The Biggest Pipeline Companies Are Doing Well

Last week Enbridge (ENB) and Enterprise Products (EPD), North America’s two biggest pipeline companies, were among those reporting earnings. Both beat expectations – ENB reported 2Q EBITDA of $3,312MM versus $3,155MM, helped by strong results in natural gas transmission. EPD came in at $1,961MM versus $1,877MM, boosted by strength in crude oil. Dividend yields of 7.7% (ENB) and 10.1% (EPD) look secure.

The earnings calls that accompany quarterly results often provide some interesting additions. The ENB call included several exchanges with analysts on renewables. For example, CEO Al Monaco noted, “…we know the supply profile is going to change globally for energy. It’s not going to be a quick transition by any stretch, but slowly renewables will be a bigger portion.” He continued, “U.S. offshore wind is certainly an attractive opportunity but… the supply chains are not as developed yet”

Bill Yardley, President of Gas Transmission & Midstream, added,“…on the ISO website… wind is 30 megawatts, natural gas is 10,200. You could quadruple the amount of wind as they’re projecting and it’s just–on the peak hours, it’s just not there.”

Although ENB expects renewables to gain market share, conventional fuels still get most of their spending on new projects. Al Monaco explained, “In terms of the asset mix today, I think when we repositioned the asset mix to almost 50/50, I’m going to call it, between natural gas and the liquids businesses, with a little bit in there for renewables, I think we’re happy with the mix there.”

Hydrogen as a potential renewable fuel has been drawing a lot of interest recently. For example, on Nextera’s (NEE) call, hydrogen appears 25 times in the transcript. But it’s still way off in the future. Rebecca Kujawa, CFO, noted that NEE is, “really excited about hydrogen, particularly in the 2030 and beyond time frame”

On the same topic, ENB’s Bill Yardley added, “Natural gas pipeline networks may be repurposed for hydrogen at some point in the future, if the economics work. To that end, It’s extremely expensive – you know, is it green hydrogen, is it blue hydrogen, how does it interact with the pipelines and the actual steel in the pipeline, and that takes a lot of engineering to look at. But you’re right – the network, and this is decades from now, would be well positioned if hydrogen transitioned from that shiny object that is potentially a solution to a reality.”

EPD’s CEO Jim Teague often adds some colorful phrases and humor to these calls. He referred to the prior quarter’s conference call as a “COVID call” and opened last week by saying, “…today, we are going to tell you our COVID story.”

Since EPD had beaten expectations during a tumultuous period in energy markets, Teague immediately addressed the issue: “We usually get the question of how much of our results are non-recurring, and it is the same question we got when Katrina blew through South Louisiana and literally knocked out every plant we had…Demand came back before indigenous supply and we made more money with our West to East pipelines than if those plants had been running. So it was non-recurring.

“We got that question during Hurricane Ike in 2008… got the question in Hurricane Harvey in 2017.” Teague continued,” Events like what we are going through now, and the opportunities they present may be labeled as non-recurring, but our performance and our results are recurring regardless of the environment.” In other words, the diversity and naturally offsetting risks among business lines create the opportunity for recurring upside surprise.

Crude oil dominates sentiment around pipelines, although natural gas is more important. Little attention is paid to the non-energy side of the business, such as plastics. Teague reminded listeners that,“…the United States, especially in ethylene, has quickly moved into being the world’s incremental supplier.” He added, “In June, we loaded a record size ethylene cargo of 44 million pounds.”

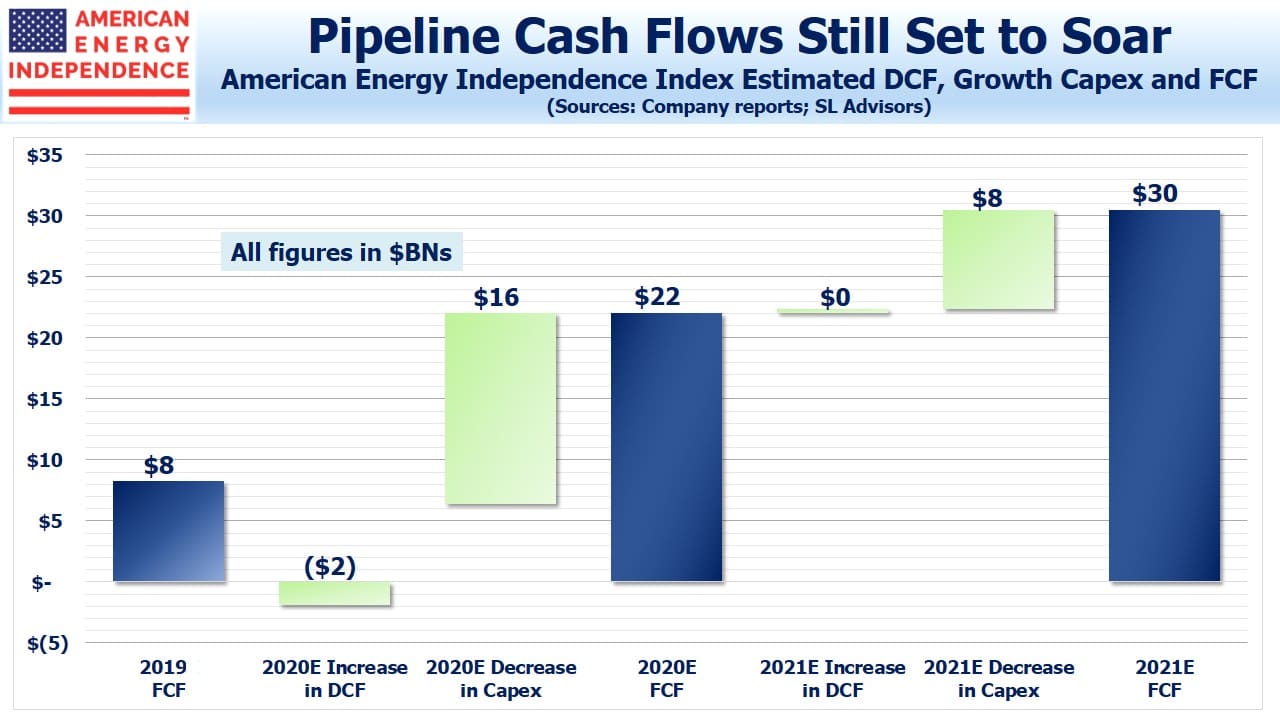

Growth capex is also falling as both companies are maintaining strict return criteria. Teague said, “For 2021 and 2022, we currently anticipate growth capital investments to be approximately $2.3 billion and $1 billion respectively. This is an aggregate $700 million reduction from guidance we provided for 2021 and 2022, at the end of the first quarter.” Last year EPD spent $4BN. Their Free Cash Flow in 2022 is on track to have doubled in only three years.

Both companies can issue ten year debt “with a two handle”, reflecting the confidence of bond investors in their balance sheets and showing a juxtaposition with their dividend yields.

Earnings continue to support our expectation of strong cash generation (see Pipeline Cash Flows Will Still Double This Year). Listening to conference calls like these provides further comfort around the outlook.

We are invested in ENB, EPD, and all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

Excellent, great chart. Seems pipes mentioned are strong buys but the strongest might be ET having been beaten up so badly and today’s 18.71% distribution! Assuming the $0 2021 eDCF but $30B in eFCF will reduce debt resulting in increase unit price and maintaining distribution. I’m riding this horse. And voting Trump.

And regarding growth capital investments, EPD is in serious joint venture talks with one party (out of six potential parties) which would reduce future capital growth expenditures.