Struggling To Justify The Pause

We’ve received a lot of questions recently about the White House pause on approving new Liquefied Natural Gas (LNG) export terminals. Several projects are already under way, and the pause does not rescind approvals that have already been issued. So for example construction of NextDecade’s Rio Grande terminal is continuing, with permits already in hand.

It immediately looked to use like a politically motivated decision (see White House Adopts An Energy Policy Where Everyone Loses). It’s easy to be dismissive of choices intended to gain votes. Democracies allow that even if the result is poor policy.

The pause is intended to allow the Department of Energy (DOE) to examine the climate impact of US LNG exports – obviously this study could be carried out without pausing new approvals. The immigration policy catastrophe is causing the White House to pivot away from progressives on that issue – hence the need to provide left wing voters an alternate reason to vote in November.

A handful of Democrat congressmen have been critical, worried that it will cost them votes of energy workers in their districts. Senator Joe Manchin (D-WVa) is holding hearings on the issue.

An official at the DOE said that they were concerned about the harm LNG exports might cause to nascent plans to develop green hydrogen among potential LNG buyers. Those countries will decide for themselves what energy mix suits them. No country, including the US, has much ability to influence the energy choices other countries make. China is the world’s biggest importer of LNG and consumes over half the world’s coal. India burns coal for three quarters of its power and plans to sharply increase its imports of LNG. Making energy prices higher for these buyers isn’t the solution.

The DOE official’s response is so implausible it shows they’re struggling to come up with coherent justifications. The pause is about November’s election not thoughtful climate policy.

Wealthy opponents of US LNG exports include members of the Rockefeller family and Michael Bloomberg. It’s always the people who fly in private jets and and have never bothered to register for TSA Pre-check that cynically push restrictive energy policies they can afford to avoid.

Taylor Swift will be jetting in from Tokyo to Las Vegas just in time to see Travis Kelce play in the Superbowl. Anticipating criticism of the CO2 emissions from her global concert tour, she bought 2X the carbon credits her private jet will generate as an offset. The effectiveness of such credits varies. She has many talents but wouldn’t make a credible proponent on climate issues.

Nonetheless the impact on stock prices has been muted. Energy Transfer (ET), whose proposed Lake Charles LNG export terminal is affected by the pause, closed up on the day of the announcement (January 26th) and on the following trading day as well.

Cheniere’s Midscale trains 8-9 aren’t yet permitted. Wells Fargo estimated that if the project is never completed that would reduce their “sum-of-the-parts” valuation of Cheniere by around 4%.

Woodside Energy, itself Australia’s leading natural gas producer, is in talks with ET about buying LNG from their Lake Charles terminal assuming it gets built.

LNG infrastructure takes years to build, and the consensus is that following the election Trump or Biden will restore the approval process. The pause has gained the attention of energy investors but hasn’t done much else.

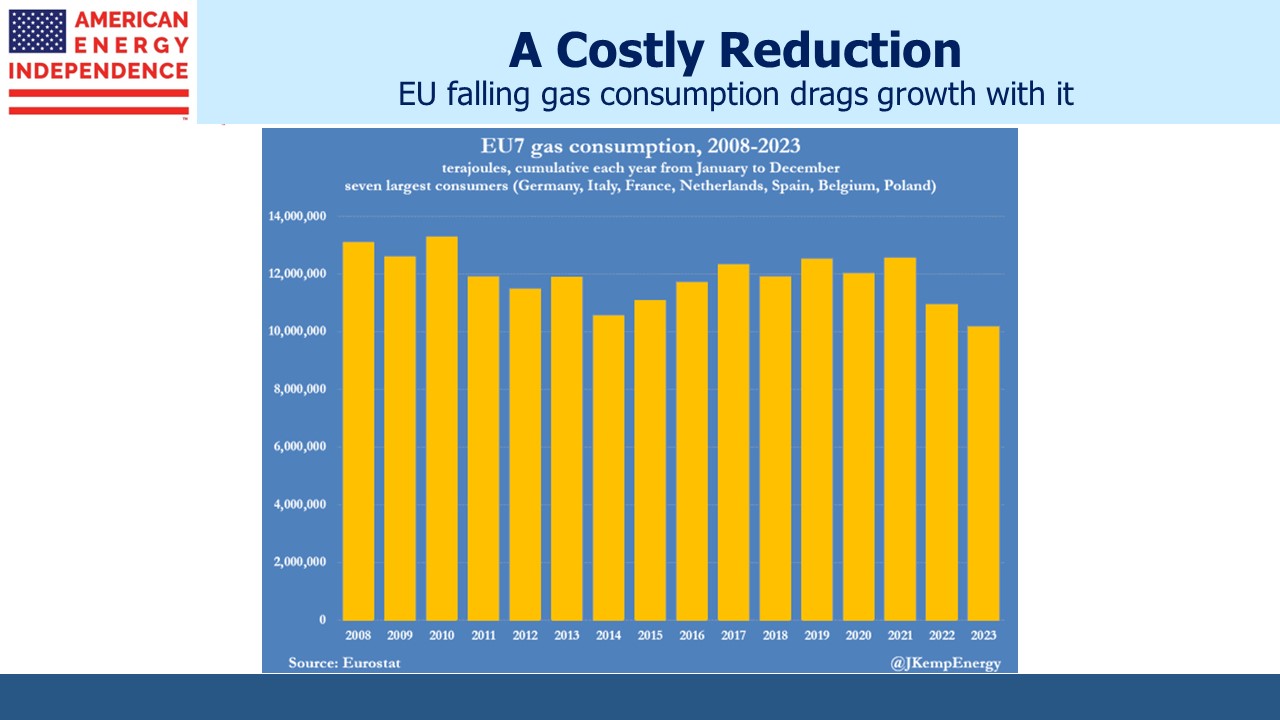

The EU’s seven biggest gas consuming countries have seen consumption drop 21% over the past two years. The loss of Russian supply has exposed them to high global LNG prices, depressing growth. Many German industrialists regard domestic energy policy with its rush towards renewables as ruinous to their manufacturing base. One business chief recently complained that it was impossible for companies to make investment decisions when they can’t be certain what their energy supply will be or what it will cost. He called current policies “toxic”.

Germany’s economy didn’t grow last year, and probably won’t this year. They could use more cheap US LNG, which Biden promised would be coming in the wake of Russia’s invasion of Ukraine in March 2022.

Alex Epstein, author of Fossil Future and The Moral Case for Fossil Fuels, calls it “a deadly fraud”. His talking points are here. Epstein argues that civilization is much safer today from extreme weather because of fossil fuels. He believes emerging economies should focus on raising living standards over the next several decades by which time new technologies and their increased wealth will make tackling the problem much easier than it is now.

Given how relentlessly coal consumption is growing among developing countries led by China, it looks as if they have embraced Epstein’s philosophy.

Smart climate policy will see the pause lifted within a year. We think that’s what will happen.

We have three have funds that seek to profit from this environment: