What A Difference A Year Makes

/

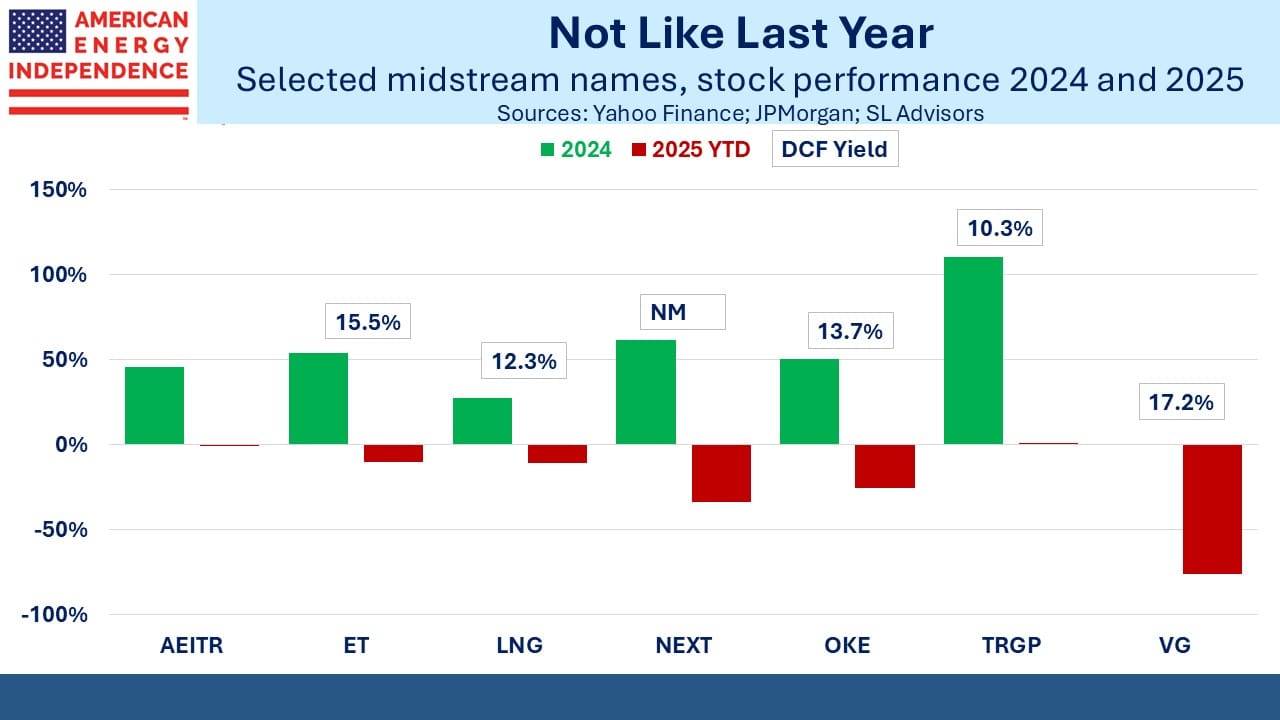

2025 has been frustrating for those who must explain short term performance in midstream energy stocks – which is to say your blogger, along with many financial advisors whose clients are invested in the sector.

It hasn’t been an especially newsworthy year. In 2024, the realization that natural gas would benefit from the growth of data centers was an important driver of stock performance. The other source of demand, LNG exports, continued to benefit from growing liquefaction capacity.

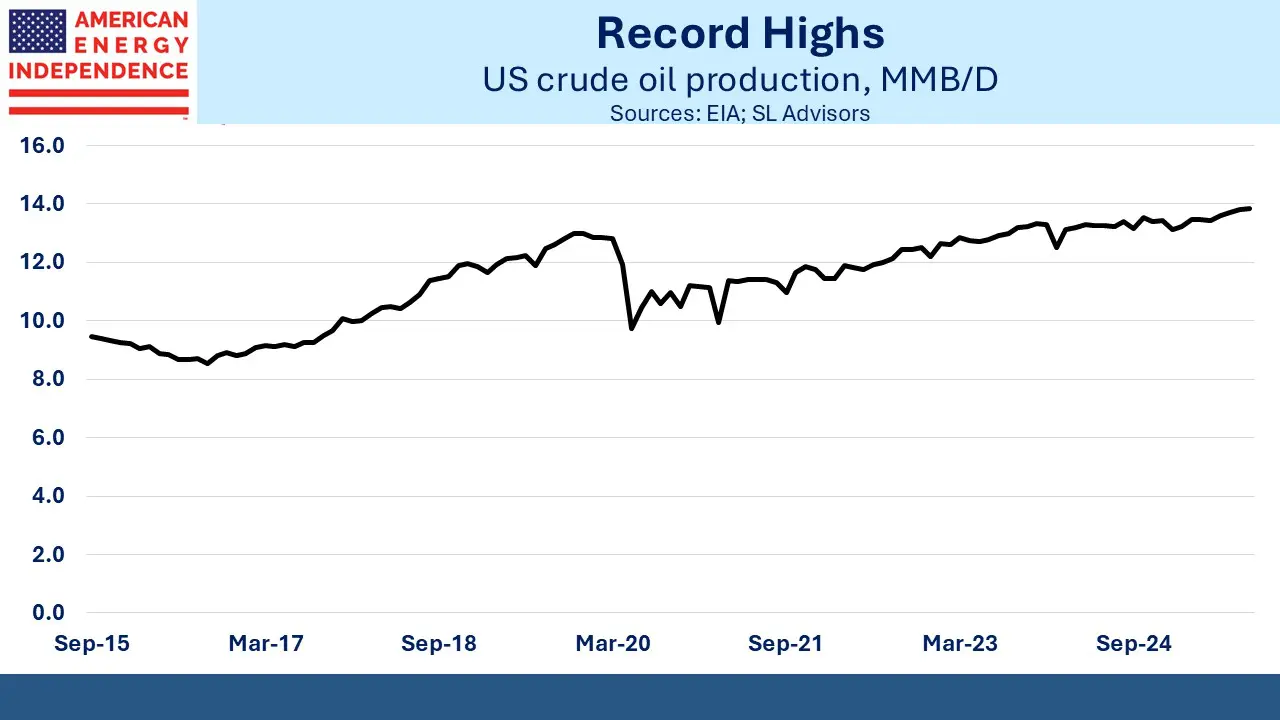

2025 hasn’t offered much in the way of dramatic new developments, simply a steady stream of confirmations that the bullish thesis from 2024 remains intact. US oil production reached a record 13.8 Million Barrels per Day (MMB/D) in September, up 5% year-on-year.

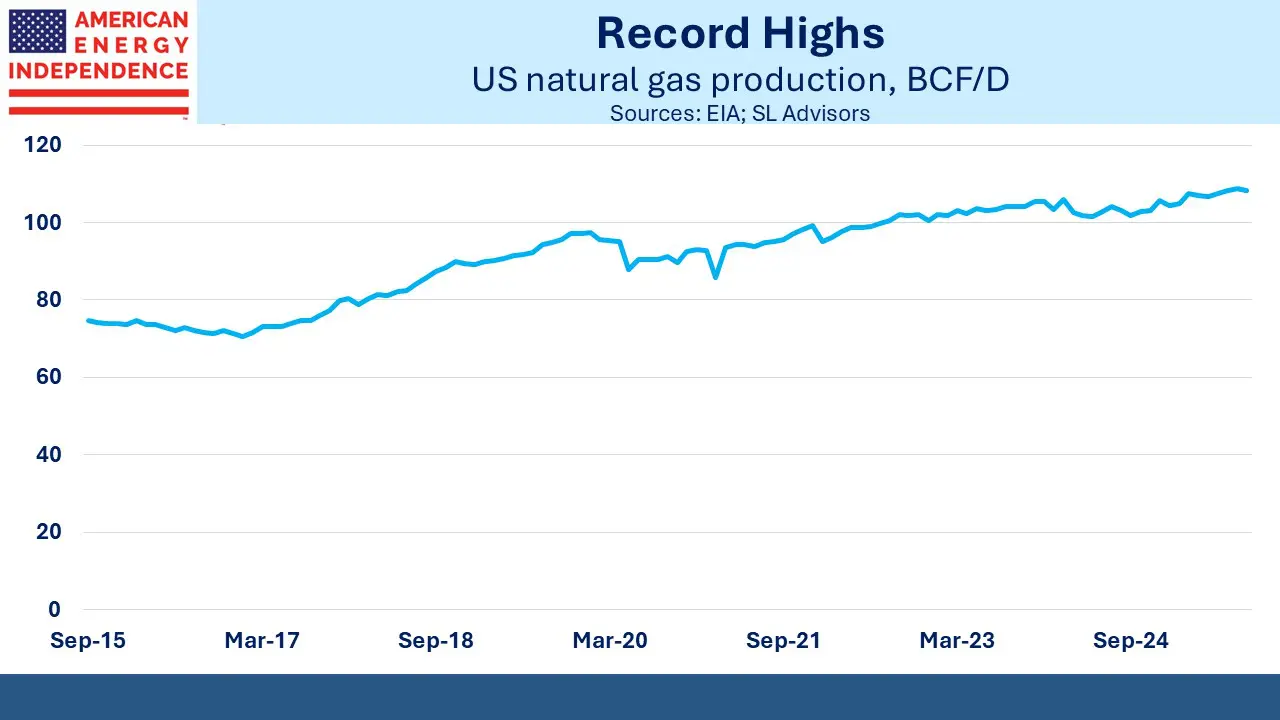

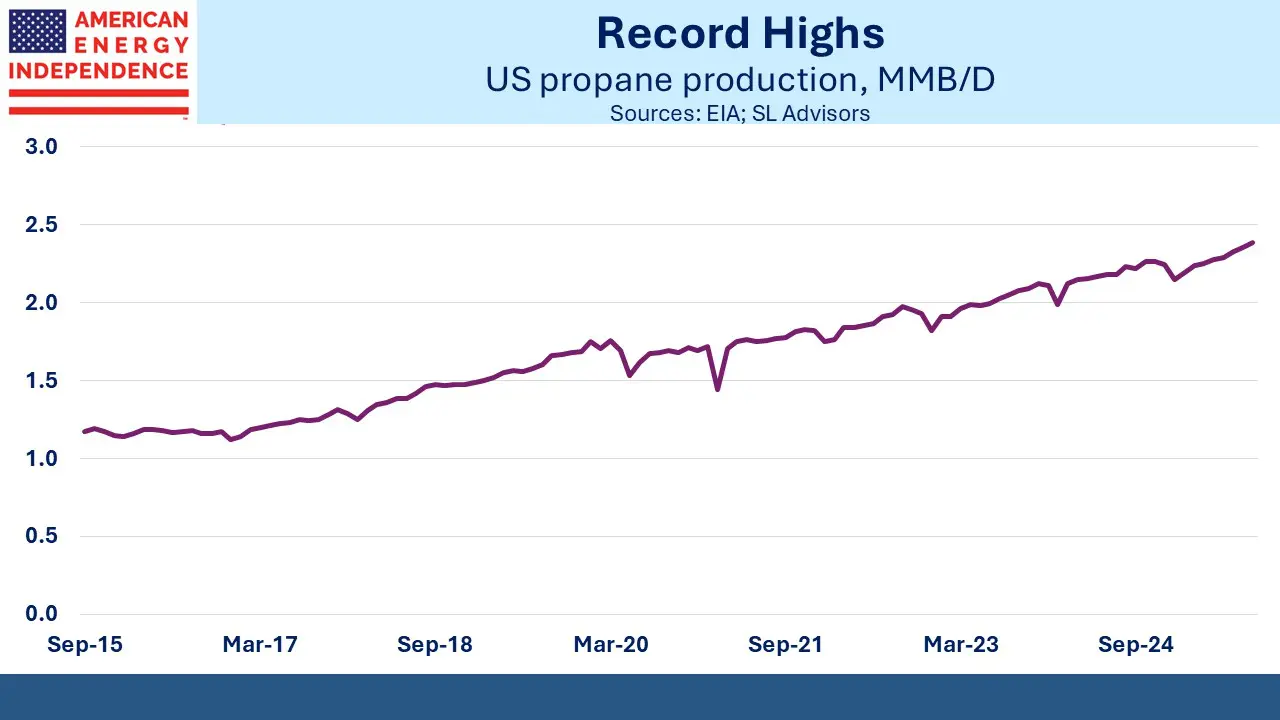

Dry gas production (natural gas) exceeded 108 Billion Cubic Feet per Day (BCF/D) in September, up 6% yoy. LNG exports were over 15 BCF/D in September, +24%. Propane production, used in backyard barbecues, by farmers for drying crops and for exports, reached 2.4 MMB/D in September, +7%.

US power generation reached 368 Terrawatt hours in September, +2.4%. Natural gas remains by far the dominant source of electricity generation. Grid operator, PJM Interconnection held a capacity auction last week that set a new record high.

In other words, natural gas and natural gas liquids such as propane are a growth story.

A year ago, many analysts expected continued growth in hydrocarbon production, although there were concerns that soft oil prices might depress output of crude. Electricity consumption has probably run modestly ahead of expectations. The big grid operators have been warning of a jump from the 0.2% pa annual growth that prevailed for the past decade. Data center demand is starting to impact, which is partly why electricity prices are up around 7%.

This has been a good year for businesses that handle natural gas and related hydrocarbons. Cash flows are growing. Dividend hikes are the norm. Leverage has been falling. And co-location of data centers with the power plants that support them (also known as Behind The Meter or BTM) is creating growth opportunities for the biggest natural gas pipeline companies.

What midstream doesn’t have is an exciting AI story. It’s true that sending natural gas to data centers is a modern-day equivalent of selling pickaxes to gold miners. But it’s not a new story.

A looming oil glut has added to the negative sentiment towards energy, with forecasts that crude may drop below $50 per barrel next year. US E&P companies continue to defy expectations by continuing to innovate and lower their production costs. The $7 drop in prices over the past year hasn’t curbed output.

Nonetheless, for many investors the oil price is probably their first thought when they consider the outlook for the energy sector. It continues to persuade many generalists to look elsewhere for opportunities.

The absence of an exciting new story has weighed on midstream stocks this year, even though operating performance has been generally good.

Investors are afraid of still-weaker oil prices with 2026 supply forecast to be 2-3 MMB/D in excess of demand. They’re afraid of a surplus of LNG exports as more liquefaction capacity comes online. They’re afraid that tariffs will be imposed on US exports of propane and other Natural Gas Liquids (NGLs).

These are all manageable and probably inconsequential risks for the midstream companies that handle, move and store hydrocarbons.

Cheniere (LNG) continues to add liquefaction capacity. Fears of an LNG glut are unlikely to be realized in our view. Regassification capacity is growing to keep up with the increased availability of LNG shipments.

Similarly, over the past year NextDecade has begun construction of their Rio Grande facility, has signed numerous long term shipping agreements and is on track to expand at its existing site.

Venture Global has fallen far below its IPO price because of an adverse arbitration ruling (see Gassy Isn’t Happy). We think the current valuation more than discounts the worst plausible outcome on the remaining cases.

Foreign buyers of US propane or ethane have generally not imposed tariffs, in part because they have few other sources. This concern has hurt Energy Transfer (ET), Oneok (OKE) and Targa Resources (TRGP). Propane trade with China has been disrupted but flows have been redirected elsewhere in Asia and to Europe. China quickly dropped tariffs on ethane because their petrochemical industry relies heavily on it.

ET is also among those well positioned to benefit from data center gas demand and has paused their LNG export terminal in Lake Charles, LA. Its 15.5% Distributable Cash Flow (DCF) yield almost defies belief.

Even allowing for the discounted valuation common for MLPs, ET looks like a cheap stock. It could also benefit from the January seasonal effect that typically impacts partnerships more than c–corps, reflecting their bigger retail ownership.

Several big midstream companies have seen poor stock performance while the fundamentals of their business have remained strong, and their valuations have improved. Some investors are already starting to take advantage of that.

Recently we had the good fortune to enjoy lunch with long-time investor Eric Schulze and his delightful wife Jessica, who were visiting Naples from Colorado. Whatever the weather in America, it’s usually sunny and warm in south Florida, as was the company that day.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

ET continues to be a “cheap stock” because of Kelcy Warren’s control, which does inhibit enhancement of the unit price.