Pipeline Companies Should Buy More Stock

The energy sector has long been criticized for reinvesting too much capital back into its business, without ensuring that such investments exceed their cost of capital. No business can survive unless its return on investments is more than the cost of financing them.

Equitrans Midstream Corporation (ETRN) has an opportunity to demonstrate that they understand this.

ETRN’s major initiative is the Mountain Valley Pipeline (MVP) project, a natural gas pipeline with 2 Billion Cubic Feet per Day (BCF/D) of capacity connecting the Marcellus shale in West Virginia with customers in southern Virginia. Environmental extremists have been using the courts to block MVP for years, but ETRN management remains confident in its ultimate completion — albeit less so on the timing.

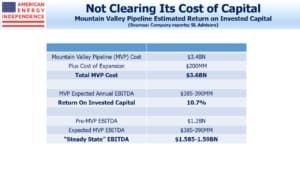

The first stage of the project, including feeder systems Hammerhead and the Equitrans Expansion Project, is expected to cost $3.4BN and generate $320MM in EBITDA. So the initial investment has a cash-on-cash return of 9.4%, well below the company’s target of a mid-teens IRR.

ETRN management believes they could add another 0.5 BCF/D of capacity for just $200MM. This would generate an additional $65-70MM in EBITDA, a whopping 33.7% Return On Invested Capital (ROIC). Expansion projects often have high returns, since they leverage off existing infrastructure and face less uncertainty.

The expanded MVP should generate $385-90MM on $3.6BN of capital, a 10.7% return. ETRN clearly needs to complete MVP – most of the capital has already been deployed. And the expansion, with its 33.7% ROIC, is an easy decision. But how should they think about allocating capital in the future, once this project is done?

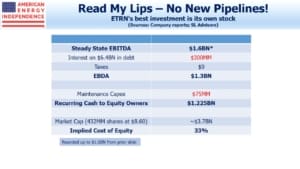

Currently, ETRN generates EBITDA of around 1.2BN. Following MVP’s completion, this will increase to $1,587MM, which we’ll round up to $1.6BN. A reasonable estimate of the sustainable cash flow to the owners is to start by deducting interest expense ($300MM on $6.4BN of debt) and taxes (which are currently zero as depreciation charges offset its taxable income). The company spends $75MM on maintenance capex, which is generally intended to offset depreciation and amortization, both of which are non-cash expenses. So the company will be generating $1,225MM for its owners.

ETRN’s 432 million shares at $8.60 give it a market capitalization of just over $3.7BN. Its cost of equity is therefore 33%.

A company is supposed to invest so that its ROIC is more than its Weighted Average Cost of Capital (WACC). In this case, assuming ETRN finances its assets with 50% debt which costs 4.7%, its WACC is 18.85%. Any project that fails to earn a return above this WACC is destroying value for the owners.

The disconnect between ETRN’s cost of equity and debt isn’t unique to them – it’s common across midstream energy infrastructure. Enterprise Products Partners (EPD) common units pay over a 10% dividend and trade at a 17% distributable cash flow yield, while it has 30 year debt outstanding yielding under 4% (see Tech Stocks Have Energy). Stock and bond investors hold sharply different views on pipeline stocks.

When EPD canceled an $800MM investment in a crude oil pipeline recently, the stock rose because this meant more cash for buybacks (see Investors Like Less Spending).

What it means is that ETRN should consider buying back equity as a use of capital competing with any other investment they might consider. Although the MVP expansion offers an ROIC comparable to the company’s cost of equity, they don’t have any other projects that come close to earning that type of return. In fact, the company has indicated they are seeking a mid-teens internal rate of return on new projects, so they’re not even trying to beat their WACC.

This makes no sense, based on ETRN’s stock price. Too many companies regard growth projects as an unassailable part of their business, almost a raison d’etre. They have a culture of always building. It’s because they’ve ignored this type of math that pipeline stock prices are so low.

Once MVP is finished, ETRN will demonstrate their grasp of corporate finance based on whether they recognize that buying back their stock is the best use they can make of their cashflow. If instead, they pursue the next growth project with a projected return half their cost of equity and even below their WACC, they’ll be confirming their financial innumeracy.

Too many midstream CFOs find grasping their cost of equity an elusive concept. If the components of WACC were reversed such that the cost of debt was 32%, few projects would be more attractive than paying down debt.

The distortion in capital markets between debt and equity should compel the entire midstream sector to reassess how they deploy their free cash flow, which is set to grow substantially (see Pipeline Cash Flows Will Still Double This Year).

Even Targa Resources, a company with a long history of flunking the math of capital allocation (see Pipeline Buybacks and ESG Flexibility), recently surprised many by correctly initiating a buyback. As others follow, the boost to their stock prices will be substantial.

We are invested in all the components of the American Energy Independence Index via the ETF that seeks to track its performance.