Pipeline Buybacks Are Coming

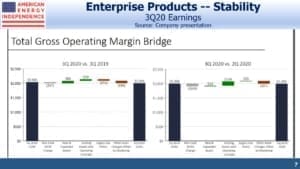

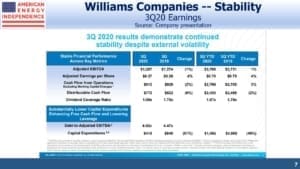

Pipeline companies have been reporting earnings. As has been the case recently, they’ve been generally coming in as expected, reflecting the stability in their underlying businesses. In many cases it’s hard to see much Covid impact at all. Williams Companies (WMB) reported 3Q adjusted EBITDA down 1% year-on-year. Enterprise Products Partners (EPD) was similar.

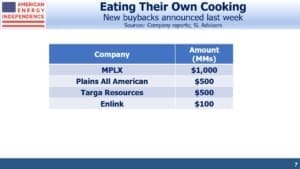

A bigger story has been the growing trend towards announcing buybacks. This is a visible confirmation of growing free cash flow (see Pipeline Cash Flows Will Still Double This Year, posted in May and remaining accurate ever since).

EPD has had a buyback program in place for the past year. Kinder Morgan (KMI) and Energy Transfer (ET) have both said that buybacks are a possible way to return cash to shareholders in the future. More tangibly, MPLX announced a $1BN buyback last week. Targa Resources (TRGP) and Plains all American (PAGP) followed up with $500MM each. Enlink announced $100MM.

It’s beginning to look like a trend.

Midstream energy infrastructure has been weighed down by a steady stream of outflows from MLP-dedicated mutual funds and ETFs — around $6.5BN over the past year. With over $2BN in new buyback announcements just last week, this source of additional demand could well absorb future sales by funds. This would allow the increasingly positive cash flow story to unfold, lifting prices.

An interesting perspective on the value of dividends was provided by Altus Midstream (ALTM). Operating with 5X Debt:EBITDA and questionable prospects in its natural gas gathering and processing business, it has been a target of short sellers for some time. Covid has reduced crude oil output in the Perman basin, thereby reducing the volume of associated natural gas which has allowed prices to rise.

Higher prices are supporting volumes through ALTM’s gathering network, and next year Kinder Morgan’s new Permian Highway pipeline will improve producer economics by offering a new transportation option from the Waha hub to the Texas gulf coast.

ALTM surprised the market by instituting a quarterly dividend of $1.50, starting next March. Forget the financial theory that dividends don’t matter – ALTM tripled in price on the announcement. Even after adjusting to the news, at $30 the stock will yield 20% when dividends start next year.

With Republicans looking likely to retain control of the senate, pipeline investors can contemplate little prospect of any sweeping legislation that might harm the energy sector. But a President Biden is likely to use regulation and executive actions to further impede new construction. On Energy Transfer’s earnings call on Wednesday, executives commented that an extensive network already installed must have even more value when little new can be built. We discussed this and included clips from the earnings call on Friday’s podcast (listen to Energy Executives and the Election). We’ve dubbed it “Goldilocks Gridlock” from the perspective of the energy sector.

We also provided a brief update of the post-election outlook in the SL Advisors Post-Election Energy Outlook webinar.

Earnings, buybacks and divided government provided plenty of positive fundamental news for midstream energy infrastructure.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

This comment on the Pembina call “The problem with just buying back your shares is it doesn’t increase your company’s capability. So let’s just say, to answer your question, there was a tie. We would always expand our business in a tie because we increase our capability, we increase our customer service and we increase the leverage and the platform for when things return. And so in a tie, we would choose to deploy capital to projects because it will create additional leverage, whereas redeeming your shares won’t.”

In that comment “tie” refers to the project returns vs the share yield. A further comment was that with the shares yielding 9%, there was not much point paying a larger dividend. Interesting times for sure.