Sierra Club Shoots Itself In The Foot

Once again a liberal activist judge has succumbed to a far-left climate extremist group. On Tuesday DC Circuit Chief Judge Srinivasan, along with Circuit Judges Childs and Garcia sent parts of a previously granted permit from the Federal Energy Regulatory Commission (FERC) back for review.

NextDecade’s (NEXT) Rio Grande LNG export terminal was one of the victims, although FERC was the respondent in the case. Today, obtaining any number of permits from a regulator is only the beginning of the approval process. Those permits then have to withstand legal challenges from judicial terrorists whose objective is to block infrastructure projects by increasing their cost and uncertainty of completion.

We’re invested in NextDecade because we believe providing cheap US natural gas to developing countries around the world, allowing them to grow their energy consumption with less reliance on coal, will continue to be profitable. The Sierra Club and their weird partners wrongly believe that India and other Asian countries will use more solar and wind if they can’t buy US Liquefied Natural Gas (LNG). This is not supported by the facts.

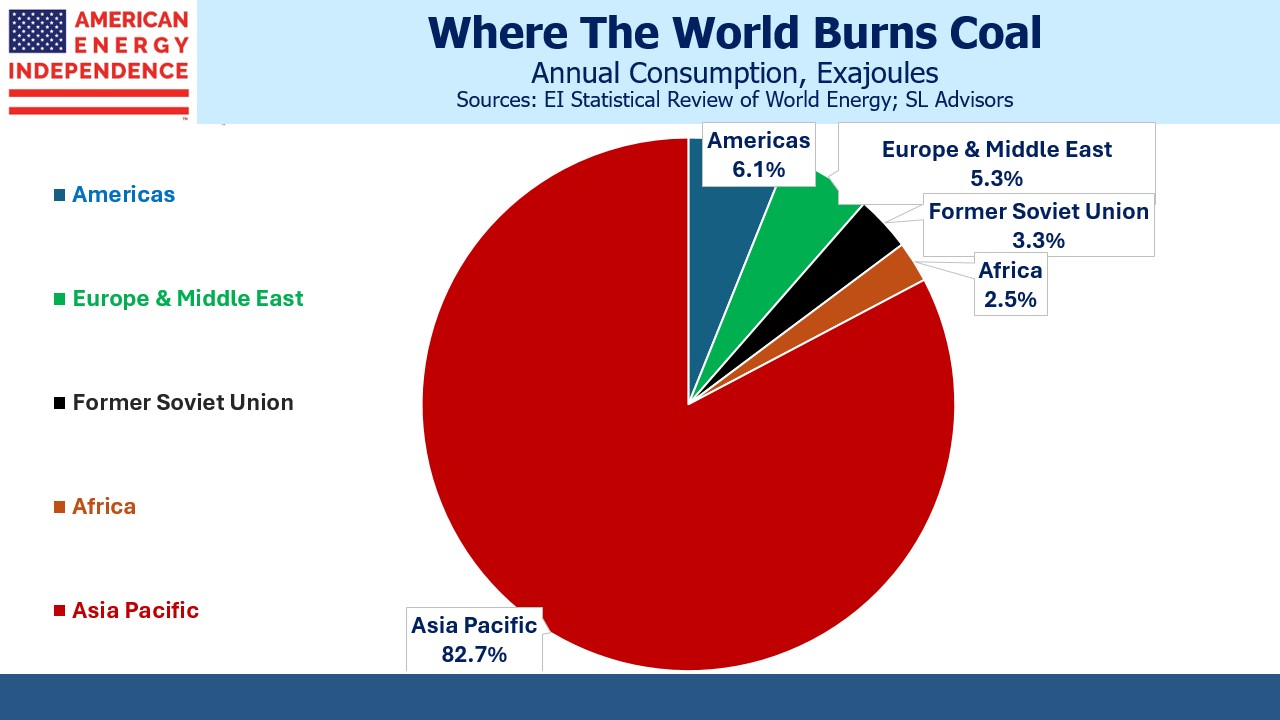

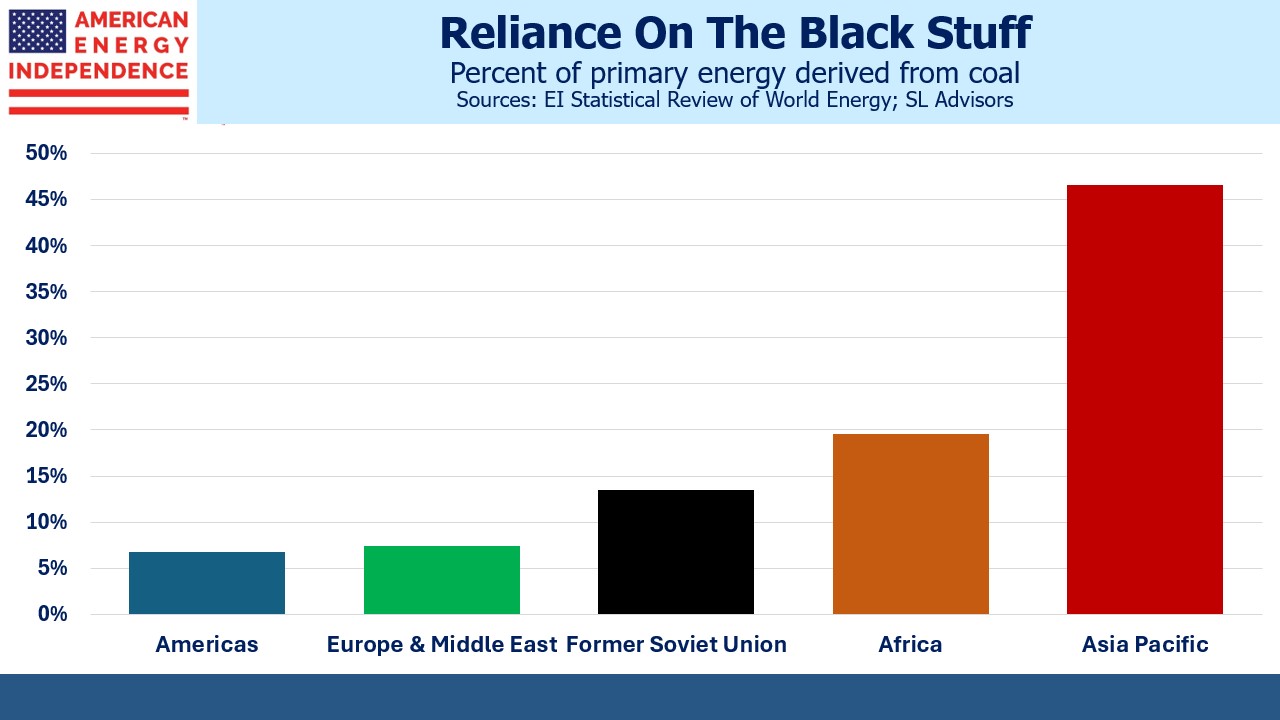

Coal is the single biggest source of primary energy for the Asia Pacific region. 83% of the world’s coal is consumed there, of which China is 56%. It provides 47% of that region’s primary energy and 54% of China’s. Coal generates on average 2X the greenhouse gas emissions as natural gas per unit of power generation and also generates harmful local pollution.

If you care about climate change, you want to reduce global coal consumption.

The Sierra Club is not pursuing policies to reduce emissions. As well as opposing natural gas to displace coal they are against nuclear. They’re obstructive to the real work and are nothing more than a bunch of virtue signaling loony leftists. They are weird.

It’s unclear how this will play out. On the same day as the court ruling which affects Trains 1-3, NEXT filed an 8-K with the SEC disclosing an agreement with Bechtel to build Train 4. The company hasn’t yet responded to the court ruling other than to say construction continues on the first phase.

NEXT has some big customers lined up to buy its LNG, including Shell and Exxon Mobil. TotalEnergies is a strategic partner, with a stake in NEXT and an agreement to buy its LNG. The ruling requires FERC to issue a revised Environmental Impact Statement (EIS), in part because the environmental justice rights of some nearby residents are at risk of being compromised. Specifically, the court found that they, “…may experience significant visual impacts, as well as significant cumulative visual impacts.”

The Rio Grande LNG terminal is being built alongside the ship channel in Brownsville, TX, so it’s this view that will be impacted. I don’t know what else you’d expect to see along the Brownsville Ship Channel other than energy infrastructure. It seems to me like buying a house near an airport and then complaining about the noise.

There’s no indication from FERC how quickly they will respond to the ruling and how long a new EIS will take.

Large holders of NEXT include York Capital Management, Blackrock and even Marc Lasry (co-founder of Avenue Capital, a distressed debt firm). Lasry is a well-known Democrat party fundraiser and has often drawn criticism from the weirdos at the Sierra Club for his investments. It’s an example of how fringe they are.

On Friday Ukrainian troops captured a key gas transit point supplying Europe as part of their incursion into Russian territory. Ukraine released a video of their troops at Gazprom’s Sudzha gas measuring station. US LNG provided vital supplies to Europe following Russia’s invasion of Ukraine. They still rely somewhat on Russia, some of which passes through Sudzha. European energy officials will have been made acutely aware of how tenuous that remaining supply is. America can be a reliable source.

Between the LNG buyers and investors there are some deep pockets who want to see the Rio Grande project through. We think that’s the most likely outcome, although the election adds some uncertainty.

New energy projects are less likely, which raises the value of existing energy infrastructure. Democrats have unwittingly been good for energy investors by discouraging investment in new supply. A President Harris probably wouldn’t be a supporter of new LNG, although she might note that swing state Pennsylvania will likely provide its throughput.

Under Kamala Harris, pipeline companies would have even less reason to boost capex, which will in turn drive up free cashflow.

Alan Armstrong, Williams CEO, has commented that they see less competition than in the past for new business. Energy Transfer and Cheniere each raised full year EBITDA guidance again when they reported earnings last week. Sierra Club policies will further strengthen their dominant market positions.

We have three have funds that seek to profit from this environment: