Terrorists Create Geopolitical Risk

/

Only last week a new investor asked how the pipeline sector might respond to geopolitical risk. Conflict in any of the world’s trouble spots is bad for most sectors and the market overall. But energy is different, because the specter of supply disruption draws in buyers.

Saturday’s massive terrorist attack on Israel by Hamas is an example. Developments will render this post outdated almost as soon as it’s written, but the surprise and initial casualties suffered by the Israelis rank this up with the 1973 Yom Kippur War or even the war that immediately followed the creation of Israel in 1948.

Less than two weeks ago National Security Adviser Jake Sullivan said, “The Middle East region is quieter today than it has been in two decades.” He did add that this could easily change.

Israel hardly produces any oil, but Iran’s backing of Hamas risks broadening the conflict. Near term fluctuations in crude will be driven by events on the ground, but an enduring risk premium is likely to remain for some time. A return to the status quo ante seems unlikely, so energy exposure offers optionality to protect the rest of your portfolio against further developments.

Fertilizer stocks have risen. Israel exports 3% of the world’s fertilizer potash. Iran is a key regional producer of nitrogen derived from its supplies of natural gas.

Looking out over the next few months, the rapprochement between the US and Iran that was potentially leading to increased Iranian exports looks less certain now. Saudi Arabian supply may not change as a result of this latest war, but it’s hard to see why they’d be more likely than before to pump more to help western economies.

Energy security is once more a winner. The US is energy-independent and a stable supplier of oil and gas. For natural gas, which is expensive to transport, trade via Liquefied Natural Gas (LNG) provides greater flexibility than a pipeline. Germany’s Nordstream link to Russia will remain a lesson for many LNG buyers around the world. Pipelines represent a permanent link between buyer and seller, creating a mutual dependence that survives as long as neither sees a benefit in breaking it. Finland and Estonia are investigating a gas leak in a pipeline connecting their two countries, and sabotage is suspected.

Four years ago we considered the tinder box that is the Middle East (see Investors Look Warily at the Persian Gulf). Last year Russia pivoted from Germany to China to export its Siberian natural gas and has been negotiating a long term agreement ever since. Current circumstances make such trade mutually beneficial, but both countries will be wary of becoming too dependent on the other. Russia has few other choices and China, already the world’s biggest LNG importer, is adding additional receiving terminals (see LNG Growth Faces Few Headwinds).

There are very few pairs of countries where stable, long term relations can be sufficiently assured to justify a pipeline connection. The US and Canada is one of the few.

This is why LNG is preferable to pipelines for trade. An era of declining globalization, onshoring and shortened supply lines makes flexibility more important to buyers. US LNG exports will probably double over the rest of the decade, providing the cleanest fossil fuel reliably to meet the world’s growing desire for natural gas while also displacing coal.

The initial market response of lower bond yields, stable equity markets and higher crude oil makes midstream energy infrastructure more attractive. The rebound in stocks during the day Monday shows the sensitivity to interest rates. The Equity Risk Premium shows the market to be historically expensive (see Why Are Real Yields Rising?).

Enbridge yields over 8% and has raised its dividend for the past 28 years, as we noted on Sunday. It is in our opinion an attractive investment, even if bond yields resume their ascent.

We’re heading into earnings season, which should provide further confirmation of the sector’s continued cash flow growth, declining leverage and focus on shareholder returns via dividend hikes and buybacks. MPLX is among the names expected to benefit from inflation-linked tariff increases, an under-appreciated feature of regulated pipelines that we’ve noted in the past.

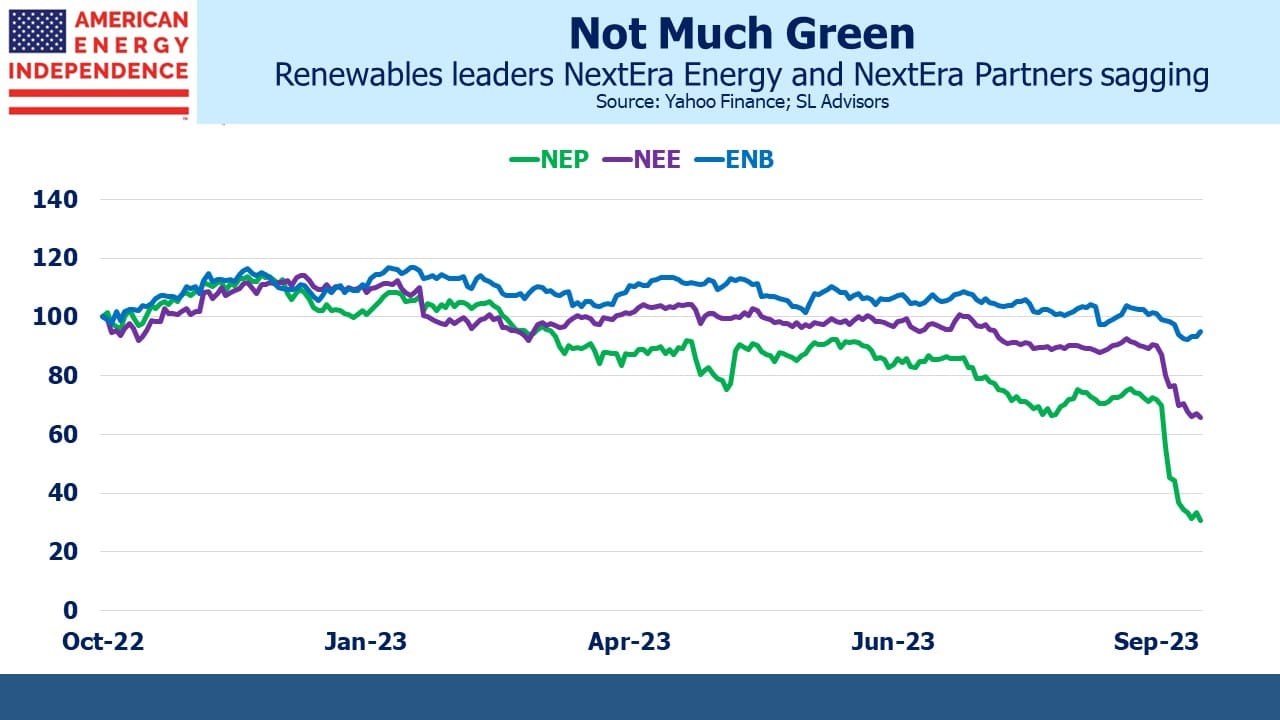

NextEra Energy (NEE) and its MLP NextEra Partners (NEP) both continue to drop, reflecting investors’ waning appetite for renewables-oriented companies. NEP has lost two thirds of its value YTD, following what should have been only mildly disappointing news that future dividend growth was being halved. With a 14.5% yield, paying dividends is a waste of NEP cash. We’ve seen this story before with other MLPs. If the stock doesn’t rebound a dividend cut will be inevitable.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!