Safely, Cautiously Bullish

/

There’s no particular reason why a 12 month outlook is more important at year’s end, but that is nonetheless when research analysts take stock of past forecasts and offer new ones. In late 2022 many economists were forecasting a recession by now. In his press conference on Wednesday, Fed chair Jay Powell retained enough humility to avoid it looking like a victory lap. The FOMC’s own forecasts have often been inaccurate in the past (see Policy Errors On Interest Rates And Energy). As he once said himself forecasters should be humble and have much to be humble about. The Fed’s critics are silenced for now.

The 2024 outlook is described as “cautious” for midstream by Wells Fargo, and “mixed” although “tactically constructive” for energy more broadly by JPMorgan. Morgan Stanley says, “We see a path higher post the pullback, but risks still exist.” Irrational exuberance is nowhere to be seen.

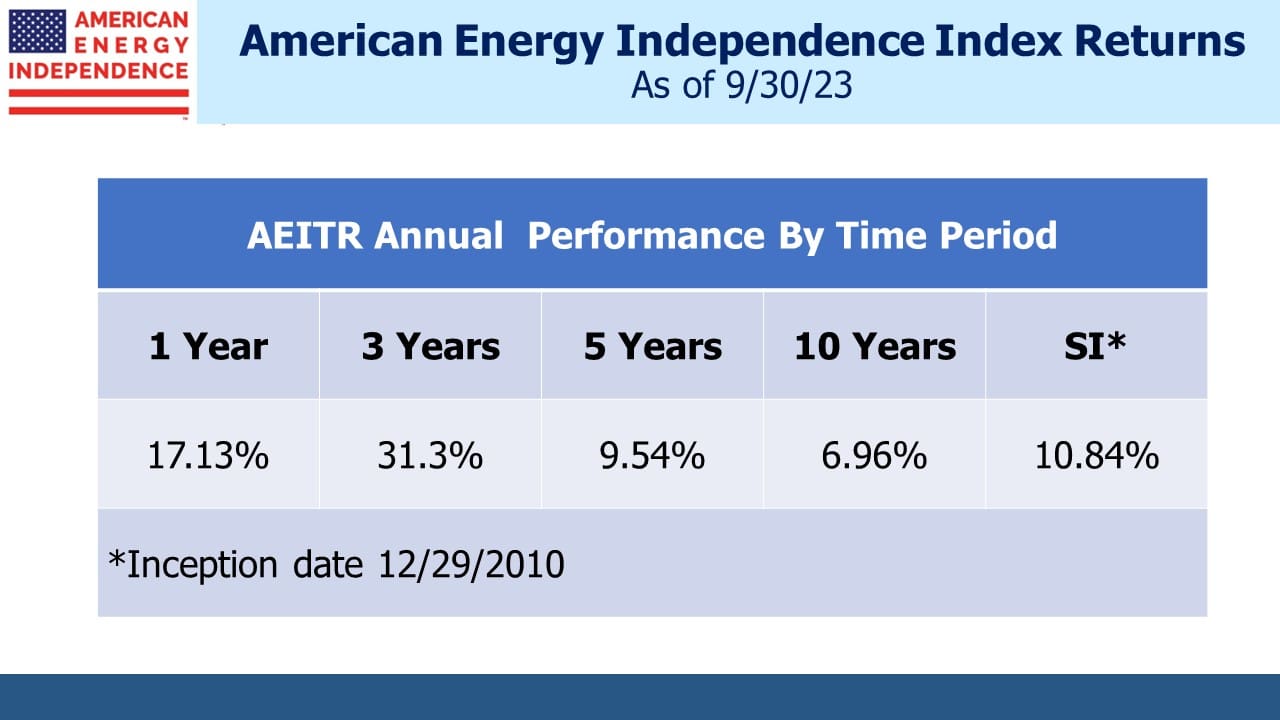

Perhaps analysts are chastened by S&P Energy ETF (XLE), which has had a disappointing year; at -1.35% it’s 24% behind the S&P500. Midstream has been the standout within the energy complex. The American Energy Independence Index (AEITR) is +14% YTD. MLPs have been especially strong, with Energy Transfer (ET) +26%. The many financial advisors we talk to who own ET should be happy.

Morgan Stanley notes that energy stocks are at a 55% discount to the S&P500, 2X the average over the past decade. They are also bullish on crude oil, like most analysts, seeing Brent averaging $85 next year. There’s just not enough E&P capex to cover well depletion plus demand growth. This has been the bull thesis on oil for some time. Perhaps now it will work.

The Fed’s latest Summary of Economic Projections (SEP) includes three rate cuts next year, although Powell reminded journalists that this isn’t a plan, simply the aggregate guidance from 19 FOMC members, all but two of whom expect at least one cut. PCE inflation is expected to reach 2.1% by 2025 with unemployment historically low at 4.1%. Phillips Curve adherents will find fault with this rosy outlook, but economists and the interest rate futures market look for a “soft” landing next year, dubbed by the WSJ the “Most Crowded Trade on Wall Street.”

Dividend yield plus dividend growth plus buybacks is a good way to forecast cash returns, exclusive of any capital appreciation, for pipelines. Wells Fargo sees 7% + 4% + 0-1% on this metric, providing a solid 11-12% total return forecast for 2024.

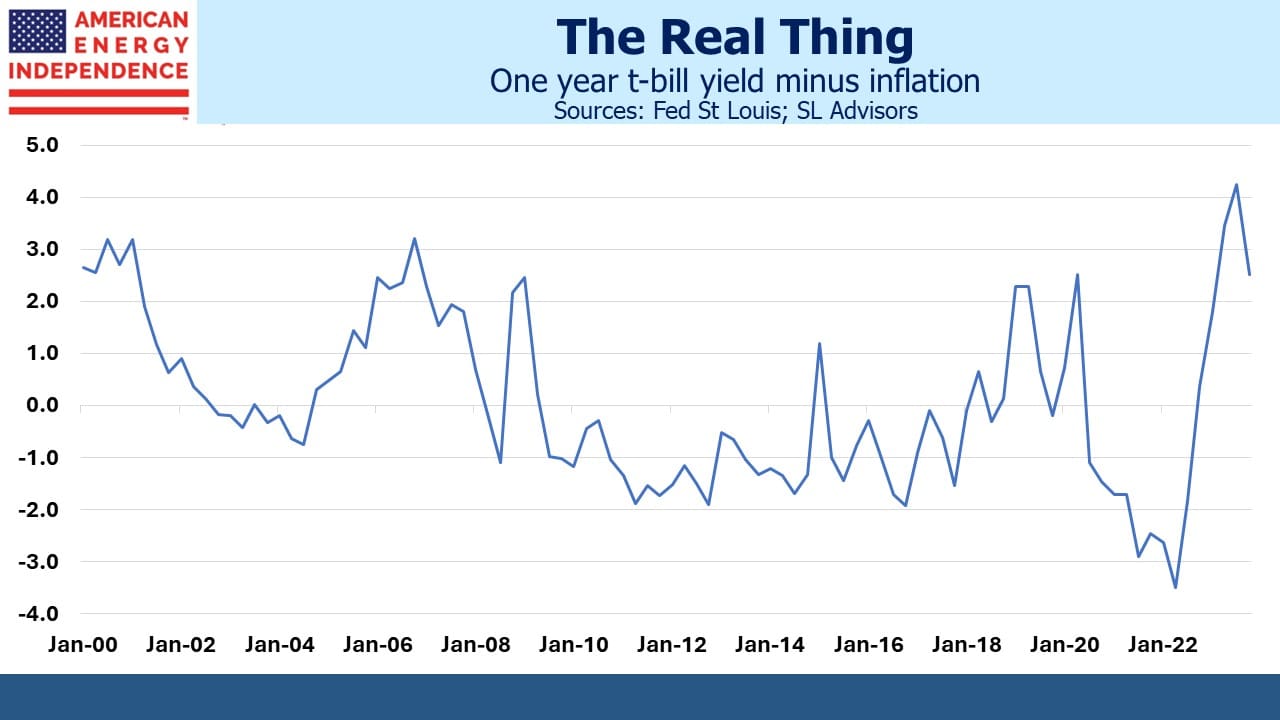

Cash became a legitimate investment choice this year. With a couple of brief exceptions prior to the 2020 pandemic, the last time cash earned a positive real return of any consequence was in 2008 before the Great Financial Crisis.

CPI is currently running at 3.1% (4.0% ex food and energy). Cash was trash for so long that for a significant percentage of today’s investors that’s all they’ve experienced. But treasury bills yielding 2% or so above inflation seems like a decent choice for anyone ambivalent about committing more long term capital to stocks. Occasionally investors have questioned why midstream infrastructure yields of 7% are to be preferred over a riskless 5.25%.

The answer lies in the Fed’s apparent pivot on interest rates, since this should further highlight the sector’s yield. 5.25% treasury bill yields look increasingly temporary. If so, midstream stocks may provide some capital appreciation on top of the projected 11-12% cash return.

Vettafi, which publishes the Alerian MLP Infrastructure Index (AMZI), dropped their 12% position limit in their quarterly rebalancing last week. This avoided the reduction of positions in several MLPs, notably ET which has reached 19.5%, partly because of its acquisition of Crestwood.

Had the 12% limit been maintained, rebalancing would have resulted in over $500MM in ET shares being sold by the Alerian MLP Fund (AMLP) which tracks AMZI. XLE’s two biggest holdings, Exxon Mobil and Chevron, represent 39% of that fund. Energy investors like their bets concentrated. AMLP is adopting that model.

ET is 5% of the AEITR, more representative of its share of the sector’s market cap.

The COP28 ended with a commitment to “transition away” from fossil fuels – a pledge to phase them out failing to draw enough support. They currently provide 80% of the world’s energy.

Solar and wind are 3%. They’re not yet growing fast enough to even satisfy the world’s increasing demand for energy. The International Energy Agency reported that coal consumption reached a new record of 8.5 billion metric tonnes this year, up 1.4% from last year.

Everybody should want to see coal phased out. It’s the most prolific source of CO2 emissions per unit of energy produced, and also creates harmful local pollution. Yet India burned 8% more this year and China 5%, due to growing electricity demand and weak hydropower output.

North American LNG exports look set to double over the next four years as several new export facilities become operational. That will help to curb the emerging world’s insatiable appetite for coal.

We have three have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

In addition to the 7% yield of midstream infrastructure investments, don’t forget that MLP distributions are returns of capital (except for that portion representing partnership earnings and profits, which are taxable whether or not distributed) and that C corporation dividends are often largely returns of capital thanks to high depreciation deductions.