Safely, Cautiously Bullish

There’s no particular reason why a 12 month outlook is more important at year’s end, but that is nonetheless when research analysts take stock of past forecasts and offer new ones. In late 2022 many economists were forecasting a recession by now. In his press conference on Wednesday, Fed chair Jay Powell retained enough humility to avoid it looking like a victory lap. The FOMC’s own forecasts have often been inaccurate in the past (see Policy Errors On Interest Rates And Energy). As he once said himself forecasters should be humble and have much to be humble about. The Fed’s critics are silenced for now.

The 2024 outlook is described as “cautious” for midstream by Wells Fargo, and “mixed” although “tactically constructive” for energy more broadly by JPMorgan. Morgan Stanley says, “We see a path higher post the pullback, but risks still exist.” Irrational exuberance is nowhere to be seen.

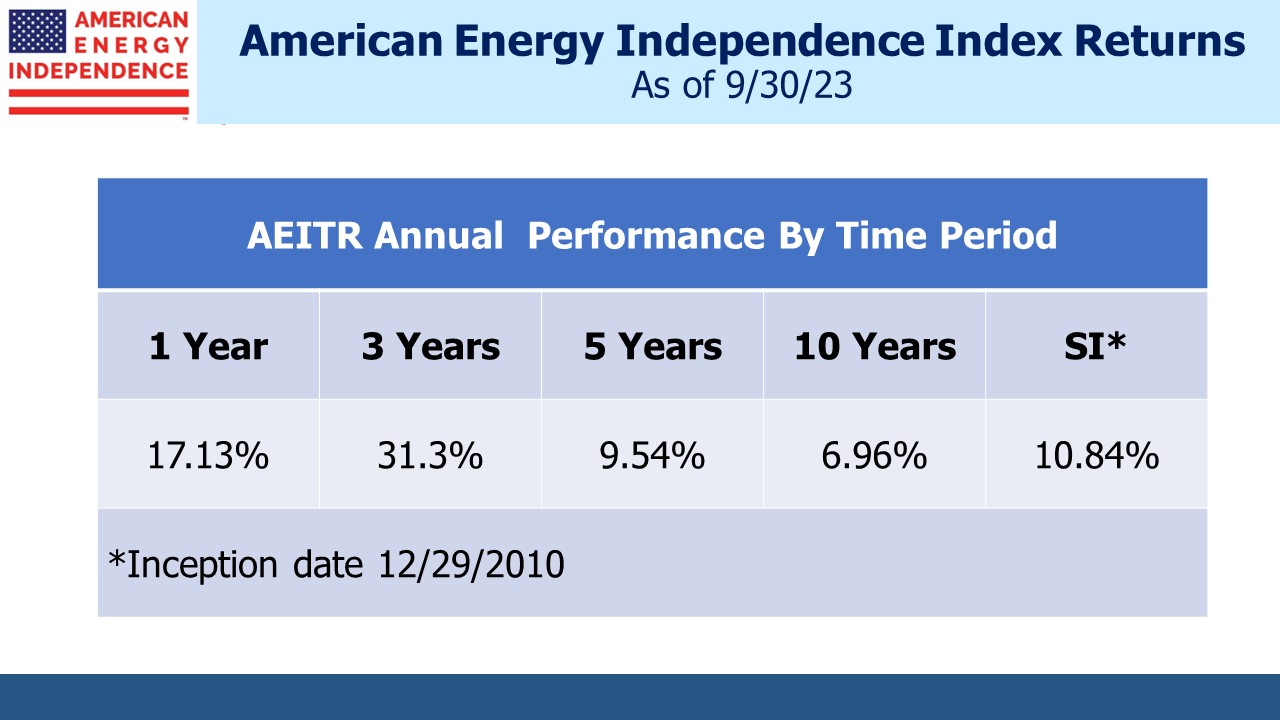

Perhaps analysts are chastened by S&P Energy ETF (XLE), which has had a disappointing year; at -1.35% it’s 24% behind the S&P500. Midstream has been the standout within the energy complex. The American Energy Independence Index (AEITR) is +14% YTD. MLPs have been especially strong, with Energy Transfer (ET) +26%. The many financial advisors we talk to who own ET should be happy.

Morgan Stanley notes that energy stocks are at a 55% discount to the S&P500, 2X the average over the past decade. They are also bullish on crude oil, like most analysts, seeing Brent averaging $85 next year. There’s just not enough E&P capex to cover well depletion plus demand growth. This has been the bull thesis on oil for some time. Perhaps now it will work.

The Fed’s latest Summary of Economic Projections (SEP) includes three rate cuts next year, although Powell reminded journalists that this isn’t a plan, simply the aggregate guidance from 19 FOMC members, all but two of whom expect at least one cut. PCE inflation is expected to reach 2.1% by 2025 with unemployment historically low at 4.1%. Phillips Curve adherents will find fault with this rosy outlook, but economists and the interest rate futures market look for a “soft” landing next year, dubbed by the WSJ the “Most Crowded Trade on Wall Street.”

Dividend yield plus dividend growth plus buybacks is a good way to forecast cash returns, exclusive of any capital appreciation, for pipelines. Wells Fargo sees 7% + 4% + 0-1% on this metric, providing a solid 11-12% total return forecast for 2024.

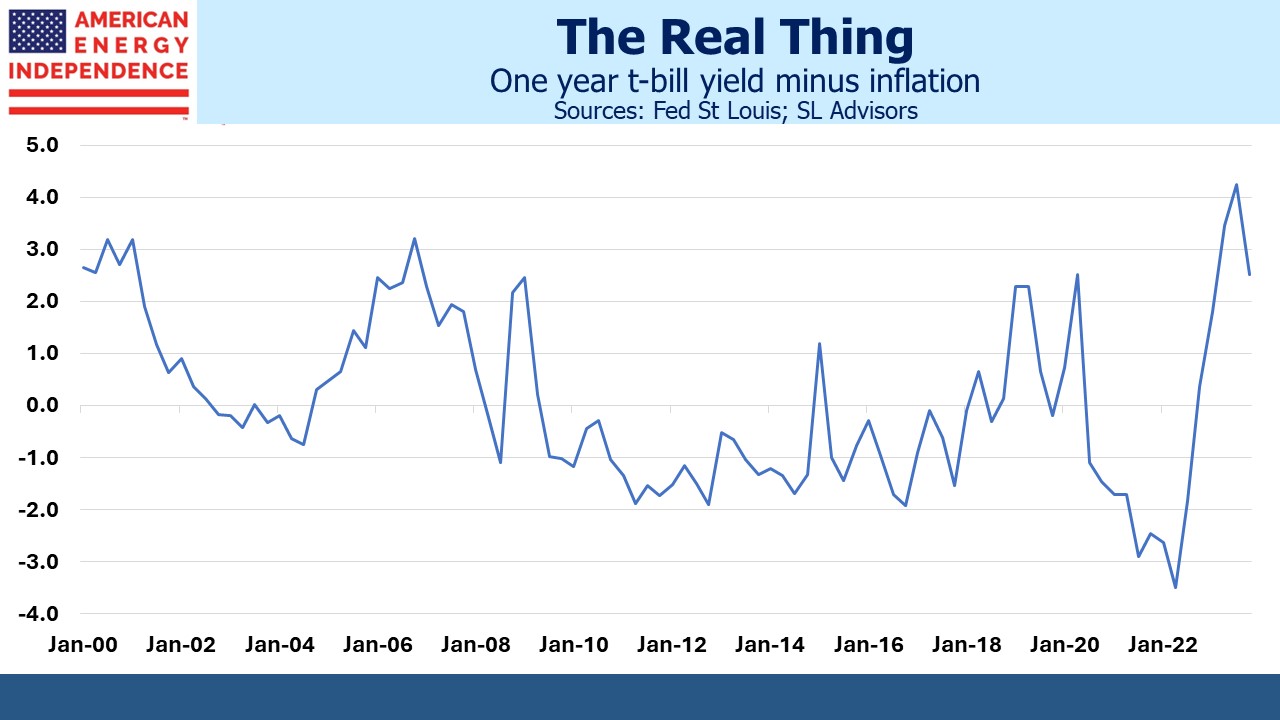

Cash became a legitimate investment choice this year. With a couple of brief exceptions prior to the 2020 pandemic, the last time cash earned a positive real return of any consequence was in 2008 before the Great Financial Crisis.

CPI is currently running at 3.1% (4.0% ex food and energy). Cash was trash for so long that for a significant percentage of today’s investors that’s all they’ve experienced. But treasury bills yielding 2% or so above inflation seems like a decent choice for anyone ambivalent about committing more long term capital to stocks. Occasionally investors have questioned why midstream infrastructure yields of 7% are to be preferred over a riskless 5.25%.

The answer lies in the Fed’s apparent pivot on interest rates, since this should further highlight the sector’s yield. 5.25% treasury bill yields look increasingly temporary. If so, midstream stocks may provide some capital appreciation on top of the projected 11-12% cash return.

Vettafi, which publishes the Alerian MLP Infrastructure Index (AMZI), dropped their 12% position limit in their quarterly rebalancing last week. This avoided the reduction of positions in several MLPs, notably ET which has reached 19.5%, partly because of its acquisition of Crestwood.

Had the 12% limit been maintained, rebalancing would have resulted in over $500MM in ET shares being sold by the Alerian MLP Fund (AMLP) which tracks AMZI. XLE’s two biggest holdings, Exxon Mobil and Chevron, represent 39% of that fund. Energy investors like their bets concentrated. AMLP is adopting that model.

ET is 5% of the AEITR, more representative of its share of the sector’s market cap.

The COP28 ended with a commitment to “transition away” from fossil fuels – a pledge to phase them out failing to draw enough support. They currently provide 80% of the world’s energy.

Solar and wind are 3%. They’re not yet growing fast enough to even satisfy the world’s increasing demand for energy. The International Energy Agency reported that coal consumption reached a new record of 8.5 billion metric tonnes this year, up 1.4% from last year.

Everybody should want to see coal phased out. It’s the most prolific source of CO2 emissions per unit of energy produced, and also creates harmful local pollution. Yet India burned 8% more this year and China 5%, due to growing electricity demand and weak hydropower output.

North American LNG exports look set to double over the next four years as several new export facilities become operational. That will help to curb the emerging world’s insatiable appetite for coal.

We have three have funds that seek to profit from this environment: