Looking Back on 2022

/

Readers know not to expect bearish views on energy from this blog. A year ago, we offered ten reasons why we thought the outlook was positive (see The Upside Case For Pipelines – Part 1 and Part 2). We were right about the direction but not all our reasons played out. Below is a report card:

1) Investors become convinced financial discipline will continue Grade: A

Growth capex has remained well contained for the most part. The two big Canadians continue to have outsized investment programs, and together make up almost half of the industry’s total even though they’re just over a quarter by market cap. They both have large business segments within Canada that enjoy highly predictable returns, and as a result both trade at a premium (EV/EBITDA) to the market. Wells Fargo expects growth capex to drop from 41% of free cash flow last year to 35% by 2027. Assuming the trend continues, the market is likely to reward the sector.

2) Pragmatism guides the energy transition Grade: B

California and parts of New England continue to pursue self-destructive policies that in effect accommodate continued emissions growth in Asia ex-Japan while enduring higher costs and less reliability. Most other regions of the US are adopting a more balanced approach. Solar and wind were 12% of US power generation in 2021, and 4.7% of total primary energy consumption. There’s much more to energy than generating electricity. The EIA expects solar and wind to reach 16% of power generation in 2023. Thanks to approaches that vary by state, the US energy transition is less disruptive than the European model.

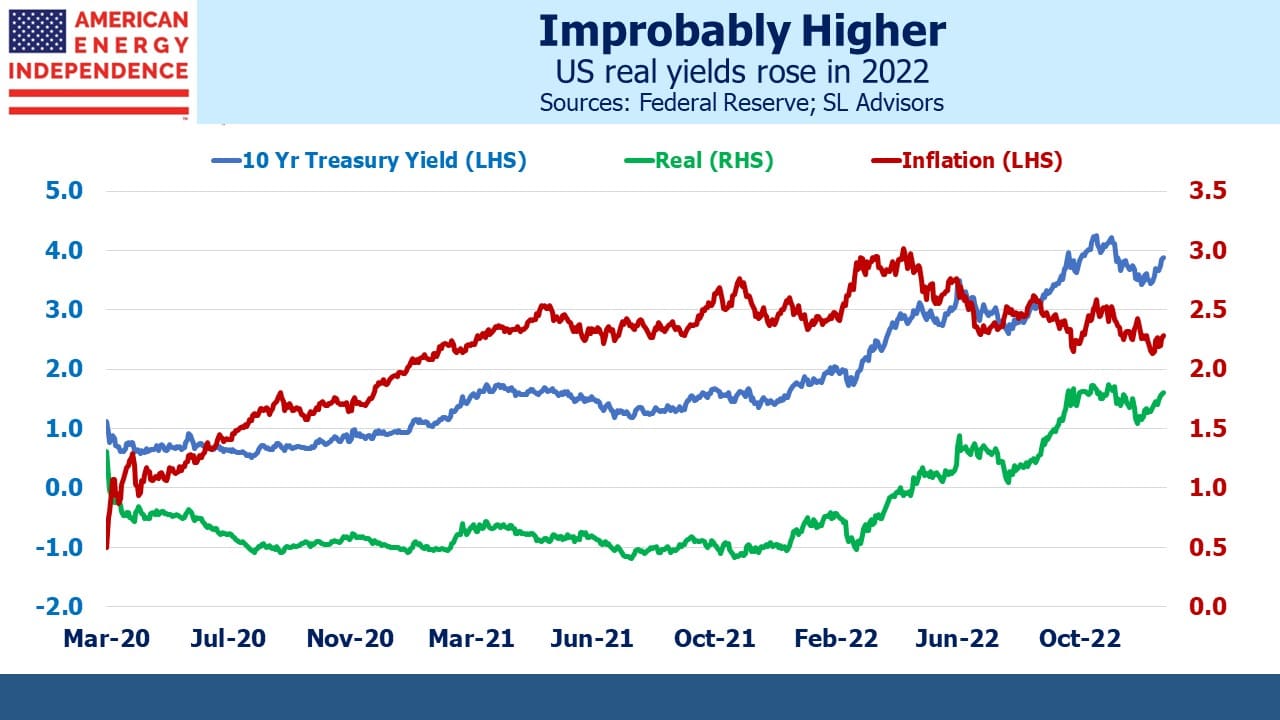

3) Real yields continue to fall Grade: F

Surprisingly (to us), real yields on ten-year treasury notes have risen by 2.5% this year, from –1% to +1.5%. We had felt negative real yields would drive more investors into income-generating assets, including midstream energy infrastructure. Tightening financial conditions were a headwind for almost all sectors, but not energy. Excessive government indebtedness is likely to limit the economy’s tolerance for high interest rates. Real yields will at some point resume their long-term decline.

4) Inflation surprises to the upside Grade: A

The Fed got this spectacularly wrong. A year ago they expected 2022 inflation, as measured by their favored Personal Consumption Expenditures (PCE) index, to run at 2.6%. They’re now at 5.6%. Private forecasters were also mostly wrong. In April JPMorgan was forecasting 2022 CPI of 5.5%, but now they’re at 7.4%. For 2023 the Fed is forecasting 3.1% (PCE) and JPMorgan 2.8% (CPI). This outcome would represent victory for the Fed. Inflation will fall, but the risk to these forecasts remains to the upside.

5) Republican mid-term gains squash any anti-energy sector legislation Grade: C

Poor candidate selection led to muted Republican gains and failure to regain control of the Senate. Regulatory reform that Joe Manchin thought he’d won in exchange for supporting the Inflation Reduction Act has still not passed. The Mountain Valley Pipeline, built but unused, would be the most tangible beneficiary but renewables advocates should recognize that construction of high voltage power lines will also suffer from the current regulatory uncertainty confronting many types of infrastructure construction. Nonetheless, Democrat policies favor energy investors by discouraging capex, thereby boosting cash flow. Hug your local climate protester and drive them to an event.

6) Sector fund flows turn positive Grade: C

Flows into midstream energy infrastructure funds were negative for the sixth straight year, albeit better than 2021 at $1.1BN through November 2022 vs $1.7BN (same period 2021) according to JPMorgan. Wells Fargo estimates 2022 buybacks at $4.8BN, so sales by retail investors are being easily absorbed by the companies themselves. 2023 buybacks are forecast at $5BN. The sector’s increasing cashflow remains a positive flow of funds story.

7) Cyclical factors that are bullish Grade: A

Goldman’s Jeff Currie believes the ESG movement is distorting the normal capex cycle of the energy sector because high commodity prices are not spurring the type of investment in new production that might otherwise be expected. The result is an extended cyclical upswing, benefiting investors if not consumers.

8) Geopolitical factors that might surprise Grade: A

World events that shock usually hurt equity markets. Energy is different, in that conflict often raises prices and makes energy security more valuable. We had no insight about Russia’s invasion of Ukraine, but US LNG exports are an unsurprising winner. For the first half of 2022 the US was the world’s biggest LNG exporter.

9) Covid loses its ability to disrupt Grade: B

The world finally moved on, except for China where rolling citywide lockdowns reduced growth and demand for oil. China’s recent pivot to dump virtually all restrictions will allow the economy to rebound.

10) Energy transition Grade: A

2022 showed the importance of “dispatchable” energy, meaning energy that’s there when you need it as opposed to when the weather permits. Western Europe didn’t scramble to buy more windmills as Russian natural gas flows petered out. They bought more LNG, especially from the US, and consumed more coal. Policymakers are increasingly accepting that solar panels and windmills aren’t the complete solution. Moreover, traditional energy companies are turning out to be vital to reducing greenhouse gas emissions. The Inflation Reduction Act has boosted investment in carbon capture projects. NextDecade is signing contracts to export LNG for which emissions generated during processing have been captured. The energy transition has gone from threatening the energy sector to providing opportunities.

Midstream energy infrastructure had a great year in spite of a few misses on our report card. Fundamentals that were good a year ago remain so. With free cash flow almost 2X dividends, buybacks increasing, and capex still constrained, 5-6% yields still look appealing.

We have three funds that seek to profit from this environment:

Important Disclosures

The information provided is for informational purposes only and investors should determine for themselves whether a particular service, security or product is suitable for their investment needs. The information contained herein is not complete, may not be current, is subject to change, and is subject to, and qualified in its entirety by, the more complete disclosures, risk factors and other terms that are contained in the disclosure, prospectus, and offering. Certain information herein has been obtained from third party sources and, although believed to be reliable, has not been independently verified and its accuracy or completeness cannot be guaranteed. No representation is made with respect to the accuracy, completeness or timeliness of this information. Nothing provided on this site constitutes tax advice. Individuals should seek the advice of their own tax advisor for specific information regarding tax consequences of investments. Investments in securities entail risk and are not suitable for all investors. This site is not a recommendation nor an offer to sell (or solicitation of an offer to buy) securities in the United States or in any other jurisdiction.

References to indexes and benchmarks are hypothetical illustrations of aggregate returns and do not reflect the performance of any actual investment. Investors cannot invest in an index and do not reflect the deduction of the advisor’s fees or other trading expenses. There can be no assurance that current investments will be profitable. Actual realized returns will depend on, among other factors, the value of assets and market conditions at the time of disposition, any related transaction costs, and the timing of the purchase. Indexes and benchmarks may not directly correlate or only partially relate to portfolios managed by SL Advisors as they have different underlying investments and may use different strategies or have different objectives than portfolios managed by SL Advisors (e.g. The Alerian index is a group MLP securities in the oil and gas industries. Portfolios may not include the same investments that are included in the Alerian Index. The S & P Index does not directly relate to investment strategies managed by SL Advisers.)

This site may contain forward-looking statements relating to the objectives, opportunities, and the future performance of the U.S. market generally. Forward-looking statements may be identified by the use of such words as; “believe,” “expect,” “anticipate,” “should,” “planned,” “estimated,” “potential” and other similar terms. Examples of forward-looking statements include, but are not limited to, estimates with respect to financial condition, results of operations, and success or lack of success of any particular investment strategy. All are subject to various factors, including, but not limited to general and local economic conditions, changing levels of competition within certain industries and markets, changes in interest rates, changes in legislation or regulation, and other economic, competitive, governmental, regulatory and technological factors affecting a portfolio’s operations that could cause actual results to differ materially from projected results. Such statements are forward-looking in nature and involves a number of known and unknown risks, uncertainties and other factors, and accordingly, actual results may differ materially from those reflected or contemplated in such forward-looking statements. Prospective investors are cautioned not to place undue reliance on any forward-looking statements or examples. None of SL Advisors LLC or any of its affiliates or principals nor any other individual or entity assumes any obligation to update any forward-looking statements as a result of new information, subsequent events or any other circumstances. All statements made herein speak only as of the date that they were made. r

Certain hyperlinks or referenced websites on the Site, if any, are for your convenience and forward you to third parties’ websites, which generally are recognized by their top level domain name. Any descriptions of, references to, or links to other products, publications or services does not constitute an endorsement, authorization, sponsorship by or affiliation with SL Advisors LLC with respect to any linked site or its sponsor, unless expressly stated by SL Advisors LLC. Any such information, products or sites have not necessarily been reviewed by SL Advisors LLC and are provided or maintained by third parties over whom SL Advisors LLC exercise no control. SL Advisors LLC expressly disclaim any responsibility for the content, the accuracy of the information, and/or quality of products or services provided by or advertised on these third-party sites.

All investment strategies have the potential for profit or loss. Different types of investments involve varying degrees of risk, and there can be no assurance that any specific investment will be suitable or profitable for a client’s investment portfolio.

Past performance of the American Energy Independence Index is not indicative of future returns.

You get to graduate magna cum laude.