Pipelines Are Becoming Less Risky

Before the Shale Revolution, midstream energy infrastructure was a boringly stable sector. MLPs, which predominated versus corporations back then, paid out most of the cash they generated and grew distributions through price escalators and improved operating efficiencies. Volatility was low, and attractive yields drew income-seeking investors. This happy marriage started to fall apart in 2015, when the industry embraced the same growth ethos that drove their upstream customers. Leverage and volatility rose, causing distribution cuts and the older, wealthy K-1 tolerant American investor started to leave (see AMLP’s Shrinking Investor Base).

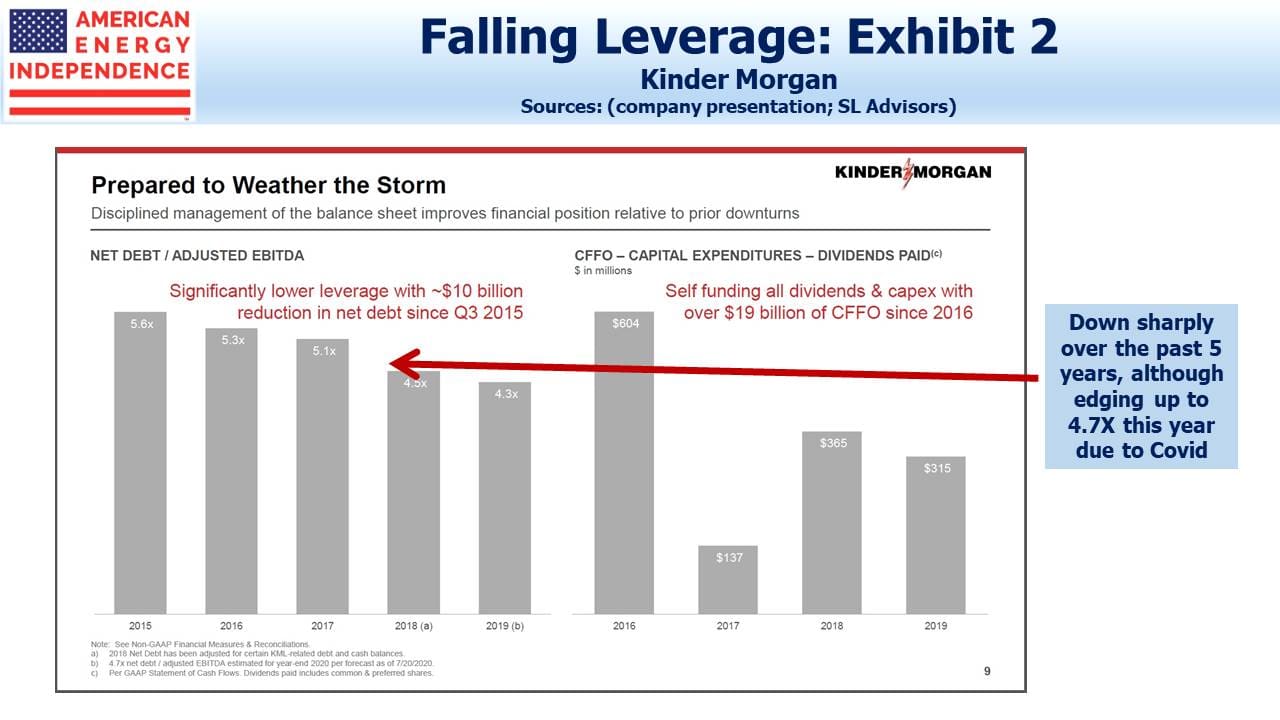

In conversations with investors, the subject of volatility often comes up. Yields are attractive – the broad-based American Energy Independence Index, AEITR yields 9.3% on a trailing basis. Few cuts in payouts are likely as companies report 2Q earnings. Kinder Morgan (KMI) maintained their dividend in Wednesday’s release. Some had been questioning whether Oneok (OKE) would maintain their dividend, but they reaffirmed it on Thursday, yielding 13.4%. Legal uncertainty remains around whether the Dakota Access Pipeline (DAPL) has a secure future (listen to Judicial Over-Reach on the Dakota Access Pipeline). Phillips 66 Partners, LP (PSXP) is most exposed, but they’re only 0.6% of the AEITR. Although Energy Transfer built DAPL and retains 36% ownership, it’s only 3.5% of their EBITDA.

In summary, payment of today’s attractively high payouts is likely to continue. Investors are trying to assess whether they’ll need to endure further downside volatility while clipping coupons.

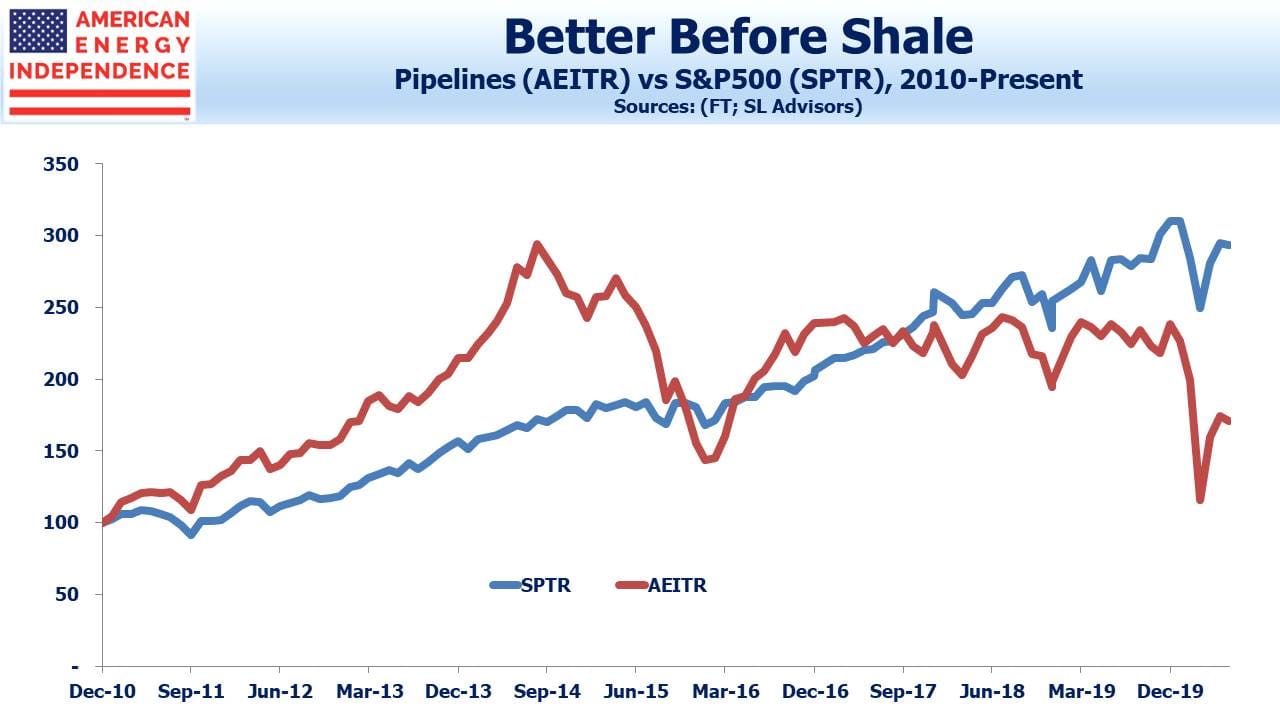

Relative to the overall market, the movements of today’s pipeline sector are more pronounced but still well short of the 2015 collapse, when energy sector weakness didn’t spill over into the S&P500. Early this year saw the biggest fall in AEITR’s history, but the panic over Covid drove the S&P500 down in the first quarter too, as indiscriminate selling was widespread. Although pipelines have rebounded strongly since then, the AEITR remains down 27% for the year – 10% ahead of the MLP-heavy Alerian Index, but still well short of matching the market, which is in positive territory.

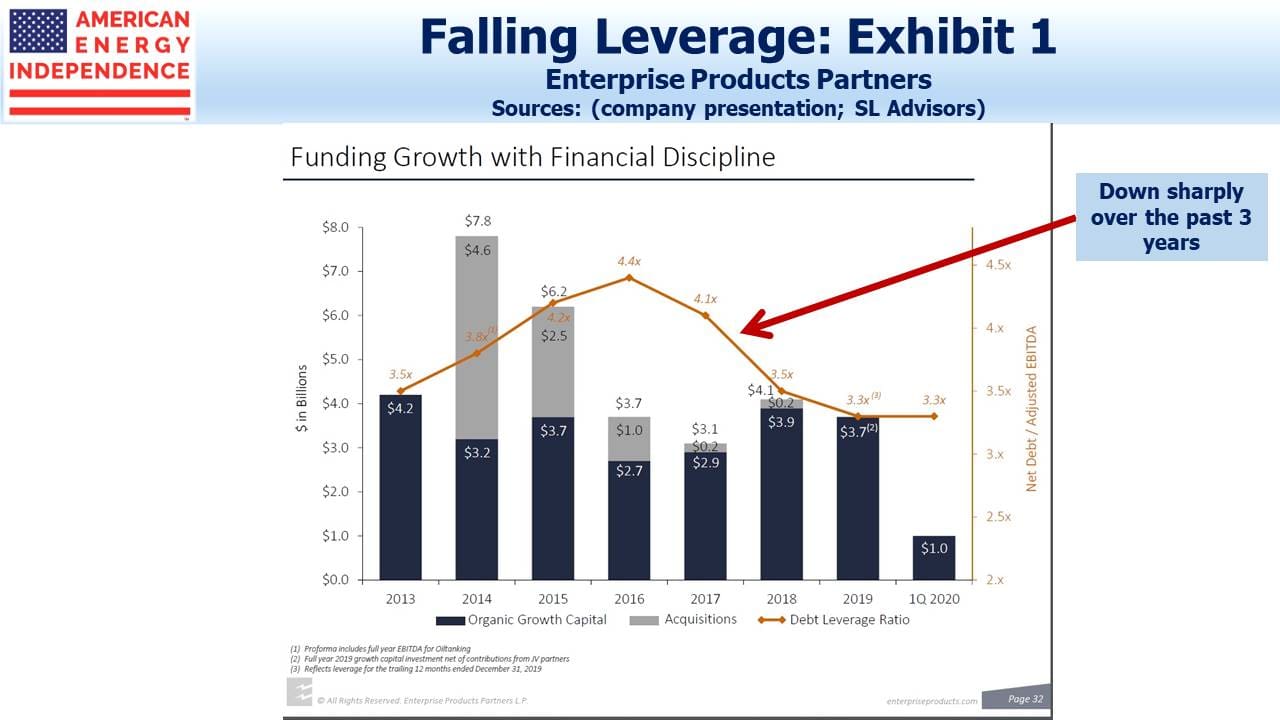

There are three reasons to think that more stability lies ahead for the sector. First, spending on new projects peaked in 2018, and the pandemic has caused every company to further reassess plans for 2020. The result is that pipelines will generate twice as much cash as they did last year (see Pipeline Cash Flows Will Still Double This Year).

Second, closed end funds, whose selling in March exacerbated an already extremely weak sector, have lost much of their ability to repeat this performance. This is because heavy losses destroyed much of their asset base, a development welcomed by all except those unfortunate enough to have assumed the fund managers practiced any responsible oversight of their leverage (see The Virus Infecting MLPs).

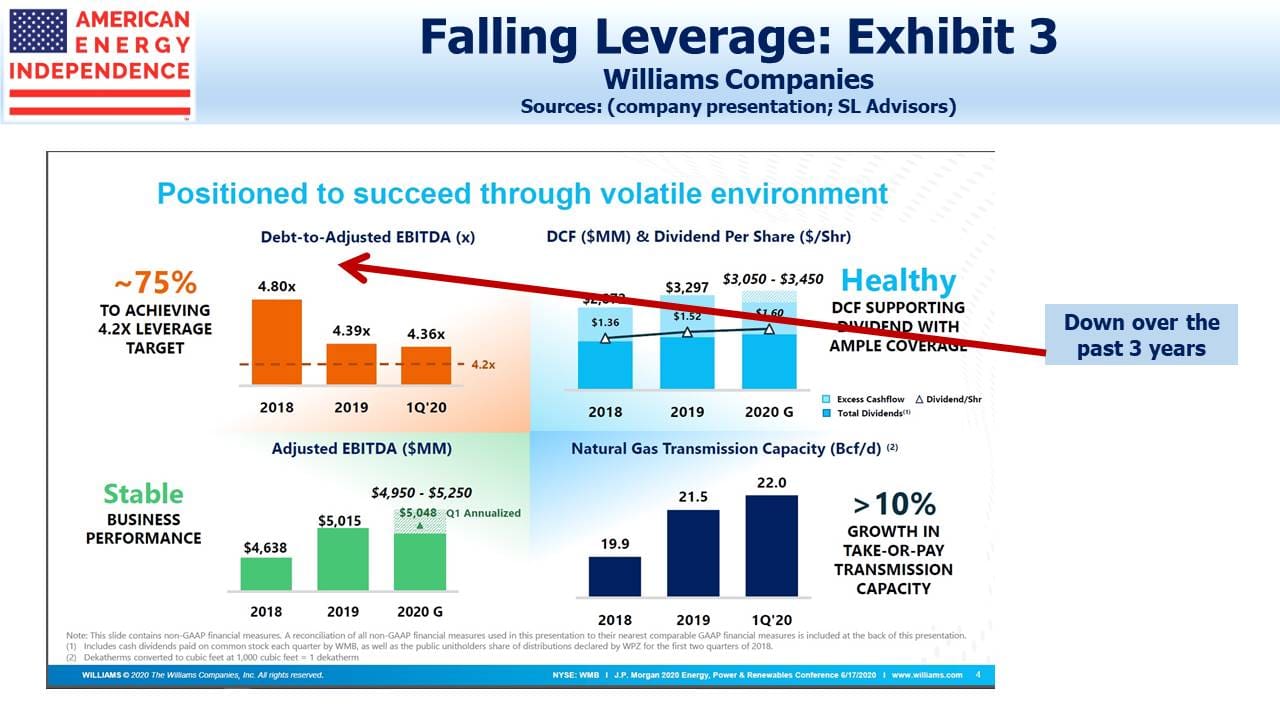

Third and perhaps most importantly, pipeline companies are reducing leverage. These slides from recent investor presentations by Enterprise Products, Kinder Morgan and Williams Companies are reflective of what’s happening across the industry. Stronger balance sheets will reassure rating agencies and investors that sharply rising free cash flow is sustainable.

These are all reasons to believe that tomorrow’s pipeline industry will return to the lower volatility and higher returns of 5-10 years ago.

We are invested in EPD, ET, KMI, WMB and all the components of the American Energy Independence Index via the ETF that seeks to track its performance.

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

There are still a few of us older K-1 tolerant Americans who enjoy tax deferral more than they want a 1099.

Given the changes that may occur in November, with the Democratic Party firmly anti fossil fuel, not exactly sure how you can say they are less risky. If they have a stable macro/political environment, the things you mentioned might matter, but they do not face a stable macro/political environment.

Mike: Regardless of what certain politicians might say about fossil fuels, oil and gas pipelines are absolutely essential to the American economy. Shut down US pipelines and you shut down the US economy. Energy is the industry that powers all other industries, and a large majority of American energy travels through pipelines before it’s transformed into the substances that power our very existence. On top of that, there are myriad reasons why there is zero chance that we will quickly switch over to wind and solar power (in fact, we will never come close to replacing fossil fuels with wind and solar).