Not All Growth Projects Are Good

/

Kinder Morgan (KMI) kicked off pipeline earnings season last week, as they do every quarter. Their adjusted EBITDA came in a little ahead of expectations at $1.97BN vs $1.95BN. Management guidance was positive.

LNG exports and data center power needs are the two growth drivers for natural gas pipelines. KMI’s Trident Intrastate Pipeline secured another customer for 0.5BN Cubic Feet per Day (BCF/D). Trident serves the Golden Pass LNG terminal on the Texas side of Sabine Pass, opposite Cheniere’s Louisiana-based terminal.

KMI also registered some growth from data centers.

The company’s backlog of projects grew by $0.5BN to $9.3BN.

Growth projects are intended to excite investors, because they’re supposed to boost earnings. Reinvesting retained earnings into the business to earn a Return On Invested Capital (ROIC) above their Weighted Average Cost of Capital (WACC) is how companies grow their profits.

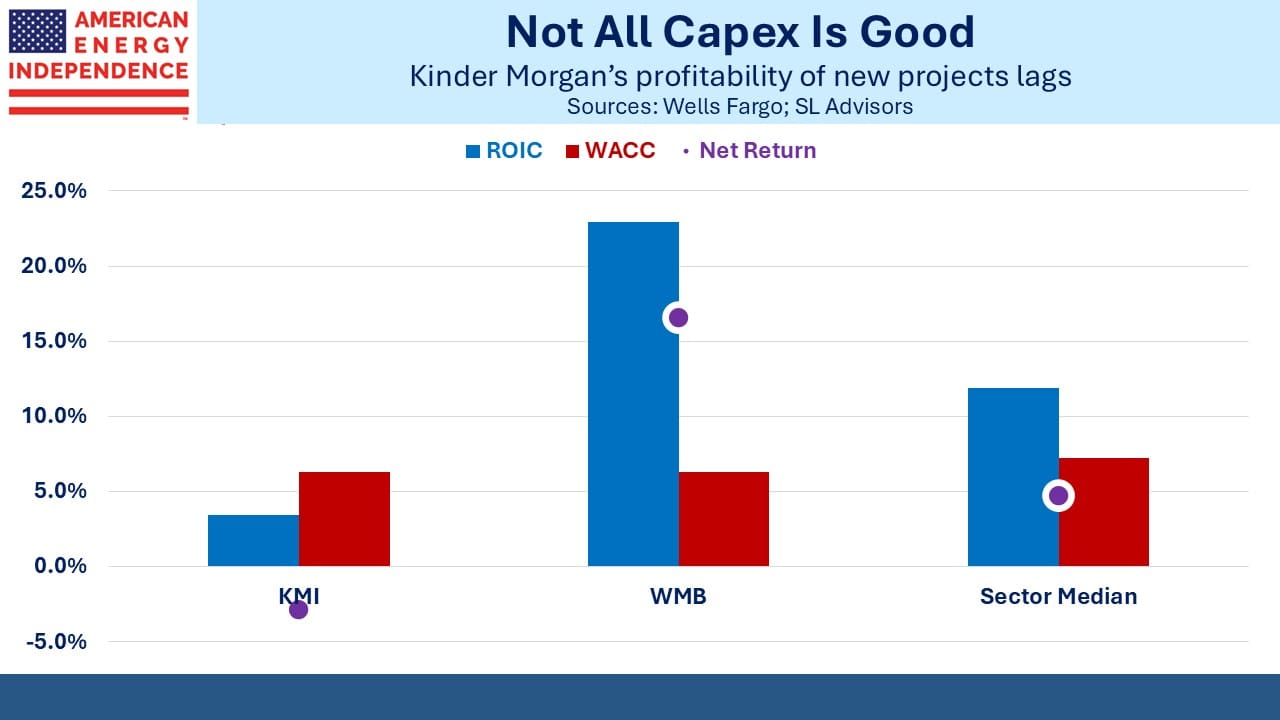

Every year or so Wells Fargo publishes Show Me The Money in which they compare ROICs for midstream companies. Its release is probably not greeted with boundless enthusiasm by senior executives at KMI, because they have ranked poorly for years. In the most recent edition (October 2024), they were dead last, with a 25-year average ROIC of just 5.4%.

For the 2018-23 period Wells Fargo calculates KMI’s ROIC at 3.4%, worse than all their peers except Plains All American. With a 6.3% WACC, they’re earning a –2.9% spread. This suggests that on average, KMI investors would be better served if the company hadn’t made those investments.

It’s not a perfect scorecard. Wells Fargo notes that KMI had some natural gas pipeline contracts that matured and were renegotiated at lower rates. Maybe those projects were done twenty years ago and so shouldn’t reflect on more recent capex. Nonetheless, KMI’s returns have been consistently poor. It means that the enthusiasm with which management describes their $9.3BN backlog should not be shared by KMI investors.

By contrast Williams Companies (WMB) has done a much better job at reinvesting earnings. Their 25-year ROIC is 12%, and 2018-23 is 22.9%. With an assumed WACC identical to KMI, that’s a 16.7% net return. The median company in the sector has an ROIC of 11.9% and a WACC of 7.2% for a net return of 4.7%.

We’ve thought for years that KMI doesn’t earn enough on its capex. We engaged with the company in early 2020 (see Kinder Morgan Responds to our Recent Criticism). When Kim Dang became CEO in 2023 she said, “A large part of my job is going to be about continuity.” As she was previously president and CFO, Dang can’t escape responsibility for the capex decisions that led to those poor returns, and continuity might not be what’s needed to improve results.

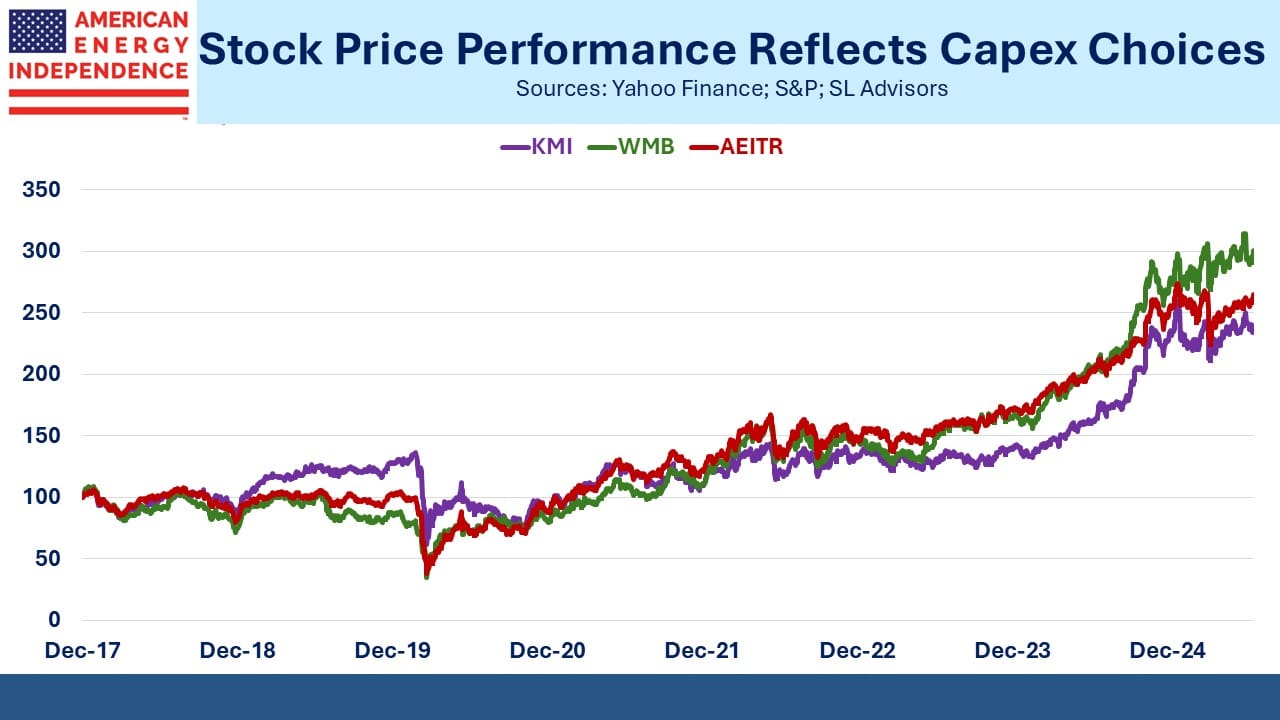

Since 2018, the most recent five-year period covered in Show Me The Money KMI’s stock price return of 11.9% pa has lagged both the sector’s 13.4% pa as defined by the American Energy Independence Index (AEITR) and peer WMB’s 15.2% pa.

Over the past decade, KMI stock has returned 2.2% vs 9.4% for the sector.

Consequently, KMI is cheaper than WMB. On an EV/EBITDA basis KMI is 11.5X and WMB 13.0X. KMI’s Distributable Cash Flow (DCF) yield is 8.7% and WMB’s is 7.1%. The market has long imposed a valuation discount on KMI because of its poor ROIC. The question investors must ponder is whether the discount is sufficient. A company that consistently earns less than its cost of capital is destroying value on new money invested.

Investment decisions don’t have to be binary. There’s a range of possible outcomes and overconfidence is a common error. You don’t have to love a stock or not own it. Positions can be sized with precision based on your confidence and the risk/reward. We’re invested in both names but have more exposure to WMB. KMI may improve its capital allocation and it is cheaper. But WMB has a better track record. KMI is likely to trade at a valuation discount until they can improve their performance.

In other news, Italy’s Eni signed a 20 year Sale and Purchase Agreement (SPA) with Venture Global, demonstrating continued strong demand for US LNG. It was ENI’s first long term agreement with a US LNG exporter.

Asian buyers continue to pursue increased purchases of US LNG to reduce trade tensions.

And NextDecade’s (NEXT) stock continued to appreciate as Morgan Stanley’s bullish report of July 11th has drawn more buyers. It shows the impact some analysts can have, because there haven’t been any news developments to affect NEXT recently, beyond Morgan Stanley’s upgrade. Nonetheless, the impact has been as powerful as any recent positive development.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Do KMI’s C suite have ROIC returns in their performance pay? Maybe they need a new incentive?

Sell KMI and use the proceeds to buy MPLX, WES or EPD.