Lower Spending Cheers Pipeline Investors

In February, following our criticism of Kinder Morgan’s (KMI) return on invested capital (see Kinder Morgan’s Slick Numeracy) the company, to their credit, reached out to us so as to better present their perspective. Our point was that capital allocation decisions in recent years had not always been accretive to equity. We offered the company an opportunity to write a rebuttal which we promised to publish, unedited, but they declined. So we summarized their response (see Kinder Morgan Responds to our Recent Criticism).

Not long after, Covid dominated the news, and historic returns on invested capital took a backseat to gauging current demand destruction. KMI’s stock sank from $21 to under $10, before recovering roughly halfway to $14.

KMI kicked off earnings reports for the sector last week. We were most interested in their outlook, but also in their planned growth capex. Industry-wide spending reductions are driving improved profitability (see Pipeline Cash Flows Will Still Double This Year).

KMI announced a $1BN goodwill writedown on natural gas gathering and processing assets previously acquired. Although a non-cash expense, this is an example of capital deployed whose cash generation will no longer meet its target. KMI will blame Covid, but nonetheless it’s a loss for shareholders.

The company confirmed guidance of $1.7BN in “expansion opportunities” (we winced) for 2020. This is well below their prior range of $2-3BN annually over the next decade, as initially communicated in April during the depths of lost production. Several questions followed on the earnings call – in response to Shneur Gershuni of UBS, CEO Steve Kean allowed that future capex, “looks like it hangs around the level we’re seeing in 2020, maybe a little less.”

This cheered us, and later JPMorgan’s Jeremy Tonet asked, “…is there a scenario where 2021, or maybe in 2022, where growth CapEx could be as low as $1 billion?” We were left positively giddy when Steve Kean replied, “We’re close, yes. We’re close.”

When it comes to pipeline company growth capex plans, they share the qualities of an overly vigorous golf swing – less is more.

KMI’s adjusted EBITDA came in at $1,568MM versus expectations of $1,634MM. They also lowered full year DCF to 11% below budget (was previously 10% below). They still plan to increase their dividend to $1.25 annually, which would yield over 8.5% at the current stock price. They expect to reach 4.5X Debt/EBITDA although conceded 4.7X is their likely year-end level. They also pushed back the date at which they expect to be a corporate taxpayer to 2026.

Meanwhile, domestic production is recovering along with demand. In recent weeks, oil production has risen from 9.7 Million Barrels per Day (MMB/D) to 10.9 MMB/D, and the industry now expects it to settle in around 11 MMB/D. That’s still well below the pre-Covid level, which was on track to hit 13 MMB/D by year’s end. But it’s improving. “It’s a slow, slow recovery, but it’s happening,” said Alexandre Ramos-Peon, a senior analyst at Rystad Energy, a consultancy.

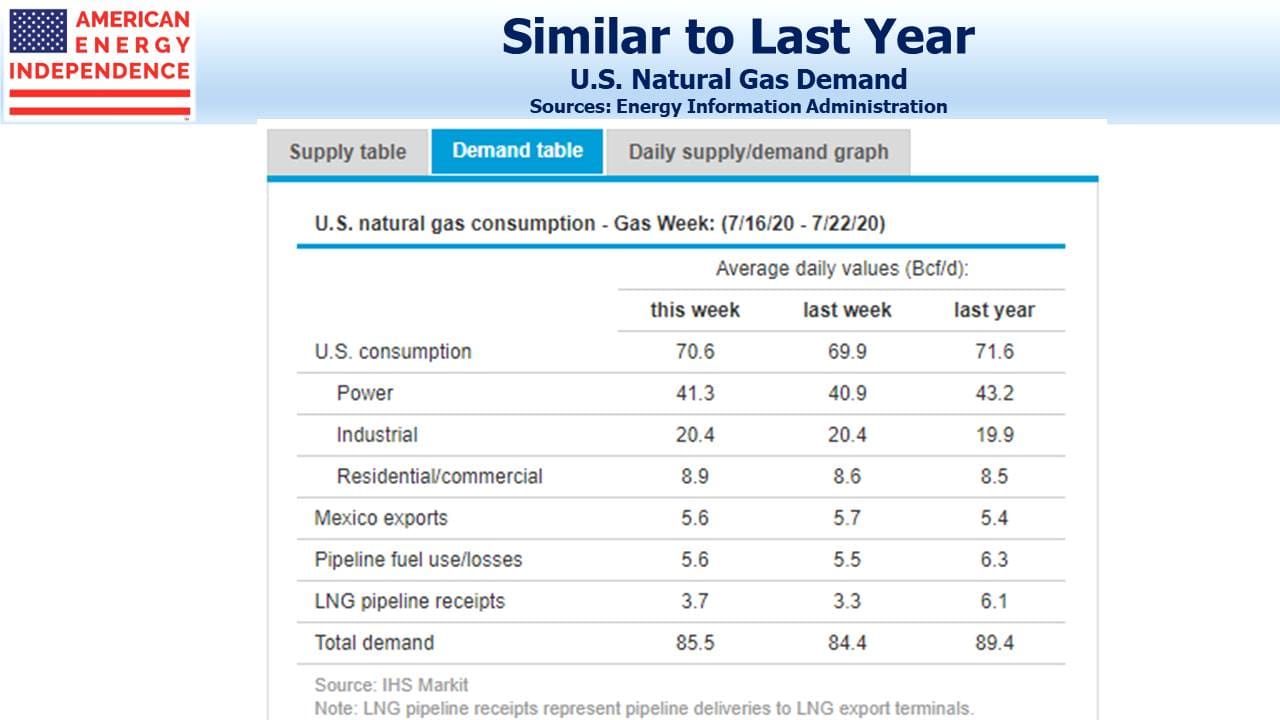

Natural gas demand of 85.5 Billion Cubic Feet per Day (BCF/D) remains close to a year ago of 89.4 BCF/D, exhibiting very little response to Covid. LNG exports of 3.7BCF/D are down by 2.4 BCF/D, representing more than half the drop as global LNG demand has softened somewhat. Overall, the market hasn’t registered much impact.

Pipeline stocks such as KMI have dividend yields that reflect considerable market skepticism regarding their longevity. Bond investors harbor few doubts, as we noted recently in comparing Enterprise Products Partners 30 year debt yields of around 3% with the almost 10% dividend yield (see Pipelines Are Becoming Less Risky). KMI just announced a 2050 maturity with a 3.25% coupon. The chasm between dividends and bond yields in this sector reflect rigid investor segmentation, and a misallocation of capital by fixed income buyers who would greatly benefit from the flexibility to incorporate some equity risk.

Earnings reports from other big pipeline companies over the next few weeks should provide confirmation of growing free cash flow and secure dividends.

We are invested in EPD, KMI and all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

…meanwhile, a large number of midstream companies have just declared dividends or distributions in line with (or greater than) the prior quarter. Coming on the heels of what may prove to be the most difficult quarter ever for a lot of these companies, it’s a good portend for the future.