Rethinking Hydrogen

/

Hydrogen has long been thought to be a viable form of carbon-free energy. When burned, it produces water vapor. But hydrogen isn’t very energy-dense (about two thirds less than gasoline), is expensive to produce and hard to handle. An interesting fact is that H2 molecules are so tiny they can gradually leak through a steel tank container and make it brittle.

The 2022 Inflation Reduction Act (IRA) included subsidies to create seven hydrogen hubs, to jump start US production.

To be a hydrocarbon substitute, hydrogen has to be produced without carbon emissions. This typically means solar-powered electrolysis. Using one form of carbon-free energy to produce another isn’t cheap, even if the intermittency of solar is more manageable in a production process than if it’s supporting the grid.

The most optimistic cost forecasts for green hydrogen are $2-3 per kg. It takes about 7kg of hydrogen to generate the same energy as a million BTUs (MMBTUs) of natural gas. At the equivalent of $14-21 per MMBTU, this makes hydrogen uncompetitive in the US and above the current European LNG benchmark of $10 per MMBTU.

The EU has great hopes for hydrogen, pledging that it will produce 10 million tonnes by 2030 and that it will provide 10% of Europe’s energy by 2050. As with most progressive policies to move away from conventional energy, this is wildly unrealistic.

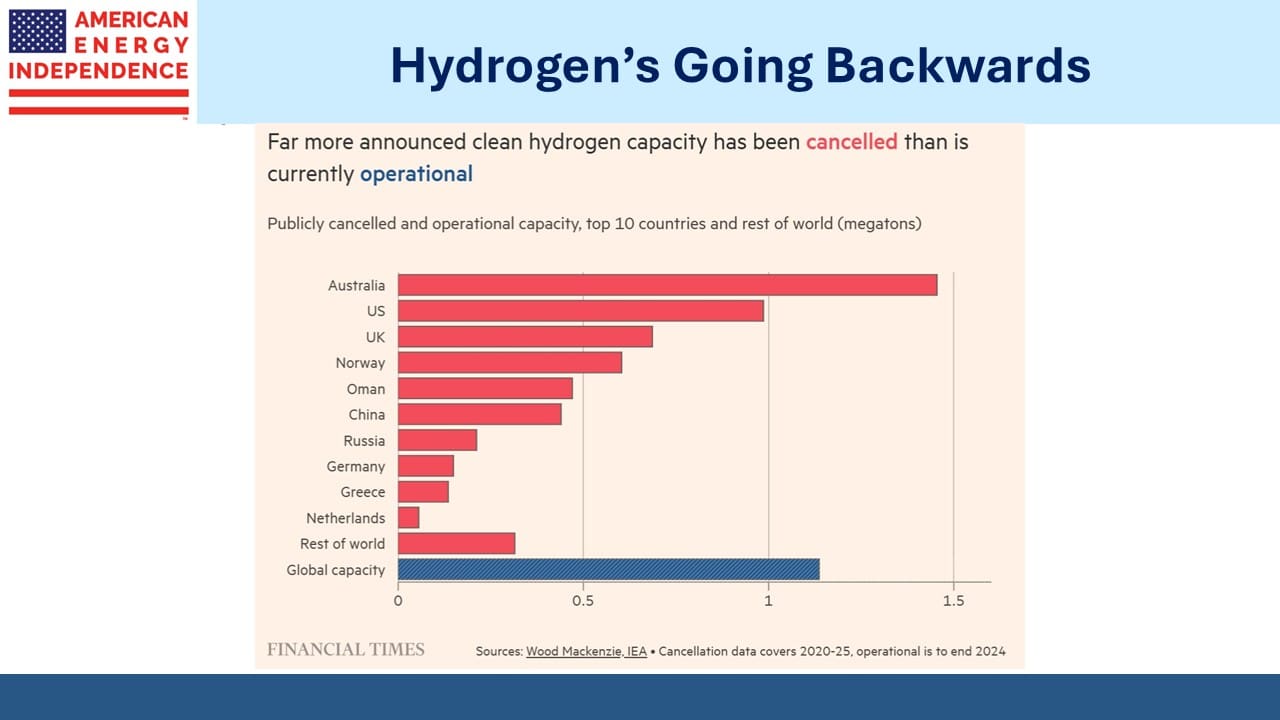

The FT reported last week that 60 low-carbon hydrogen projects have been canceled or put on hold this year, equal to 4.9 million tonnes of capacity which is more than 4X what currently exists. Spiraling costs and the absence of ready buyers are the most commonly cited reasons.

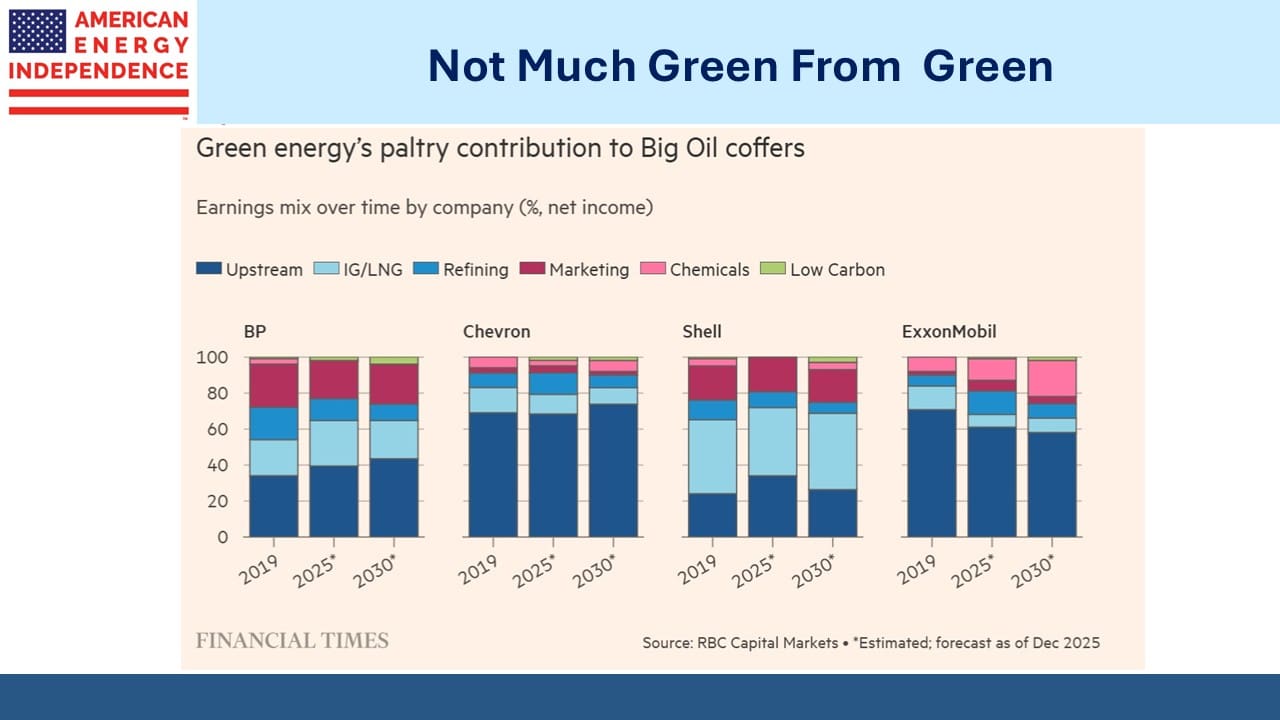

None of the energy majors derive significant profits from low carbon business units. Shell and BP drank the Kool-Aid more readily than their American peers which has weighed on their stock prices. BP has slashed its spending on clean energy by 80 per cent compared with last year, to just $332MM.

The 2022 Inflation Reduction Act in reality was a fiscal injection into renewables. The White House recently slashed funding for two of the contemplated hydrogen hubs, and further cuts are expected. The policy uncertainty has halted construction.

Hydrogen faces substantial hurdles to wider use, including high cost and challenging transportation/storage. It’s often converted to ammonia which is easier to transport and then converted back for use.

Hydrogen is likely to remain a niche market for the foreseeable future.

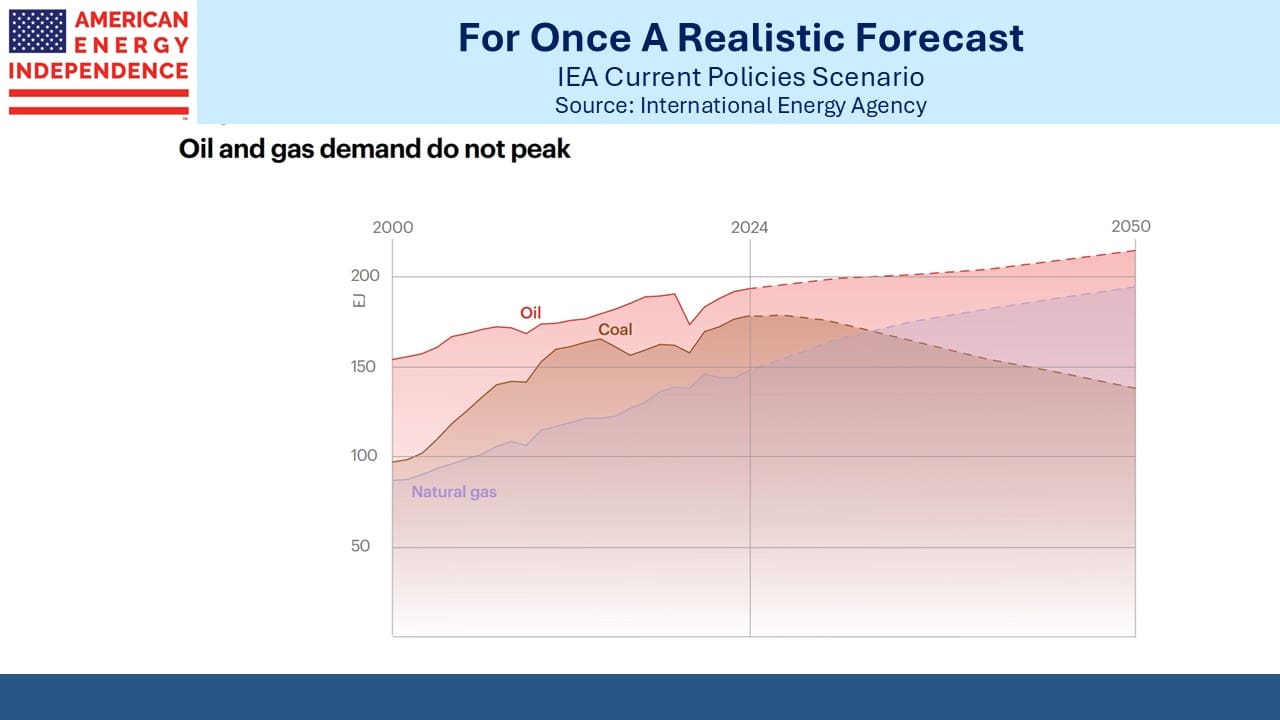

The dimming interest in hydrogen is symptomatic of a broad acknowledgment that reducing consumption of hydrocarbons as pushed by progressives is impractical. The International Energy Agency (IEA) restored serious forecasts in their 2025 World Energy Outlook and now sees no peak in global oil or gas consumption.

Nature magazine withdrew a flawed paper whose prediction of economic catastrophe relied on wrong data from Uzbekistan. It’s why Democrats are concluding that climate change fearmongering doesn’t resonate with voters.

Last week Exxon Mobil (XOM) boosted their forecast earnings growth through 2030 with higher oil and gas output. Renewables were a footnote, with the Carbon Solutions unit focused on carbon capture. Last year, XOM announced the construction of a large hydrogen plant in Baytown, TX, but they recently canceled it.

US natural gas prices recently traded above $5 per MMBTU before pulling back to around $4.50. Gas provides 43% of America’s electricity, so the price run-up adds fuel to the affordability debate. Climate extremists have long opposed adding natural gas infrastructure which would improve access to this resource.

New York policy has recently become more amenable as the political cost of such opposition becomes apparent (watch Are Democrats The Problem?). Renewables have consistently failed to meet promised generation targets or low costs.

Increasing LNG exports have been blamed by some for high domestic gas prices. As long as the gap between foreign LNG benchmarks and the US exceeds the cost of liquefaction and transportation, exports will continue to flow. The price gap will narrow, in part by US prices moving higher. It’s an issue that bears watching. Popular opinion in Australia led to curbs on LNG exports a few years ago when many felt it was boosting domestic prices.

The problem is most easily solved by adding takeaway capacity to get more gas out of the ground to where it’s needed. As in so many cases, left wing energy policies have stalled the use of conventional energy, raising prices for US consumers.

In his press conference last week, Fed chair Jay Powell made the surprising admission that the Bureau of Labor Statistics (BLS) is probably overstating employment by around 60K workers per month. It’s due to problems estimating the impact of new and failing businesses (the “birth-death” model), an issue that’s challenged BLS statisticians for years.

The cut in rates was partly due to the labor market weakness this implies.

Midstream yields of 5% and higher look ever more attractive.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!