Ten Reasons To Consider Buying Midstream Now

/

Last week an investor asked us for ten reasons why they should commit funds to midstream energy infrastructure now. Typically, three or four bullet points will suffice to make the case, but in this case the request was for ten. Believe it or not, we were up to the challenge!

Here they are:

- Valuations are attractive. Enterprise Value/EBITDA is 10X, below the ten year average of 11X. Wells Fargo regularly produces the corresponding chart. This year, EBITDA has grown while stock prices have languished or dipped. Price performance bears little relationship to operating results, but the explanation lies mostly in the current fixation on growth stocks although that is starting to wobble. In our opinion, given the list of positives below, the sector should trade at a premium to long term valuations, not a discount (see Getting Cheaper By Moving Sideways).

- Dividend yields of 5% are attractive and will become more so as the Fed continues to cut rates. Not that many years ago, investors were drawn to midstream for the income. Easier monetary policy will help (see MLP Yields Look Better Than Cash).

- Dividends are well covered by Distributable Cash Flow (DCF) and are generally growing. Gone are the days when the MLP structure dominated and 90% or more of DCF was paid out in distributions. Midstream companies today are mostly structured as c-corps, with lower payout ratios that make dividends more secure (see Pipeline Earnings Or Cashflow?).

- Balance sheet leverage has been declining for years and is now generally 3-3.5X Debt/EBITDA compared with the 4-5X that prevailed 5-10 years ago. Kinder Morgan even argued to rating agencies that their diverse businesses deserved a multiple of 5-6X, although few were convinced. The widespread adoption of lower leverage targets has lowered the sector’s correlation with energy prices. It’s no longer the case that oil drags pipelines lower. Last year was a perfect example, with strong midstream performance coinciding with a bear market in crude (see Picking The Top Pipeline).

- Companies such as Cheniere are buying back stock — $1BN in 3Q25 and an additional $300MM in October. Buybacks have become increasingly common as a way to return cash to shareholders – very different from the old MLP model that routinely did secondary offerings to finance growth projects. Targa Resources, Enterprise Products Partners, MPLX and Oneok are among those that have repurchased shares this year (see Notes From The Midstream Industry Conference).

- Exports of Liquefied Natural Gas (LNG) continue to grow, currently around 15 Billion Cubic feet per day (BCF/D) and likely to reach 30 BCF/D by 2030. Because LNG export terminals take years to build, it’s possible to project out the annual increases in capacity. LNG trade is growing much faster than inter-regional pipeline connections because of the flexibility it allows both consumer and supplier. The US is the world’s biggest exporter of LNG (see LNG Keeps Growing).

- Power demand from data centers is driving domestic natural gas demand higher, since gas provides quick, reliable electricity. Behind the meter solutions which rely on a dedicated power plant and avoid the grid are increasingly popular. Nuclear remains a long term solution but is more costly and still many years away (see Bullish News On Gas).

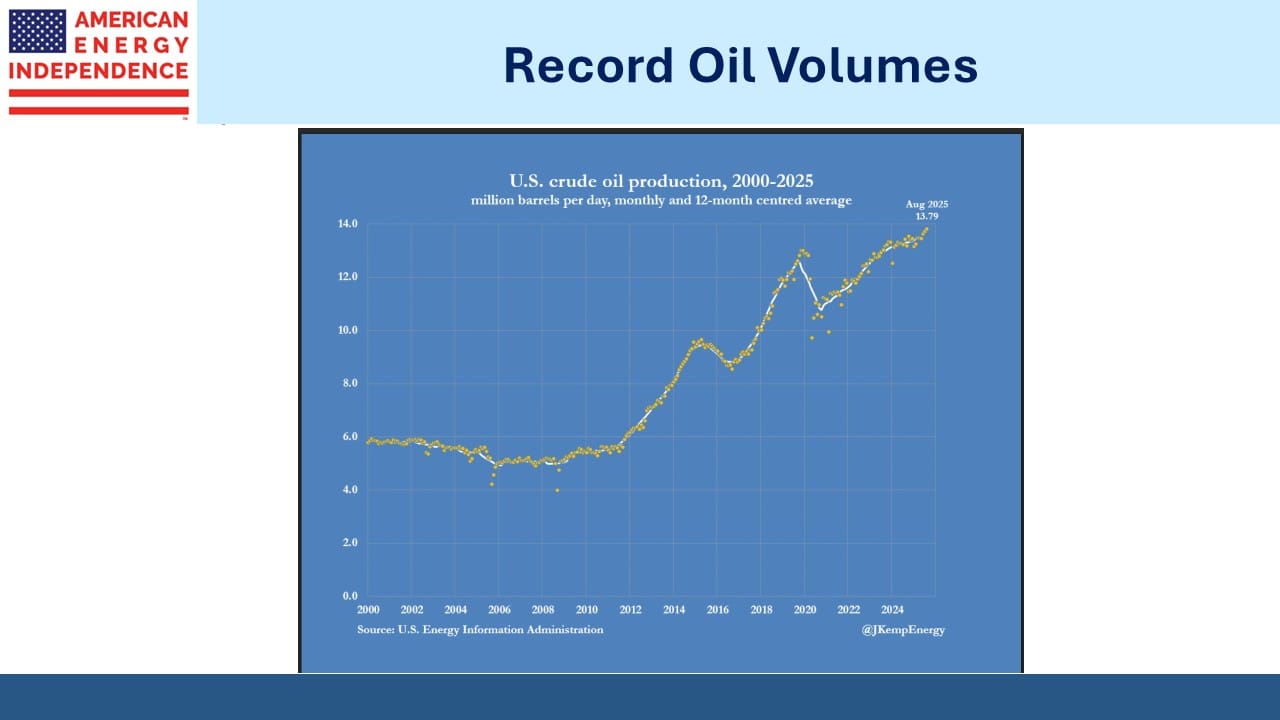

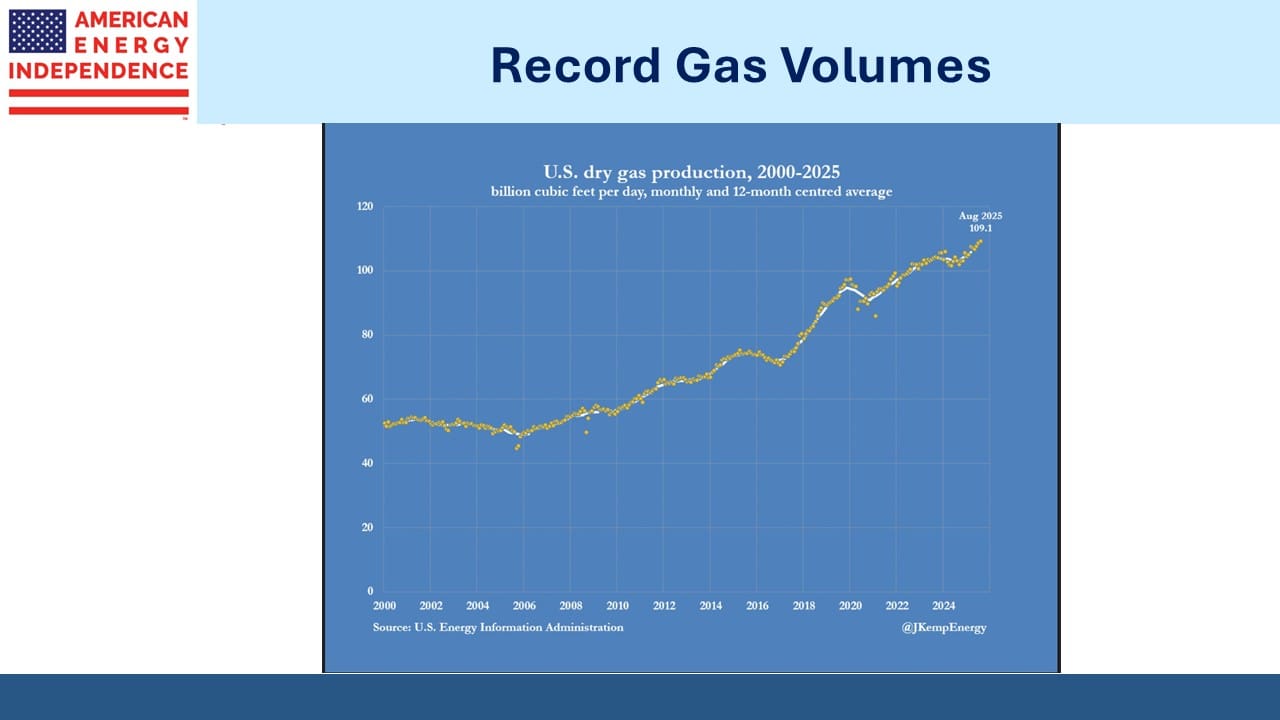

- Oil and gas production reached new records in August, the most recent data available due to the government shutdown. It’s especially hard to reconcile this year’s weakness in pipelines with the volume growth in hydrocarbon output. AI stocks have been exciting, but we find steadily growing cashflows preferable (see Why Lower Oil Prices Will Boost Natural Gas).

- The International Energy Agency (IEA) recently forecast growing global oil and gas consumption for 25 years, more realistic and positive than prior forecasts. In recent years the IEA became a left-wing cheerleader for renewables. They moved away from objective forecasts, and as a result their work became less useful. Although Executive Director Fatih Biroh claims that their recent more positive outlook doesn’t reflect a change in philosophy, I just don’t believe him. The US quite rightly threatened to pull its funding which is 14% of the IEA’s budget. It helped. (see Drama-Free Energy Stocks).

- It is the White House’s favorite sector — Trump routinely seeks increased US energy exports as a solution to bilateral trade deficits. Energy Secretary Chris Wright was a great choice. Industry satisfaction with the improved regulatory environment is only tempered by the softer oil prices that have followed. Trump’s policies are designed to produce lower gasoline prices. Energy executives are unlikely to vote Democrat, and the higher volumes are clearly good for midstream if less so for E&P companies. (see Midstream Is Better Under Trump 2.0).

We could have added seasonals – for years MLPs have followed a pattern of strong performance early in the year (see The MLP Yuletide Spirit). Pipeline c-corps are less responsive to the calendar, but it remains the case that purchases made late in the year are generally done at better prices than those done in the new year. There are eleven reasons to invest in pipelines today, and probably more.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

And, for balance, how about some reasons to be cautious? I’m actually a believer and an investor (via a European listed ETF), but it’d be wise to have some triggers in mind (valuation, regulation, competition, protectionism?) to ensure it’s not a closed-minded always-on position

My reason number 1 is the very nice life style provided to me by my MLP investments (and one C corporation). High yields and tax deferral make me happy.

In case you missed it, an excellent posting this Tuesday on X re: Energy Transfer and the southwest US gas market.

https://x.com/rleewilson21/status/1990798881081475188?s=20