Rallying Crude

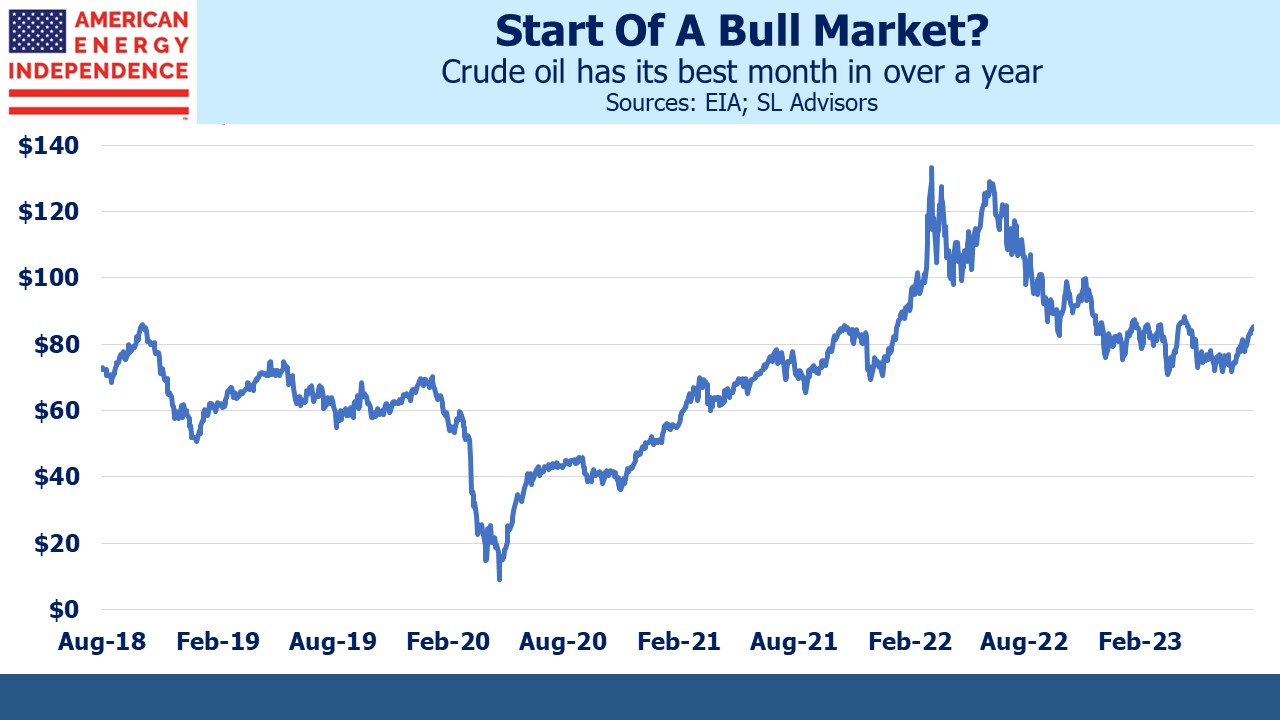

It doesn’t look like a bull market, but July was crude’s best month in more than a year with the Brent benchmark closing up almost $11 per barrel at over $84. After peaking in spring of last year following Russia’s invasion of Ukraine, crude oil has been sliding irregularly lower. Russia has found ways to get its product to market, to the quiet relief of western Europe’s governments whose application of sanctions has been constrained by a desire to avoid causing a price spike. China’s long Covid lockdown further depressed demand.

OPEC wants stable, high prices and regularly tweaks output to that end. Traders now expect Saudi Arabia to extend their voluntary production cuts of one Million Barrels per day (MMB/D) into September. The US is also replenishing the Strategic Petroleum Reserve following the Administration’s blatantly political release of reserves in the run up to last year’s mid-term elections.

Recession fears are also receding, helped by last week’s US 2Q GDP report. Goldman Sachs recently increased their forecast for global oil demand but stuck to their one year forecast of $93 for Brent. For now, the Fed has confounded the skeptics who believed monetary tightening would cause a recession (see Jay Powell’s Victory Lap)

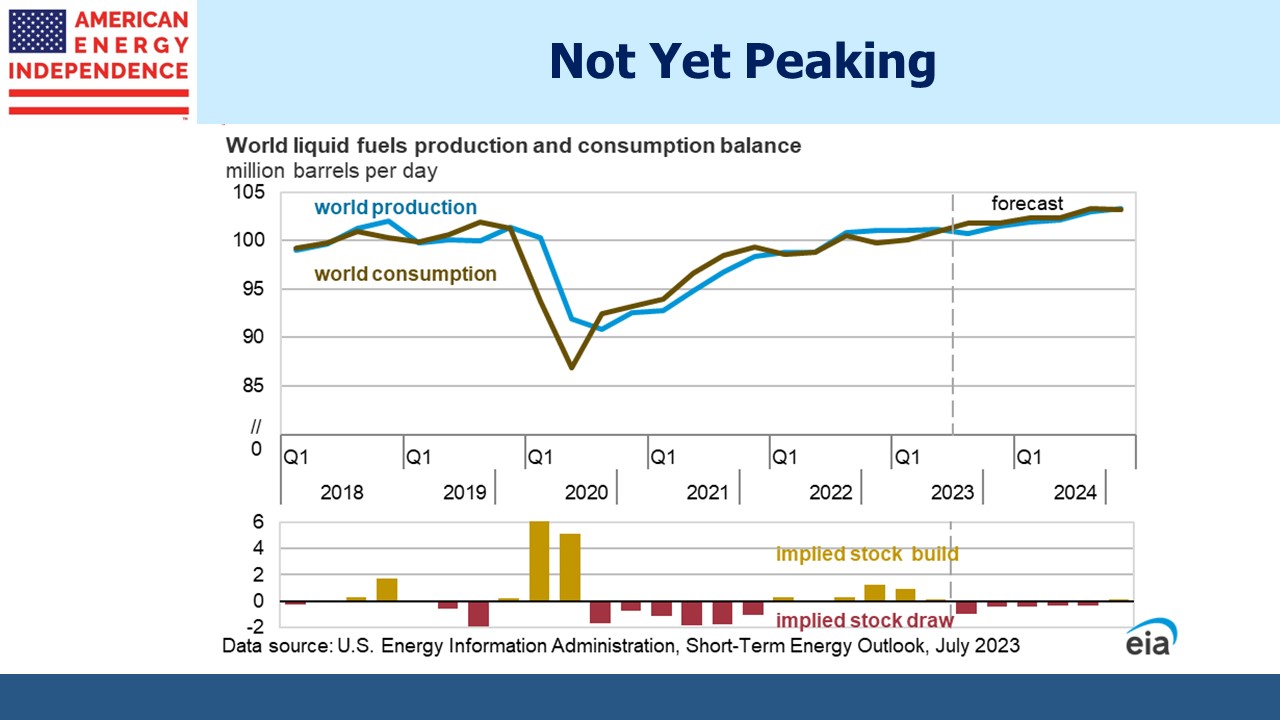

Peak oil is still out there somewhere, but for now demand keeps growing. The US Energy Information Administration (EIA) calculates that the second quarter saw record global liquids consumption of 100.96 MMB/D, marginally above the prior record of 3Q18 (100.91 MMB/D). For 2024 the EIA is forecasting 102.80 MMB/D, up from 101.15 MMB/D this year.

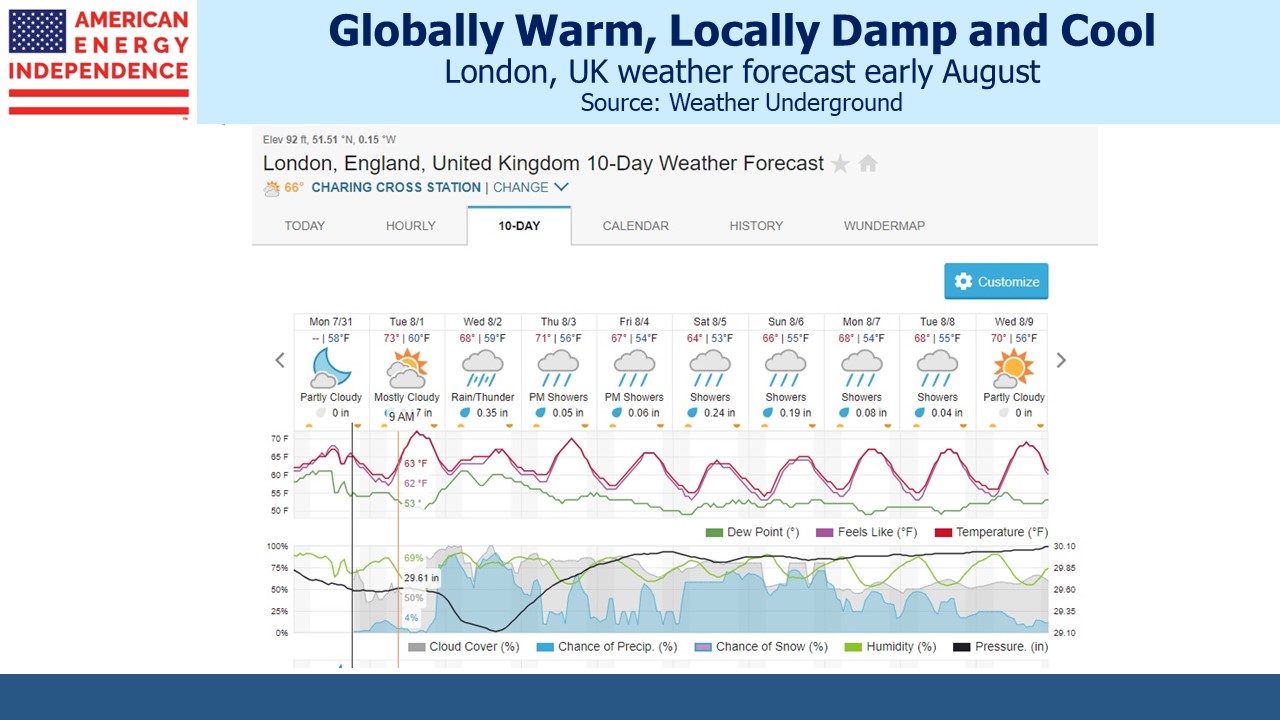

The hot weather we’ve recently experienced in the US has boosted energy demand. But above average temperatures haven’t been the norm throughout the northern hemisphere. In any case, your blogger finds 90+ degrees less distressing than most following a childhood in the UK where the climate is euphemistically referred to as “temperate”, thanks to the moderating effect of the gulf stream. Damp and cool might be more accurate, as the current forecast shows. Britain’s efforts at lowering CO2 emissions are especially selfless, because they could surely benefit from an extra couple of degrees.

Record natural gas consumption for power generation has helped keep Americans cool over the past few days, with an estimated 52.9 Billion Cubic Feet (BCF) burned last Friday. That compares with an average daily consumption forecast for this year by the EIA of 34.5 BCF, which is up 1.3 BCF/Day from 2022.

Union Pacific expects railroad shipments of coal to receive a warm weather boost, as coal-burning power plants ramp out consumption to meet increased demand for air conditioning. However, coal is rapidly losing its share of power generation at 15%, down from 28% five years ago. Natural gas remains America’s favorite source of power at 41% this year, up from 39% last year. Solar is at 4% and wind 11%, both flat year-on-year.

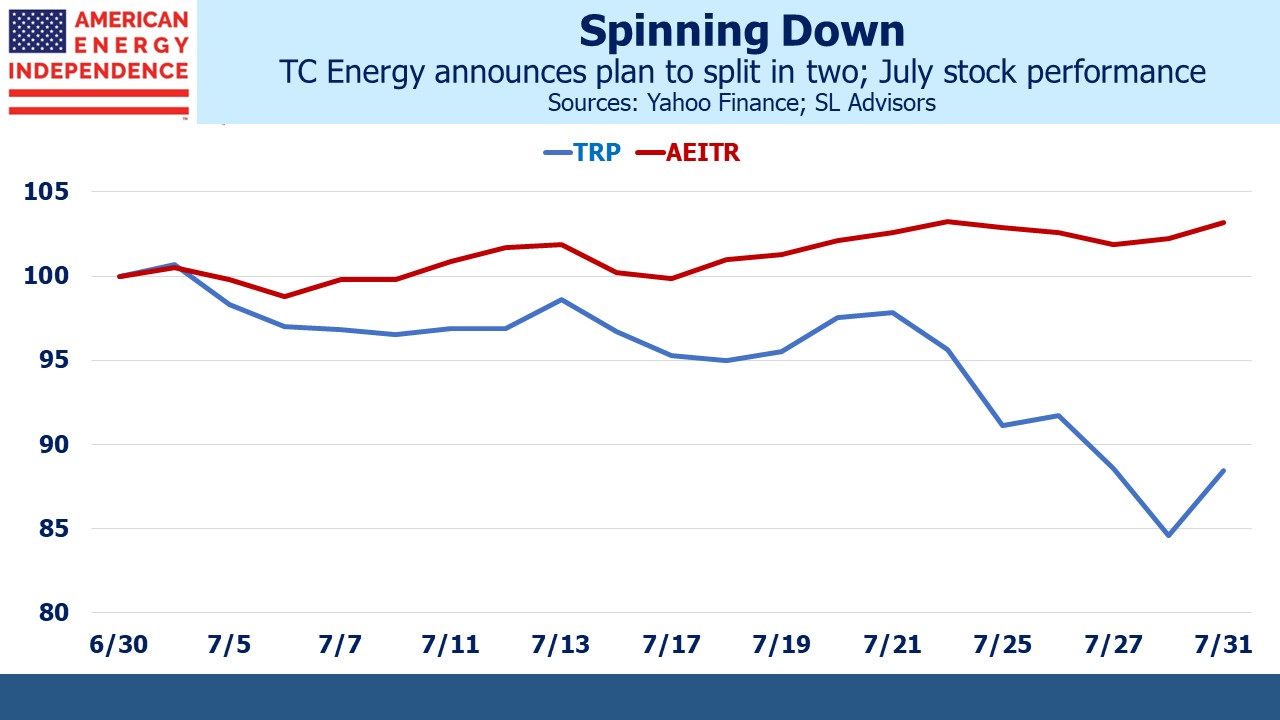

TC Energy (TRP) announced they’d be splitting the company into two last week on Thursday, 27th. Usually such announcements boost a company’s stock because it’s assumed each new entity will benefit from more focused management attention. Oddly, TRP sank on the news.

Three days earlier TRP had announced the sale of 40% of their Columbia pipeline system to Global Infrastructure Partners. The 10.5X EBITDA multiple was below what some analysts had valued the business at in their sum-of-the-parts analysis. This was followed by the spin-off announcement, and the relatively high projected 5.0X Debt:EBITDA leverage of the new stand-alone liquids business is high relative to peers.

After the price drop, TRP now yields over 8%. Canadian pipeline companies have a more robust history of maintaining dividends than their southern counterparts. A sustainable dividend at this level is likely to find value-oriented buyers.

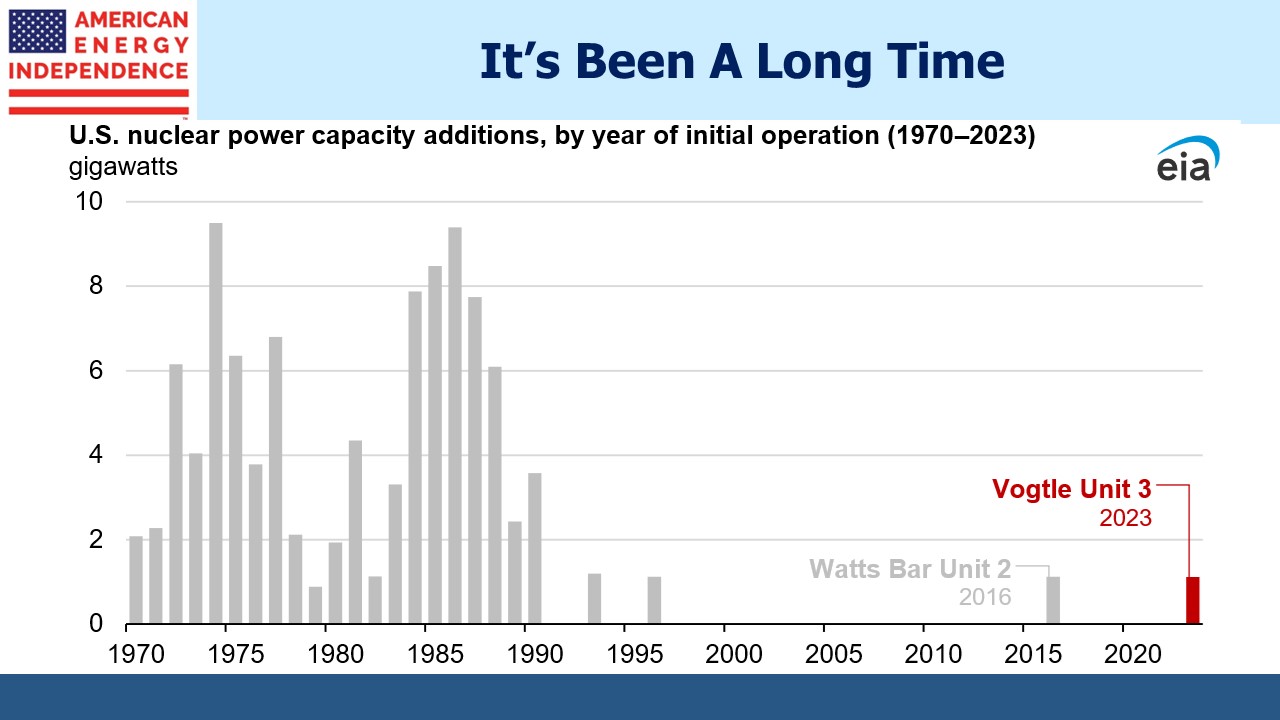

Finally, the Vogtle nuclear power plant in Georgia began commercial operations recently. It’s the first new nuclear power plant in the US since 2016 and only the second since 1996. The long hiatus since the early 1990s reflects public skepticism about nuclear safety along with the successful use of legal challenges by opponents to impede development. Nuclear power is expensive because our broken permitting process allows opponents to use the courts to insert unpredictable delays. This boosts the cost, thereby depressing the IRR. The same techniques have been used to delay needed pipeline infrastructure.

The Mountain Valley pipeline is an example – even though Congress recently fast-tracked its approval under the Fiscal Responsibility Act that headed off a debt ceiling crisis, a DC court still saw fit to impose a stay on resumed construction. It took an emergency ruling from the US Supreme Court (a “stay of the stay”) to allow construction to begin again. Long distance high power transmission lines and the related infrastructure in support of solar and wind will face similar headwinds. Reform of infrastructure permitting is an issue that both ends of the political divide should agree is well overdue.

We have three funds that seek to profit from this environment: