Rethinking Hydrogen

Hydrogen has long been thought to be a viable form of carbon-free energy. When burned, it produces water vapor. But hydrogen isn’t very energy-dense (about two thirds less than gasoline), is expensive to produce and hard to handle. An interesting fact is that H2 molecules are so tiny they can gradually leak through a steel tank container and make it brittle.

The 2022 Inflation Reduction Act (IRA) included subsidies to create seven hydrogen hubs, to jump start US production.

To be a hydrocarbon substitute, hydrogen has to be produced without carbon emissions. This typically means solar-powered electrolysis. Using one form of carbon-free energy to produce another isn’t cheap, even if the intermittency of solar is more manageable in a production process than if it’s supporting the grid.

The most optimistic cost forecasts for green hydrogen are $2-3 per kg. It takes about 7kg of hydrogen to generate the same energy as a million BTUs (MMBTUs) of natural gas. At the equivalent of $14-21 per MMBTU, this makes hydrogen uncompetitive in the US and above the current European LNG benchmark of $10 per MMBTU.

The EU has great hopes for hydrogen, pledging that it will produce 10 million tonnes by 2030 and that it will provide 10% of Europe’s energy by 2050. As with most progressive policies to move away from conventional energy, this is wildly unrealistic.

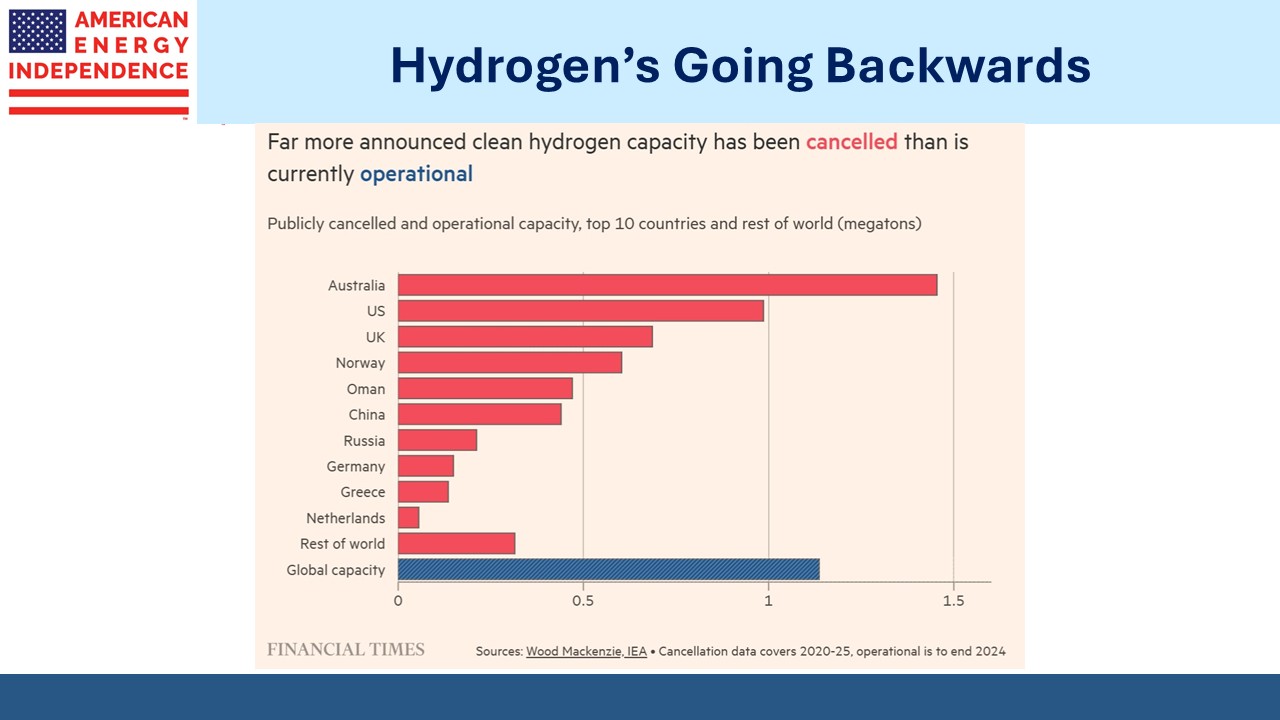

The FT reported last week that 60 low-carbon hydrogen projects have been canceled or put on hold this year, equal to 4.9 million tonnes of capacity which is more than 4X what currently exists. Spiraling costs and the absence of ready buyers are the most commonly cited reasons.

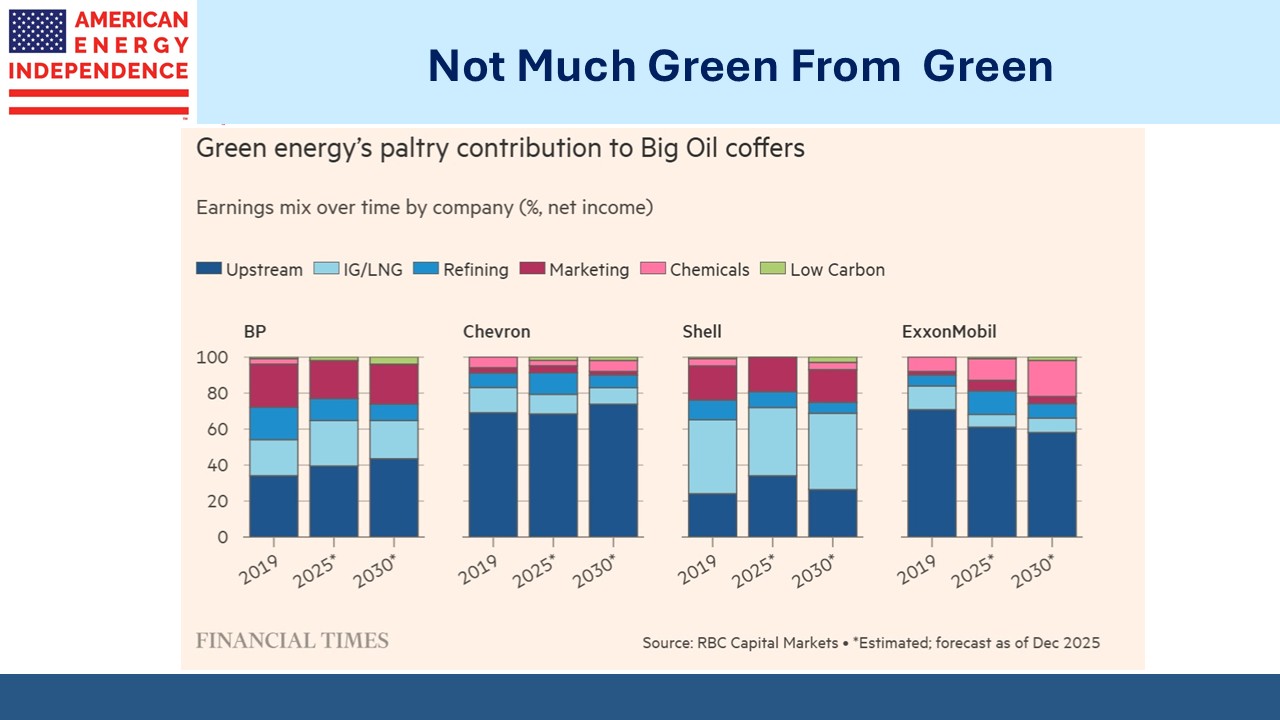

None of the energy majors derive significant profits from low carbon business units. Shell and BP drank the Kool-Aid more readily than their American peers which has weighed on their stock prices. BP has slashed its spending on clean energy by 80 per cent compared with last year, to just $332MM.

The 2022 Inflation Reduction Act in reality was a fiscal injection into renewables. The White House recently slashed funding for two of the contemplated hydrogen hubs, and further cuts are expected. The policy uncertainty has halted construction.

Hydrogen faces substantial hurdles to wider use, including high cost and challenging transportation/storage. It’s often converted to ammonia which is easier to transport and then converted back for use.

Hydrogen is likely to remain a niche market for the foreseeable future.

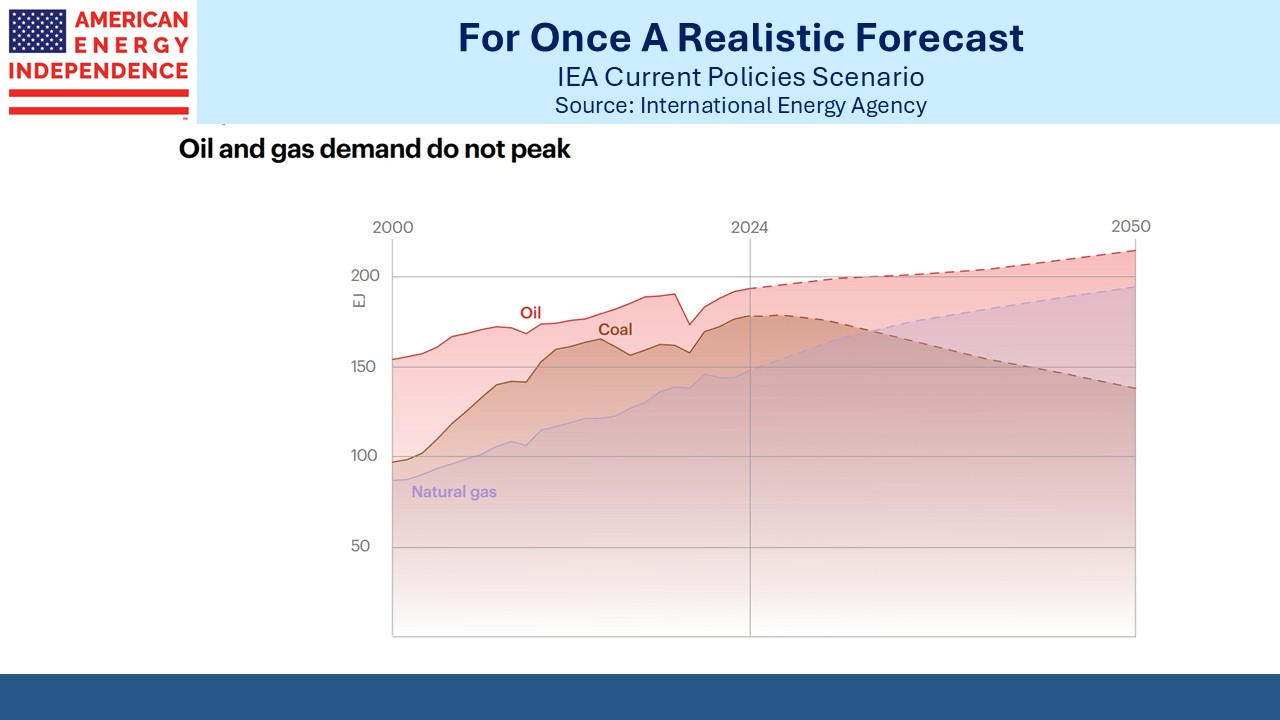

The dimming interest in hydrogen is symptomatic of a broad acknowledgment that reducing consumption of hydrocarbons as pushed by progressives is impractical. The International Energy Agency (IEA) restored serious forecasts in their 2025 World Energy Outlook and now sees no peak in global oil or gas consumption.

Nature magazine withdrew a flawed paper whose prediction of economic catastrophe relied on wrong data from Uzbekistan. It’s why Democrats are concluding that climate change fearmongering doesn’t resonate with voters.

Last week Exxon Mobil (XOM) boosted their forecast earnings growth through 2030 with higher oil and gas output. Renewables were a footnote, with the Carbon Solutions unit focused on carbon capture. Last year, XOM announced the construction of a large hydrogen plant in Baytown, TX, but they recently canceled it.

US natural gas prices recently traded above $5 per MMBTU before pulling back to around $4.50. Gas provides 43% of America’s electricity, so the price run-up adds fuel to the affordability debate. Climate extremists have long opposed adding natural gas infrastructure which would improve access to this resource.

New York policy has recently become more amenable as the political cost of such opposition becomes apparent (watch Are Democrats The Problem?). Renewables have consistently failed to meet promised generation targets or low costs.

Increasing LNG exports have been blamed by some for high domestic gas prices. As long as the gap between foreign LNG benchmarks and the US exceeds the cost of liquefaction and transportation, exports will continue to flow. The price gap will narrow, in part by US prices moving higher. It’s an issue that bears watching. Popular opinion in Australia led to curbs on LNG exports a few years ago when many felt it was boosting domestic prices.

The problem is most easily solved by adding takeaway capacity to get more gas out of the ground to where it’s needed. As in so many cases, left wing energy policies have stalled the use of conventional energy, raising prices for US consumers.

In his press conference last week, Fed chair Jay Powell made the surprising admission that the Bureau of Labor Statistics (BLS) is probably overstating employment by around 60K workers per month. It’s due to problems estimating the impact of new and failing businesses (the “birth-death” model), an issue that’s challenged BLS statisticians for years.

The cut in rates was partly due to the labor market weakness this implies.

Midstream yields of 5% and higher look ever more attractive.

We have two have funds that seek to profit from this environment: