AMLP Trips Up On Tax Complexity

/

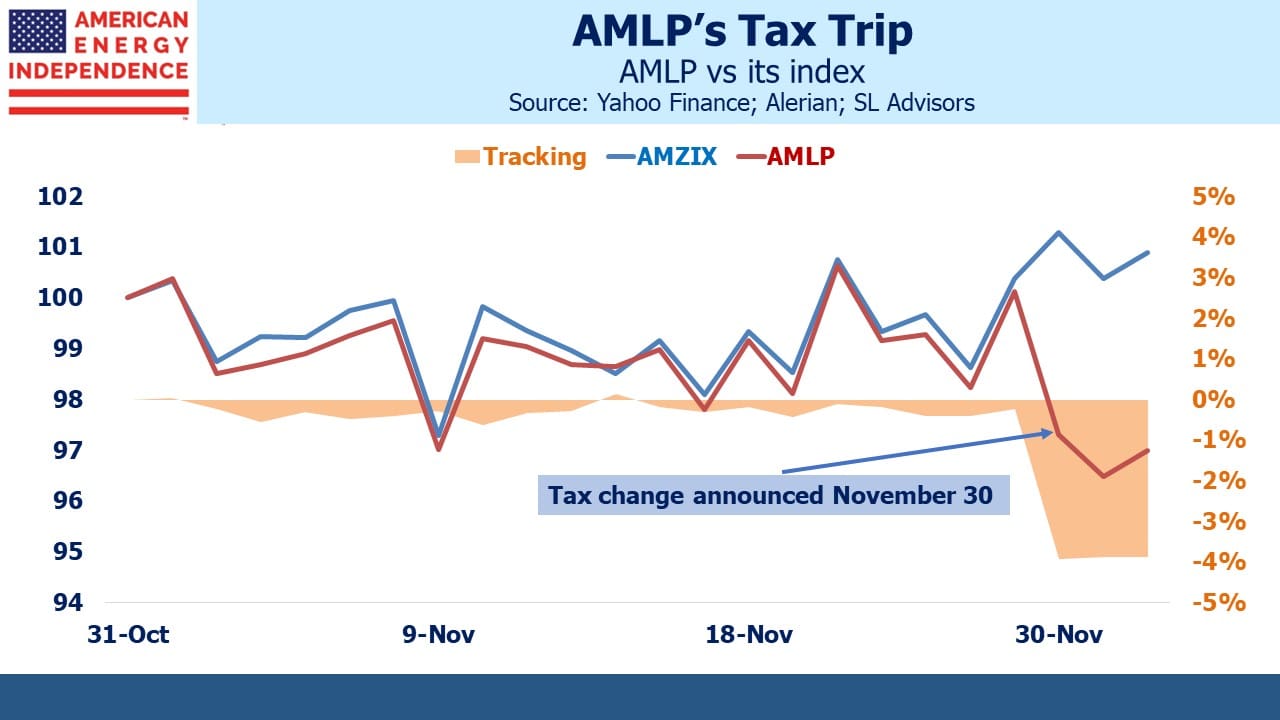

We all know the US tax code is complicated. ALPS Advisors, manager of the Alerian MLP ETF (AMLP), has been tripped up by the tax complexities inherent in their fund structure. As a result they’ve been forced to make an embarrassing NAV adjustment to AMLP for taxes, depressing the fund’s NAV by almost 4%. It must be frustrating for recent buyers, since it shifted the fund to a 2.7% monthly loss, 3.9% behind its index.

AMLP is that rare ‘40 Act fund that pays corporate tax. Under the 1940 Investment Company Act, mutual funds and ETFs, which are corporations, can qualify to be RICs (Regulated Investment Companies) and therefore be exempt from corporate tax if they meet certain rules. These include being fully invested in securities, meeting certain diversification thresholds and so on. Almost all such funds qualify. Investing more than 25% of your assets in Master Limited Partnerships (MLPs) fails the test to be a RIC.

AMLP holds MLPs because in 2010 when it was launched, midstream energy infrastructure businesses were mostly MLPs, not corporations. AMLP provides a way for retail investors who don’t want K1s to invest in MLPs – but at the cost of lower returns because AMLP first pays corporate taxes on its realized returns before making distributions to its investors. We’ve written about this in the past (see AMLP’s Tax Bondage and Uncle Sam Helps You Short AMLP).

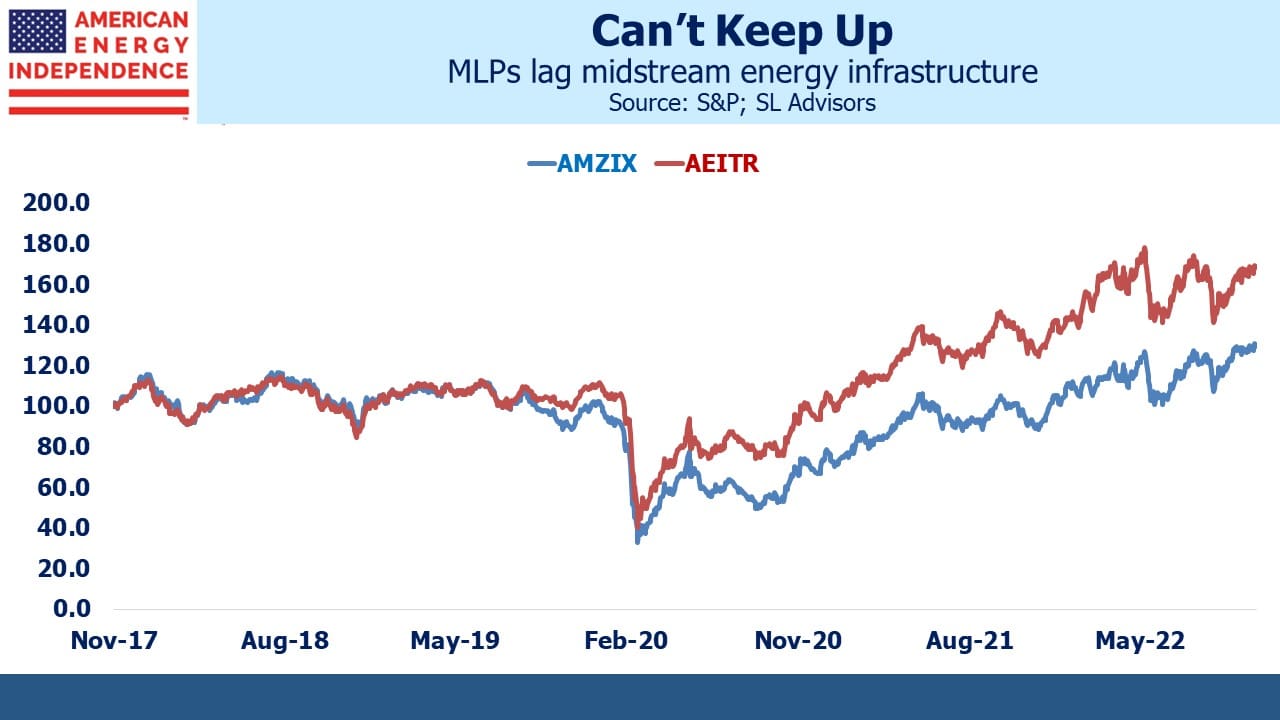

An MLP-dedicated portfolio is out of touch with today’s sector, since many MLPs have converted to be corporations. The pool of money willing to invest directly in MLPs is limited to K1-tolerant US taxpayers – older, wealthy Americans. US equities are overwhelmingly held by institutions such as pension funds, endowments, foundations and sovereign wealth funds. These investors are mostly exempt from US taxes, so they avoid MLPs because it would create a tax liability for them. Only two of the ten biggest North American pipeline businesses are MLPs – the rest are corporations.

Several years ago the Federal Energy Regulatory Commission (FERC) announced a change in how their expenses were calculated that was adverse to natural gas pipeline MLPs. Taxes owed by their investors used to be included in the operating costs on which MLPs based their tariffs. FERC’s new rule would have lowered revenues, so natural gas pipelines soon converted to corporations to sidestep the issue.

It’s another example of the tax complexity that comes with MLPs. Although FERC later modified their stance, today’s MLPs tend to be (i) more liquids/less natural gas oriented, (ii) smaller, and (iii) more levered. The pipeline sector and MLPs are no longer synonymous.

AMLP has stuck with MLPs despite their shrinking relevance. If they considered diversifying into corporations this would put downward pressure on their current holdings, depressing their NAV and alarming investors. They’d need to obtain shareholder approval for this change of strategy and doing so would signal to the market an impending seller of MLPs. Many investors use AMLP to achieve pipeline exposure and, in our experience, few consider either the dwindling number of MLPs or the tax drag on returns. If AMLP was created today it would include pipeline corporations, in order to reflect the entire industry. It is an anachronism.

It now appears that AMLP investors must consider tax uncertainty on top of the haircut this imposes on returns. In their press release ALPS Advisors blames the NAV reduction on tax legislation passed in 2017, as well as the Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”), which was passed in March 2020. The problem is not recent.

AMLP’s tax liability is updated daily, which suggests some certainty around its calculation. It looks as if ALPS had to modify their interpretation of the tax code, resulting in the sudden 3.9% NAV reduction. It must be complicated. Going forward, investors can no longer rely on the published tax liability. The press release warns that, “the daily estimate of the Fund’s deferred tax liability used to calculate the Fund’s NAV could vary significantly from the Fund’s actual tax liability.”

In other words, if ALPS gets their tax math wrong again, investors might face another big NAV adjustment. Because AMLP is a tax-paying entity and the tax code is fiendishly complicated, you can’t rely on the NAV being accurate.

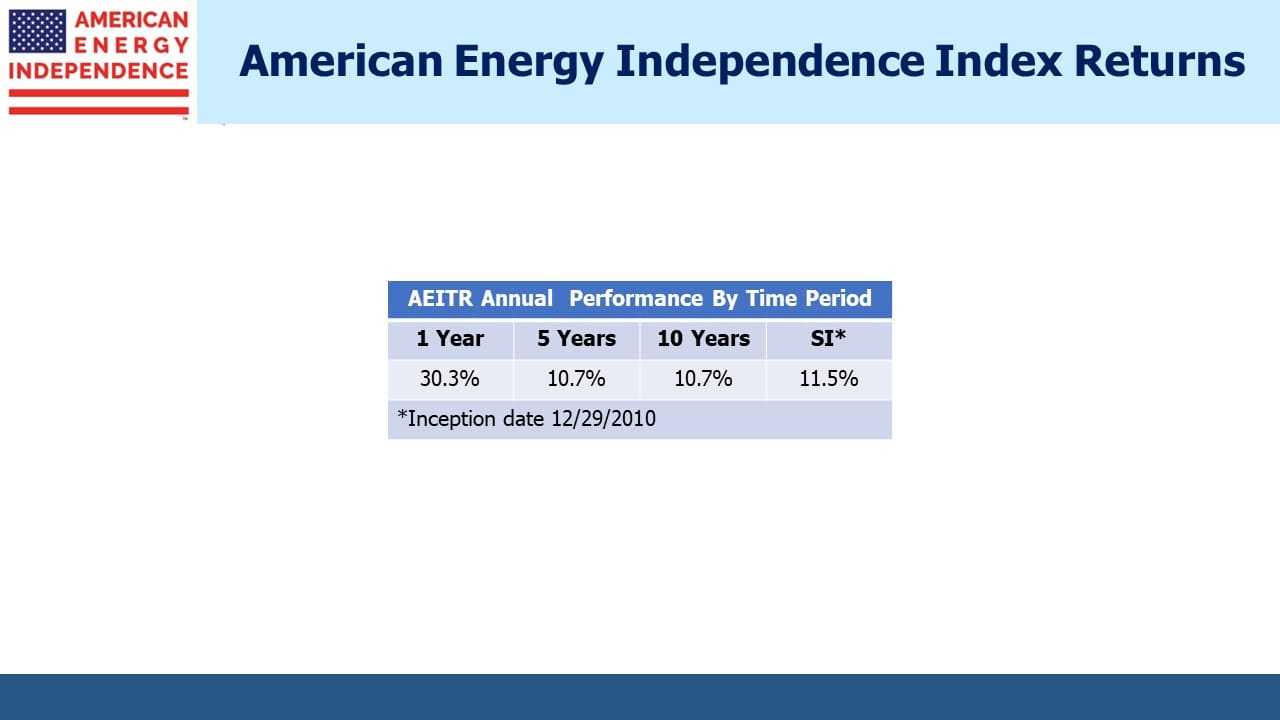

Over the past five years, AMLP has significantly lagged the midstream energy infrastructure sector, because MLPs have lagged corporations and been more likely to cut their distributions. Investor inertia has presented little reason for any changes but lagging performance and now uncertain tax expense leave little here for the discerning investor.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Leave a Reply

Want to join the discussion?Feel free to contribute!