Pipeline Stocks Defy Retail Fund Selling

/

Midstream is up 27% for the year as of Tuesday, but investors are showing no irrational exuberance. The North American pipeline sector retains its MLP moniker because MLPs used to be the dominant business structure. Even though it’s now two thirds corporations, the ‘40 Act funds who specialize in the sector are still called MLP funds.

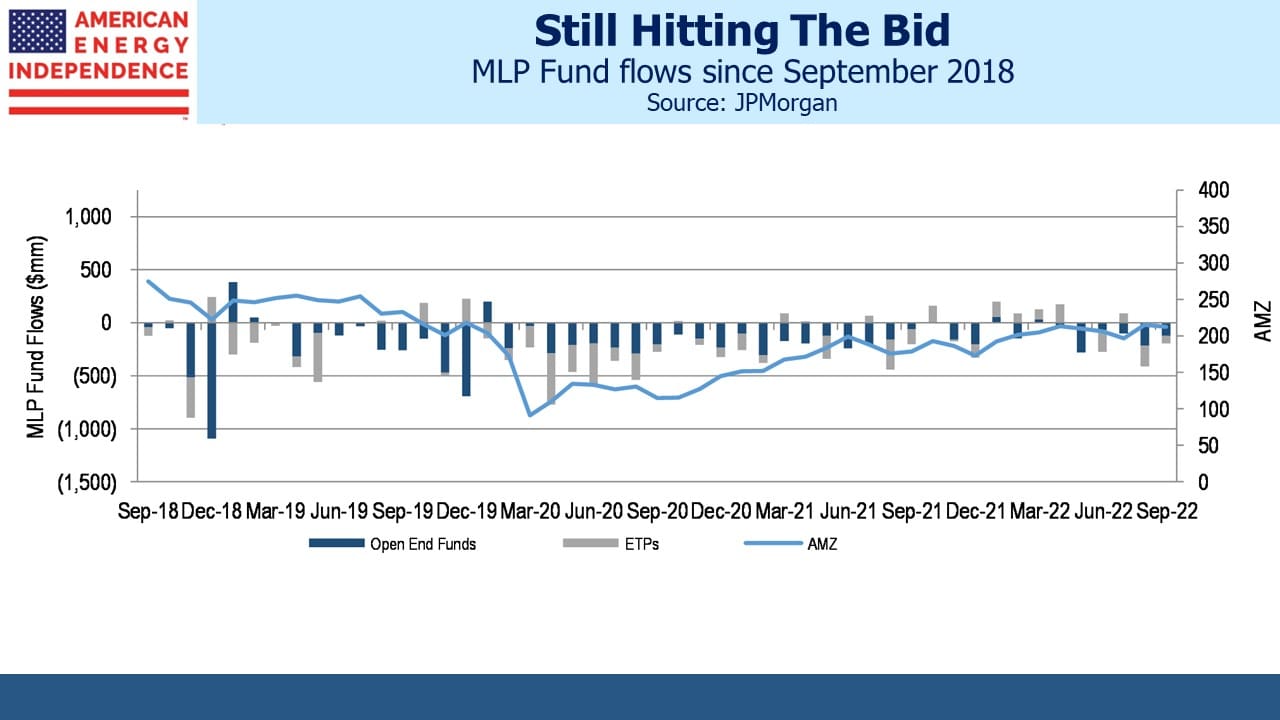

Investors have been exiting MLP funds for several years. JP Morgan calculates that 2016 was the last calendar year that saw inflows. The shale bust led to distribution cuts and saw several big MLPs convert to corporations. They did this in search of a broader investor base but often created a poor tax outcome for their MLP holders. The archetypal K-1 tolerant, US taxable, income seeking investor (ie rich old American) left in disgust. The Covid collapse in March 2020 was, for some, the last straw.

Fund flows are a notoriously poor predictor of performance. Look at the ARK Innovation ETF, where inflows were synchronized with its peak in early 2021. Within a year it had achieved the ignominy of earning a negative return on the average dollar invested (see ARKK’s Investors Have In Aggregate Lost Money).

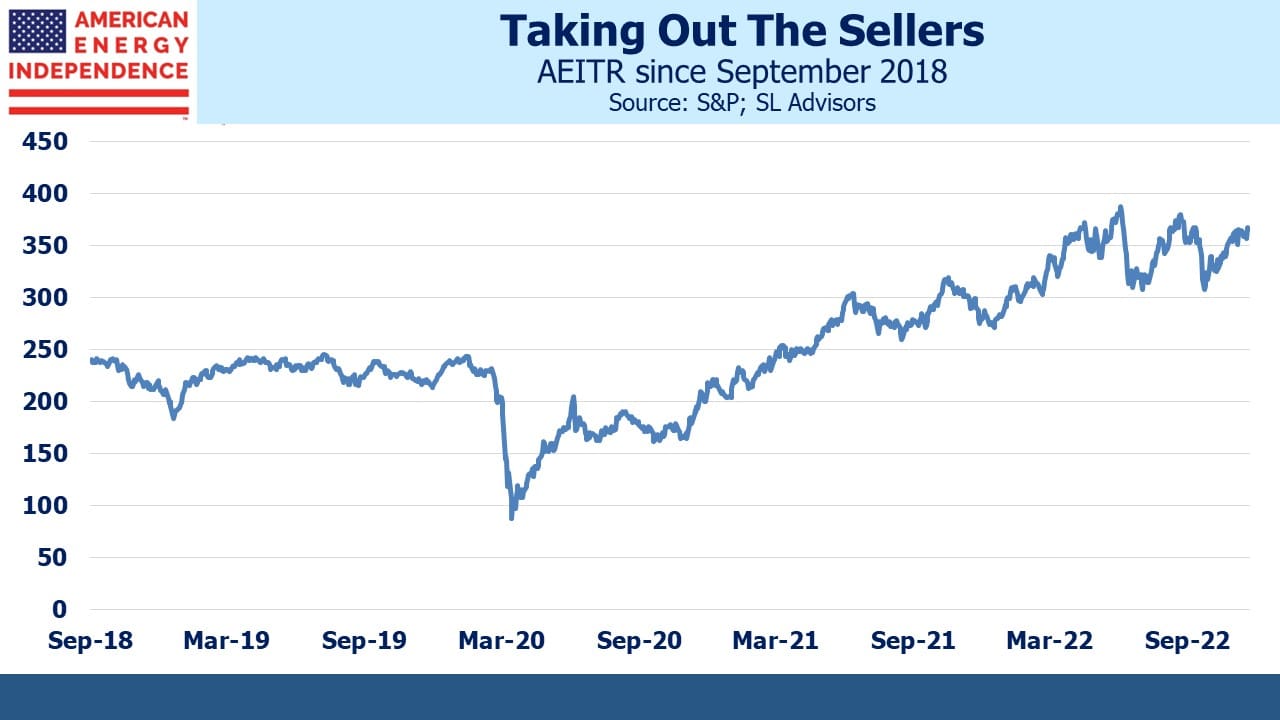

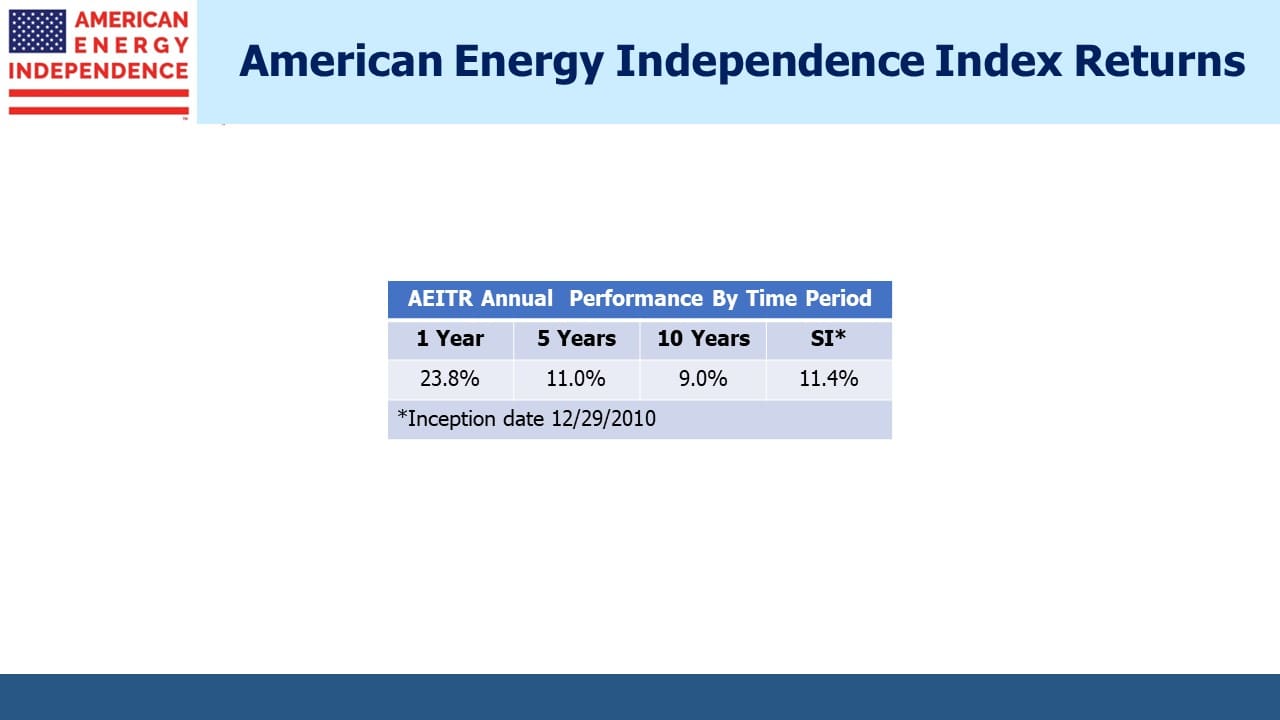

The history of MLP fund outflows coincides with a generally declining Alerian MLP Index (AMZ), but that is misleading because AMZ omits pipeline corporations which are held by the more diversified funds. Since September 2018 (the beginning of the fund flow chart) the broad and therefore more representative American Energy Independence Index (AEITR) has returned 10.8% pa.

The fundamentally bullish case for the sector is familiar to regular readers. However, the positive return despite persistent retail selling of MLP funds is another reason for optimism. If prices are rising when investors are turning away, it suggests that even a cessation of outflows could provide a further boost.

Morgan Stanley calculates that for the first nine months of this year midstream companies repurchased over $3.1BN in stock. This more than offset the selling of MLP funds by retail investors. What could be more bullish than the less informed selling to the better informed?

Investors like the link to PPI inherent in pipeline tariffs. It allows the companies to raise prices in line with inflation, expectations for which have remained surprisingly quiescent. The ten year CPI implied by treasury yields minus TIPs is a remarkable 2.28%. Since the next year will be well over the Fed’s 2% target, investors seem very comfortable that inflation will be back at pre-pandemic levels soon after. The University of Michigan survey provides a slightly different view, with CPI for the year ahead expected to be 5% and 2.9% over the long run.

More consumers report hearing about inflation hurting business conditions, and 43% report that rising prices are eroding their own living standards, up from 20% a year ago. John Williams, president of the Federal Reserve Bank of New York, warned that the unemployment rate could reach 5% as the Fed cools the economy, which would mean around 2.5 million extra unemployed.

With the unemployment rate at 3.7% and inflation just under 8%, the Employment Cost Index (ECI) is rising at 5%. This still leaves many workers worse off in real terms. Greater awareness of inflation as shown in the Michigan survey suggests it will figure more in pay demands as well as spending patterns where half of consumers report cutting back.

Four railroad unions have rejected a 24% pay increase over four years, threatening a strike that could cripple the movement of freight across the US. Congress may force them back to work. The US has a history of legislating against the disruption caused by strikes. In 2005 the New York City transit system shut down for a couple of days over a pay dispute. Under the law, the union leader was sentenced to ten days in prison and the union fined $2.5 million. Workers can strike but not if it causes substantial economic harm, which seems right.

By contrast, in the UK workers on the London underground schedule one day strikes every couple of weeks. An email update sent to travelers in early November breezily advised that there are “lots of public transport options” but added, “There are also some planned strikes taking place over the weekend and into next week.” There is no equivalent legislation that prevents a small group from inconveniencing millions, a significant omission from UK labor law reflecting the country’s liberal leanings.

It’s one reason why UK inflation tends to run higher than in the US.

Upcoming ECI releases will be interesting because pay raises tend to come around year end. Consequently, the December and March ECI seasonal adjustments correct for this and lower the index. The seasonal factors are based on pay increases in a world of 2% inflation. With pay raises running at 5% and the job market robust, it would seem that the ECI could reflect higher than normal pay raises because the seasonal adjustments will be inadequate. Inflation will appear more entrenched, requiring a higher rate cycle peak.

The December ECI is some way off – the September report will be released on December 15th. Inflation won’t return to 2% until workers accept reduced compensation. There’s plenty of reasons to think this won’t happen soon.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!