Energy Leads The Market

/

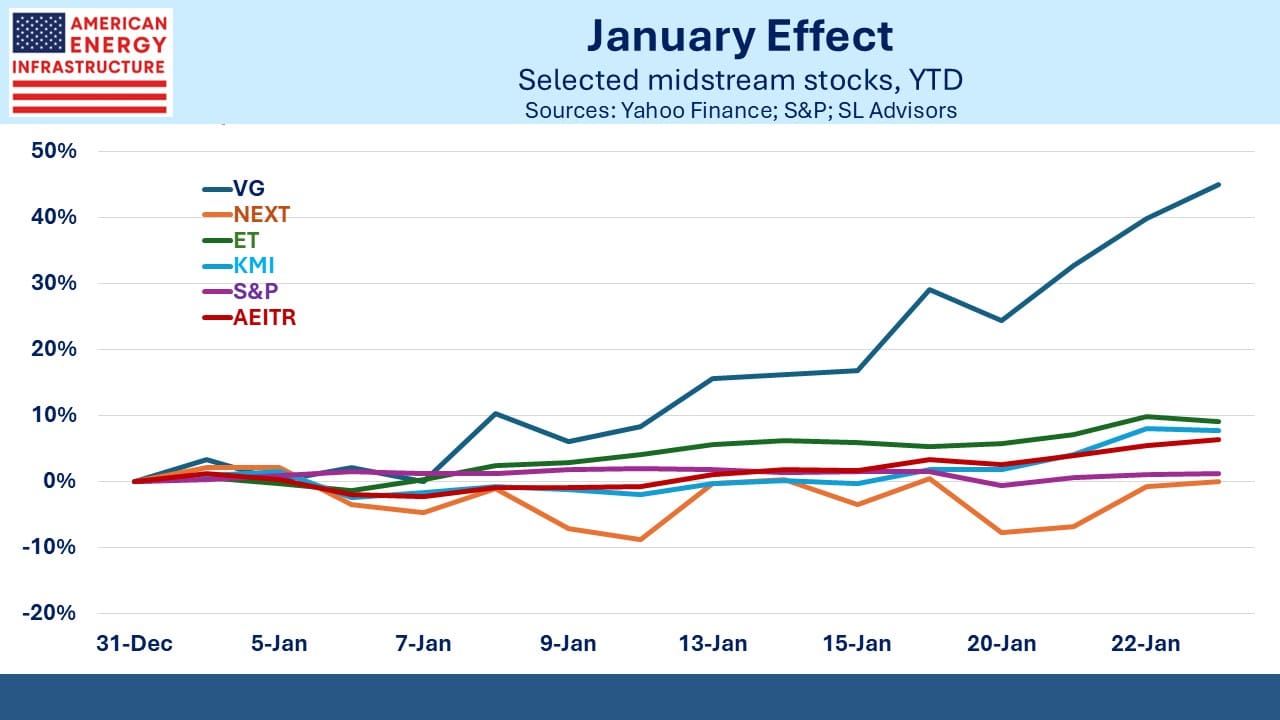

There were several positive news stories last week that helped propel the American Energy Infrastructure Index (AEITR) to +7% YTD, well ahead of the S&P500 which is +1%. Kinder Morgan’s (KMI) earnings unusually beat expectations. Moreover, their increased backlog of projects didn’t scare investors as much as it should given their perennially low Return On Invested Capital (ROIC, see Not All Growth Projects Are Good ). Most of their capex is in natural gas infrastructure. Investors concluded that even KMI must be able to generate an attractive ROIC providing gas to power data centers.

Venture Global (VG) prevailed in an arbitration dispute with Spain’s Repsol. They’ve won two (the first was Shell), lost one (BP) and settled one (Sinopec). Four remain outstanding. The worst fears following September’s loss to BP are not being realized. Consequently, the stock has rebounded 45% YTD.

VG’s plausible worst case if all the arbitration cases went against them including successful appeals by Shell and Repsol is around $6BN. The standard for challenging arbitration rulings is higher than in US civil courts. Industry lawyers think they’re unlikely to be successful.

Even after VG’s recovery this year, its market cap is still about $7.5BN below where it was in early September, before the Shell ruling. We think it looks cheap.

European LNG prices have been strong, which has increased the differential with the US Henry Hub benchmark. This increases the profit opportunity for LNG export terminals able to use some of their uncontracted liquefaction capacity to sell on the spot market (see Quantifying The Gas Arb). NextDecade (NEXT) seems to respond to this even though their Rio Grande facility won’t begin operations until late this year at the earliest. NEXT dipped early in the month but is now flat YTD.

Energy Transfer (ET) has responded to the January effect that tends to boost MLPs (see What A Difference A Year Makes). Five years ago ET enjoyed a $2.4BN windfall gain from the disruption to the Texas gas market caused by Winter Storm Uri. As you read this on a Sunday morning, ET holders are wondering whether there will be a repeat. The Texas legislature responded to Uri with new laws on improved weather resilience and reliability.

We’ll soon see how effective that was.

Mitsubishi purchased the pipeline assets of Aethon in the Haynesville shale in Texas last week for $7.5BN, showing that foreign investors continue to find attractive valuations in this sector. They expect to profit from the world’s growing need for power.

US pipeline construction is set to reach an 18 year high this year, led by gas projects in Texas, Louisiana and Oklahoma. These will add around 18 Billion Cubic Feet per Day (BCF/D) of capacity and are intended to meet the twin demand drivers of data centers and LNG exports.

Capital is flowing into the sector, thanks to attractive valuations and unremarkable retail flows. Energy is the 2nd best performing S&P sector this year, just behind Materials.

In November, the Energy Information Administration (EIA) boosted their forecast of US oil production to 13.6 Million Barrels per Day (MMB/D). US drillers continue to find efficiencies, allowing output to remain firmer than last year’s declining crude price would otherwise dictate. The EIA reaffirmed their 13.6MMB/D forecast in a recent Short Term Energy Outlook, roughly flat with last year.

Presidential ruminations and dropped threats related to Greenland showed that midstream energy is less exposed than the broader market.

New Jersey’s recently elected Democrat governor Mikie Sherrill showed that the progressive drift in the Garden State continues. Voters evidently don’t mind reduced quality of life and affordability caused by high taxes and widespread construction of apartment buildings that are turning suburban towns into urban areas.

Sherrill wasted no time in signing an executive order promoting solar power and storage, instead of tapping into the vast supplies of gas in neighboring Pennsylvania. Over time, electricity will become more expensive and less reliable for NJ.

Elon Musk was interviewed in Davos last week by Blackrock’s Larry Fink. Musk thinks the production of AI chips will far outpace our ability to generate enough power to use them. He thinks space-based data centers, positioned to receive solar power 24×7, are “a no-brainer.”

Musk also offered some advice for living life, which might also be applied to golf: it’s better to be optimistic and wrong than pessimistic and right.

Finally, I am generally not an early adopter of new technology, so my latest ChatGPT discovery may strike savvier readers as ho-hum. Thanks to John O’Sullivan, friend and regular blog reader, I recently learned that the subscription version will create a daily email with news updates on the stocks we care about. It’s infinitely customizable, so through iterative feedback can be refined as needed. It helps research the blog, but the human touch will remain ascendant.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!