Midstream And Variable Costs

/

Renewables’ advocates are fond of linking solar and wind with the power needs of data centers. Superficially, the marriage of new technology and new energy seems inevitable. Bloomberg New Energy Finance (BNEF) is just one example of media outlets that are telling this story (see Power Hungry Data Centers Are Driving Green Energy Demand).

Inconveniently, this narrative is at odds with the facts. Intermittent power that runs 20-40% of the time is not an obvious choice for customers whose acceptable annual downtime is measured in seconds. Solar and wind can be cheap if you’re willing to be opportunistic in your use of electricity, but few of us are so accommodating.

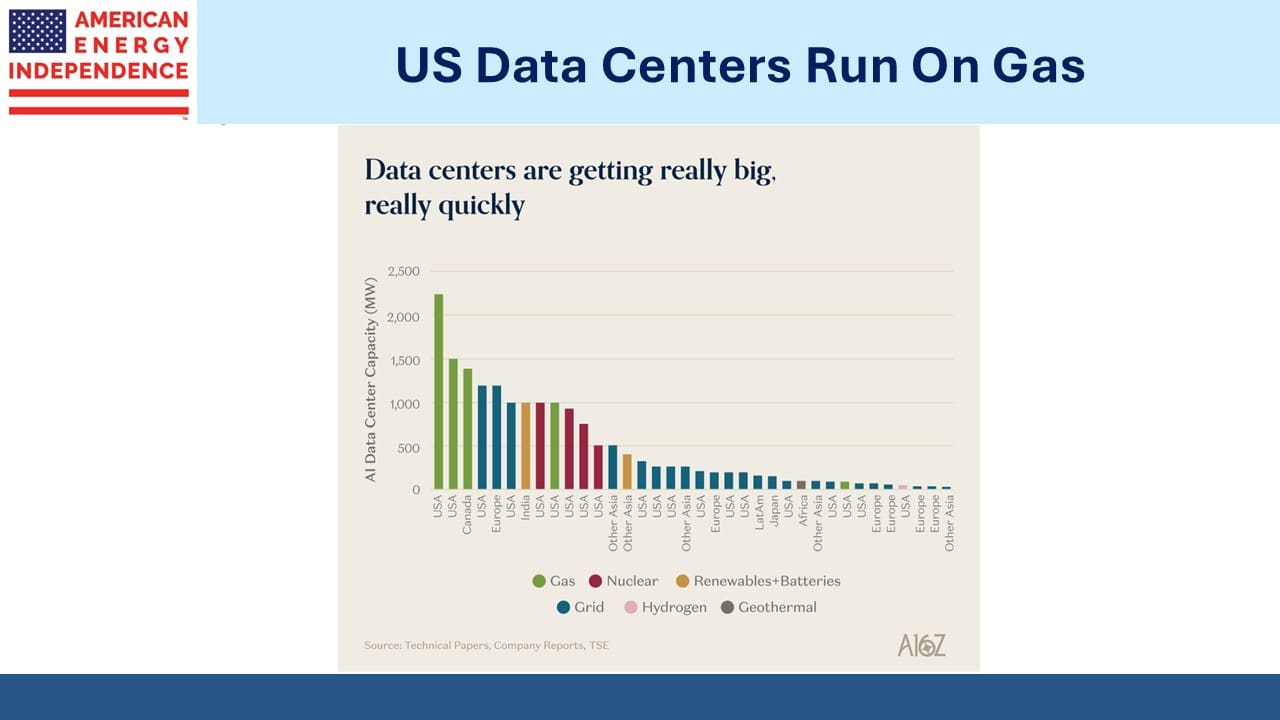

This is why four of the five biggest data centers in the US are being built to run primarily on natural gas. The renewables + batteries combination, the only way to harness sun and wind reliably, is nowhere in sight.

Elong Musk, an original thinker who executes his big, bold ideas, has suggested that data centers operating in orbit where they can constantly re-position for 24X7 sunlight will become cost-competitive within 4-5 years.

Natural gas currently provides 43% of US electricity. This is higher than almost any other OECD country (Italy is 44%). Gas has been increasing its share of power supply for decades, a trend that we believe will continue. This is because the growth in electricity demand is largely from data centers, and they are going to rely on gas for much more than 43% of their power needs.

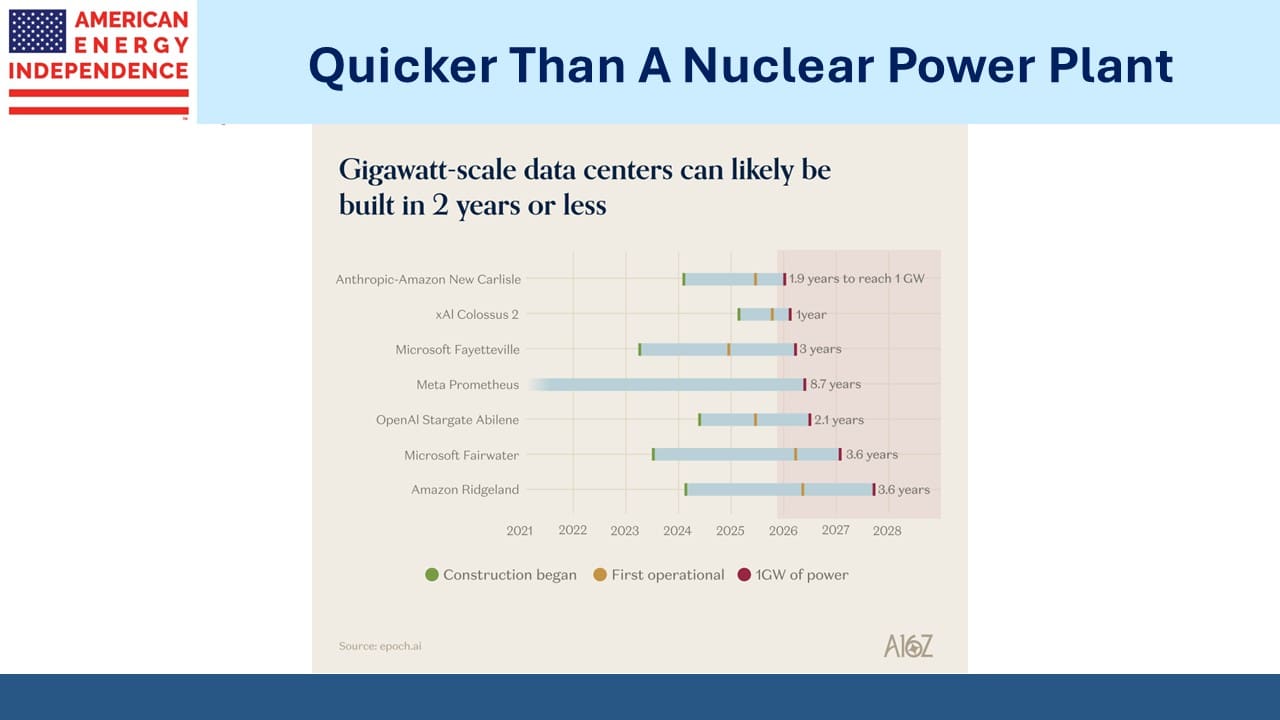

For those who worry that an AI bubble will derail this source of growth, many projects are already under construction. Returns to the financiers of the AI boom may be unsatisfactory, but losses to the investors in fiber optic cable built during the dot com bubble didn’t prevent it from being used by subsequent owners.

Once capital is invested in fixed infrastructure, covering the variable costs can be sufficient to assure its operation even if the returns on that initial capital are poor.

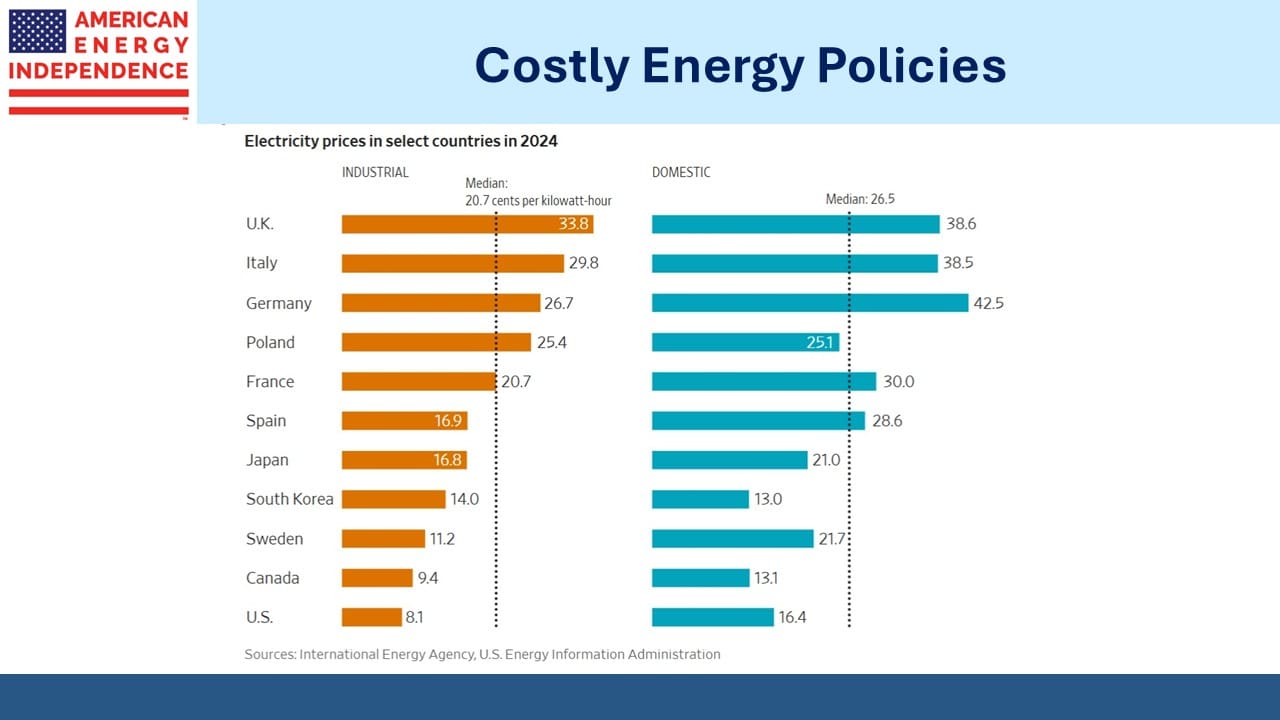

The US is better positioned than the EU to develop AI capabilities. Years of progressive energy policies have reduced greenhouse gas emissions across Europe but at a significant cost. (see Europe’s Green Energy Rush Slashed Emissions—and Crippled the Economy). Voters were fooled by renewables advocates into believing an era of cheap, abundant energy was at hand.

“Very clearly the cost of the transition has never been admitted or recognized,” said Gordon Hughes, a professor at the University of Edinburgh and a former adviser on energy to the World Bank. “There is a massive dishonesty involved.”

The region is slowly de-industrializing because of high energy prices, slow GDP growth and falling birth rates. Most countries will want data centers that they rely on to be located within their national borders. The commercial case for building anything in Europe is weakening every year.

The growth in gas demand caused by feedstock for Liquefied Natural Gas (LNG) export terminals continues to draw skeptical analysis from those warning of a supply glut in the years ahead.

This cautious outlook also doesn’t square with the facts. LNG exporters sign long-term Sale Purchase Agreements (SPAs) with shippers that go out 10-20 years. These are generally investment grade counterparties who have committed to pay for liquefaction whether or not they use it. Cheniere has sold 90% of their capacity through 2035.

It seems implausible that these buyers have made long term commitments without having the other side of the trade locked in. There’s little reason for them to speculate on global natural gas prices many years in the future. If there is a supply glut, it shouldn’t hurt the LNG export terminals.

If for example Kogas of South Korea declined to use some of their already purchased liquefaction capacity, the LNG operator could use it themselves in effect for free since it’s already been paid for. Or Kogas could use it at a loss, as long as they covered their variable cost since the liquefaction fee is in effect a capital commitment.

As noted above in the cases of fiber optic cables and data centers, a cash profit that covers variable costs and contributes to fixed costs can support the operation of an asset even if it results in a poor return on capital for the owner.

This year’s news developments for midstream have largely confirmed the positive outlook that took hold last year. The absence of anything further has caused many investors to turn to more exciting areas, such as AI and growth stocks, for example. Meanwhile, the fundamental bullish case for midstream is only getting stronger.

We have two have funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!