweeps majestically higher, impervious to the carnage afflicting all markets other than energy. But investors in Blackstone’s stock (BX) see a closer relationship with public real estate values as measured by VNQ rather than the private valuations represented by BREIT. Blackstone created the appearance of public market liquidity for privately held assets and asserts valuations remain strong. Their bluff is being called.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

It was interesting to read that it is non-traded REITs which attract the ethically challenged. I always thought that the ethically challenged preferred politics as a profession. Those ethically challenged who go into fund management must be those who are not ethically challenged enough to become politicians.

Simon

My condolences to England losing yesterday. However, using American football terms I have to give you a 15 yard penalty for unsportsmanlike conduct for piling on.

I own BREIT and have listened into numerous conference calls from them. You are comparing apples and oranges when you are comparing BREIT’s total return of 8 to 9% with VNQ index being down around 25%.

You have to adjust BREIT for the distributions this year which are just under 4%. That brings the markup this year to 4 to 5%. Likewise adjust VNQ for their dividends this year of around 2% brings the decline in VNQ to 23%.

Ask yourself, did the value of the properties that are owned by the REITs in VNQ decline 10 – 15% this year? I used 10 – 15% to adjust for leverage. Nobody knows because REITs don’t value their underlying properties. What they report is book value which most believe understates the properties value because of depreciation.

The value of private REITs is determined by rental income and the cap rate. What happens to the value of your real estate if same property net operating income grew 13% this year? If there is no change in the cap rate the value would grow 13% give or take. Increase your cap rate because of higher interest rates and the value of your properties falls. BREIT increased their cap rate this year which brought down the growth this year to a reasonable 4 to 5%.

Also, BREIT was prudent with their debt. 87% of their debt is fixed rate according to BREIT.com.

Investors have invested almost $1 trillion with Blackstone because of their track record and integrity. They have access to information that I believe few, if any, REIT management teams have. They invested BREIT into rental and logistic assets that can grow rents in difficult environments. Don’t hard assets increase in value in an inflationary environment?

When I purchased BREIT I knew the rules. Just like when I purchased Catalyst Energy Infrastructure Fund I understood I had daily liquidity I knew that with BREIT I had quarterly liquidity but could be restricted. I also knew in March of 2020 not to sell you fund due to the actions of others.

You of all persons should know that the value assigned to the market value of certain assets bears no relation to the true value of the asset. As you recall it was only two years ago that the public markets in March of 2020 valued Energy Transfer at $3.75 per share, Western Midstream at $3 per share and Enlink below $1. Were these stocks only worth that much?

I’m not saying that BREIT is undervalued like energy infrastructure was back in March of 2020. I certainly don’t believe that it is overvalued either.

You should have found a better target to attack.

Nice ideas and tips that investors can follow through. Thanks for it.