Midstream And Variable Costs

Renewables’ advocates are fond of linking solar and wind with the power needs of data centers. Superficially, the marriage of new technology and new energy seems inevitable. Bloomberg New Energy Finance (BNEF) is just one example of media outlets that are telling this story (see Power Hungry Data Centers Are Driving Green Energy Demand).

Inconveniently, this narrative is at odds with the facts. Intermittent power that runs 20-40% of the time is not an obvious choice for customers whose acceptable annual downtime is measured in seconds. Solar and wind can be cheap if you’re willing to be opportunistic in your use of electricity, but few of us are so accommodating.

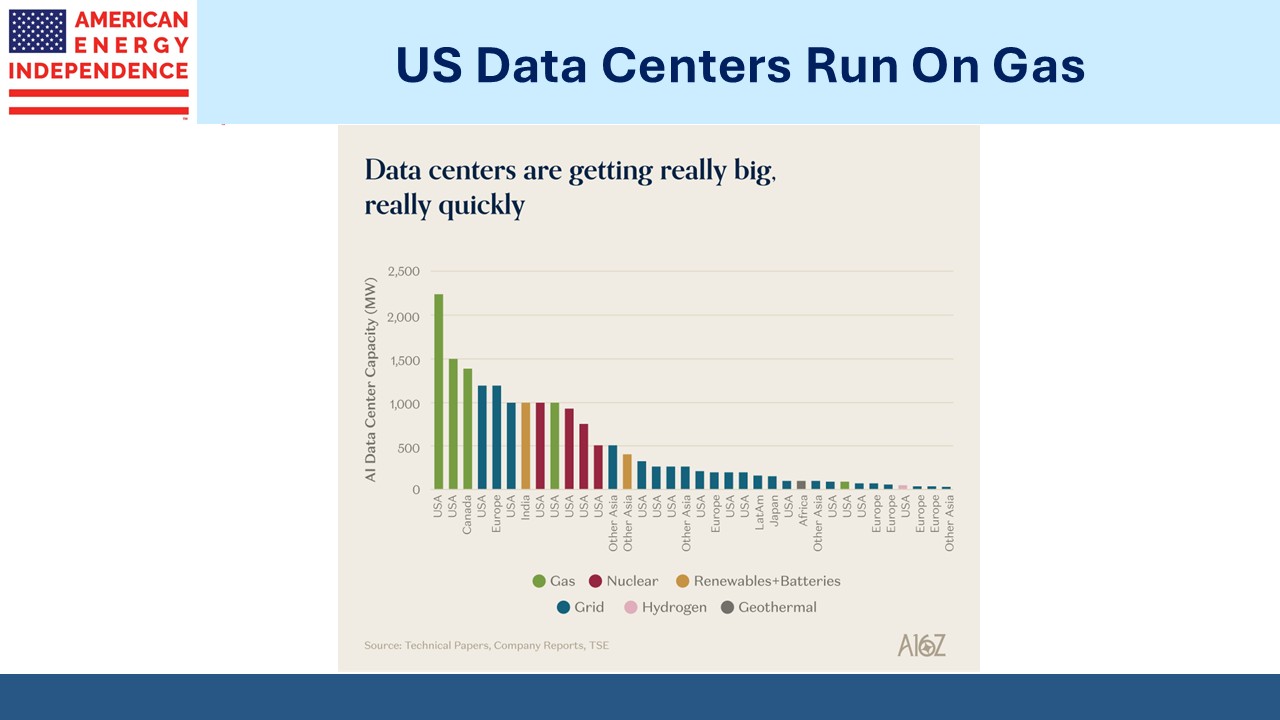

This is why four of the five biggest data centers in the US are being built to run primarily on natural gas. The renewables + batteries combination, the only way to harness sun and wind reliably, is nowhere in sight.

Elong Musk, an original thinker who executes his big, bold ideas, has suggested that data centers operating in orbit where they can constantly re-position for 24X7 sunlight will become cost-competitive within 4-5 years.

Natural gas currently provides 43% of US electricity. This is higher than almost any other OECD country (Italy is 44%). Gas has been increasing its share of power supply for decades, a trend that we believe will continue. This is because the growth in electricity demand is largely from data centers, and they are going to rely on gas for much more than 43% of their power needs.

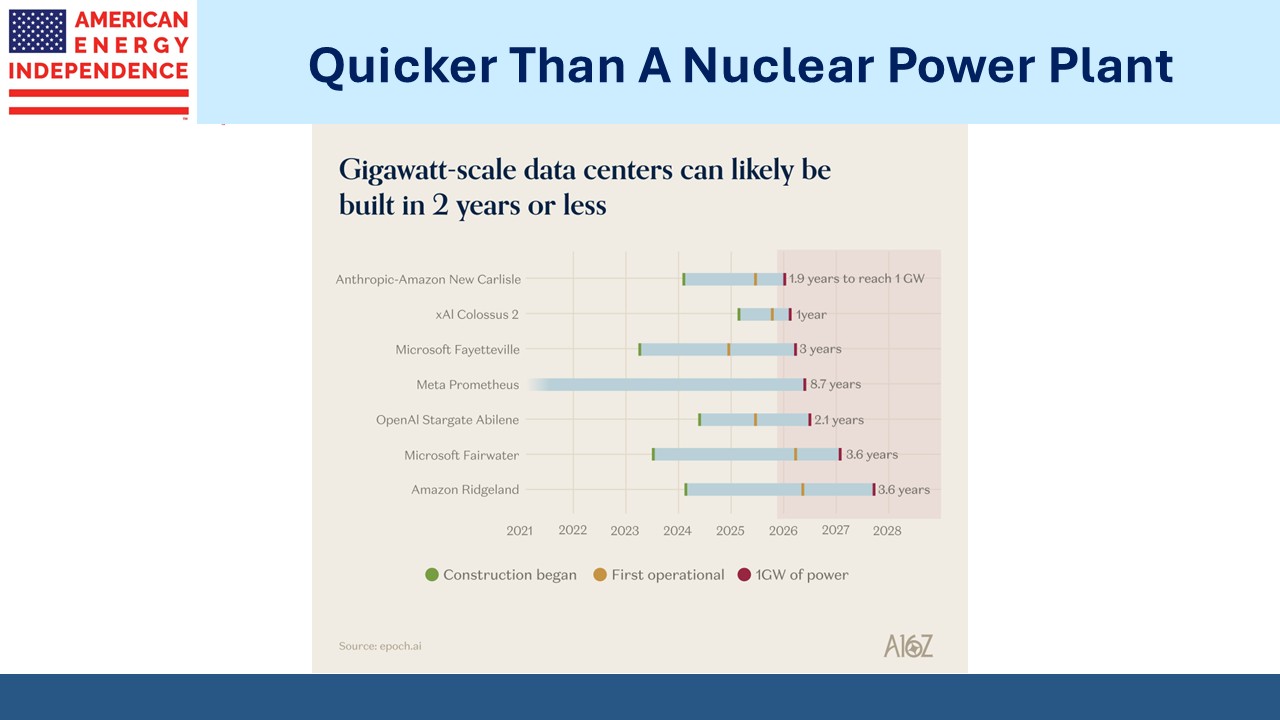

For those who worry that an AI bubble will derail this source of growth, many projects are already under construction. Returns to the financiers of the AI boom may be unsatisfactory, but losses to the investors in fiber optic cable built during the dot com bubble didn’t prevent it from being used by subsequent owners.

Once capital is invested in fixed infrastructure, covering the variable costs can be sufficient to assure its operation even if the returns on that initial capital are poor.

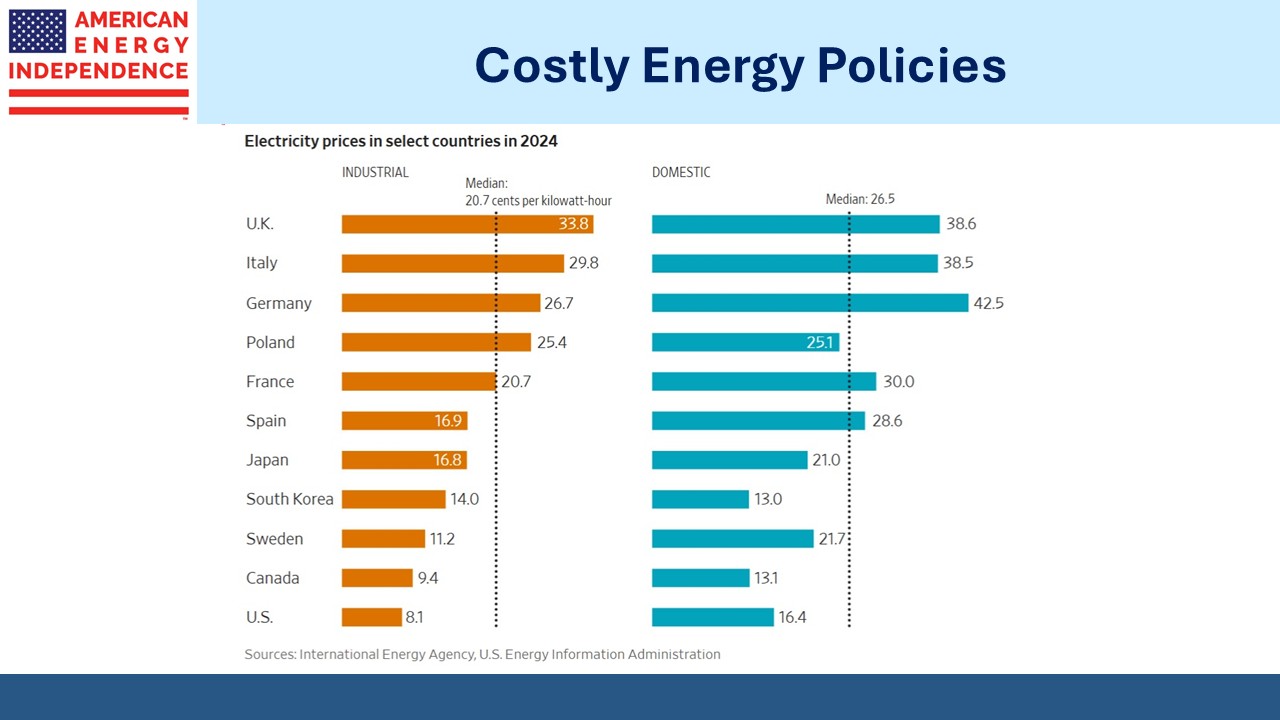

The US is better positioned than the EU to develop AI capabilities. Years of progressive energy policies have reduced greenhouse gas emissions across Europe but at a significant cost. (see Europe’s Green Energy Rush Slashed Emissions—and Crippled the Economy). Voters were fooled by renewables advocates into believing an era of cheap, abundant energy was at hand.

“Very clearly the cost of the transition has never been admitted or recognized,” said Gordon Hughes, a professor at the University of Edinburgh and a former adviser on energy to the World Bank. “There is a massive dishonesty involved.”

The region is slowly de-industrializing because of high energy prices, slow GDP growth and falling birth rates. Most countries will want data centers that they rely on to be located within their national borders. The commercial case for building anything in Europe is weakening every year.

The growth in gas demand caused by feedstock for Liquefied Natural Gas (LNG) export terminals continues to draw skeptical analysis from those warning of a supply glut in the years ahead.

This cautious outlook also doesn’t square with the facts. LNG exporters sign long-term Sale Purchase Agreements (SPAs) with shippers that go out 10-20 years. These are generally investment grade counterparties who have committed to pay for liquefaction whether or not they use it. Cheniere has sold 90% of their capacity through 2035.

It seems implausible that these buyers have made long term commitments without having the other side of the trade locked in. There’s little reason for them to speculate on global natural gas prices many years in the future. If there is a supply glut, it shouldn’t hurt the LNG export terminals.

If for example Kogas of South Korea declined to use some of their already purchased liquefaction capacity, the LNG operator could use it themselves in effect for free since it’s already been paid for. Or Kogas could use it at a loss, as long as they covered their variable cost since the liquefaction fee is in effect a capital commitment.

As noted above in the cases of fiber optic cables and data centers, a cash profit that covers variable costs and contributes to fixed costs can support the operation of an asset even if it results in a poor return on capital for the owner.

This year’s news developments for midstream have largely confirmed the positive outlook that took hold last year. The absence of anything further has caused many investors to turn to more exciting areas, such as AI and growth stocks, for example. Meanwhile, the fundamental bullish case for midstream is only getting stronger.

We have two have funds that seek to profit from this environment: