The Big Rotation Begins

Monday’s dramatic news on Pfizer’s vaccine triggered a sector rotation which could be enduring. A vaccine that’s 90% effective is a far better outcome than most had expected, bringing the prospect of an early end to lockdowns, self-quarantines and the rest of the Victorian-era public health measures we’ve come to accept.

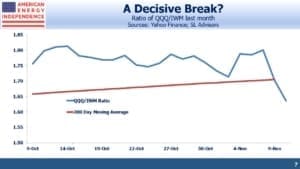

The ratio of the Nasdaq QQQ with the Russell 2000 is followed by many as a reflection of technology versus small cap value. Covid gave a boost to a long-established trend favoring tech stocks in March. The reversal of the past couple of days has caused this ratio to decisively cross its 200 day moving average to the downside. Given the vaccine news, it wouldn’t be surprising for this new trend to continue.

Having lagged value stocks most of the year, energy is leading the way higher. The S&P Energy ETF (XLE) has jumped 16% since Monday morning, helped by a 10% rally in crude oil. The broad-based American Energy Independence Index (AEITR) is up almost 12% since Monday. Pipeline stocks are so undervalued that it doesn’t take much to move them higher.

The recently announced buybacks buoyed sentiment, as well as helping neutralize the relentless selling by MLP fund investors (see Pipeline Buybacks Are Coming). Fund outflows have been persistent for most of the year, but the buybacks are big enough to absorb the typical outflows. Western Gas (WES) added to the growing list with a $250MM program yesterday.

Long-suffering energy investors are wondering if the recent move up is the real deal or another head fake. The election is likely to produce the best of both worlds – divided government with an instinctively moderate president (listen to Energy Executives and the Election).

Georgia’s run-off for two senate seats will be heavily financed by both parties – without winning both races, the Democrats will be unable to push the more radically liberal elements of their platform (Green New Deal, fracking ban).

In this political environment, long term capital commitments to new hydrocarbon production or related infrastructure are unappealing (see Why Exxon Mobil Investors Might Like Biden).

The world relies on fossil fuels, and there is little chance of that changing any time soon. Curtailed investment in new supply should lead to higher prices for oil & gas. Fewer new infrastructure projects will lead to less competition, as well as reduced capital needs.

This will boost the pipeline sector’s free cash flow, which is already set to double this year (see Pipeline Cash Flows Will Still Double This Year).

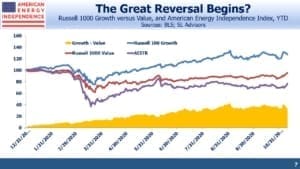

The style rotation has shown up in other areas too. Tech stocks have seemed a one-way bet, so it was no surprise that on Monday, Bloomberg’s US Pure Momentum Portfolio suffered its biggest ever one day drop. It lost over 3.5%, on a day the S&P500 rose 1.2%. MTUM fell another 1% yesterday.

Over two days, Russell Growth has lagged Value by over 8%. As recently as Friday, Growth was 40% ahead of Value for the year.

Pipelines may be the quintessential value play. The components of the AEITR still yield 8.9% on a market cap-weighted basis. 3Q earnings saw dividends paid once again. Energy Transfer (ET) was the only meaningful exception (see Why Energy Transfer Cut Their Distribution).

A recovery in the pipeline sector is long overdue, and given valuations has enormous upside from current levels.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

The break has been a long time coming. Hope it wasn’t a false break. Did it hold today with qqq bounce?