Is Energy Becoming Less Cyclical?

/

It’s a question posed at every mid-cycle. Observers of commodity markets will often advise that the cure for low prices is low prices. Meagre profits reduce production, eventually curbing supply and driving prices higher.

2014 was the last cycle peak for energy. The shale revolution brought new US supplies of oil and gas onto the market, which upset the prior equilibrium. The downturn that followed had run its course by 2019 when the pandemic caused another leg down. But the industry embraced financial discipline, reducing capex and improving returns.

An essay by Veriten’s Arjun Murti makes the case that the current cycle of positive returns has many years left.

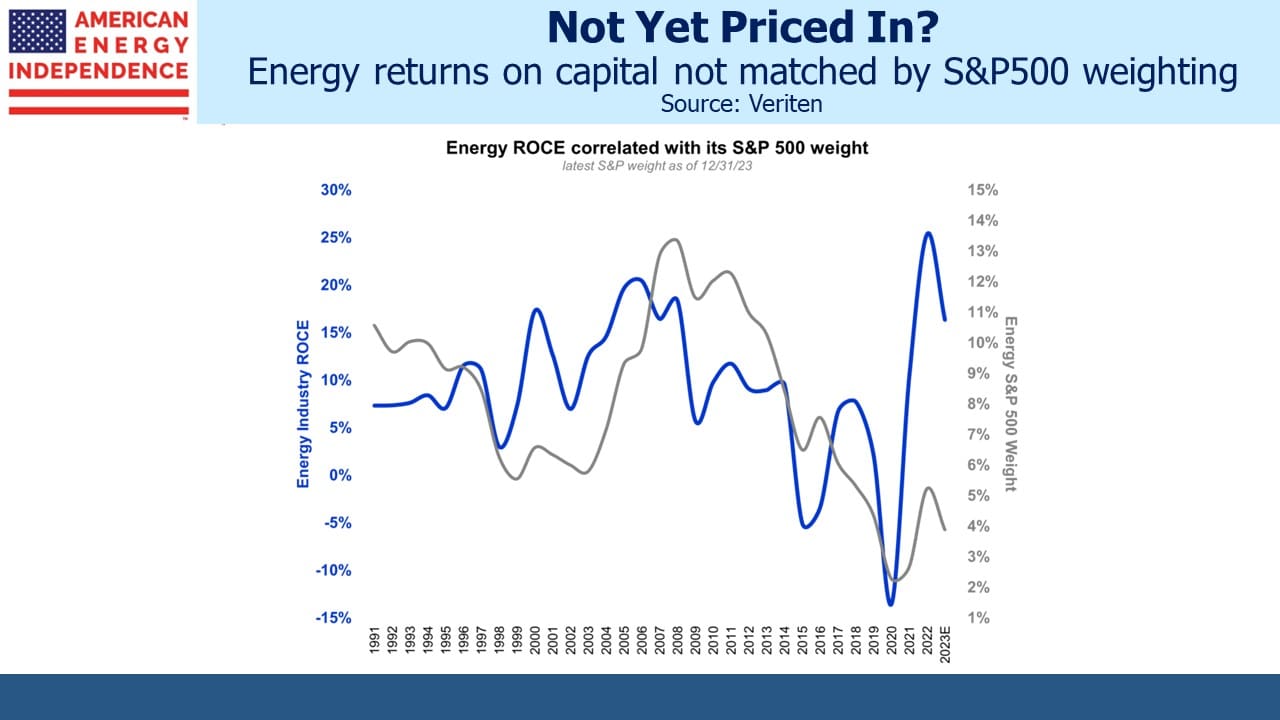

Murti’s favored metric is Return On Capital Employed (ROCE), and he notes that high ROCE generally corresponds with a high weight in the S&P500. Today energy remains at an historically low 4% market weighting, while returns are the best in over three decades. Murti believes that we’re a couple of years into a 10-15 year bullish cycle.

This theory will please energy investors. But another possible explanation is that energy companies are eschewing the normal boom/bust capex spending cycle that has long pervaded their industry. High ROCE would normally draw additional capital, but continued capital parsimony generally prevails.

Adjusted for inflation, energy capex is still less than half of the 2014 peak.

Uncertainty about the path of the energy transition has added to the caution practiced by many CFOs. Climate extremists stand ready to criticize the big publicly traded energy companies and file lawsuits to impede their activities.

The other day I was in a discussion sponsored by the Naples Council on World Affairs. One participant bitterly criticized Exxon Mobil for withholding internal research decades ago that showed the potential for fossil fuel combustion to lead to global warming. I reminded him that climate extremists have been at least as disingenuous. Many have preached that the world can run entirely on solar and wind, in willful disregard of science and the facts.

If energy companies have presented facts to suit them, the Sierra Club and wretched little Greta have routinely offered policy prescriptions grounded in fantasy. Alex Haraus and his anti-LNG TikTok crowd belong in the same gang of socialists trying to impose poverty and starvation on billions of people (see White House Adopts An Energy Policy Where Everyone Loses).

The coincidence of a high industry ROCE with low market weight could have another possible explanation – that we’re in a profitable equilibrium where high returns aren’t drawing dilutive capex because the reasons for financial caution are likely to persist.

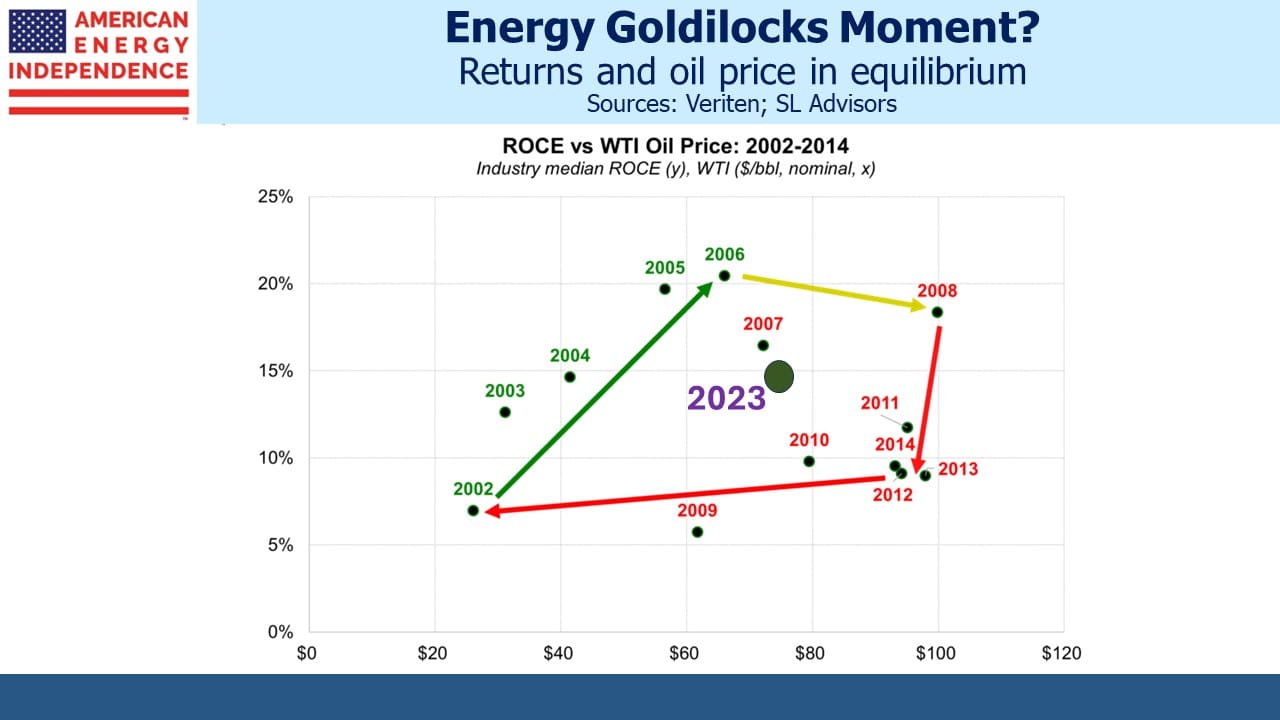

This is illustrated in the “Quadrilateral of Death” which shows low returns leading to higher oil followed by higher returns, then lower returns caused by inferior capex and finally lower prices, returning to the starting point. But today we’re sitting in the middle of the quadrilateral, with decent returns and moderate prices. Perhaps it’s the sector’s Goldilocks moment – neither too hot nor too cold. The market has found a balancing point where excess returns aren’t self-destroying because of the continued uncertainty about the energy transition.

Oil and gas projects often require a decade or more to generate adequate returns. Forecasting demand and prices over such a long period is harder than in the past. Perhaps we are at the point of Happy Equilibrium.

If you read Murti’s research paper you’ll find it informative, and perhaps like me be mildly amused at the pretentious use of plural first person pronouns. For example, at SL Advisors we are bullish on energy infrastructure. But we can’t emulate Murti when he says “we … moved to Goldman Sachs in 1999” (emphasis added) or refers to “our career.” Smile and look beyond the misused pronouns.

In other news, the White House’s moratorium on new LNG approvals has drawn criticism from moderate Democrats in Texas, Alaska and California. They’re worried that there aren’t enough progressives in their districts to offset those employed in the energy sector or perhaps don’t see this as an effective way to lower emissions.

Germany’s extreme climate policies are part of the political discourse. Siegfried Russwurm, head of Germany’s main industry association BDI, criticized the government’s approach as “dogmatic” and “absolutely toxic.” The country is facing a recession driven by high energy prices. There’s no place for nuclear power and they want to derive 80% of their electricity from solar and wind by 2030, up from 41% in 2021.

Germany’s recent progress on reduced emissions has largely come from lower industrial output. China and other developing countries will easily make up for it.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Correction: Murti uses ROCE for Return On Capital Employed. See that paper you link.

Paul

Thank you for noting the error. It has been corrected.